I was thrilled to get an advance copy of the (newly-released) Generator Statistical Digest 2020 which contains all the operational and market data for each of the NEM’s 330 registered units. The single source of truth from the AEMO systems are presented in an easy-to-read visual format. The authors have presented each NEM generator unit (by DUID) across two pages in a genius visual layout displaying 10 years of statistics and data across one page followed up with 2020 in detail on the second page. For anyone in the energy industry, the GSD2020 is the ultimate ‘go to’ for a vast array of relevant and well-presented information.

As I reviewed each generator, looking at its outputs over the years, the performance, constraints, rebids, revenues, costs, utilisation, availability, capacity factors, conformance, energy harvest, operating hours and constrained hours etc. I found myself looking at the details of a challenging 2020 in the context of the last 10 years and made a few initial general observations.

1) There seemed to be a lot of new plant registered in 2020

2) There is only five registered batteries (265 MW)

3) Operational hours and capacity factors through 2020 appear on par with previous years

4) Some older generators are showing their age by way of reduced operation

5) Coal generation remains generally consistent in capacity factor – with some older plants as exceptions.

I will explore a couple of these in detail:

1) New Plant Registrations in 2020

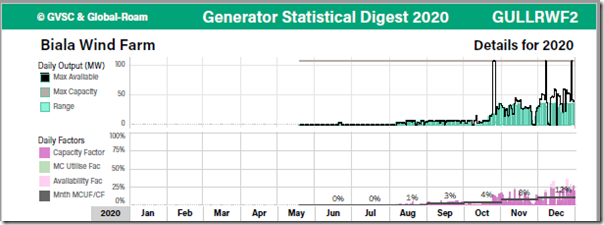

Glancing through the GSD2020 it is easy to quickly identify the plants that only have charts commencing in 2020. Biala Wind Farm is shown below:

Flicking through the GSD, I made a list to have a look at what new plants joined the NEM:

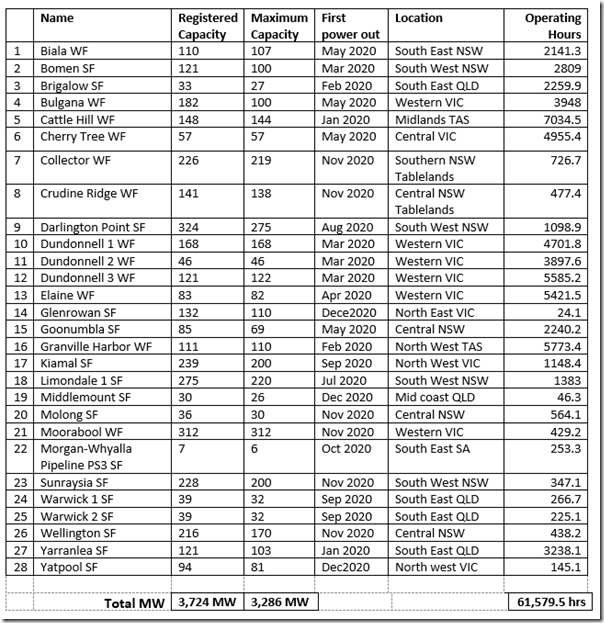

Table 1: Power stations registered in 2020

During 2020 a registered capacity of 3,724 MW was added to the NEM. This comprised 1,705 MW wind generation and 2,019 MW solar generation, broken down by region:

| . | SA | VIC | TAS | NSW | QLD |

| Wind | 0MW | 969MW | 259MW | 477MW | 0MW |

| Solar | 7MW | 465MW | 0MW | 1,285MW | 262MW |

| Total | 7MW | 1,434MW | 259MW | 1,762MW | 262MW |

To put this into context, the highest demand on the NEM registered generators was recorded in January 2009 at 35,796 MW and the smallest demand on the NEM generators was 14,538 MW on boxing day in 2005.

The Capacity registered in 2020 is 10.4% of the NEM maximum demand and just over one quarter at 25.6% of NEM minimum demand. It appears, despite the challenging year, to have been a very busy 2020, registering 3,724 MW of new generation capacity across 28 sites in a year that had some difficult and adverse circumstances.

The detail of charts and graphs show that each new generator operated at a variety of levels during 2020 particularly during the commissioning and hold point testing. The 28 new generators ran up a combined 61,579.5 operational hours. This will increase as they come up to full output and make for an exciting 2021 as we see even more new generation competing for a space in the market.

2) Only 5 batteries ?

Increases in intermittent generation will see more need for storage and we will see more batteries joining the NEM in future. In the meantime, the five battery energy storage systems (Dalrymple North, Lake Bonney, Hornsdale Power Reserve, Gannawarra and Ballarat) appear to have revelled in 2020, in part due to a very lucrative February when South Australia was being operated as an island.

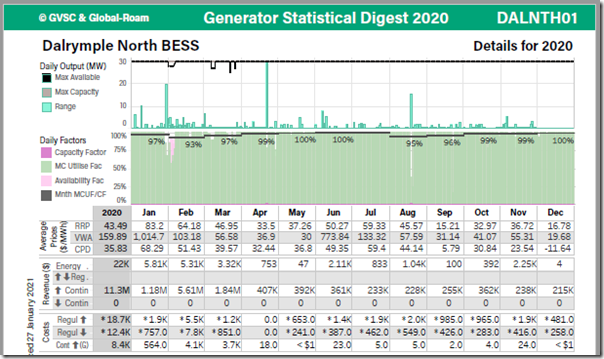

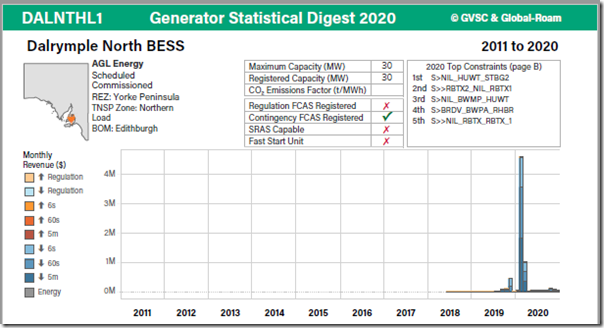

For example, Dalrymple North (30MW) in South East SA, from the ‘B’ Page:

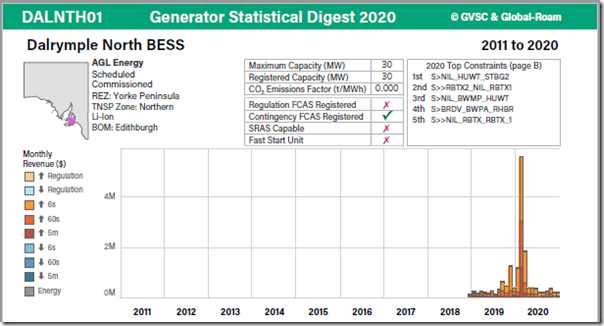

… and revenues shown graphically, including prior years, on the ‘A’ Page:

… but remember that revenues are not just linked to discharging, but also (via Lower FCAS services) in charging:

February 2020 alone grossed just under $5M in Raise contingency services and just under $5M in Lower contingency services. This is a rare event though goes to show that the NEM is vibrant and during this transition can return some interesting results.

The other SA based batteries had a similar story with record contingency revenue during the February 2020 SA island.

I think the transition continues to be well underway, certainly not slowing for the pandemic. We will see more storage in the next few years and more need for grid services such as system strength, voltage control and reactive plant. It is inevitable as more intermittent generation is added. The key to continuing the transition is finding the right connection points in the grid that enable both a technical and commercially successful project.

————————————–

About our Guest Author

|

Mark Stedwell is the Director at NEM Connect.

NEM Connect are specialist expert consultants in energy markets, power systems, renewable energy integration and demand side resource solutions. Amongst his experience, Mark worked in various roles with the AEMO for over 7 years. You can find Mark on LinkedIn. |

Leave a comment