On 1st July (last week) we had this quick look at some price activity early in the morning on 1st July – and then posted these short comments a little later in the day.

Readers of this 2nd post will note the question mark at the end of the title of my article – “Prices plunge in QLD – because of solar?”. This was deliberately added as not all data was available at that time to analyse all possible contributing factors (nor sufficient time available to investigate further).

However the thought that solar was the main cause of the price drop seems to have sprouted its own legs across social media in the past 9 days (minus the enquiring question mark).

With another hours available today, and with Canberra seeming to want to continue talking about the carbon tax before passing the repeal (hence continuing to leave generators and retailers in limbo land), I thought it would be timely to start looking at recent bid history to understand the significance of bid changes.

Learning from experience, I’ll try to point out that there are a number of reasons why bid structures might change from June into July – with generator’s perceptions of the likelihood of (speedy) repeal being only one factor. Another significant factor could be the changing nature of hedge cover that each generator will be carrying from Q2 into Q3 and FY14 into FY15 (which might also be affected by expectations on carbon pricing, amongst other things – though that’s another food for future analysis…).

1) Bidding over 2014 transition

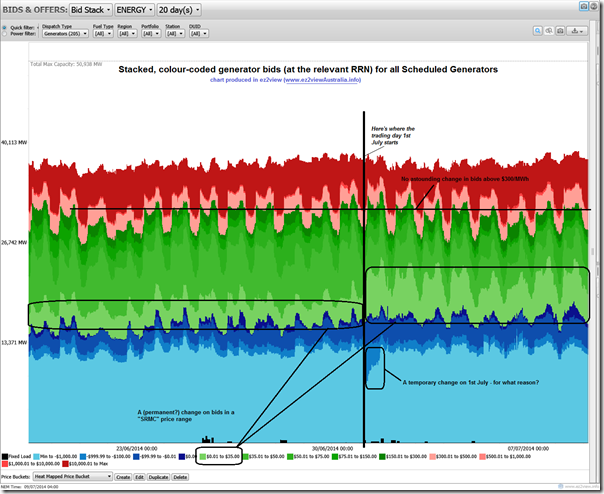

Powering up ez2viewAustralia, and looking back over 20 days of bidding behaviour across all generators in the NEM we see a very colourful chart that does highlight some changes:

The light-green area (highlighted in the chart) shows the most noteworthy change – in that there is clearly a higher volume of generation bidding in the range $0/MWh to $35/MWh at the relevant Regional Reference Node (RRN) and correspondingly less in the bracket above.

With the carbon price in 2014-15 currently legislated to be $25.40/tonne (hence equating, in rough terms, to an additional input cost of $25/MWh for thermal generators) it would be expected that this type of change would be observed if generators were subtracting this cost from their bid prices from 1st July.

Keep in mind that this chart is (to the purist) a bit of a nonsense, really, as it implies that all generators are bidding into a common supply point – this is not the case. However it is useful from the perspective of enabling the user to gain a helicopter view of macro changes.

Looking at this chart, it seems clear that this change in generator bidding patterns (if they have occurred in Queensland*) would have a very significant bearing on spot prices dropping as low as observed here on 1st July – more significant than the effect of solar reducing scheduled demand.

* something we will investigate in a later post

2) Bidding over 2012 transition

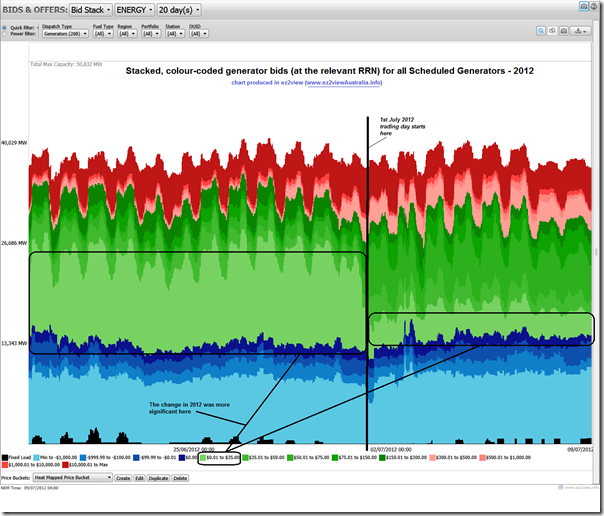

Out of curiosity, we re-wound ez2view two years previous to show the similar transition from June (without carbon) into July (with carbon) 2012.

As can be seen here, there was a more significant shift observed:

The first thought that springs to mind is that this might indicate that all generators across the NEM have not, yet, backed the price of carbon out of their bids in 2014. If this is the case, it would be quite understandable, given that the carbon tax still exists, and that it is not still 100% certain that the repeal process will proceed.

3) Bidding over 2013 transition

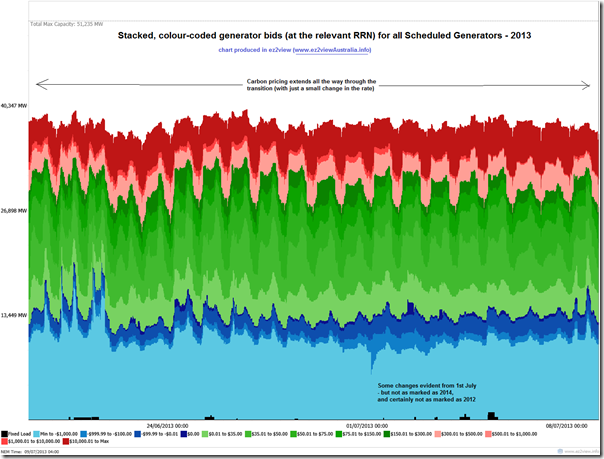

As the final image for this post, I have included here the identical chart shown for the 2013 calendar year transition from FY13 into FY14:

Over this period, the carbon price increased from $23/tonne up to $24.15/tonne and, as noted in the chart, there is not the same degree of broad macro change observed in 2012 and (to a lesser extent) in 2014.

More food for thought, until next time…

It would be interesting to see this look at teh bid data repeated for the 17 July repeal date. My hypothesis would be the muted response from 1 July could be indicative of mixed sentiment around likelihood of the repeal bills passing the senate. However, once made certain there should be a “second wave” of bidding in the lower SRMC band.

Hi Wayne

Thanks for the comment/question. Others have asked questions along similar lines, offline. It’s on my “to do” list.

Paul