It was back in October 2020 that Stephen Wilson reminded us that ‘‘The Market’ means different timescales’ … and in fact:

1) a wide variety of timescales many (Stephen says 12!) orders of magnitudes apart:

(a) From sub-second data used for metering purposes

(b) Up to multi-decadal time scales for purposes such as:

i. System-wide studies … internal ones, but also publicly released (and much debated) ones such as the ESOO and the ISP

ii. For project development, amongst other reasons

2) But, perhaps more importantly, Stephen reminds readers that we (collectively) commonly forget that others who speak about ‘The Market’ or ‘The system’ might be thinking at a different timescale from us.

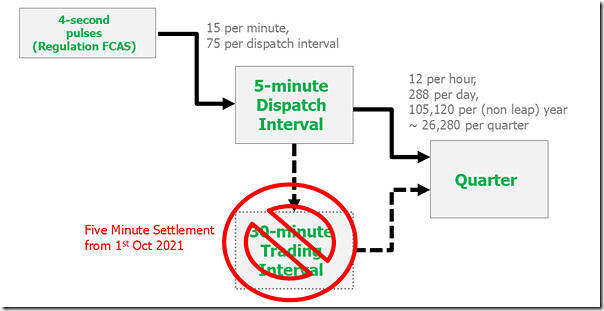

In some training delivered late in 2024 for a particular client I included this slide to (hopefully) emphasize the above, and also to provide some context to three of the most commonly used (time-based) building blocks:

These are the three that we (at Global-Roam Pty Ltd) most often deal with, but each of our readers will have their own experiences … some down at the sub-second level, whilst others up at longer time-scales:

| Time-step | Some notes |

|---|---|

Millisecond data |

For completeness, worth noting we’re posting an increasing number of articles about frequency disruptions we observe down at 100 milli-second level. Some we remember to tag with ‘frequency disruption’. |

4-second timesteps |

As Linton noted as recently as last Friday in his article ‘Incentivising primary frequency response’ 4-second time-steps are used in Regulation FCAS for both: 1) On the ‘supply’ side: The 4-second pulses used (on the mainland … Tassie is different) to signal the need for Raise or Lower Regulation FCAS to those DUIDs enabled to provide the relevant Regulation FCAS service within that particular Dispatch Interval. 2) On the ‘demand’ side: The same 5-minute timesteps are used for allocation of Regulation FCAS cost, with the method soon changing: (a) from ‘Causer Pays’ (b) to the newer ‘Frequency Performance Payments’ mechanism — Within (at Global-Roam Pty Ltd) 1) We are increasingly making use of the 4-second data: (a) You’ll find some of the articles written following analysis of 4-second SCADA data tagged here (if we have remembered to do so) (b) But there’s more to come, as well… 2) In addition (as noted in our 25-year review), we invested in a wind-farm focused self-forecasting company over a year ago now. 1) Because of what they do, they constantly deal with the 4-second data. 2) For those who have not seen it, the company provides clients with a very impressive dashboard enabling for fast and clear analysis of AEMO’s published 4-second data. |

5-minute timesteps |

5-minute time-steps have always been used in Dispatch of Australia’s National Electricity Market (and even beforehand in the Queensland Interim Market). 1) That’s different than most other electricity markets around the world (e.g. in WA they only moved to 5-minute dispatch about a year ago); 2) It’s also different than what was the case in the pre-NEM VicPool market in Victoria, which then integrated with NSW prior to the start of the NEM. These 5-minute timesteps (all ~105,000 each year) have always been the ‘bread and butter’ focus of our ez2view software, striving to provide a better and better understanding of ‘why was … the dispatch outcome such-and-such at that particular dispatch interval’. More on that, coming soon… Much more recently (in relative terms, but still now ~3.5 years ago) the NEM moved to 5-Minute Settlement on 1st October 2021 at great expense (much greater than some earlier official estimates assumed) – but because of the assessed longer term benefits. |

30-minute timesteps |

However if you were (simplistically) thinking that 30-minute timesteps did not exist anymore in the NEM following the inception of 5-Minute Settlement a few years ago, you’d be wrong. 1) For instance (by virtue of Tripwire #1 and Tripwire #2 and the underlying computational intensity in an increasingly congested grid), the AEMO’s P30 predispatch process: (a) is still central to signaling ahead of time that some form of market response might be required. (b) and still ‘only’ works with 30-minute timesteps (and a 30-minute data update frequency as well). 2) The AEMO’s ST PASA process also still works with 30-minute timesteps only. 3) It was over 3 years ago that we released GenInsights21 … (a) which included 22 Key Observations (amongst many other things). (b) In Observation 6 we wrote about ‘What’s next for market modelling’ noting that: i. Much of this is still done on 30-minute timesteps ii. Which seems increasingly limited/simplistic, given the changing nature of the NEM … including increasingly common (and rapid) ramps in Aggregate Scheduled Target. iii. and also at odds with requiring the industry to invest an very large sum of money in the implementation of Five Minute Settlement. |

Quarterly timesteps |

Market participants are freely able to try to* hedge their exposures in the spot market through any means they . * obviously they need to find an acceptable counterparty to effect such a hedge. 1 ) ASX Energy (formerly d-cyphaTrade) is one entity that has evolved to facilitate hedging on a quarterly basis – with quarterly products offered for >20 years. 2) End-of-day data is available in our ez2view and NEMreview software, and occasionally is analyzed in articles here on WattClarity ®. Also importantly, the quarterly timestep has been an important cadence of some very useful reporting on NEM performance: 1) Since its inception, the AEMO’s Quarterly Energy Dynamics publications (some of them noted in WattClarity articles) have been important boosts to the general level of energy literacy across NEM stakeholders. 2) The AER has also been usefully publishing their own AER Wholesale Markets Quarterly (some of them recorded here on WattClarity). 3) For a period of time, until heightened busyness made it impossible to continue, we teamed up with GVSC in publishing our own GenInsights Quarterly Updates. |

So from here we’ll start progressively exploring ‘Watts Within a Dispatch Interval’ .

Leave a comment