It’s Tuesday 5th August 2025, my second day back in the office – and this is my first article on WattClarity since this article on Friday 27th June 2025.

1) That’s just over 5 weeks ago, during which time I disconnected from the NEM and took a break overseas.

2) Since that article there have been a stack of articles written by a range of other authors here on WattClarity to keep your reading list full.

Yesterday, I focused my attention:

1) On re-connecting one-on-one with a range of customers and prospects with which I had conversations underway in June (plus a few leads that arrived in the intervening period),

2) and I also invested time internally with our software team to understand progress with the latest ez2view upgrades (noting that last Thursday was the ‘go-live’ date for new data sets that were a focus in the v9.12 upgrade to ez2view).

But I also invested a bit of time to review what’s been happening in the NEM in the intervening period – as a result of which this article has transpired (plus some more notes internally). I’m wondering if readers can point out anything that jumps out that I have missed please?

Renewal in the Renewables Sector

Last week, I did swing by Sydney to ease back into the NEM at the Clean Energy Council’s Australian Clean Energy Summit, as noted noted beforehand on LinkedIn:

It was a good way for me to ease back into the personalities, issues and acronyms before sitting down this week to get back into more focused work.

1) Thanks for the conversations, to the many I spoke with;

2) Thanks also to the CEC for organising:

(a) their events have, for many years, been worth attending

(b) let’s hope that these still retain their value into the future with the renewal/maturation underway in relation to other aspects of the organisation.

3) Incidentally, Dan Lee was also another of our team attending, and…

(a) was quick with the keyboard in posting ‘Four answers we received during the 2025 Clean Energy Summit in Sydney this week’ on Friday last week (see related conversation here).

(b) This followed from the article Four questions we’re pondering ahead of the 2025 Clean Energy Summit in Sydney from 7 days earlier.

Worth remembering the ‘changing of the guard’ has been occurring over the past couple months (discussed here on 5th May and then on 19th May):

Out with the old …

Dan’s written about some of this in the articles above, and there was a risk the event would turn into a swansong for Kane (and others who were pulling up stumps) … but thankfully that was not the case at the sessions I was involved in

… noting for readers that we skipped the CEC dinner this time (which I understand might have been more misty eyed) to have our own private drinks+dinner including people from Global-Roam Pty Ltd, and Overwatch Energy and ETSI who also live/work in Sydney and/or were in Sydney for the conference or other business.

From our perspective, the two CEC team members (who’ve left) that we’ve had the most to do with have been Kane Thornton (off on a bike, and then (to be determined?)) and Christiaan Zuur (headed to KPMG). I’d like to say thank-you for the interactions over many years.

… In with the new

I was interested to listen in to the Chairman’s address at the start of the conference (I’d noted this here beforehand) but nothing particularly jumped out to me in that or throughout the conference about the ongoing path to maturation of the clean energy sector.

I imagine that there’s work still to do – behind closed (Board Room) doors, so to speak – before we hear much more publicly (beyond this note of 7th May). We’ll look forward to seeing who’s appointed as the incoming CEO.

Beyond Dan’s 4 points, there were other different/additional insights I gleaned from attendance. Some are noted below (and some we might share later in other articles) … but some we’ll definitely retain internally (including the private conversations)!

‘Focus on the fundamentals’ … but was it?

It was Kobad Bhavnagri of BNEF in his address that took the philosophical step in titling his presentation ‘focus on the fundamentals’

Now, I already knew that it was not Kobad’s Modus Operandi, but I would have hoped a session titled ‘Focus on the fundamentals’ might have invested time peering inside of each dispatch interval to understand what’s actually happening ‘under the covers’ inside of NEMDE and the AEMO Control Room:

1) Instead, the title was more a pointer to Kobad’s tip to avoid obsessing too much about the daily shenanigans coming out of Trump’s USA in the next 3.5 years, but instead to focus on some more global supporting trends (with China being the big one).

2) However with respect to the fundamentals of how dispatch works (and what’s actually happening within each dispatch interval), insights were few and far between:

(a) Of course Jonathon Dyson (who was a panel member in the ‘Forecasting’ session) made plenty of mention in his limited comments;

(b) and Daniel Westerman did mention the massive increase in the number of interventions/directions:

i. noting Linton had already written about via ‘Directions up to almost five a day’ , published on 16th May

ii. and which led to some strange interpretations in July, including the two in this exchange.

(c) Others made vague reference to issues like curtailment of VRE, but (in my view) many other presenters were quite short on real details.

Trouble in Transmission land …

At ACES both Mark Collette and Frank Calabria (sharing the Day 2 morning panel session) grabbed attention that morphed into the headline ‘‘Staggering’ cost of grid expansion to hit energy bills: Calabria’ in the AFR by Angela Macdonald-Smith on 31st July.

1) … and it’s not just enormous costs that are a focus

2) These problems have been brewing for a long time.

On 1st August, Sumeyya Ilanbey, Angela Macdonald-Smith and Ryan Cropp wrote ‘Electricity bills will climb without building infrastructure: minister’ in the AFR.

Basslink

Just as I was jetting off, we heard operational developments with respect to Basslink.

1) On Thursday 26th June Dan noted ‘AER approves application for Basslink to be converted into a regulated transmission service’

2) Then on 25th July Linton noted ‘Basslink flows shift since end of agreement on 30th June 2025’:

… speaking to the gap between the 30th June 2025 lapsing of the prior arrangement and the 1st July 2026 commencement of regulated status.

VNI West

There’s been ongoing troubles with the VNI West project (which is strongly opposed in some quarters):

1) On 1st July Dan wrote ‘VNI West given an official two year delay, with expected completion date pushed back to late 2030’ here on this site.

2) Then (during the ACES week), we heard of a another substantial (but unfortunately not unexpected) blow-out in costs on VNI West. This generated some media mentions, including:

(a) In the AFR:

i. on Thursday 31st July via ‘VNI West costs double amid calls to scrap major energy projects’ by Angela Macdonald-Smith, Ryan Cropp and Sumeyya Ilanbey

ii. on Friday 1st August via ‘Electricity bills will climb without building infrastructure: minister’ by Sumeyya Ilanbey, Angela Macdonald-Smith and Ryan Cropp

(b) On the ABC:

i. on Friday 1st August via ‘VNI West transmission network costs double as Victorian farmer protests’ by Angus Verley

(c) And other places as well…

Western Renewables Link

Also gaining a mention in the media was the Western Renewables Link (which is also strongly opposed in some quarters), with Sumeyya Ilanbey writing ‘Farmers’ fury over Victorian government’s power grab’ on 29th July in the AFR.

Renewable Energy Zones (inside of NSW)

There were some discussions held with respect to Renewable Energy Zones :

1) Noting, for a start, that the approaches taken in QLD, NSW and VIC are (as far as i can see) quite different, with the approach taken in NSW particularly challenging to understand down within a dispatch interval:

2) With respect to NSW:

(a) First cab off the rank was the Central-West Orana REZ in NSW, … which was discussed during the “Grid Connection & Stability” session ACES, Kate Summers (on behalf of ACE REZ) gave a keynote presentation:

ii. Unfortunately I was unable to listen in there (was upstairs in the Nelson Review session instead – the downside of a packed agenda) …

iii. … but hope that Kate will share her thoughts more broadly in another article here soon….

iv. Worth noting, for completeness, the update ‘Construction ramping up in Central-West Orana Renewable Energy Zone’ on 18th June from EnergyCo.

(b) We also saw developments with respect to the New England REZ:

i. On 8th July the Street Talk team wrote ‘Exec shuffle at CIMIC’s Pacific Partnerships as New England REZ hunts network operator’ in the AFR.

ii. On 25th July, EnergyCo noted ‘Strong market interest as expressions of interest close for New England REZ network operator’ as an update.

(c) More generally with respect to REZ design and structure (particularly the NSW approach of ‘guaranteeing’ maximum levels of curtailment) I still have not been able to find anyone who can explain to me …

QUESTION for READERS –> Can you help me understand how these ‘maximum curtailment level’ guarantees in the NSW REZ designs will be formulated, given the way NEMDE works?

Marinus Link

Last Friday we saw the news break that the Tasmanian Government had approved stage 1 of Marinus Link …

1) This was noted in Government circles:

(a) By the Tasmanian Premier on 1st August in ‘Tasmania secures significant agreement for Marinus’…

(b) By the Federal Government on 1st August in ‘Marinus Link gets the green light, unlocking clean energy and jobs’;

(c) Perhaps by the Victorian Government, but I have not seen that

… to which there were understandable responses:

(a) The company responded ‘Marinus Link welcomes a positive Final Investment Decision’.

(b) and also ‘Hydro Tasmania welcomes green light for Marinus’ on 1st August.

2) the decision (and process used) has led to consternation in various quarters, including:

(a) On the ABC, Monty Jacka wrote ‘Tasmania signs on to Marinus Link power cable project despite government caretaker period’, and in that article noted…

‘The business case for the project is expected to be released this afternoon. Mr Duigan says the cable will go live in 2030.’

(b) In the Australian

i. On 31st July, Matthew Denholm wrote ‘Tasmanian Premier Jeremy Rockliff seeks ‘formal advice’ on Marinus Link tick-off, keeps power prices secret’;

ii. And then followed up with ‘Marinus deal ‘without mandate’: balance-of-power independents slam Rockliff Tasmanian Liberals’ on Friday 1st August 2025, noting that:

‘Premier Jeremy Rockliff overnight on Thursday inked a deal with the Albanese and Victorian governments to build a second, 750-megawatt, 345km long power interconnector under Bass Strait, and associated Tasmanian transmission lines.

The decision to proceed with the contentious Marinus Link came despite the Liberals being in protracted caretaker mode following the election of a hung parliament on July 19.

Facing a deadline to secure finance and contracts for the scheme, Mr Rockliff proceeded, despite failing to secure bipartisan support and suppressing the final business case.’

(c) Over on RenewEconomy, I saw:

i. Sophie Vorrath write ‘Tasmania Libs defy convention to pull trigger on Marinus Link FID, and bury their own political future’ on 1st August.

ii. On 4th August, Sophie followed with ‘Marinus business case warns of “very large” cost to industry as federal green tick seals its fate’.

(d) Also jumping off the page was comments (such as Bruce Mountain’s here) that also expressed some scepticism.

3) as Sophie noted in her article on 4th August, there’s further information (including the Whole of State Business Case and summary documents) available on the RECFIT department website here

… with that link requiring a few more to get to this page on the Treasury & Finance website that actually contains the Whole of State Business Case:

(a) The 25 page Exec Summary; and

(b) Whole report 400 pages in total (albeit redacted).

That’s just dropped, and (even with the best intentions) I know I probably won’t have time to read, but I am particularly interested in understanding the following…

QUESTION for READERS –> Can you help me understand what’s been assumed in terms of aggregate flows on Basslink and Marinus Link, in relation to the size of TAS (and supply and) demand and the protection schemes in place … because I’m struggling to understand how Marinus Link will open up anywhere near its rated transfer capacity as additional flows (i.e. over and above what’s possible in Basslink) in the real world?

Half-full, or half-empty (‘the energy transition is sick’), with the roll-out of VRE?

On 22nd July 2025 in the Media Release ‘NEM experiences surge in new generation and storage assets reaching full operation’ the AEMO with an upbeat message in terms of new projects reaching full output, and earlier stage projects in the pipeline.

I did also see that ‘NEM-wide wind generation exceeds 10GW for the first time, on Friday evening 25th July 2025’.

… so some positive news

‘The energy transition is sick’

But others have not been quite so positive.

1) Back on 9th July (quoting Innes Willox from AI Group) Angela Macdonald-Smith wrote ‘Step up on energy rollout or lose out: industry’s warning’ in the AFR.

2) And on 22nd July 2025 (following comments by others on the AEMO update above) Angela Macdonald-Smith wrote ‘Clean energy rebound masks wind ‘disaster’’ in the AFR.

As Dan noted here:

‘the opening speech that grabbed the most headlines was Ross Garnaut’s address, which warned “the energy transition is sick”. He argued that current policy settings are falling short of what’s needed to deliver the scale and pace of investment required, and renewed his long-standing call for a carbon price to restore direction and momentum.’

I was engaged outside in a conversation with another potential new client, so only got to hear the start of Ross’ talk, but Dan documented his four symptoms on an internal Slack channel, so I’m sharing them here for you:

‘Symptom 1 = Australia will miss its renewable energy target, by a big margin

Symptom 2 = Progress on Australia’s renewable energy export industry is failing

Symptom 3 = Lack of private investment in renewable projects without government underwriting.

Symptom 4 = We run the risk of government overspending to deliver scheme and programs.’

Altogether, not so positive… so understandably generating some headlines, including:

1) In the ABC as ‘Reintroducing a carbon price the ‘most economically efficient tax reform’ to repair budget by Michael Janda; and

2) In the AFR as ‘Labor risks ‘buying failure’ with supersized renewables subsidies’ by Ryan Cropp and Angela Macdonald-Smith.

No surprise (given his history) that Ross Garnaut’s preferred solution was a carbon tax … which many suspect is so poisoned as to be politically impossible to achieve.

———————

PS … Full Text of Ross Garnaut’s speech now available

I have belatedly noticed that the full text of Ross Garnaut’s speech on Tuesday 29th July 2025 has been shared here on the CEC website, so I have linked to directly to this for reader’s ease of access.

———————

… so ‘the answer’ is to supercharge the government procurement and underwriting processes?

On Day 1 of ACES, NSW Energy Minister (Penny Sharpe) spoke and announced a new tender for another 500MW of firming capacity (focused on the Newcastle-Sydney-Wollongong population (and industry) hub):

1) This was noted in the Media Release ‘NSW boosts energy security with new firming tender’;

2) And also here on LinkedIn by Paul Peters of the (NSW) Energy Security Corporation.

With respect to the Capacity Investment Scheme:

1) Our Energy Minister Chris Bowen zoomed into ACES (but not in person) to announce, amongst other things an 8GW boost in the size of the Capacity Investment Scheme

(a) Here he is on the big screen:

(b) Interestingly, there’s no Media Release here?

(c) The ‘Capacity Investment Scheme’ sub-site page (updated on 30th July 2025) contains a bit more.

(d) There was a bit of reporting in the media as a result:

i. In the AFR, there was ‘Labor supersizes renewables subsidy scheme’ by Ryan Cropp and Angela Macdonald-Smith published at 22:30 on 28th July (indicating a media drop beforehand);

ii. In RenewEconomy, there was ‘Bowen seeks more wind, solar and storage as he supersizes CIS to meet 82 pct renewables target’ by Giles Parkinson.

… and no doubt others…

2) Whilst speaking about the CIS, worth re-iterating Dan’s question ‘To what extent does the Capacity Investment Scheme cover curtailment risk, and how to interpret its ‘force majeure’ terms?’ from 17th July here

(a) Thanks to Ben Beattie for bringing this question to our attention (it’s something I was now aware of)

(b) Is this another case of ‘killing new entrants with kindness’?

(c) QUESTION for READERS –> Can you help us understand the extent to which congestion is paid for in the CIS?

The market value of VRE is challenged…

It was way back in 2018 that I wrote about ‘Villain #5c – too much focus on COST, not enough focus on VALUE’. There were a number of reminders of two things through the ACES:

1) Some are still focused on declining LCOE and other such metrics;

2) Whilst others are slowly realising that the value of VRE is challenged.

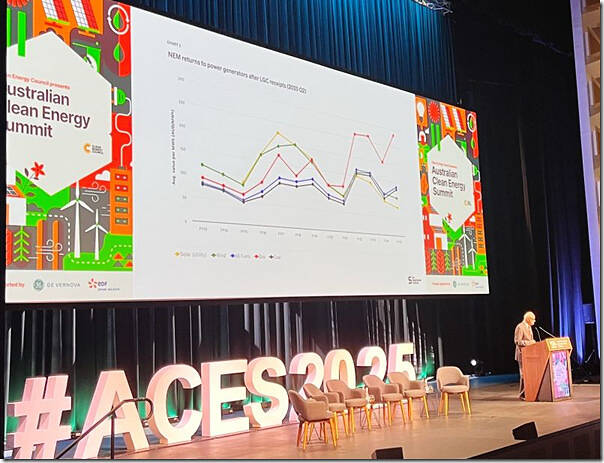

It was Dan Sturrock at ARENA who grabbed this snippet from Ross Garnaut’s address to illustrate his calculations of ‘NEM returns to power generators after LGC receipts’:

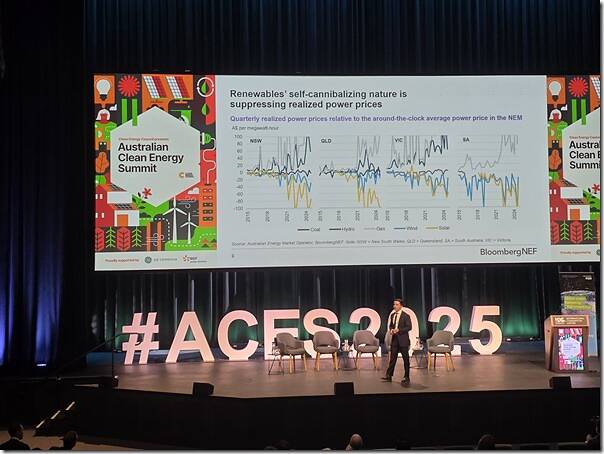

Whilst others just focused on spot market outcomes … such as this snapshot here from Leonard Quong from BNEF:

… though readers will note that Leonard focused on the ‘glass half full’ message in the title of his chart –> ‘Renewables self-cannibalising nature is suppressing realised power prices’.

A reminder to readers that the GSD2024 is available to enable clients to perform their own detailed reviews of metrics such as these down at an individual unit level.

Money, money, money …

The number of zeros attached to this energy transition seem to keep growing larger …

1) at least in terms of reporting (as there were always those who’ll say ‘I knew it was going to be enormous!’).

2) For instance, on 28th July Angela Macdonald-Smith wrote ‘CEFC investments hit record $4.7b as grid bill climbs’ in the AFR, following some statements by the CEFC .

3) On 4th August, Geoff Chambers wrote ‘Anthony Albanese’s net zero transition won’t be cheap or easy, Productivity Commission warns’ in the Australian.

How each stakeholder views these staggering numbers might depend a bit on various factors (including whether they will be on the receiving end or paying end).

Coal Closure

Dan’s already riffed (in his before and after articles) about the ‘G-word’ that was barely spoken at the conference, but I did note a few big mentions of the ‘C-word’ as follows:

1) On 16th July we saw ‘Pressure grows on Allan government over coal plant closure’ (with respect to Yallourn closure) by Sumeyya Ilanbey and Angela Macdonald-Smith in the AFR.

… which was followed by other articles (drawing links to the expanded CIS and need for transmission and so on).

2) At ACES it was Anthony Fowler (I think) who made the (uncommon?) common sense statement

‘In order to close coal, we need to replace all of the services those coal units deliver’

3) In parallel with ACES, I also noticed that Origin Energy (in releasing its Quarterly Report June 2025) re-committed to the (once already extended) closure date for Eraring Power Station in August 2027.

It’s a Gas … but not at ACES

As Dan noted in his after-the-fact wrap, Daniel Westerman did use the ‘g-word’ several times, including 4 times in this passage:

‘And for several years our reports have been clear: that when it’s cold, dark and still, the ultimate backstop for reliability is gas powered generation.

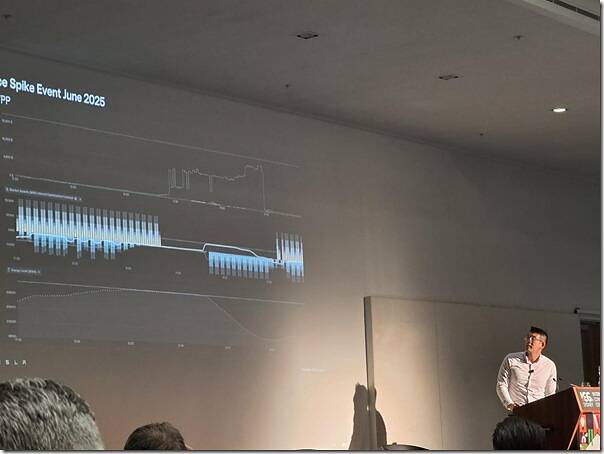

To bring that to life, June saw periods when it was cold, dark and still… and that resulted in both an all-time record gas demand for power generation in the NEM, as well as 5 of the top 10 gas demand days for power generation in the past decade.

AEMO’s message has been consistent and clear: that as Australia’s coal fired power stations retire, the least cost replacement for that energy is renewable energy, firmed with storage, backed with gas, and connected with upgraded networks.’

My own sense is that AEMO has become louder in recent months in vocalising the need for gas powered generation – though I do note this passage in reviewing Daniel Westerman’s address to CEDA back in July 2021:

‘And gas will continue to play an important role in our integrated network.

In Australia, gas seems to have become the most debated piece of the energy jigsaw. I don’t think it needs to be.

Gas firming is currently invaluable, since it can be called on for short periods or long.

It’s incredibly flexible, but might not be used very often.

The prospect that the recently announced gas-fired power station at Kurri Kurri, might only be needed for 2 per cent of the time seemed to draw quite a lot of attention.

But the conclusion to make is not that firming plants like these aren’t required.

The point is even at 2 per cent of the time, dispatchable generation like this unlocks many multiples of low-cost renewable generation capacity into the market, by providing the security for when the sun isn’t shining, the wind isn’t blowing, and other storage can’t bridge the gap.’

Indeed, with respect to the CEC:

1) My sense is that the quieter notes that AEMO made about gas in the past gave reason for organisations/groups/individuals like the CEC (and others more to the left of the Emotion-o-meter) to be quite dismissive of the need

(a) Which, in my view, hindered (rather than helped) the path to closure of coal

(b) So it’s great to hear AEMO being louder now about this need.

2) I gather that some of the departures at the CEC were due to some hesitations to speak about gas as openly as might be expected in an organisation fully focused on helping the energy transition succeed.

One thing that popped up in my ez2view alerts (which were re-routed to a different inbox that I did not see whilst I was away!) was the commencement of operations at the long-awaited Hunter GT peaking plant (i.e. Kurri Kurri) from Snowy Hydro.

Firming Capacity … the well loved, and the unloved

About 11 months ago now, I’d asked whether ‘Are we *still* not building enough replacement Firming Capacity?’ … but there’s been distinct uptick in announcements for battery capacity in the past 11 months (including over the past month or so).

When time permits we’ll be keen to take another look, to see how that (backwards-and-forwards) waterfall chart has been trending … as there was certainly some buzz at the conference about the development pipeline and activity for some types of firming capacity

Booming Battery Bonanza … but slimmer pickings for (real) Long-Duration

Some quick notes here…

The big berthas

There’s been quite a bit of buzz about battery developments that we’ve seen. Even in the past week, there’ve been

1) With respect to the established participants:

(a) There was news from AGL about ‘Final Investment Decision on the 500 MW Tomago Battery’, which was then picked up in the media.

(b) There was news from Origin (in its Quarterly Report June 2025) with respect to its own battery plans

(c) And we also saw Giles write ‘EnergyAustralia focuses on storage as retail margins crimp its wholesale gains’ on 4th August.

2) But there were also plenty of media announcements I saw (and conversations at ACES) from newer entrants who have achieved, or working hard to achieve, FID on their first or second battery projects.

3) Special mention to the Waratah BESS being activated for SIPS in recent days.

———————

PS … Follow-on WattClarity® article about Waratah BESS

We’ve subsequently posted the article ‘Recapping operations at Waratah BESS (including enablement for SIPS) … to August 2025’ that is relevant here.

———————

Three questions about operating these Large-Scale BESS in the NEM

Reflecting on the above, and the conversations we had (and updates we read in the media and on social media) three questions with respect to these large battery developments:

Q1) About behaviours in the market?

Reacting to the release of the QED for 2025 Q2, Giles Parkinson pointed to (what he called) ‘Bad bidding behaviour’ in this article on Thursday 31st July.

Q2) Are they equipped to fly that plane?

Worth reminding readers of James Tetlow’s analogy from November 2024 of the difference between:

1) flying a glider (for Semi-Scheduled units); and

2) flying a plane (for a fully Scheduled unit, such as a BESS).

… especially for those who have just started up the (very steep) learning curve in transferring from ‘just’ an operator of Semi-Scheduled units to an operator including fully Scheduled units.

That’s one reason we’ve asked whether we’ve been killing new entrants with kindness due to the approach taken to integrate into the NEM).

Q3) More sophisticated trading – including ‘Virtual Tolling’

There’s been an increasing amount of talk about more complex aspects of operating a battery:

1) with a number using terms such as ‘virtual tolling’

(a) including Alan Rai, now at Core Markets:

i. who (speaking at ACES) who presented this continuum:

ii. after pointing the audience to the earlier article ‘Modern BESS offtake agreements: A guide for project developers, investors and buyers’ by Core Markets.

(b) and I saw Maria Cahir pose an interesting challenge here.

(c) And it’s worth reminding readers of the earlier article ‘Stacking up: Unlocking multiple revenue streams in the NEM’ by Ben Nethersole following his presentation at an earlier CEC event.

2) But I have a particular question …

QUESTION for READERS –> With the move to ‘virtual tolling’ and the like, who gains and who loses when the virtual arrangement differs from what actually happens (in dispatch) with the battery (because it seems certain both books will diverge in a short period of time)?

… of course, the answer is probably ‘it depends’, but perhaps my head is still too much in holiday mode to not have washed off some scepticism?

8 hours is NOT ‘long’!

It was Anthony Fowler who made some (uncommon?) ‘common sense’ statements in relation to long-duration energy storage … which is a ‘massively understated problem’, and I think it was also Anthony who hoped to clarify that we should be thinking here about ‘weeks and weeks’, not just 8 hours.

Interestingly, we’d seen on 10th July how ‘AGL raises bet on after-dark solar with SA acquisition’ with respect to a potential long-term storage options. I had been envisaging getting to the Long-Duration Energy Storage session to close out Day 2, but was waylaid elsewhere – so would be very interested to hear from people who were in that session?

Down in DER (or CER*?) land

* seems that, after a few weeks away, I’ve forgotten which is the politically correct acronym to use about all the machinations deep in the distribution grid with Mums and Dads as spot traders

Earlier on in my time away, Angela Macdonald-Smith wrote ‘AGL buys Tesla home battery network in community power push’.

1) there was a comment made about this VPP by Nate Chang from Tesla in his presentation at ACES:

2) I can’t recall which specific day in June Nate was speaking about here … perhaps Thursday 12th June 2025 or Thursday 26th June 2025?

I also saw Ryan Cropp write ‘Home battery bonanza to blow through budget forecasts’ on Friday 1st August 2025 … which quoted from the Solar Quotes’ article ‘Federal Battery Rebate On Track To Run Out Of Funding’ by Max Opray on 29th July.

… this followed on from the article ‘How to turn your solar battery into a side hustle’ by Jessica Penny back on 10th July 2025.

The hype machine rolls on

With respect to ACES and elsewhere, it seems that the ‘buzzword bingo’ game card has been changing …

Out of favour…

If was notable that on 29th July Angela MacDonald-Smith wrote ‘Huge extra costs for first offshore wind, nuclear plant: CSIRO’ in the AFR following release of GenCost.

At ACES, and in the broader discussions, some of the yester-year darlings are out:

1) Obviously no mention of nuclear, given the forum and audience and election result

2) Also out-of-favour was off-shore wind,

… though I did see the CEC earlier in the year had its own focused conference on off-shore wind (but we skipped that one – a long way from operational).

3) Also notably out of favour was the hydrogen hype:

(a) On 4th August Hannah Wootton highlighted ‘Twiggy Forrest erases green hydrogen projects from website’ in the AFR;

(b) In the Australian Michael McKenna wrote ‘How gullible politicians got taxpayers lost in Andrew Forrest’s hydrogen hype’.

Very Much in favour …

In another case of ‘out with the old and in with the new’ there were new sessions at ACES dealing with the latest round of hype.

Dazzle, about Data Centers

Whilst the hydrogen hype has certainly faded compared to prior years at CEC events, there was plenty of dazzle about data centers – including it’s own dedicated session (that was standing room only, I understand).

1) Unfortunately I could not be in the session (another where there were multiple interesting streams at the same time)

2) But understand that Rob Koh’s talk was worth a listen:

(a) I was told Rob Koh’s jokes did elicit genuine laughter (more than other sessions) – but I’d have to believe that wraps on Rob’s talk was not just because of his winning personality!

(b) Perhaps one day we might be able to include some more from Rob’s deeper dive on data centers here?

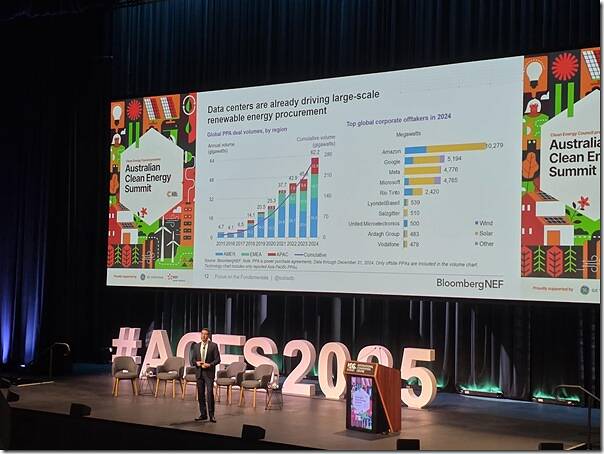

But that was not the only mention, with Kobad also presenting this slide, for instance:

To avoid risk of confusing any reader here, these are global numbers – as Kobad likes to present

The dark horse …

There’s even an uptick interest in AI:

1) yep, also a session

2) … but much less attendance than the Data Center session next door at the same time.

Tying the two together, our team did see that ‘Tasmania enters the ‘AI race’ with Firmus Technologies factory in north of state’ on 2nd July in the ABC with respect to the development there – including the note at the end:

‘Firmus said the first stage of its project required 90 megawatts of energy.’

This development was also covered on 8th July via ‘Firmus in final days of $280m capital raise amid $1.5b AI push’ by Street Talk in the AFR

For Energy Users …

On day 1 of ACES there was a session ’Unlocking Australia’s clean industrial growth potential’ during the afternoon … unfortunately it was simultaneous with two other sessions that the team wanted to be at, so Linton drew the straw to attend this one:

I’ve not yet compared notes with Linton about the discussions during this session, so nothing to report here publicly

… though I did have some interesting discussions later over drinks, before we headed out for our own private dinner.

Specific Energy Users

More broadly in energy user land, over the past month or more we’ve noted much coverage of challenges with large energy users.

1) On 20th July we noted Ronald Mizen and Angela Macdonald-Smith wrote ‘Labor flags equity, loans in strategy to save metals smelters’ in the AFR.

2) That followed ‘‘Bailouts don’t cut it’: Coalition wants metals processing inquiry’ on 16th July by Angela Macdonald-Smith.

With respect to a few specific energy users:

1) I’d already noted on 7th June that there were ‘Large Energy Users feeling the strain (such as at Tomago)’.

2) With respect to the TEMCO smelter in Tasmania smelter (more recently named Liberty Bell Bay as part of Sanjeev Gupta’s sprawling/crumbling industrial empire):

(a) We’d noted earlier about ‘Trouble at the TEMCO Smelter in Tasmania in May 2025?’

… though we did not follow that up to see what actually happened in June (nor did we see anything specifically about the temporary closure in subsequent media)

(b) But we did see that (according to Simon Evans here in the AFR on 27th June) …

‘The corporate regulator said late on Friday it had begun action in the Supreme Court of New South Wales against [OTHER ENTITIES] and Liberty Bell Bay for failure to lodge the documents with ASIC.’

3) Nyrstar, with its operations in TAS and SA, was also in the news

(a) this was reported in the AFR on 1st July and on 2nd July and on 8th July and on 13th July …

(b) Plus elsewhere as well…

(c) With the latest being on Monday 4th August that ‘Nyrstar smelters get $130m rescue package’ in the AFR.

4) Adding to the angst, I saw Brad Thompson wrote ‘Alcoa hits back at unions as Portland smelter faces damaging shutdown’ on 31st July in the Australian

5) Seemingly never far from the news is the embattled Whyalla steelworks, formerly part of the GPG empire. There’s been a range of media articles about this whilst I’ve been away, including the article ‘BlueScope joins with Japanese, Korean, Indian giants for Whyalla tilt’ by Simon Evans and Peter Ker in the AFR on Monday 4th August.

6) Not in the NEM (at least until – and if – CopperString is fully built … that’s a whole other story) is Mt Isa, which gained its own mentions such as in ‘Mt Isa fights for its life, and a billion-dollar smelter bailout’ by WHO in the AFR on WHEN.

Market Developments, and Outcomes

Plenty went on in the past month or two, including …

Sunday 8th June 2025 = commencement of Frequency Performance Payments

Prior to me heading away, there had been plenty of articles written about the commencement of Frequency Performance Payments (FPP) from 4th June 2025. Notable that Linton pieced together a two-part analysis of the early days of operation:

1) Firstly with my article ‘Frequency Performance Payments 44 days in’ on 23rd July.

2) Then ‘Frequency performance payments 44 days in, part 2’ on 1st August

… will need to invest some time to read and consider in more detail.

Volatility in June and July 2025

Here on this site, there was plenty of coverage of market volatility:

1) With June 2025 seeing its own share

(a) Particularly on days like Thursday 12th June 2025 and Thursday 26th June 2025.

(b) Which fed through to the ongoing bump in prices seen for 2025 Q2.

… when Q2 used to be the most ‘boring’ quarter!

2) And a couple bursts in July 2025 as well

… particularly (remembering Jon Dyson’s admonition from years ago to ‘Let’s talk about FCAS’) in some FCAS markets

Worth calling out the article ‘Systems and markets and dysfunction’ published by Alex Leemon (who’s changed horses in his day job?!) on 3rd July 2025 that pointed out that readers should be careful not to conflate ‘the market’ (which experiences extremes more often) and ‘the system’ (not so often).

… that’s similar to the point that Allan made in this comment here.

1st July 2025 = commencement of ERI

From 1st July 2025, two changes are to be made under the ‘Enhancing Reserve Information (ERI)’ project:

Change #1) Publication of previous day’s 5-min data for batteries

Change #2) Publication of daily energy limits (total availability) for scheduled generators at the start of the trading day

These changes will be subject of internal discussions this week.

Thursday 31st July 2025 = enhancement of ST PASA and PD PASA

On Thursday 31st July, Dan noted that ‘Today marks the go-live date for the AEMO’s new unit-level availability data and other STPASA changes, on 31st July 2025’.

We’ve already received some compliments from clients in relation to what we have done there in ez2view version 9.12.* released in June 2025.

Persisting with the WDRM?!

Back on 3rd May, we’d noted that the ‘AEMC underway with review of the Centralised Negawatt Dispatch Mechanism (a.k.a. the WDRM), and consultation closed’.

I noticed that (despite some profound scepticism about the value of the program by myself and others – including with some very lacklustre registrations over the past ~4 years) the AEMC draft ruling that came out on 10th July suggested:

1) that the AEMC was going to persist with the method.

2) and that the Expanding eligibility under the WDRM rule change request be initiated.

One to puzzle over… submissions to the draft report are due 14 August 2025

Nodal Pricing … again, again, again

Also making me fall off my chair is another push at nodal pricing for the NEM … this time with ERC0418 at the AEMC. I see that David Havyatt, formerly with the Energy Consumers Australia, is involved.

Not quite there (yet!), with the draft report from the Nelson Review

I was expecting (hoping?) that the draft report of the Nelson Review would be released whilst I was away.

1) However the expected time for publication of the has been extended from July into Q3

2) At ACES, Tim had said that the release was ‘imminent’ …

NOTE for READERS –> And yes, for those who are waiting, I’ve not forgotten the questions asked of me (with respect to updated thoughts about whether the Semi-Scheduled category is sustainable or scalable, and will endeavour to post more on this in the weeks ahead.

Blackouts, internationally

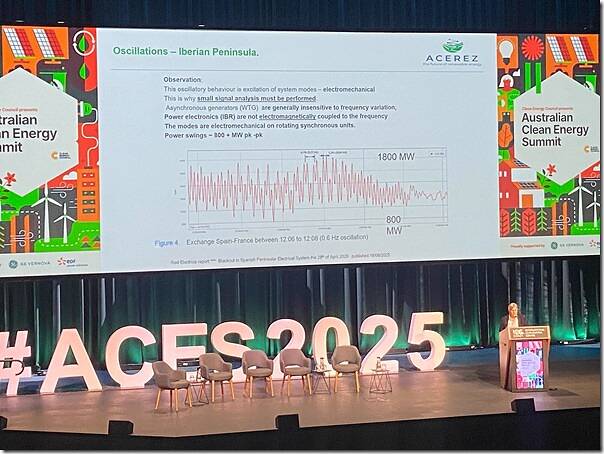

We did not spot any other (major) reporting about what happened with the April 2025 power outage on Iberian Peninsula in Europe, but:

1) There was a bit of chatter on some internal communications channels about commentary we’d seen; and

2) At ACES it gained some mentions, including:

(a) Daniel Westerman noting:

‘Power systems are complex, and detailed investigations are still ongoing, but it’s very clear that there was not just one single event or root cause.

Up to 12 simultaneous issues have been identified as contributing to the cascading trips of generation, and ultimately the complete collapse of the power system.

Their system saw: swings in voltage; reductions in reactive power; unexpected behaviour of grid connected equipment; oscillations in system frequency, and more…

All things that we broadly put in the category of system security.’

(b) Also worth noting that Kate Summers did touch on it in her key note at ACES:

There was a smaller (though still significant) blackout in the Czech republic on 4th July that we noticed.

Adding to the reading list

We already wrote about the publication of:

1) On 1st July, about the ‘Directions Paper adjusts approach to loop IRSR’ from the AEMC; and

2) On 9th July, AEMO’s release of the Enhanced Locational Information (ELI) report; and

3) The Gencost update, there were a number of other reports to add to the reading list

4) On 1st August, the QED for 2025 Q2 (noting that the AER Wholesale Quarterly was also released);

… but that not all.

As time permits we’ll try to add notes about others (and then belatedly link them in here).

Churn in Participant Land

From 24th July 2025 this Street Talk article starts with the lead in…

‘Australia’s renewable energy M&A and financing scene has never been busier, dominated by …’

… and that seems to sum up the increasing difficulty of keeping up with ‘who’s who in the zoo’.

Amongst the things I’ve noted are:

1) There was some talk about a possible tie-up between Alinta Energy and EnergyAustralia

… for instance on 29th June Angela Macdonald-Smith wrote ‘Alinta Energy says it is ‘open to exploring options’ with rivals’ in the AFR.

2) There were developments for Baywa Australia

… as noted here by the Street Talk team on 29th June in the AFR.

3) Some good news for Ampyr Energy Global with $340M financing (noted here by Street Talk on 8th July)

4) Through the month we saw ongoing coverage of some challenges at HMC Capital …

(a) which (through STOR Energy) is supposed to be acquiring the Victorian assets of Neoen as a by-product of its acquisition by Brookfield:

i. See this media release ‘Brookfield’s acquisition of Neoen not opposed, subject to divestments’ by ACCC back on 31st October 2024;

ii. See this media release ‘Neoen divests Victorian portfolio in AUD 950m sale to HMC Capital in Australia’ on 4th December 2024;

(b) The transfer was slated to occur on 1st July 2025 but more recently hit some hurdles:

i. At the start of the month …

> This was noted on 1st July in the AFR here by Elouise Fowler and here by Chanticleer.

> and in the Australian Bridget Carter wrote ‘HMC Capital struggles could see Neoen underbidder Iberdrola resurface’ on 1st July, including this:

‘Investors punished HMC on Tuesday, with its share price down more than 17 per cent to $4.22, wiping about $400m off its market value as it told the market it had pushed back the settlement date of Neoen by one month.

It had also borrowed $200m of mezzanine debt for Neoen and merged it with its Stor Energy battery platform, as its gun infrastructure executive who was to run the business, Angela Karl, leaves.’

ii. Then towards the end of July I saw Bridget Carter write ‘Lazard on hunt for buyers for HMC Capital’s renewable energy group Neoen’ in the Australian on 29th July

iii. And then on 4th August the company announcement about ‘Financial Close of the Acquisition of Neoen Australia’s Victorian Assets’.

iv. Which garnered attention then:

> In the AFR with ‘HMC seeks to raise up to $1b for reworked renewable energy platform’; and

> In RenewEconomy with ‘Return of fire-hit Bulgana turbines delayed as HMC completes Neoen asset deal, seeks new investor’.

4) Soul Patts investing ~$40M in North Harbour Clean Energy (noted here by Angela MacDonald-Smith on 27th July)

5) KKR investing $500M in CleanPeak Energy (noted here by Angela MacDonald-Smith on 28th July )

6) APG Asset Management investing $1b in Octopus Australia (noted here by Angela Macdonald-Smith on 29th July)

7) Not in the NEM, but also worth noting challenges/changes at Suncable (noted here by Angela Macdonald-Smith on 25th July)

The future…

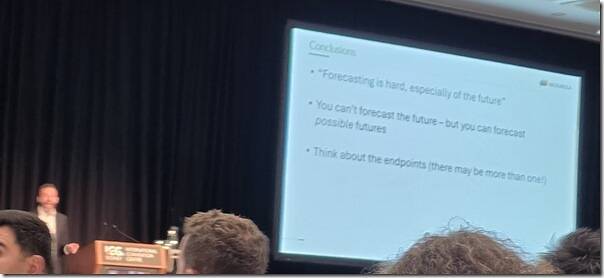

Towards the end of ACES there was a session on forecasting, with Joel Gilmore leading with some pithy lines:

This session was well worth attending, but also notable that:

1) One of the panel members, Sabine Schleicher from KPMG, noted this on LinkedIn.

2) Geoff Eldridge did not attend, but:

(a) He noted via this LinkedIn update that:

‘I was recently invited to join a panel at the Clean Energy Council’s hashtag#ACES2025 event — Forecasting key trends in the Australian energy market and system. I couldn’t attend …

To be honest, I was surprised to be asked. … I’ve never considered myself a forecasting expert.

So I took the invitation as a prompt to reflect over the last few months since the invitation.

What would someone like me — more comfortable with pattern recognition than prediction — offer in a forecasting conversation? That reflection became a recent Substack post crafted in Berlin and now shared here as LinkedIn Article:’

(b) With his article ‘The Future Doesn’t Forecast Itself’ is worth a read.

3) Also notable was that Kane also had asked me to be on the panel, but I’d declined because I was also just returning from a long holiday overseas:

(a) But also on my mind was what I reminded the audience the last time I was asked to be on a forecasting related panel (way back in 2017 at ACES back at the Sydney Hilton) which was that ‘Forecasting is a mugs game’

(b) Back then I did give a forecast of sorts, which was this still unfolding train wreck…

(c) I don’t know for sure what Kane was thinking in asking me:

i. Perhaps he’d forgotten the stir I’d caused last time?

ii. Or perhaps he thought he’d end his tenure at the CEC with a bang?

So (perhaps well beyond the 80:20 rule) I’ll leave this article here for today with the ultimate question for readers…

QUESTION for READERS –> What (else) did I miss, in my time away?

Leave a comment