November saw thunderstorms and strong winds topple a transmission tower in SA, causing a a line trip on part of the state’s network that forms the Heywood interconnector. This all resulted in a seven-day separation between SA and the rest of the NEM until maintenance workers were able to restore full interconnection with a temporary replacement for the fallen transmission tower.

In the physical system, modern inverter technology and other mechanisms helped manage the initial frequency swings, and the AEMO diligently maintained system security in the difficult period until the line was restored. Two days into the islanding event, Allan O’Neil took an early look at the effects in the market, particularly the early returns of generators who provide frequency services in the region. Now that the smoke has cleared, I’ve had some time to delve through the final revenue outcomes throughout the event.

FCAS commodities dominate

Notably, spot energy prices in SA remained relatively stable throughout the course of the separation. More extreme price outcomes were seen in the FCAS markets before they were eventually subdued by the Administered Price Cap (APC).

Seven of the eight FCAS commodities hit the $15,500/MWh market price cap in the initial period after the line trip, with locally-sourced FCAS providers suddenly being called upon in the region. The $300/MWh APC (which has coincidentally since been raised to $600/MWh after a fast-tracked rule change) capped all FCAS commodities after the Cumulative Price Threshold was reached for the Lower Regulation service on the afternoon of the 14th of November.

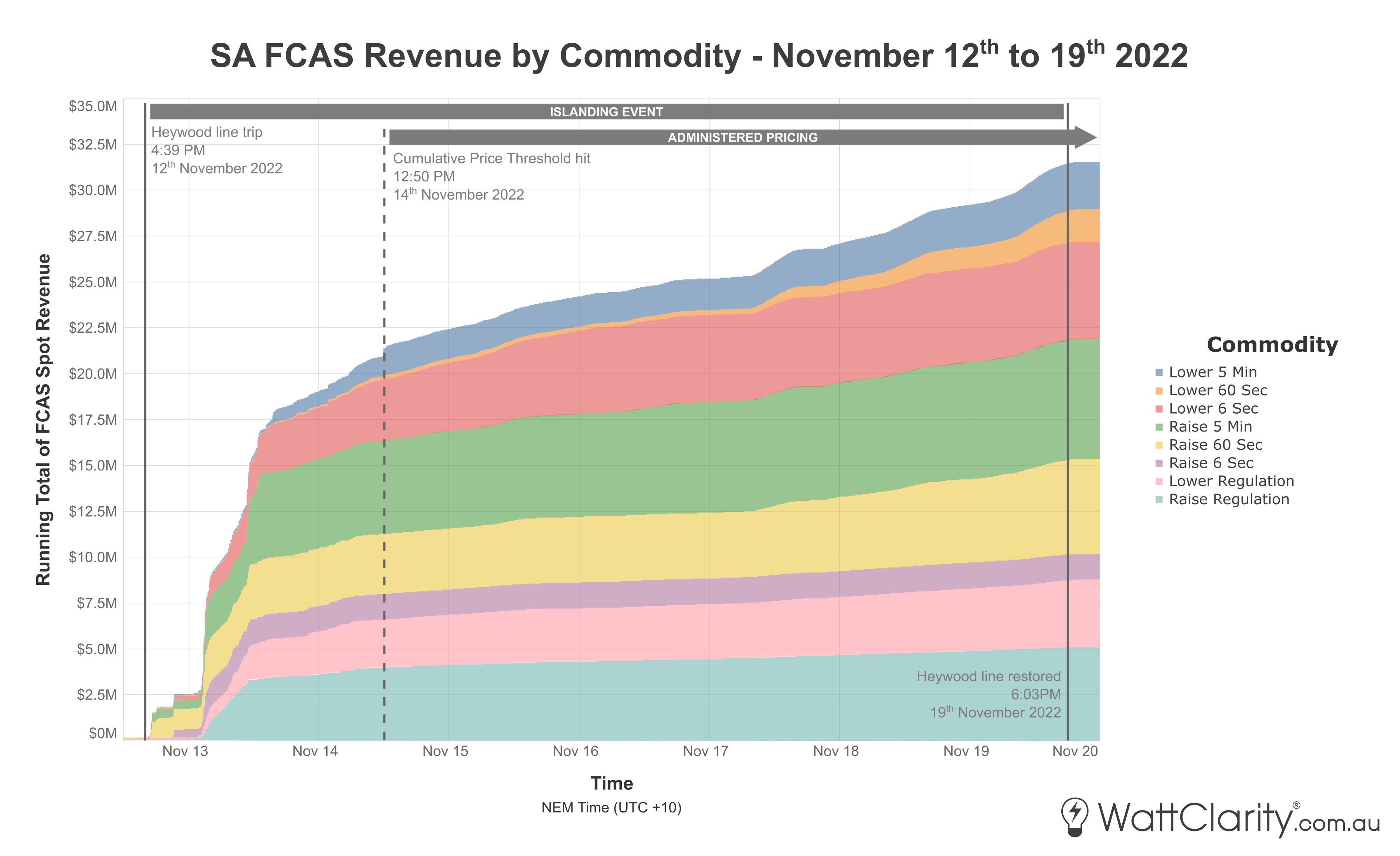

The chart below has been recreated from Allan’s initial article and extended until the point when the Heywood line was restored. It combines enablement volumes and prices to show the cumulative spot revenue totals for each of the eight FCAS commodities in the region.

A break-down of the FCAS revenue generated by commodity during the seven-day separation.

Source: NEMreview v7

Sustained high prices resulted in pronounced revenue outcomes for all eight commodities, with the cumulative revenue total ending highest for the Raise 5 Min Contingency service.

Interestingly the price for Lower 60 Second Contingency service, the one commodity that didn’t initially hit the market cap, increased in the second half of the week once the APC was in effect.

Batteries and gas power stations take home the lion’s share of FCAS revenue

Two utility-scale batteries (Hornsdale Power Reserve and Dalyrmple North BESS) and three gas power stations (Torrens Island B, Quarantine and Pelican Point) were the biggest beneficiaries once SA-based FCAS provision suddenly became very valuable. This party of five took home approximately 82% of all revenue that was generated in the SA FCAS market during the separation.

Those batteries provided the greatest percentage of contingency services, while gas plants dominated the regulation services (while also providing a large chunk of energy while the Heywood interconnector was out).

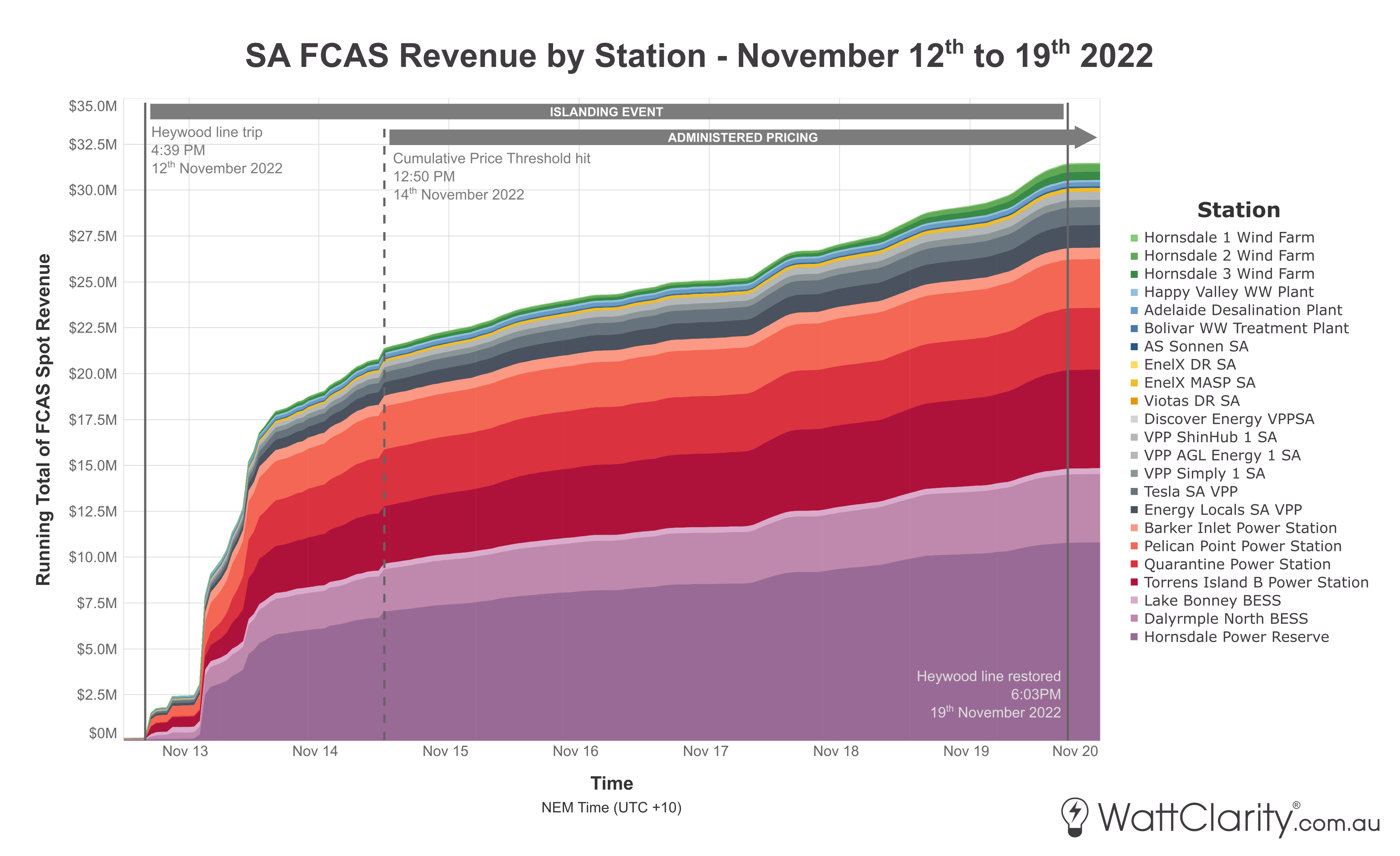

The chart below shows the cumulative combined FCAS revenues of all stations (i.e. excludes energy spot revenue).

Batteries and gas plants took home the largest share of the FCAS revenue that was generated.

Source: NEMreview v7

Neoen’s Hornsdale Power Reserve raked in around $10.7M of FCAS revenue over the seven days. Meanwhile, the comparatively small 30MW/8MWh Dalyrmple North BESS punched above its weight to bring in $3.7M.

And as Allan noted, the Adelaide Desalination Plant and several Virtual Power Plants also outperformed their relative size, albeit at a smaller scale.

Jointly owned by Neoen and First Sentier, the three Hornsdale Wind Units (the only wind farm/s in SA that have registered to provide FCAS) collectively earned approximately $910k through the separation.

Overall ~$31.5M of FCAS revenue was generated for all frequency-related services over the week. Cost recovery of this sum will be distributed between generators and market consumers through the ‘causer-pays’ mechanism, in the case of regulation services, and in proportion to energy consumed/generated in the case of contingency enablement services.

One thing I don’t understand is how the Hornsdale wind units can provide FCAS services. That seems to be a contradiction in terms. Gas and batteries make sense, but wind units? Can you explain?

Hi Paul, the three Hornsdale wind units are registered to provide six of the eight FCAS services (Lower 6 Sec and Raise 6 Sec contingency the exceptions). The document below describes the trial process that was undertaken in order to allow them to do so:

https://aemo.com.au/-/media/files/electricity/nem/strategic-partnerships/2018/hwf2-fcas-trial-paper.pdf?la=en&hash=9C9EFF402D42FD6170A0967AE877BE11

Any wind or solar farm that has suitable inverters and control systems can register to provide FCAS. Currently my understanding is that they are only providing a service by quickly cutting their output, but having an output like a big resistor to dump load into, could also provide a similar service.

However there is no reason that a wind or solar farm couldn’t de rate their output, thus holding some capacity in reserve to deliver immediately. To date I don’t think AEMO is registering this later form of capacity as it is considered more risky than having a battery operating behind the inverter.