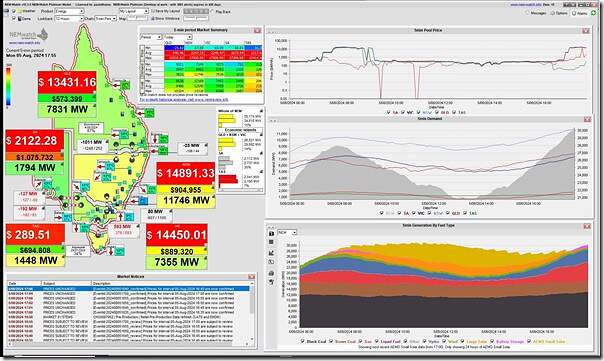

Earlier today we wrote about the ‘Morning burst of volatility across the NEM on Monday 5th August 2024’ … so this is an accompanying piece starting with this snapshot from NEMwatch at the 17:55 dispatch interval on Monday 5th August 2024:

Quick notes…

(A) What to watch

There’s a couple things to watch here:

(A1) Tight supply-demand balance

For those with their own copies of NEMwatch (or in ez2view it’s in the ‘NEM summary stats’ widget) you can keep an eye on the NEM-wide IRPM, which has dropped down below 15% into the ‘yellow alert’ level this evening.

… those with access to our SMS alerts facility might like to configure their own SMS alert on this metric being below 15% as:

(a) that happens quite rarely

(b) but, when it does, it indicates tight supply-demand balance

In the snapshot above it had dropped below 15% for the first dispatch interval (to 14.70%).

(A2) Watch prices

Of course, watch the Dispatch/Trading Prices! Plenty of tools for that.

(A3) Watch the Cumulative Price (more than just South Australia, now)

Back On Wednesday 31st July we wrote a warning to ‘Keep an eye on the Cumulative Price … especially in South Australia’.

(a) We see above that the Cumulative Price in South Australia has is above $1,000,000 (and so over half the way to the Cumulative Price Threshold).

(b) Other regions (particularly NSW and VIC) are also climbing!

(A4) Watch FCAS Prices!

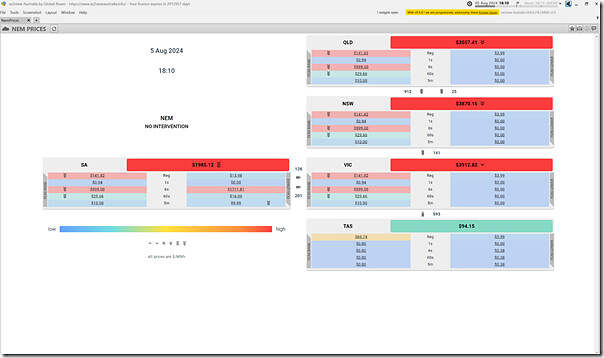

Remembering the prior exhortation ‘Don’t forget about FCAS!’ it’s useful to highlight that there’s also some spicy prices for some FCAS commodities in some regions, as captured in this snapshot from the ‘NEM Prices’ widget in ez2view at 18:10:

(B) An initial list of Contributing factors

This morning I listed four contributing factors for this morning’s volatility … they are similar this evening as well…

(A1) Evening peak in demand

In the NEMwatch snapshot above we see the typical shape for an evening peak in ‘Market Demand’ (noting in the snapshot that this has climbed over 30,000MW and would be expected to climb further). Keep in mind that:

(a) The absolute level is important;

(b) But also is the rate of ramping required.

(A2) Low wind

The low wind conditions noted this morning have continued … it’s been below 1,000MW since noted this morning.

(A3) Low solar

Whilst solar yield was depressed in sunlight hours because of cloud cover (noted this morning) at this point the sun’s pretty much gone to bed for the winter bedtime.

A4) 7 (of 44) Coal units out

This morning we presented a snapshot from the ‘Generator Outages’ widget in ez2view snapped at the 09:30 dispatch interval … at the time noting that there were 7 coal units offline (a combination of planned and forced outages).

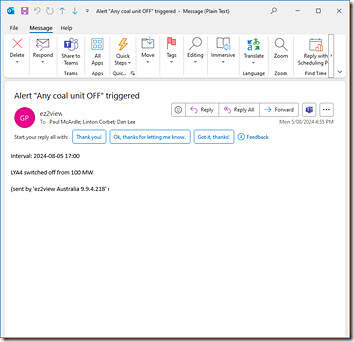

Late this afternoon Loy Yang A4 also came offline, as captured in this ez2view alert in the ‘Notifications’ widget at the time.

So, by my count, that’s still 7 units out this evening (as GSTONE4 came back online during the day) … but LYA4 is larger (lower cost) and more important.

A5) Other factors

No doyubt there are other factors….

In Victoria Newport Power Station contributed nothing through the morning and evening price spikes, while Mortlake was well below full output. Are gas pressures low through inadequate withdrawl capacity from the Iona storage?