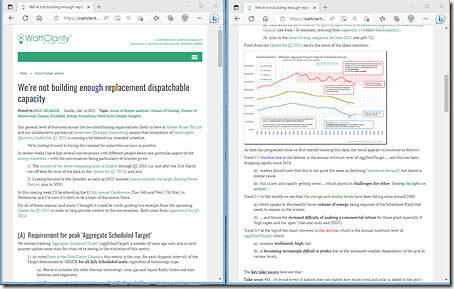

On 14th May 2023 we wrote about how ‘We’re not building enough replacement dispatchable (i.e. firming) capacity’ following the inclusion of some new data in GenInsights Quarterly Update for Q1 2023.

But our concerns go back way further …

For instance (back in 2017 when we began compiling the GRC2018) we had clearly seen that there was an emerging Schism between:

Service #1) the rise of ‘anytime/anywhere energy’ and

Service #2) the need to provide separate mechanisms to encourage the development, maintenance and operations of a range of different technology providing ‘keeping the lights on services’.

So it was with keen interest that we saw the development of the Capacity Investment Scheme as (what we thought was) an attempt to provide for that 2nd type of service (i.e. firming capacity).

1) When we saw (back on 9th December 2022) the announcement that the ‘Capacity Investment Scheme to power Australian energy market transition’.

2) When we saw that the ‘Discussion Paper released on Capacity Investment Scheme’ in Aug 2023.

… In that article we noted the ambition that

‘… The CIS expects to bring on at least $10 billion of new investment and 6 GW of clean dispatchable capacity by 2030.’

3) And then when we were (perhaps suckered) with the headline that the ‘Federal Government announces expansion of the Capacity Investment Scheme on 23rd November 2023’.

… although on this front we were a little concerned that it seemed a bit like ‘bait and switch’ given that the large share of the increase in capacity touted (i.e. to a headline of 32GW installed capacity) was:

(a) for new incentivisation for the development of more ‘anytime/anywhere energy’ capacity (i.e. 23GW of the 32GW headline number)

i. which already had support mechanisms including the RET (albeit now in its twilight years), and state-based renewable targets, and corporate purchasing processes (expanding the market for LGCs);

ii. some of which were already noted as Villain no 7 back in 2020 when we wrote ‘we’ve been killing new entrants with kindness?’.

(b) leaving the procurement incentives for providing ‘keeping the lights on services’ down to a much more meagre 9GW capacity … which our analysis in May 2023 had already shown was nowhere near enough!

Perhaps the devil was always in the fine print (in which case it’s my fault for not finding it) but I’m more cautious as a result of feeling burnt by the headlines – for instance in reading the news this week that consultations open on the Design Paper for the expanded Capacity Investment Scheme:

This page on the ‘Department of Energy’ Canberra website notes three important things:

Important Note #1) 35-page PDF Design Paper

For a start, on Thursday 29th February 2024 the Department released this 35-page Design Paper on the Capacity Investment Scheme:

An appropriate (and ironic) day for release of a design paper on a Capacity Investment Scheme, given it was the day this week:

1) that NSW probably experienced all-time peak in ‘Underlying Demand’, and

2) Would have really struggled to maintain supply without the contributions (or energy, and other services) by Eraring power station

… a plant that is slated to close in August 2025 (now under 18 months away).

Important Note #2) Consultation Webinar this coming Friday 8th March 2024

There’s a Consultation Webinar on this coming Friday (8th March) with details here on how to join:

Important Note #3) Submissions close before the end of the month

Importantly, submissions close by Monday 25th March 2024.

Leave a comment