… and it has not been doing so since January 2021

One of the challenges with the influx of an increased number of stakeholders forming their own views and making their own statements on social media with respect to the energy transition overtaking Australia’s National Electricity Market is that:

1) The situation in the NEM continues to change;

2) So that means that what might have been true in the past may no longer been true today.

Whilst working on aspects of the 2023 Q3 issue of the GenInsights Quarterly Updates this weekend, I noticed this note by James Carter on LinkedIn claiming that:

‘Now, [South Australia], exporting >3x more electricity than it imports.’

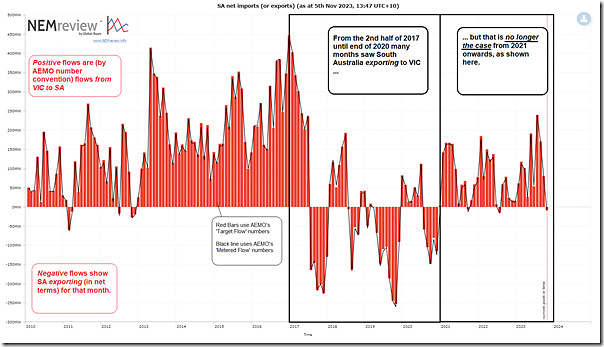

Whilst I’ve not specifically zeroed in on the numbers to work out what specific period South Australia might have been exporting three times what it imported (around 2019), it would seem to be a surprise to some people:

1) that South Australia is not exporting more than it consumes at all any more (let alone ‘three times’); and in fact

2) for much of the past 3 years (since January 2021) its average monthly transfers have almost exclusively been from VIC into South Australia.

Here’s a trend from NEMreview showing monthly average flows that should help people understand more clearly:

Those with their own licence to the software can open their own copy of the query here.

Project Energy Connect … connecting two regions both currently in deficit

Useful food for thought, with Project Energy Connect proceeding to completion, that it will connect the two regions (NSW and SA) that have each been net importers for quite some time (even before the slated closure of Eraring (perhaps as soon as in 2025?)).

Other data with respect to South Australia

With respect to the rest of what James has written, that’s food for another article at another time …

PEC was purported to provide energy security to SA.In fact on most days it will drive up prices in SA because higher prices in NSW than SA will drive output from SA to NSW.

However on high renewable days in southern NSW, capacity on PEC will be mostly taken up by Riverina solar and Western slopes wind.

With storage being installed in SA and increasing surpluses of cheaper Victorian brown coal it is difficult to see any more than trivial amounts of NSW energy flowing to SA.

You are mixing up energy security with spot prices. PEC will result in greater energy security for SA as it will provide an additional transmission path including inertia. This will further reduce the need for the operation of fossil gas based generators just to provide inertia and fault services.

In addition with PEC in place it will allow more RE to be in the SA grid should there be a failure on the Heywood interconnector such as when the 500kV tower was knocked down in Victoria. This fault significantly increased the total cost of electricity in SA due to reduction in RE in the grid and the increased need for additional grid services to be provided.

The peak wind conditions in SA are largely out of phase with those on the Western slopes, so exports from SA will be good during those periods.

The capacity to handle solar in all markets when solar generation is good is going to be a problem, however when conditions are good in eastern or northern NSW and poor in SA, energy will be able to flow into SA. The same applies for wind.

I agree that in the next few years the scope for cheap energy to come from NSW to SA will be very limited, however as NSW builds out its RE capacity the situation will change.

@Craig Fryer I didn’t realise how simple the solution was! Just build 900km of 330kV lines! Easy and cheap as! I’m sure this dirt-cheap endeavour will be completed by July 2026 and we won’t experience any delays or cost blowouts with our trusty Australian workforce. Furthermore, I’m sure our energy situation will be perfectly fine from now until then.

“The peak wind conditions in SA are largely out of phase with those on the Western slopes.”

Patently false. The same high-pressure systems constantly sweep across SA and into the Western slopes at the same time and give us those nice NEM-wide wind droughts.

“when conditions are good in eastern or northern NSW and poor in SA, energy will be able to flow into SA. The same applies for wind.”

PEC connects to Wagga Wagga which is as far south-west of NSW as it gets. What makes you think generation in northern NSW will easily make its way into SA?

“As NSW build outs its RE capacity”

You mean that genius idea of “over-building?” Which effectively means committing to large-scale infrastructure financing without a return on investment? But maybe it’ll come by once all that transmission is fitted out, right?

The reason why there SA isn’t a net exporter is due to the lack of transmission capacity in NW Victoria going back towards Melbourne. When RE conditions are good in SA and Victoria, energy in NW Victoria flows into SA as some of the RE producers in NW Victoria seem to be able to supply the grid at more negative prices than those in SA. This may be due to older contracts.

The end result is a net reduction of 300MW export capacity from SA to Victoria. This has resulted in considerable reduction in RE exports from SA to Victoria. When transmission capacity out of NW Victoria towards Melbourne is increased, SA will become a net exporter. Potentially EnergyConnect will come online prior to this and may result in SA become a net exporter earlier.

The real limitation here is on northward flows out of NW Vic and SW NSW – as Peter pointed out above. The physical solution for that set of constraints is Humelink.

Might be interesting to look at market prices between SA / VIC / NSW on the same graph. I suspect that once much of the constrained on dispatch in SA ceased courtesy of synch comps etc and the price of gas (including start up cost) into the SA stations simply the RE was sopped up at home and shortfalls met by low SRMC coal out of Vic (or Tas). The market doing what the market does.

As Andy says, while transmission constraints played a part, it is mainly the price difference between Victorian brown coal and SA gas. In 2019/20 when gas was cheap in SA and coal output was limited by outages in Victoria then SA was a net exporter. As soon as Victorian renewable output increased to the point that there was spare coal-fired capacity, then Victoria became a net exporter again.

However over the last 5 weeks SA has become a net exporter while averaging 83% renewables, so it seems that transmission constraints can be managed at least some of the time.

As for energy security SA would have been far better served by a similar investment in renewables/storage.