I’ve already noted about the appropriateness of holding the EUAA National Conference this week … with gas and electricity spot prices being elevated as they have been in recent times!

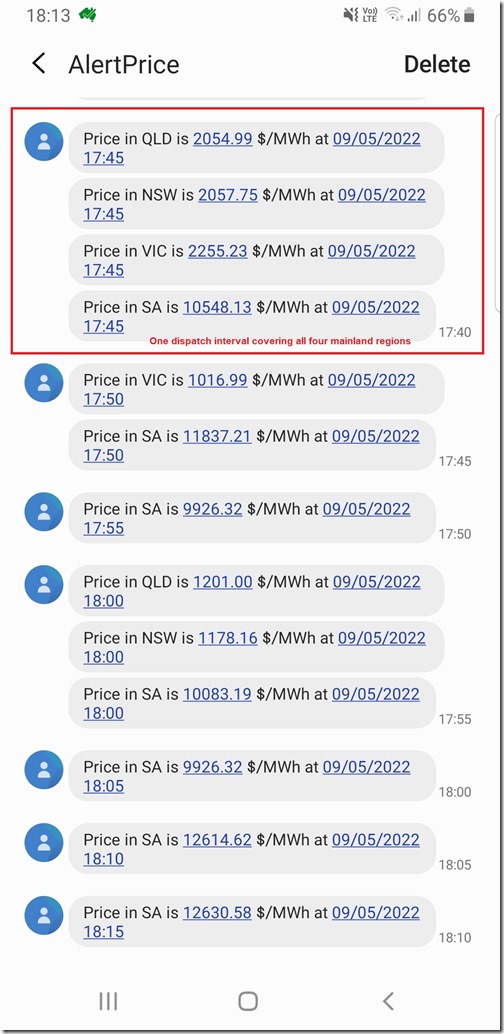

This evening (Monday 9th May 2022) market volatility has put on a show, with prices experienced above $1,000/MWh this evening in all four mainland regions, as seen in this run of spot prices seen in SMS alerts (configurable in a number of our products – ez2view, deSide® and even NEMwatch Platinum):

There’s an overarching story about the interrelated challenges of the energy transition coming to the fore this evening … but there are also discrete stories (probably more than one) in each region – which we might seek to progressively explore in future as time permits.

As we add more commentary (as subsequent articles) we’ll try to remember to return here and retrospectively link them in here. You might like to remind me, if I forget!

Here’s some, for a start:

(A) Market volatility in South Australia on Monday 9th May 2022

The spell of prices above $1,000 ran from 17:30 to 18:40 inclusive (excepting 17:35) – with many of these above $10,000/MWh.

For instance, here’s the 18:35 dispatch interval (NEM time) in South Australia via NEMwatch this evening, with the spot price up just below $10,000/MWh:

Note this morning the comments about (temporarily) forecast load shedding for Thursday this week (and see the blue forecasts shown for low Solar+Wind in South Australia for this evening in the ‘Forecast Convergence’ snapshot in ez2view for this evening).

This whole week will be an interesting week to watch!

(B) Market volatility in Victoria on Monday 9th May 2022

Victoria’s not seen much volatility, but today the 17:40, 17:45 and 17:50 dispatch intervals were all above $1,000/MWh – with the last two captured in the SMS snapshot above.

(C) Market volatility in NSW on Monday 9th May 2022

The NSW region had a few spells above $1,000/MWh:

1) Five consecutive dispatch intervals 17:25 to 17:45 (the last of which is captured above).

2) Then at 18:00 as seen above.

3) Last spike (so far) this evening was at 18:35

(D) Market volatility in QLD on Monday 9th May 2022

The QLD region has been the epicentre of market volatility in recent weeks, with today also seeing a share.

D1) Morning volatility in QLD on Monday 9th May 2022

Unlike the other regions, QLD saw some volatility this morning from 09:15 to 09:30.

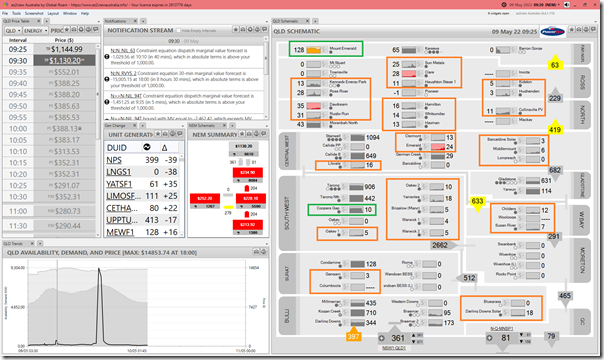

One additional factor contributing here would have been the widespread rain event (which Weatherzone was forecasting earlier, such as on Friday 6th May) that smashed solar output across practically the whole of QLD – have a look at this snapshot from 09:30 this morning using ez2view in Time Travel:

I’ve highlighted all of the ‘Large Solar’ farms to make it easy for readers to understand how widespread the event, with instantaneous capacity factors at 09:30 all quite low (at every single solar farm).

Also worth noting, as an additional factor, a rapid decrease in output at the Coopers Gap Wind Farm in the South-West zone, for unknown reasons (with prices as they are, we’d presume the operators would want to have run if they could!)

—

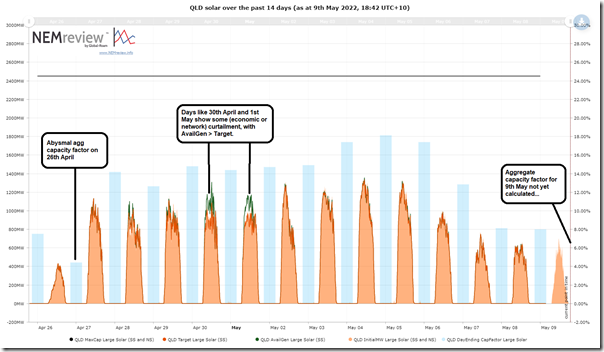

Out of curiosity, I’ve trended aggregate solar output across today and the prior 13 days in this trend from NEMreview v7 and see that today’s rain/cloud event drove aggregate capacity factor for the day down somewhere below 8% across 24 hours (but not as badly as on Tuesday 26th April 2022, which was a woeful solar day):

D2) Evening volatility in QLD on Monday 9th May 2022

This evening in QLD:

1) The first two spikes above $1000/MWh were at 16:55 and 17:00.

2) But it kicked off more consistently from 17:25 to 17:45 (the last one being captured as the first in the run of SMS alerts that fit on a single screen above)

3) Then spurts at 18:00 and 18:35 as with NSW above.

Leave a comment