Early afternoon yesterday I posted ‘The forecast LOR2 for NSW on Thursday 29th February 2024 grows more extreme…’ … and this has subsequently been doing some rounds on social media.

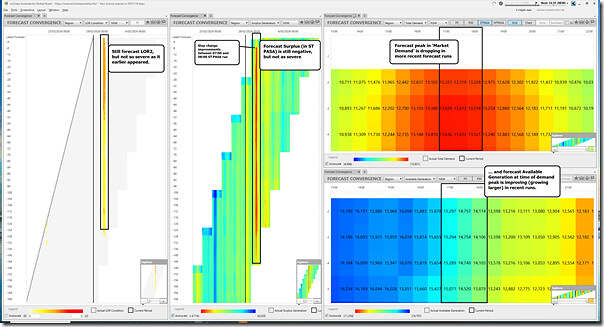

Well, the good news is that the more recent AEMO forecasts, whilst still seeing forecast LOR2 tight supply-demand balance for tomorrow afternoon/evening in NSW, it’s not as extreme. This juxtaposition of 4 different ‘Forecast Convergence’ widgets in one window at 14:05 on Wednesday 28th February 2024 highlights a few factors:

In particular, we see:

1) The most recent forecast runs for forecast ‘Market Demand’ see this improving (i.e. getting lower), though still above 13,000MW – so still high, in the context of summer 2023-24.

2) The most recent forecast runs for forecast Available Generation also see an improvement here (i.e. growing larger).

3) In terms of the ‘Surplus’ calculated between the two, in the ST PASA runs there was a step change improvement seen between the 07:00 run and the 08:00 runs this morning (which have not been investigated).

The most recent AEMO Market Notice (MN xxx published at 13:34:34 NEM time today) reflects this:

‘——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 28/02/2024 13:34:34

——————————————————————-

Notice ID : 115287

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 28/02/2024

External Reference : PDPASA – Forecast Lack Of Reserve Level 2 (LOR2) in the NSW Region on 29/02/2024

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR2 condition under clause 4.8.4(b) of the National Electricity Rules for the NSW region for the following period:

[1.] From 1600 hrs 29/02/2024 to 1900 hrs 29/02/2024.

The forecast capacity reserve requirement is 1186 MW.

The minimum capacity reserve available is 602 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-’

We’ll keep an eye on this – but worth noting we won’t have time for a running commentary (back to analysis for GenInsights Quarterly Update for 2023 Q4, amongst other things).

Leave a comment