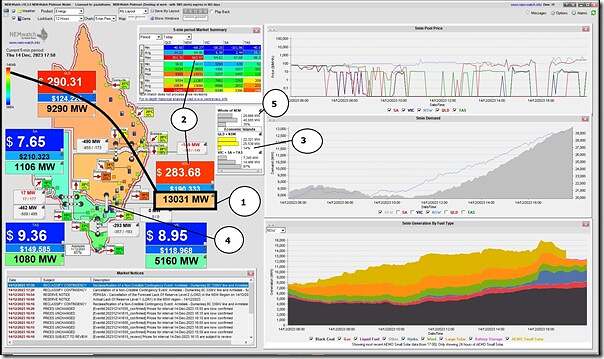

A snapshot of NEMwatch at 17:50 (NEM time) shows a number of things:

With respect to the numbered annotations:

1) The NSW ‘Market Demand’ has climbed further into the ‘orange zone’:

(a) past 13,000MW to 13,031MW at this dispatch interval

(b) So 1,618MW below the all-time record of 14,649MW (which occurred on 1st February 2011);

2) The NSW spot price, however, remains subdued … in contrast to earlier P30 predispatch forecasts:

(a) At $283.68/MWh currently

(b) with the highest point today being (only) $662.97/MWh

3) The IRPM of the ‘NSW-QLD’ ‘Economic island’ has dropped to 14%:

(a) With available generation of 25,539MW across those two regions

(b) supplying the 22,321MW aggregate ‘Market Demand’ in the same

(c) Because VIC1-NSW1 interconnector is constrained.

4) Indeed we see that the interconnector’s not running in either direction at present:

(a) Import Limit = Export Limit = Target Flow = 0MW

(b) Not shown here, but this is due to a number of constraint equations:

i. Exports (i.e. flow north) are limited to 0MW by the ‘N>>NIL_970_051’ constraint equation

… there’s that 051 line again, which Allan wrote about in ‘What’s happening around Wagga?’.

ii. In this particular dispatch interval, imports (i.e. flow south) are also switched off by the ‘NRM_NSW1_VIC1’ constraint equation (i.e. for negative residue management).

5) The NEM-wide ‘Market Demand’ has climbed to 29,666MW.

That’s all for now…

Be the first to comment on "NSW ‘Market Demand’ climbs past 13,000MW – and IRPM drops – but prices stay moderate"