The change to use the energy bid’s MaxAvail as a cap on semi-scheduled unit availability was implemented on Monday 7th August 2023.

Using the bid is easy and transparent

This new functionality provides NEM Participants with a way to restrict their semi-scheduled unit’s availability through the energy bid and may be useful when the need arises for commercial reasons – such as to avoid negative prices.

Using the bid increases market transparency because the MaxAvail is market-visible and, when adjusted as part of a rebid, the rebid reason can provide some indication of the reason for the change.

Drivers for the change

Previously, before the change, for the dispatch timeframe (the next dispatch interval), units generally had the more indirect option to ‘get out of the market’ by putting volume into higher-priced bid bands. An alternative, and poorer, option to address commercial availability might have been to adjust the physical signals of availability such as local limit or turbines or inverters available which really isn’t what those are designed for. And in the predispatch timeframe the use of the upper MW limit in the generator availability portal has equivalent intent in that it should reflect physical and technical plant availability.

Additionally, before the change there was no good way to manage any form of availability at a dispatch interval by dispatch interval granularity for the 5-minute predispatch timeframe.

So, to summarise, the change allows Participants to use the energy bid MaxAvail value to specify which intervals should have restrictions on their semi-scheduled unit’s availability and it can be done through the regular bidding and rebidding process.

The first week – a review

At the time of writing, it’s been just over a week since the change was implemented.

With the release of the next-day public data that includes unit bids, UIGFs and availabilities we analysed roughly 7.5 days of public data to observe how this new capability has been adopted.

High level findings include:

- 357 intervals saw one or more units with bid MaxAvail lower than the UIGF (restricting availability), out of a total of 2189 intervals (16%).

- 24 units made use of the functionality on at least one occasion.

- Large solar: 6 units, wind: 18.

- By NEM Region –

- NSW: 4 units,

- QLD: 3,

- SA: 12,

- TAS: 1,

- VIC: 4.

- Rebids are the predominant bid entry type that is typically used for bids where MaxAvail acts as a limit. Per occasion, the relevant bid entry types were:

- Daily bids: 111, Rebids: 459.

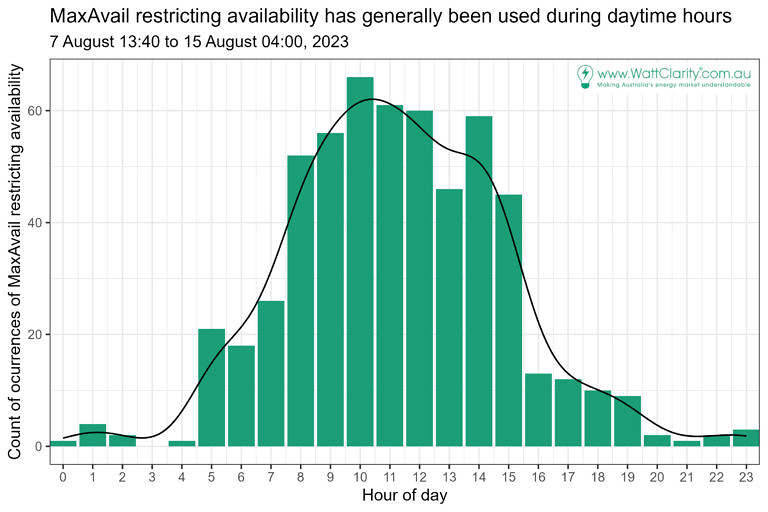

- The most common time of day where the functionality has been used is between 8am and 4pm, as indicated in the following chart:

Bid MaxAvail in action

In this section we present three unit-level examples where bid MaxAvail suppressed availability. We’ve used ez2view’s Unit Dashboard Widget to display bids (coloured bars), dispatch availability (red dashed line), output (black line), and sometimes energy prices (thin dotted line, second y-axis), in association with the Unit Interval Table on the right of the widget that captures information specific intervals listed in the header row.

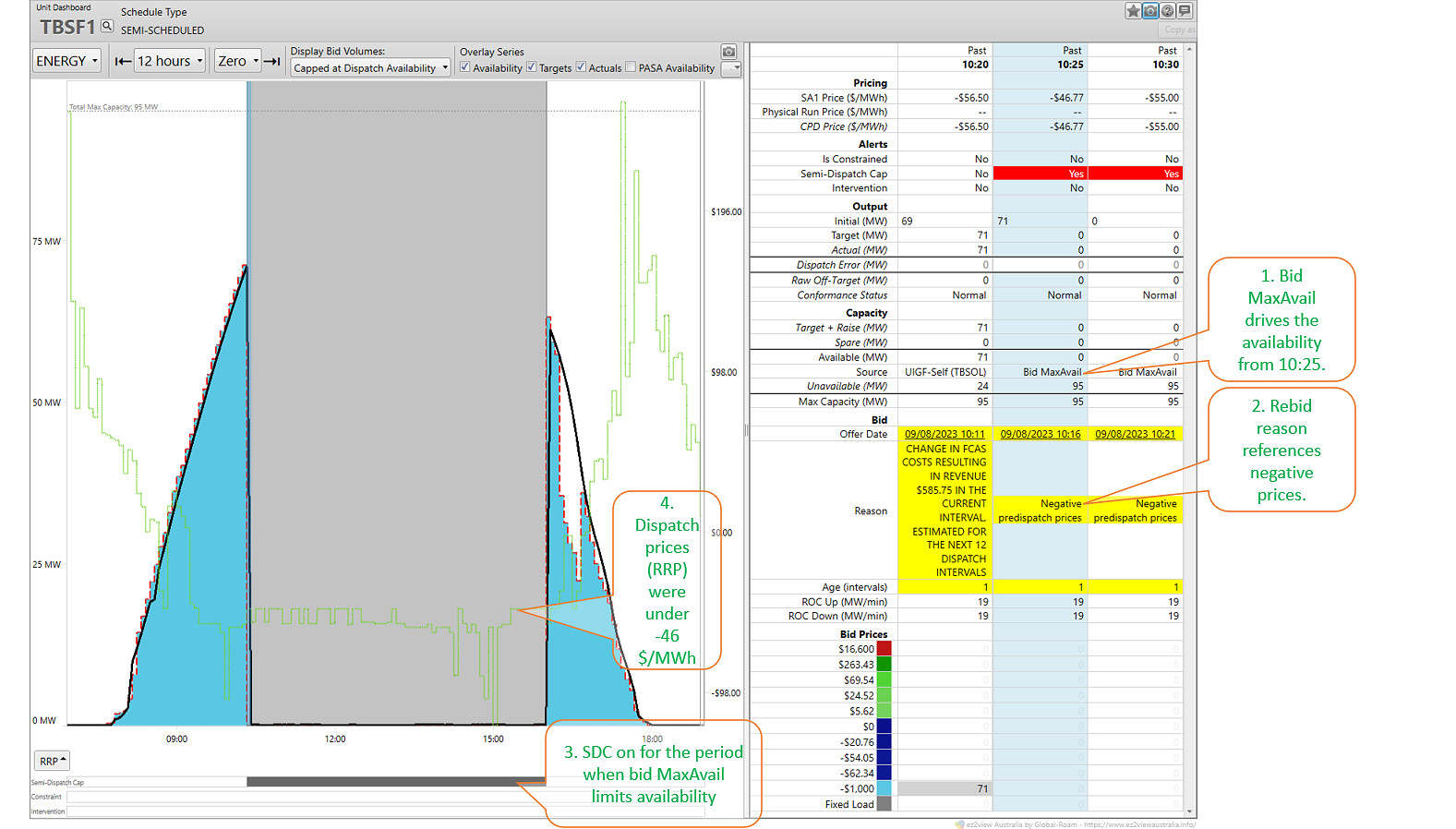

i) TBSF1 (Negative predispatch prices)

Tailem Bend Solar Farm in SA, on 9 August. This example provides the clearest use of bid MaxAvail since the change was implemented.

Starting from the first numbered annotation at top-right, we note:

- At 10:25 the source of the unit’s availability was the Bid MaxAvail, having changed from the Self-Forecast’s UIGF. This indicated the bid MaxAvail was lower than the UIGF and that it set the availability. The value of MaxAvail was 0 MW therefore availability was also 0 MW. Zero availability remained until 16:05.

- The rebid referenced negative prices.

- The semi-dispatch cap was on for the period when MaxAvail was limiting availability at 0 MW.

- The price series overlaid (green dotted line on chart) verifies that prices were negative, under -46$/MWh for the period.

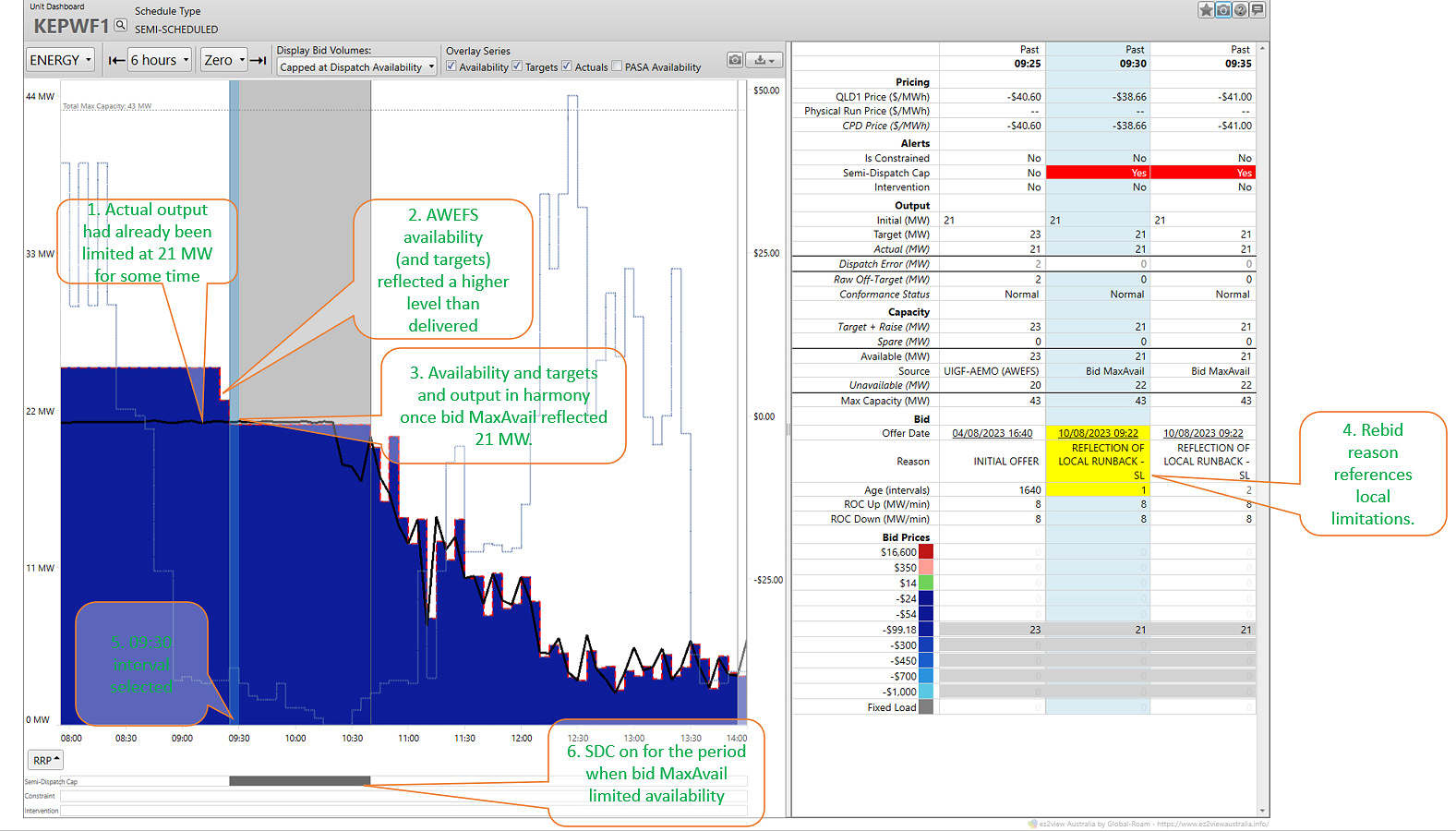

ii) KEPWF1 (Reflection of local runback)

Kennedy Energy Park wind farm in QLD restricted availability using bid MaxAvail between 09:30 and 10:40 on 10 August. This case provides an example where MaxAvail appears to have been set to reflect local limits.

The numbered annotations capture:

- Preceding the use of bid MaxAvail, actual output had already been at 21 MW.

- In the 09:25 dispatch interval AWEFS issued the UIGF that set availability and it reflected a reduction (possibly due to a local limit or plant limitation) to 23 MW available.

- In the 09:30 interval bid MaxAvail was set to 21 and this suppressed the availability to that level. Bid MaxAvail was previously 43 MW, before the rebid.

- The rebid reason for the rebid active in the 09:30 interval referenced “reflection of local runback” suggesting that the MaxAvail was set to mirror local limits. This matches with the steady output at 21 MW seen in the leadup to the rebid.

- The selected interval on the chart sets which intervals are shown in the table.

- The semi-dispatch cap was on while bid MaxAvail was limiting availability.

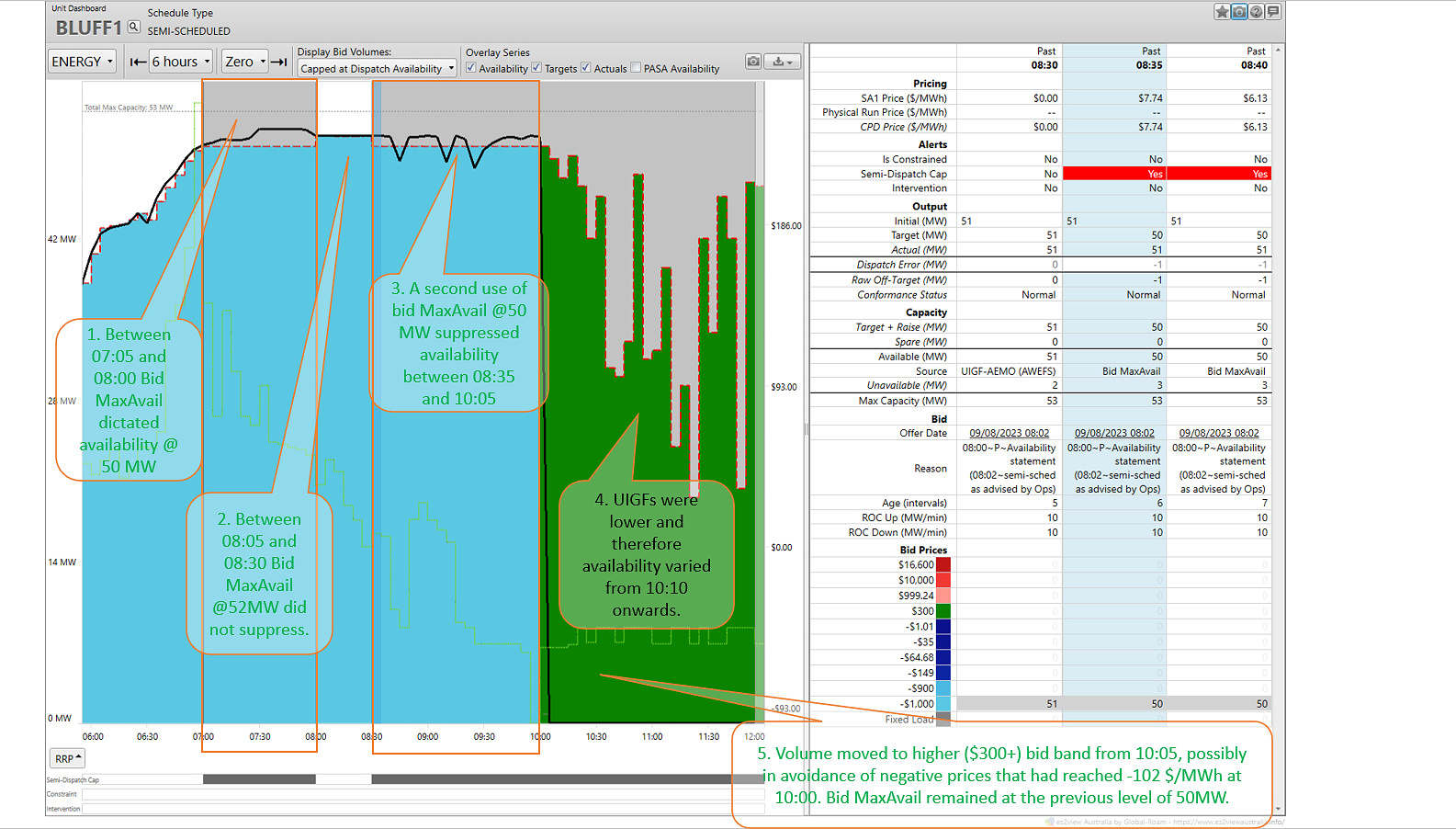

iii) BLUFF1 (general availability)

Bluff wind farm in SA saw MaxAvail limit during two periods in the morning of 9 August. We highlight the two periods with orange boxes in the screenshot from ez2view’s Unit Dashboard. This case provides an example of how MaxAvail appears to be used to reflect local limits, and is not used to avoid negative prices (instead band volumes were moved).

The numbered annotations capture:

- Between 07:05 and 08:00 availability was set at 50 MW, reflecting the level of the bid’s MaxAvail.

- A short period saw the UIGF be the source of availability. This coincided with a bid that raised Max Avail for this period to 52 MW, and let the UIGF of 51 MW set availability.

- The second period when MaxAvail set availability was between 08:35 and 10:05, yet actual output (black line on chart) varied up to 1 MW higher even while the semi-dispatch cap was on.

- UIGFs from 10:10 onwards were lower than the bid MaxAvail and therefore availability varied with (presumably) the wind resource.

- Yet from 10:05 output was 0 MW reflecting targets of 0 MW and in accordance with volume moved to a higher priced band ($300/MWh). The SA energy price at 10:00 had dropped to -102 $/MWh and this may have been the reason for the rebid to a higher priced band. Band volumes remained in the $300 band (as per 10:05), past midday, and attracted 0 MW targets. This appeared to be intentional to avoid negative prices but also provides an example where bid MaxAvail wasn’t used as the tool to attract a 0MW target.

Further information on the change to MaxAvail

The change to use the energy bid’s MaxAvail as a cap on semi-scheduled unit availability was implemented on Monday 7th August 2023.

Readers seeking further information on how it works may find this article on What inputs and processes determine a semi-scheduled unit’s availability useful.

Using the MaxAvail as a means to avoid negative prices is inappropriate. If your intention is to turn off when prices are too low then simply include your minimum price in your bid. Including a price in your bid that is lower than your real minimum price is misleading and could/should be found to be in breach of the rules.

Hi Greg, I’m not a lawyer so would always defer Participants to seek their own legal advice where appropriate. However, I can offer that the AEMO Operational Forecasting and Dispatch Handbook for Wind and Solar generators indicates in S2.4.4 that the use of MaxAvail is ok, subject to the requirement that bids must not be misleading (NER clause 3.8.22A) and rebids must be consistent with the requirements in NER clause 3.8.22. The other good reference is the AER Semi-Scheduled Generator Compliance Bulletin and Checklist but that hasn’t been updated since 2022, as far as I can tell so can’t yet reflect good-practice use of MaxAvail in this regard, since the change on 7 August 2023.