The road to decarbonisation

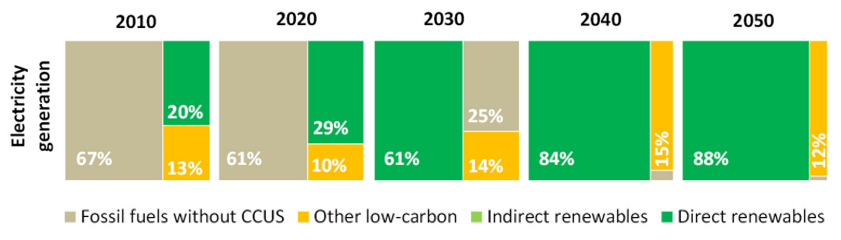

Whether or not you think we should decarbonise our energy markets, the fact is we are. Utility scale wind and solar are the cheapest to build and have been for some time. In many cases, they are even cheaper than running existing coal-fired and gas-fired generators. So, like it or not, variable renewables (wind, solar and anything else that gets down the cost curve) will provide the majority of power supply before long. The IEA currently predicts this will happen by 2030 on a global level, and Australia is decarbonising its power system quicker than the global average.

Figure 1 Fuel shares in total energy use, IEA Net Zero Scenario[1]

Not only will power markets become fully decarbonised, due to electrification and green fuels, we will decarbonise everything else in our economy. In a best case, that expansion includes export markets. Australia could realise the next phase of the ‘Lucky Country’ in the form of becoming a renewable export superpower.

The question is really whether this happens quickly and smoothly, or painfully and slowly. And for the last decade, outcomes in Australia have been decidedly second rate.

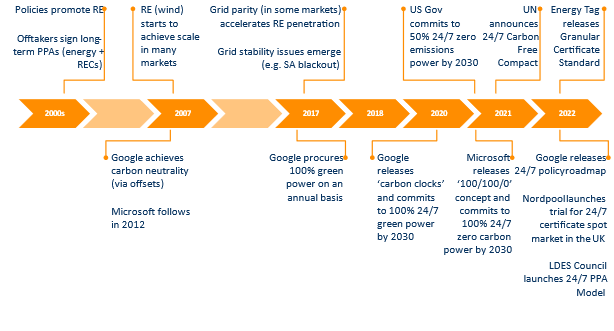

Decarbonising our power markets began with John Howard legislating the Mandatory Renewable Energy Target in 2000. This scheme started small, bridging the financial gap between the (then high) cost of utility scale wind farms and grid power. Simply put, renewable generators could create a tradable Renewable Energy Certificate (REC) for every MWh produced. Retailers (on behalf of customers) were liable to surrender these certificates against a percentage of their customers’ power usage such that an annual target was met. On assuming this liability, retailers either built their own renewables or underwrote third party investments. Mostly it was underwriting via long-term, bundled Power Purchase Agreements (PPAs) where the buyer agrees to buy all the renewable energy and RECs from a project for 10/15/20 years. Bundled PPAs underwritten by credit worthy buyers supported project finance, qualifying the renewable projects as infrastructure and unleashing global capital markets and huge investment. Australia was not alone, with comparable RET schemes being launched globally, including in the UK and USA. Wind immediately became more investable, a lot of new wind capacity was built, costs fell dramatically, and wind came to be a major source of renewable power supply. A similar thing happened to solar PV over the 2010s.

A textbook case of good public policy. A promising technology (renewable energy) is deemed to be socially desirable (to reduce carbon emissions) and is supported by government policy (the RET) which leverages private sector capital to achieve the intended outcome.

But, as variable renewable energy began to reach higher levels of penetration, some downsides emerged. Whilst the RET was only a small portion of total system demand – like the original 2% and scaled-up 10% targets – the power system could easily absorb and support the variability of wind and solar generation. Similarly, the cost impact on consumers was manageable and arguably reduced net costs paid by consumers (more REC-subsidised supply results in lower wholesale prices). Under Australia’s 20% target (plus varying state-based support) and as renewables became cost competitive with conventional grid energy, older coal-fired generators started to exit the system, prices and costs rose and the merits of supporting more renewables became less clear.

Things got decidedly second rate.

The problem, at its heart, is simple. We want and need renewable energy. But we need it not just in bulk, but just in time. And we need it 24/7, year in and year out.

There is a customer-led solution to this mismatch between when renewable power is generated versus when it is needed. There is also an opportunity for Australia to lead the adoption of this solution, to accelerate its decarbonisation ambitions and to repeat the early success of the RET.

That solution is hourly RECs.

The Need for Hourly RECs

It’s not just power markets and policy makers that grapple with the challenges of decarbonisation. Large power users are increasingly committing to decarbonisation goals, none more so than Google. Data centres are energy intensive and consume industrial scale power. Big Tech needs to green up its data centres and has told its customers and shareholders that it will do just that.

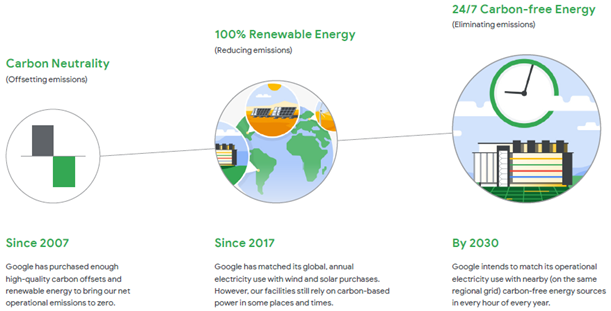

Google achieved carbon neutrality in 2007 via carbon offsets. Like many buyers of offsets, Google discovered that they may not be getting what they paid for.[2] This led Google to commit to 100% renewable energy, a goal it achieved in 2017. Every year, Google purchases an amount of renewable energy equal to its global consumption of power. However, the actual electrons supporting its operations in many places and at many times of the day still come from carbon emitting generators within the mix of grid power. As such, ‘100% renewable’ is only true in the aggregate. In 2020 Google announced that “by 2030, Google intends to run on carbon-free energy everywhere, at all times.”[3]

Figure 2 Google’s energy journey[4]

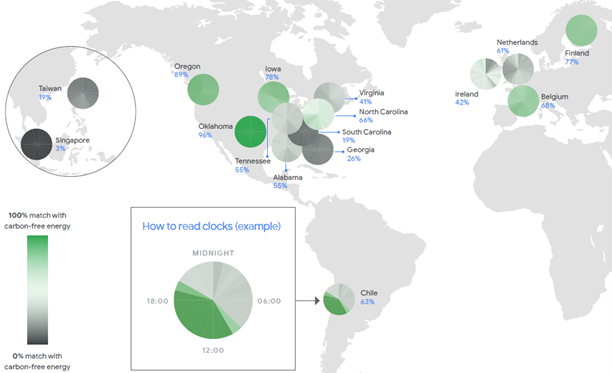

To help visualise the scope of the challenge, Google released ‘carbon clocks’, which starkly illustrate how challenging it will be to procure green power to meet usage on a 24/7 basis at some of its data centres.

Figure 3 Hourly carbon clocks for a September day[5]

In 2022 Microsoft announced a similar commitment (100/100/0) to powering its operations with 24/7 zero emissions sources by 2030.[6] The US Federal Government also committed to powering 50% of its power purchases from zero emissions sources on an hourly level by 2030.[7] Other Big Tech, major corporate and government buyers will increasingly follow suite. And that is before considering promising new green industries such as green hydrogen, green ammonia, green steel, etc. All of which require, by definition, 24/7 carbon free power.

Large customers increasingly want green power. It’s cheaper, and in many cases it underpins the social licence of the business. In some cases, like green hydrogen, green power is central to the entire business model. These buyers have realised that carbon offsets are not enough, matching of renewable energy purchases (annually or across geographies) is not enough. They need 24/7 green energy. But the storage technologies that are critical to deliver 24/7 – short and long duration storage – are not currently cost-economic to meet the task. Similarly, the right incentives to deploy Demand Response (DR) at scale are absent. So these businesses are underwriting investment in these technologies via mechanisms like 24/7 Clean Power Purchase Agreements (24/7 PPAs).

And the push to see this happen is accelerating globally. Google, Microsoft and the US Government have committed to 24/7. EnergyTag, a not-for-profit foundation, has worked out a methodology and set of procedures to add hourly timestamps to existing REC and carbon certificates and the rules for using them. The UN orchestrated a 24/7 Carbon Free Compact as part of building a global commitment akin to the RE100 pledge.[8] The Long Duration Energy Storage Council released a report (which I contributed to) outlining an industry standard for 24/7 PPAs.[9] Trials are beginning for spot markets for hourly RECs, most notably in the UK and backed by Nordpool.[10] And all this has happened in the last 18 months.

Figure 4 24/7 accelerates

These efforts will eventually decarbonise our power markets (and hopefully wider economies). But there is an opportunity to do it faster by mandating 24/7 RECs.

Keep it simple

2022 has seen unprecedent rises in coal, gas and oil prices on the back of war in Ukraine and continuing supply chain issues globally. The result has been fully fledged energy crises in most major economies as the cost of fuel soared. Australia suspended the NEM over 15 to 24 June 2022 and the impacts look set to continue for not just months, but years.

Even prior to this crisis, the NEM has been struggling under the weight of unclear market objectives, carbon wars, conflicting policy and extreme weather for some time. The Energy Security Board was established in 2017 in response to the South Australian blackout that was, in part, a consequence of variable bulk renewables exceeding the ability of NEM’s asset base and operational processes to maintain system security in the face of extreme weather. The ESB got underway with the ambitious NEM 2025 reform program – seeking to develop and implement a complete re-design of the NEM by 2025. State governments, facing sharper issues, have also pursued a range of reforms that would deliver more tailored and immediate outcomes. Market participants have floated several reform options.

Solutions to date have mostly been complex, costly to implement and slow. Government and industry have failed to find sufficient consensus to achieve the rapid and practical reform that is needed in the NEM. And it’s not surprising. Reforms under consideration include: capacity markets, nodal pricing dressed up with yet another acronym, carbon pricing with no prices, wholesale DR mechanisms, a suite of new markets for ever narrower services (such as Fast Frequency Response (FFR), inertia, operating reserves, thermal exit auctions), higher RET targets for bulk renewables, certificate schemes for short-duration storage, Long Term Energy Support Agreements (LTESAs) for generation and long-duration storage, etc, etc.

Market reform is a hard task, and one that gets harder as the scope and scale of ambition widens. However, the options currently on the table are generally piecemeal, complex, involve long lead times, create inconsistent interactions with each other and are narrowly scoped in many cases leading to a high potential for unintended consequences in a rapidly moving power market.

We should keep it simple. Customers want and need green power that matches their load. Policy should support that outcome. Make the RET hourly. Set a sensible glidepath for the hourly minimum target. Raise the scheme penalty to enforce compliance. Make 2023/24 the first compliance year. Investment would flow before Christmas.

Specifically, a sketch of an hourly REC scheme includes:

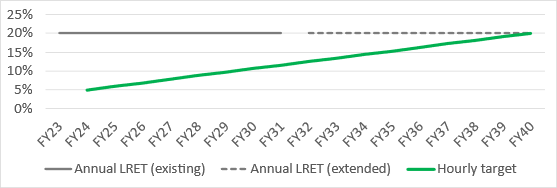

- Extend the annual target (to at least 2040) and add a new hourly target that scales up over time such as 5% from 2023/24 rising to 20% in 2040 (see below). One of the issues with the MRET which led to subsequent argument is that there was never an underlying principle supporting the target – the targeted renewable MWhs were the targeted renewable MWhs. An hourly target for dispatchable green power should be tied to the need for replacement dispatchable power as thermal plant exit the system and demand grows. This would provide an objective and outcomes-based rationale for the level of the target and its glidepath. The glidepath should be used to manage cost impacts on consumers.

- Timestamp LGCs and (broadly) adopt the EnergyTag standard to update creation and surrender rules for the certificates.

- Adapt the RET’s existing 10% ‘bank and borrow’ rules to apply on a rolling hourly basis and, as a transitional measure, expand the hourly bank and borrow for the first 4 years of the scheme (to give a sufficient lead time for the scale up of investment). For example, allow 40% bank and borrow in year 1, 30% in year 2, 20% in year 3 and 10% for year 4 and beyond. This will give retailers and customers time to sign contracts and build capacity prior to the hourly target and penalty starting to bite.

- Raise the penalty to ensure compliance. The penalty needs to be higher that the levelised cost of energy for 24/7 green power, year in, year out. This most likely entails a significant increase from the current level ($65/LGC, non-deductible).

- Allow generous baselines for existing renewable supply and storage eligibility. The objective here is to ensure both existing and new resources are incentivised to change the way they supply loads to ensure 24/7 outcomes. Excluding existing assets mutes this incentive and creates a high barrier for many offtakers to find 24/7 supply (parallel development and funding of new renewable and storage projects).

Of course, the full details of an hourly REC scheme need to be expanded and modelled. But this task seems no harder (and most likely simpler) than most of the complex reforms currently under consideration.

Once implemented, liable entities (retailers) will need to invest in the roll out of not just renewables, but the storage and DR to flatten it out across the day, across seasons and come flood or drought. Where they don’t invest themselves, they will underwrite the investment via long term agreements – 24/7 PPAs – in exact analogy to the bundled energy plus REC PPAs that ignited investment in utility scale wind in the 2000s. Storage will move from a pure merchant market business model to one supported by long‑term contracted revenue capable of accessing project finance and global capital markets that want to invest in the energy transition in stable jurisdictions.

The storage and DR needed to flatten out wind/solar will provide the side benefit of massively supporting system security and reliability and make the system more resilient as it becomes more weather dependent. The ability of DR to monetise – without the need for baselines and complex aggregation arrangements – will help deliver a more two-sided market. The value of renewable energy at different times of the day and across seasons (an ever-moving target) will be explicitly priced by the hourly certificates, not set by regulation, ensuring the scheme continues to work in the more uncertain future market.

And it’s simple. The REC scheme exists and has worked for two decades in its current form. All that’s needed is minor (from an administrative perspective) changes to the target and scheme rules (as outlined above). Large Generation Certificates (LGCs) gain a time stamp. Certificate surrender is a bit more complex, but orders of magnitude simpler than adopting a new market (capacity, inertia or otherwise). And certainly simpler than facing unhegable price basis risk under nodal pricing. Consumers face some extra costs (which can be managed via a sensible target glidepath as the original REC scheme costs were) but benefit from lower wholesale prices once the investment starts flowing at scale, and hopefully as the more costly reform options are abandoned.

And critically, adopting a reform that can be rapidly deployed and produce near-term results de-risks the entire NEM2025 reform process itself. The NEM needs dispatchable power now, not later this decade. And the worst time to be undertaking major fundamental reform is during a rolling crisis.

Worst case, hourly RECs are a bridge to more complex reforms with longer lead times. The ability of certificate schemes to adapt around interacting policies is one of their greatest strengths.[11] An hourly REC scheme certainly won’t preclude further reform.

Best case, investment flows at scale, much of the motivation for reactive and complex reform is dampened as dispatchable, green power rises across the system. Thermal power provides a necessary bridge, but is excluded from hourly REC revenue streams. Ultimately this will lead to the exit of thermal plant but with more certainty that dispatchable green power enters the system to replace it and without the need for moral hazard inducing ‘exit auctions’.

Bottom line

Hourly RECS present an opportunity for ‘no regret’ NEM reform.

The Federal Government has a chance to back a practical and ‘shovel ready’ market reform that perfectly aligns with their goals: supporting green energy, storage and DR; undertaking world leading action on climate change and decarbonisation; enabling an Australian green industrial revolution; aligning with state objectives; and realising investment outcomes quickly. And all this is an outcome that corporates and the private sector are increasingly insisting on and are willing to fund.

And maybe we even get a new generation of Australia policy makers and energy experts that can again tell the world a positive story about how Australia finally got its act together, jumped on a good idea, and decarbonised first its power system and then its economy in record time – and how we can supply the rest of the world with green power to help them do the same.

About our Guest Author

|

James Allan worked as a consulting economist for 15 years specialising in the design and ongoing reform of electricity, gas and green markets. He advised governments, regulators and market participants across Australia and Asia. This included advice on NSW GGAS, the removal of the Snowy Regional Boundary, VRET, NSWRET, QRET, OBA carbon pricing, Contracts for Closure, the RET review, the EIS, the NEG, Optional Firm Access and several other reforms long forgotten.

James is currently a Senior Director at Quinbrook Infrastructure Partners, a renewable infrastructure investor. Representing Quinbrook, James sits on the boards of Energy Trade (an Australian embedded network business) and Habitat Energy (a leading UK battery optimisation platform that is also expanding to Australia and the US). The views expressed in this article are entirely those of the author and do not reflect the official policy or position of Quinbrook Infrastructure Partners or its affiliates. You can view James’s LinkedIn profile here. |

References

[1] IEA, Net Zero by 2050 A Roadmap for the Global Energy Sector, May 2021, page 73

[2] https://reneweconomy.com.au/they-are-clearly-afraid-of-scrutiny-dispute-deepens-over-carbon-offset-integrity/

[3] Google, 24/7 by 2030: Realizing a Carbon-free Future, 2020, see: https://www.gstatic.com/gumdrop/sustainability/247-carbon-free-energy.pdf

[4] Google, 24/7 by 2030: Realizing a Carbon-free Future, 2020, see: https://www.gstatic.com/gumdrop/sustainability/247-carbon-free-energy.pdf

[5] Google, 24/7 by 2030: Realizing a Carbon-free Future, 2020, see: https://www.gstatic.com/gumdrop/sustainability/247-carbon-free-energy.pdf

[6] https://blogs.microsoft.com/blog/2021/07/14/made-to-measure-sustainability-commitment-progress-and-updates/

[7] https://www.whitehouse.gov/briefing-room/statements-releases/2021/12/08/fact-sheet-president-biden-signs-executive-order-catalyzing-americas-clean-energy-economy-through-federal-sustainability/

[9] https://www.ldescouncil.com/news/ldes-council-report-highlights-potential-for-new-type-of-power-purchase-agreement-to-accelerate-decarbonization-of-electricity-consumption/

[10] https://www.nordpoolgroup.com/en/message-center-container/newsroom/exchange-message-list/2022/q2/new-system-to-track-electricity-by-the-hour-launched-in-great-britain/

[11] In the late 2000s the NEM operated with multiple overlapping certificate schemes (the RET, VRET, NSW GGAS, QLD Gas certificate schemes).

Interesting read but much of it I don’t agree with.

1 – The article makes a tacit admission that long term PPAs are a marvellous way underwrite what would otherwise ne highly rsiky investments in renewable generation, but as a means o reducing emissions are in fact a bit of a scam.. (I agree)

2 – The sentence “Once implemented, liable entities (retailers) will need to invest in the roll out of not just renewables, but the storage and DR to flatten it out across the day, across seasons and come flood or drought. Where they don’t invest themselves…..” pretty much gives the game away. Just an admition that generators will no longer be obliged to supply stable and reliable power, and users will just be supplied with what ever power is available from intermittant renewables, and the huge costs associated with dealing with such intermittancy (such as storage, firming or DR) will need to be borne by the retailers and users themselves.

Well retailers are not obliged to remain in a market or operate at a loss, so all I can see happening is most energy retailers exiting the market and investing their finite resources elsewhere, leaving relevant state governments holding the can in yet another energy market thought bubble…

Thanks for sharing your ideas, James.

Back in May 2019 when we released the Generator Report Card 2018, we wrote about what we saw as an emerging schism between:

Service #1) ‘Anytime/Anywhere Energy’, a name we coined to describe the dominant form of support in use for renewable generation – i.e. not focused on the time, or the place, of its production.

Service #2) ‘Keeping the Lights on Services’, a name we coined to describe all of the other services that need to supplied over the short term and the long term to keep the electricity grid operational.

We then expanded on this Schism in GenInsights21 late in 2021.

You spoke about your ideas for a ‘Three Stage Transition’ back at an Australian Institute of Energy event earlier this year, and it sounded like you were talking about ideas that could potentially address some of the limitations of ‘the Schism’ above. Hence they are worth sharing on WattClarity here today.

Paul

James. Great article – I like the simplicity. Can you clarrify how you see storage being treated within this framework? Is storage granted a REC time stamped with the hour it is dispatched and obligated to buy a REC time stamped with the hour of charging? Or are you imagining that storage is a way that a customer is able to shift the time profile of its load (and, hence, move its REC liability to a cheaper hour)?

I don’t think this would be at all simple to implement or manage. Spot prices deal with attempting to value energy when it is most needed already, so this would add to complexity. It’s also unclear what hours are we talking about i.e. which of the 8760 per year do we plan to average? Are there summer/winter/weekly/weekend hours that are different? How are they forecast in advance? What if the market fails to meet an hourly REC target, is there another penalty? Can hourly REC’s be produced in another region? This may also dissuade low cost renewables with storage in preference to high cost renewables producing in the right hour…it makes you want to revert to a carbon price where the externality of pollution is priced and has a spot market that values the scarcity of energy supply.