What happened yesterday (Tuesday 13th February 2024) has a number of parallels with what unfolded over the period 30th and 31st January 2020, and then for months into the future from that point. Within 48 hours of that event I’d posted ‘13 headline questions and observations following the long-term islanding, starting Friday 31st January 2020’.

So, with less time elapsed to get my thinking straight, I’ve had a stab at an initial list of questions (that we’ll try to find answers for – time permitting) with respect to 13th February 2024 … not enough time for any real observations yet (with apologies to the journalists and so on who are calling to ask):

(A) What could have been expected (and prepared for) in advance?

It’s logical (and important) for the industry to ask the question ‘what could have been expected (and prepared for) in advance?’. Given the current stresses* of the current challenges of returning supply to those still without power, and initiating the process for repairing the destroyed transmission towers, we’re probably not going to get the best answers* in asking these questions right this minute.

* these stresses, and chances of reaching useful conclusions, are not helped by the growing band of people (especially at the extremes of the Emotion-o-meter) looking for someone (or their least favoured technologies) to ‘blame’! As Andrew Richards noted earlier today.

But for now just wanted to flag that this is a question for the future…

A1) About the possibility of severe weather

At 10:56 on Tuesday 13th February 2024, Ashleigh Lange posted ‘Dangerous mix of weather in VIC, NSW, TAS’ … so only a couple hours before the storms toppled the transmission lines. There may well have been earlier warnings in the days beforehand.

A2) Weather and the electricity market

The AEMO had previously issued ‘NEM Local Temperature Alerts’ for VIC in relation to temperatures in Mildura some days beforehand:

1) Market Notice 114521 at 10:44 on Monday 12th February; and

2) Market Notice 114700 at 11:12 on Tuesday 13th February 2024.

These types of notices are about helping generators located in the area (e.g. around Mildura) to ensure they update AEMO with the generally reduced plant capability due to the higher reference temperatures.

—

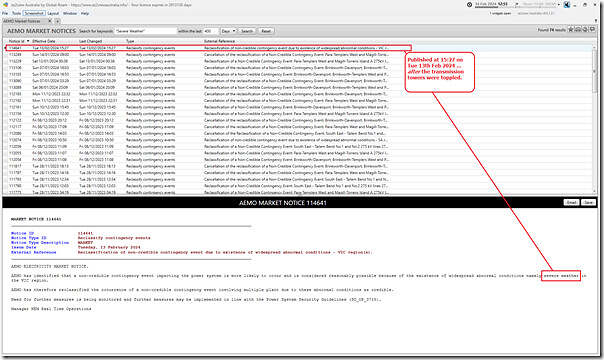

However (unless I am missing something – which is quite possible) I could not find any Notice from AEMO about ‘Severe Weather’ prior to (and related to) what happened on Tuesday 13th February – as shown in this snapshot search in ez2view today:

Looking back 400 days in the search there are a fair number of notices … just none related to Tuesday 13th February 2024.

My recollection (which again, might be wrong) is that (after the SA System Black) the AEMO ramped up its processes for using forecasts of Severe Weather to reclassify contingencies or otherwise downgrade network transfer capacity to provide more headroom for if calamity should strike.

I wonder what pre-emptive steps might have been taken to provide more safety margin in advance of Tuesday 13th February 2024 … and whether it would have been possible to forsee an increased risk of transmission towers on the ground in that particular location?

A3) Market Participant preparations?

A different thread for consideration is the extent to which market participants were able to prepare in advance for calamity.

For instance, those with very limited energy capability … were they fully charged and ready to go (noting that this is of particular interest in the future as we accelerate towards a more ‘just in time’ approach to managing stored energy on the ground).

(B) What was the sequence of events?

There’s a few different timeframes that come to mind, under this heading – which we could sum up in three buckets:

Timescale #1) Within the day

Focusing just on the day (Tue 13th Feb), what was the sequence of events (e.g. as storms rolled through to topple the transmission towers and cause widespread) which led to the tripping of demand and also the tripping of supply (including Loy Yang A – but also some renewable generation). In this timescale we’d be interested in:

(a) what the weather did …

i. In terms of driving Underlying Demand;

ii. Then when the storms rolled in to cool the demand, and (unfortunately) knock over transmission towers and cause major damage at the distribution level.

(b) what AEMO and the NSPs did in response to the system stresses through this period

… for instance, AEMO notified the market of RERT Negotiations (i.e. separate to the 300MW directed Load Shedding and the earlier automatic Loss of Load), but I did not see any update about either:

i. Something (i.e. RERT) being contracted; and/or

ii. Something being dispatched.

(c) what the behaviour, and responses from Market Participants …

i. Such as who bid what in response, and the speed and duration for which various assets were deployed;

ii. Not so much from a ‘who saved the day’ perspective (frequent readers will recall I find that mindset irritating!), but from a perspective of who reacted on what timescale, what the motivations might be (remembering it’s impossible to know someone’s motive), and what the outcomes were.

… for instance, Pedro asked us here ‘I would be interested to see your insights into the performance of the large battery generation systems in Victoria for yesterdays event.’.

1. We’d also be interested … not just in relation to technical capability and performance, but also in terms of what was offered into the market (and how any SIPS-like scheme contributed).

2. But not just about batteries!

… and I’m not just meaning at a wholesale level …

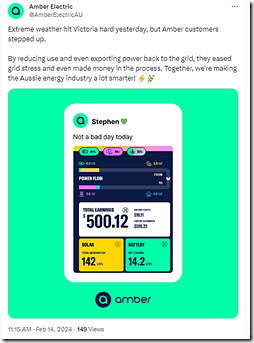

1. Amber Electric’s proudly promoting it’s impact of spot price pass-through (and a bit of automation) to retail customers:

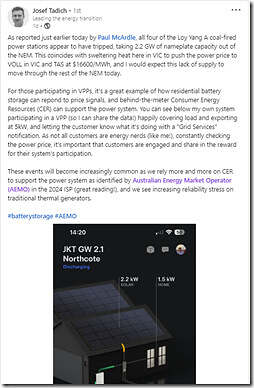

2. Over at Tesla, Josef Tadich is also proudly promoting the effect of the Tesla VPP process:

… also noting that this update was picked up on RenewEconomy in ‘Grid drama and power cuts as multiple coal units and lines trip in midst of heatwave’.

3. Closer to home, we wonder about what happened onsite at many of the large industrial energy users who are our clients across Victoria (having some form of spot exposure and/or participation in FCAS markets)

Update: On Thursday morning 15th February 2024 we posted a first pass through what we could see that happened on Tuesday 13th February 2024 in the article ‘A sequence of events for what happened in Victoria through the day on Tuesday 13th February 2024 (via Timeline #1)’, and will look to drive our understanding further in the coming days….

There are plenty of other questions that arose in the course of this investigation!

Timescale #2) Seconds and Minutes

Zooming in, to just focus on the minutes before and after 13:08 … when the transmission element failure at 13:08 NEM time on Tuesday the 13:15 dispatch interval – to consider such things as:

(a) A microscopic sequence of events (e.g. did the loss of load occur before the Loy Yang A trip, as speculated here yesterday); and

(b) The impact on system frequency and so on.

plus much more.

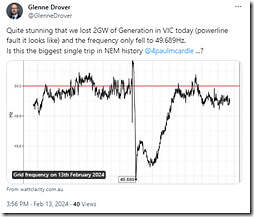

As another ‘for instance’, Glenne Drover’s tagged me on a particular rabbit hole (oops, question) about whether this was the biggest trip in the history of the NEM:

Resisting the temptation to slip further into that rabbit hole, it’s worth highlighting that ‘biggest trip’ might be broadened to mean ‘biggest disruption’ and so encompass various threads, including:

i. Largest number of MW offline in a single instant in time

ii. Largest drop in system frequency;

iii. Most customers (or highest number of MW) offline as a result;

iv. Largest $$ cost to consumers

… and so on…

Timescale #3) Days, Weeks and Months

Zooming out to look at the days, weeks and months ahead in:

(a) the repair process for returning damaged transmission lines to service … remembering that the DNSP challenges are not really our focus; and

(b) the investigations into what happened, the lessons learnt, and the implementation of the recommendations.

… which we’ll collate under this Headline Category on WattClarity)

(C) Questions, and implications, about transmission system failure?

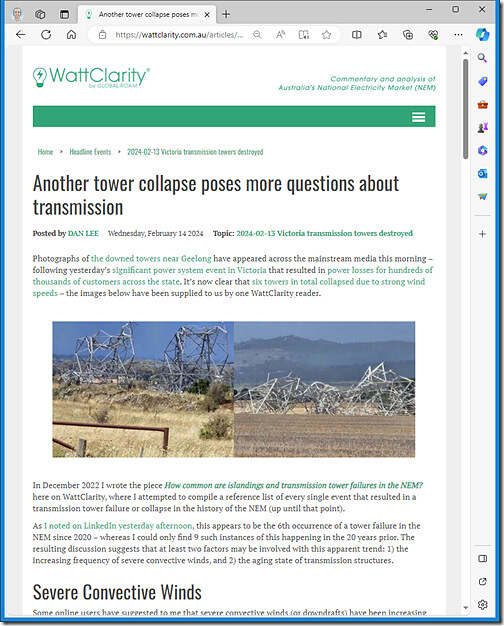

Yesterday evening Dan Lee posted some thoughts here on LinkedIn that related to the article ‘How common are islandings and transmission tower failures in the NEM?’ he wrote on 16th December 2022. Both the post on LinkedIn and the article from late 2022 generated discussion.

Today Dan has posted ‘Another tower collapse poses more questions about transmission’:

Dan’s noted some of the questions we have – below I will try to categorise them:

C1) Higher (than expected) Failure Rates?

From an ‘outside looking in’ perspective, we’ve wondered if it’s actually the case that we’re seeing more frequent transmission failure in the NEM (in more recent years)? There’s essentially two different questions in one here:

(a) Are we experiencing higher failure rates now?

(b) Are these higher failure rates unexpected … and, if so, why?

If time permits, this is something we’d like to explore in more detail … though it may be that there are others out there better placed (with the right data) to help us answer this?

On this question, interesting to note Dr John Holmes’ comment on one of yesterday’s article here, where he says:

‘JDH Consulting are wind loading specialists and have been studying failure of high voltage transmission line towers in Australia, particularly in Victoria for about 25 years. Failures due to small but intense storms such as microbursts are common for a number of reasons, such the wind structure within the storms and the directional orientation of the line. The risk of failure along a line is also dependent upon its length. JDH has been in discussion with AusNet regarding a specific study of line risk for the Victorian network, similar to the extensive studies carried out for ElectraNet in South Australia, following the many failures that occurred there in September 2016.’

… and noting the other comments as well.

C2) Weather impacts?

Dan’s note above speaks of ‘severe convective winds’, and links through to more information from the ESCI Project.

With climate change a key variable in (and driver of) this energy transition, what does this mean for the future?

C3) Technical and organisational considerations?

It’s worth flagging here that there are also technical and organisational considerations. Dan’s note above speaks of ageing assets, but it’s also worth noting …

(a) that it’s worth asking if there are other considerations (e.g. changing design standards, or changing operating and maintenance practices) that

(b) Seems at this point (with us on the outside looking in) that these are unlikely to be factors … but it would seem useful to ask.

C4) Implications for the energy transition?

It’s worth noting that there have been those on social media who have used this as an opportunity to propose undergrounding transmission (a very expensive exercise?) and/or utilising more DC connection. These questions will be asked.

There’s also questions related to the energy transition … such as:

(a) What does it mean in the light of the ‘we need to build 10,000km of transmission’ as part of the first stages of the ISP ?

i. How does it change the cost-benefit of the whole plan, compared to a more localised approach (before being misread – I am NOT specifically advocating a more localised approach here)?

ii. What does it mean in terms of particular transmission paths or network configurations … would some represent higher risk (remembering Risk is a function of Probability and Consequence)?

(b) What does it mean in terms of the approach taken for modelling (i.e. by AEMO in the ESOO and the ISP … but also in terms of the rigor in market models run by consultants for various project proponents in their business models)?

i. What assumptions are made for MTTR and MTBF for transmission elements … and hence what is assumed in terms of specific Outage-related Constraint Sets in the market models?

ii. For instance, we noted last year that the 2023 ESOO only includes ‘System Normal’ (i.e. it does not consider the HILP effect of events such as this). So buyer beware!

iii. Reminds me that we flagged this specific challenge when covering ‘What’s next for market modelling’ as Key Observation #6 within GenInsights21 a few years ago now!

… specifically we wrote (in 6.5) ‘Modelling System Normal is not enough’.

(D) Plus many more…

Other questions keep popping into our collective heads, but no time to record them all here…

Even more questions come to mind

What was the response of industrial equipment to the frequency and voltage changes resulting from the event?

How did station auxiliary equipment respond to the disturbance, did this contribute to the trip of LYA?

How did Loy Yang B and basslink ride through the initial disturbance and trip of Loy Yang A (could there be lessons for inverter based and thermal generators)?

Also a partial answer to A2

At 4:27pm local time, AEMO issued notice 114641

RECLASSIFY CONTINGENCY

13/02/2024 03:27:46 PM

Reclassification of non-credible contingency event due to existence of widespread abnormal conditions – VIC region(s).

AEMO ELECTRICITY MARKET NOTICE.

AEMO has identified that a non-credible contingency event impacting the power system is more likely to occur and is considered reasonably possible because of the existence of widespread abnormal conditions namely severe weather in the VIC region.

45 minutes later, there was a trip of all four 500/220 kV transformers at the Hazelwood Terminal Station.

Market Notice 114643 “Significant power system event

– Victoria Region – Hazelwood transformers”.

A side note, during the LOR3 period I was unable to access my DNSP (Ausnet, offline altogether) or the AEMO (Gateway timeout) websites. The latter did delay my response as an Amber customer. Other parts of the state suffered large scale communications outages. I question whether our telecommunications and IT infrastructure is suitable for market participation or even advisory of outages during severe weather events. I also wonder about the effect of communications outages on virtual power plants or demand response.

AEMO did invoke a constraint to procure 450MW of mainland raise reg – possibly to cover overspeed cutout at windfarms? I could see VIC bringing in a protected event category similar to SA – not sure how they would operate system more conservatively eg SA limiting flow on their one AC interconnector

Thanks HR10 … on Friday, the AEMO’s release of their preliminary report provided more details about the increase of mainland Raise Reg procured.

With regard to the 2.3GW generation loss of LYA, given the 1GW of lost load downstream of the transmission failure, we should regard the low frequency event as a loss of 1.3GW.

Re Basslink/LYB/(and YPS) riding through the voltage dip and subsequent low frequency, I feel it is likely that LYA tripped due to the operation of its equipment that facilitates its Trip to House Load market ancillary service contract with AEMO?