I’ve been away for a bit and otherwise occupied … but I could not help notice that my SMS messages were strangely quiet, given that it’s summer.

That’s what La Nina summers do for you (at least compared to El Nino horrors like summer 2019-20)!

(A) AEMO warnings of possible Load Shedding on Wednesday 2nd February 2022

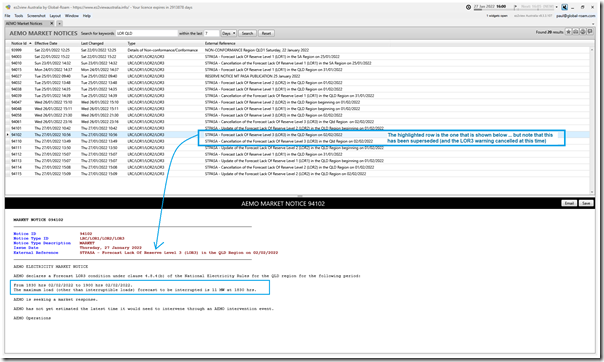

However, I have been messaged four times in the past 24 hours with respect to discrete Market Notices warning of possible LOR3 Low Reserve Condition conditions (i.e. controlled ‘load shedding’) in the Queensland region on Wednesday afternoon next week, 2nd February 2022. Here’s a filtered view of Market Notices from our ez2view software over the most recent 7 days, focused just on the QLD region:

Note that, as I post this article, there are no warnings for LOR3 conditions … but lower-level (LOR2 and LOR1) warnings are still present for parts of the week – so it will be a time to watch with interest (inside, in the cool).

(B) Current view of the Supply/Demand balance

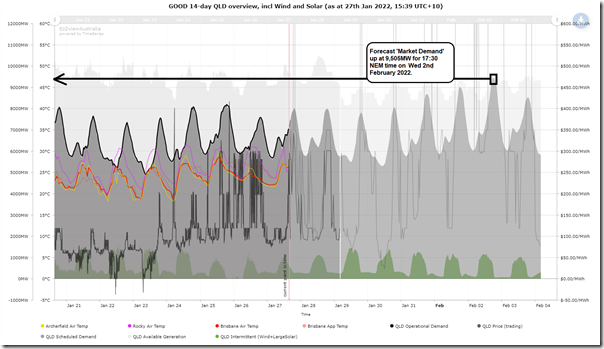

Referring back to this pre-prepared 14-day trend query composed in my copy of ez2view online, this is what I can saw earlier this afternoon when I started looking:

As noted on the image, at this time (i.e. 15:39 NEM time on Thursday 27th January) the forecast was for ‘Market Demand’ in the QLD region to be up at 9,505MW in the 30-minute period ending 17:30 on Thursday 3rd February 2022.

At this level, it would be about 500MW below the all-time maximum set at 10,052MW in the 16:55 dispatch interval on Wednesday 13th February 2019.

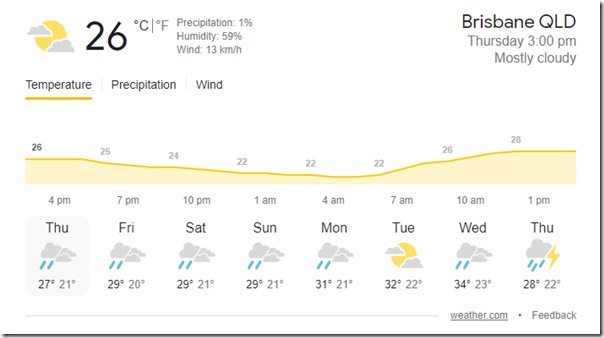

A Google ‘Weather in Brisbane’ search around the same time showed this:

… so clearly there is a cooler front forecast to sweep through sometime later in the week (but it looks like that won’t be until Thursday 3rd February … at least with the current forecast).

My understanding is that the AEMO uses a number of different weather forecast providers, and there is some discrepancy between the forecasts provided by each for Wednesday next week.

(C) Changes in the forecast for demand

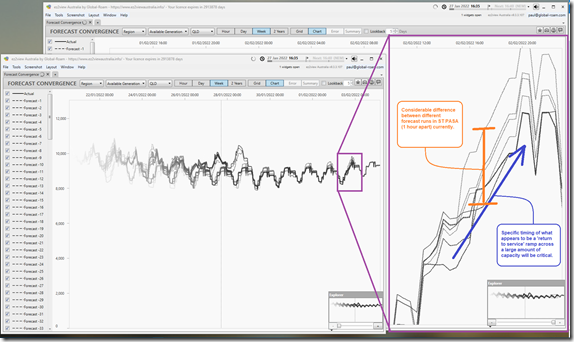

Self-evidently, there are two main components to the supply/demand balance – there’s supply, and there’s demand. We’ll look quickly at how forecasts for each have been changing using the ‘Forecast Convergence’ widget in ez2view:

(C1) Demand side

Remembering the gory details about how there are a variety of different measures for ‘electricity demand’ …

(and that we will frequently refer to ‘Market Demand’ as it is this measure that is most directly related to how prices are set in the NEM whereas AEMO speaks more commonly about ‘Operational Demand’)

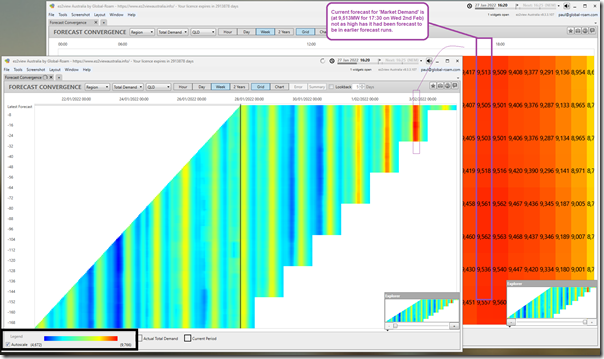

… here’s two windows of the ‘Forecast Convergence’ widget in ez2view.

1) The window at the front shows the full 7-day view (i.e. 7 days forward and 7 days back in rows below).

2) The window at the back is ‘zoomed in’ to focus on the most recent forecast runs for ‘Market Demand’ for Wednesday evening next week (2nd February 2022) … and in particular the 17:30 time point flagged in the ez2view Trend image above … which showed a forecast at that time of 9,505MW:

Scanning across the whole of the grid, the highest demand forecast at any point was up at 9,766MW … so considerably higher than the most recent forecast run.

This was published in the forecast run for 00:00 this morning and still pertaining to the half-hour ending 17:30 on Wednesday 2nd February. So the forecasts published later today have cooled off, somewhat.

(C2) Supply side

On the supply side, and with reference to the ez2view Trend chart above it’s useful to remember that the ‘Available Generation’ figure published by AEMO in ST PASA is different from (and typically lower than) the ‘Available Generation’ figure shown for P30 predispatch … because of better information known closer to dispatch, and the different mechanisms used in each process. That’s the reason for the discontinuity there

Looking at the same in the ‘Forecast Convergence’ widget in ez2view in the same way (but using the ‘Chart’ function in this case in each) we see what would seem to be critical in managing the tight supply-demand balance:

As highlighted in the image:

1) It appears that there is a considerable Return To Service (RTS) ramp across a number of generators in the QLD region over the afternoon and evening period (the increase might be 1,000MW or more); and also

2) There is a fair degree of uncertainty as to when these plant might actually be returned (i.e. at a vertical slice of the chart there is a noticeable difference in where the various forecast lines cross on the y-axis, being Available MW).

(D) Preparing for possible Generator Recall

As such, the AEMO is being prudent …

Not shown in the window above were two Market Notices (94079 and 94080) published this morning by the AEMO and titled ‘Request for Generator Recall Information for the period for [DATE] for OLD Region’ with respect to both Tuesday 1st February 2022 and Wednesday 2nd February 2022. Here’s the full text of the latter.

________________________________________________________________________________________________

Notice ID 94080

Notice Type ID RECALL GEN CAPACITY

Notice Type Description MARKET

Issue Date Thursday, 27 January 2022

External Reference Request for Generator Recall Information for the period for 02/02/2022 for OLD Region

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE

Refer to AEMO Electricity Market Notice 94047

Please provide Generator Recall Information for 02/02/2022 by 1200 hrs EST on 31/01/2022 via the Generator Recall communication system, in accordance with clause 4.8.5A of the National Electricity Rules.

SO_OP_3719 Procedure for Submitting Generator Outage Recall Information is available at:

https://www.aemo.com.au/-/media/files/electricity/nem/security_and_reliability/power_system_ops/procedures/so_op_3719-procedure-for-submitting-recall-information-scheduled-generator-outages.pdf

Procedure on how to use Generator Recall in the EMMS Markets Portal is available at

http://www.aemo.com.au/-/media/Files/Electricity/NEM/IT-Systems-and-Change/2018/Guide-to-Generator-Recall-Plans.pdf

AEMO Operations

… both Market Notices listing 12:00 Monday 31st January 2022 as the deadline for the information.

Next week will clearly a period to watch more closely next week!

Leave a comment