Turning our attention once again to events in Victoria on January 31, 2022, we were motivated take a look at Wholesale Demand Response activity following EnelX’s note about 10 MW of wholesale demand response being delivered into the NEM (note on Linkedin here).

Since the start of the WDR mechanism

Readers would be aware of our interest in the Wholesale Demand Response mechanism, introduced on October 24, 2021 through earlier WattClarity articles. Since the start of the WDR mechanism:

- On October 24 we highlighted we will keep an eye out for “Negawatts”.

- And although it was early days with the new mechanism in operation, Paul was surprised to see that there were no early adopters offering Negawatts on October 27 as volatile prices in South Australia presented lucrative demand response opportunities.

- In December, at the end of 2021, Dan Lee reviewed how many how many Negawatts have been dispatched since the mechanism’s introduction, commenting on number of registrations (3) and dispatch activity (November 12 only).

Since Dan’s review at the end of 2021 and Now (9 February 2022) not much has changed. There are still three units registered (1 in NSW and 2 in VIC), and until January 31 no further dispatch activity had arisen.

January 31

The recent WDR activity on the January 31 took advantage of the spicy Victorian wholesale energy prices that eventuated in the late afternoon and early evening under unusual circumstances.

If you missed it, or want to revisit the events from another angle, the unusual events that took place to drive the prices were well covered in Allan O’Neil’s article on why to Expect the unexpected – it’s the NEM after all!

Taking a brief look at what happened, and conveniently, ez2view’s bids and offers widget now makes accessing dispatch targets and bid volumes lightning fast.

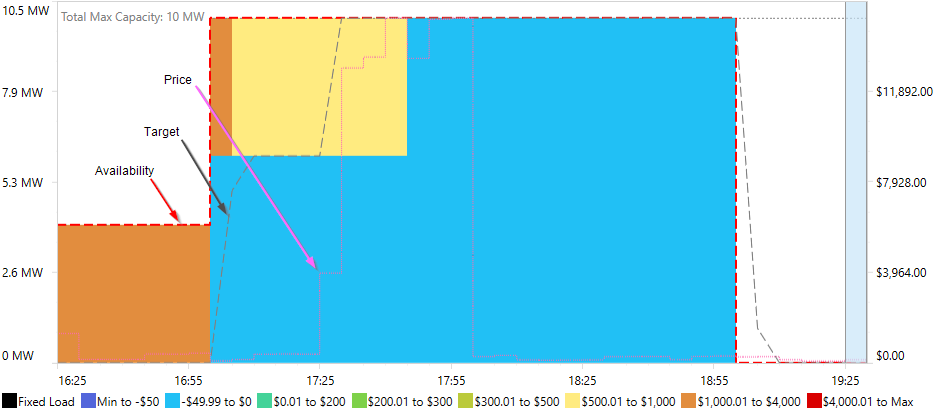

The screenshot below of the bid stack chart presents aggregate bids (in selected price-buckets), dispatch targets and availabilities for the two currently-registered WDR units in Victoria. The VIC energy prices are overlaid (right axis).

Viewing the non-zero dispatch targets (ez2view’s interactivity makes it easy to do this), we can see demand response was triggered across dispatch intervals from 17:05 to 19:05.

The event started slowly, with the units possibly anticipating that prices would spike sooner than they did. The actual price didn’t rise above 382 $/MWh until the 17:30 interval when it jumped to almost 4,000 $/MWh.

Prices above 10,000 $/MWh were sustained until 18:05 when a drop to levels under 330 $/MWh persisted until the end of the event, the 19:05 interval. The dispatch targets at this stage were at maximum capacity (10 MW) of the two units.

Reflecting on Allan’s description of events during this period I can only imagine how the price uncertainty during the period would have translated into rebidding decisions and communication with the sites responsible for the responses. At 18:00 the price was beautiful for the Negawatts at 15,100 $/MW and had been like that for at least half an hour, and more intervals like it were forecast to come. Yet, suddenly, the constraint that was holding back supply into VIC (driving the price outcomes) was lifted at 18:05 and price sunk back under 300 $/MWh.

So just like that, in an instant, the pot of gold at the end of the rainbow had disappeared. We now look forward to the next event.

Is there some publicly available way to view compliance with a Negawatt target?

Hi MK,

Unfortunately, to my knowledge, no. The official calculation of the response – actual consumption relative to baseline consumption – is done for settlement after the event so it would be private to the Participant.

A good question, MK

Further to Linton’s comment, this was one of the concerns (there were a number!) that I raised when this Rule Change was being considered:

1) On 5th March 2019:

https://wattclarity.com.au/articles/2019/03/some-thoughts-about-demand-response-in-parallel-with-aemc-deliberations/

2) On 21st October 2019:

https://wattclarity.com.au/articles/2019/10/all-aboard-the-negawatt-express/

In short, transparency in the NEM has been reduced as a result of this rule being implemented.

Paul