Editor’s note: Mitch recently posed his thoughts about the AEMO’s draft 2024 ISP on LinkedIn. Mitch was happy to share them here on WattClarity, as we believe his comments and quesions would be of interest to our readers as well.

I’ve had a chance to read through the Australian Energy Market Operator (AEMO) draft 2024 ISP over the last couple of weeks. Well done to AEMO, they’ve done a good job at what is a very difficult task. Some highlights:

- We are increasingly relying on consumer resources to do the heavy lifting, which in turn eats the lunch of utility-scale renewable energy profits that benefit all

- The need for gas is increasing, and hydrogen is now assumed to be part of the gas mix- I’m skeptical for several reasons

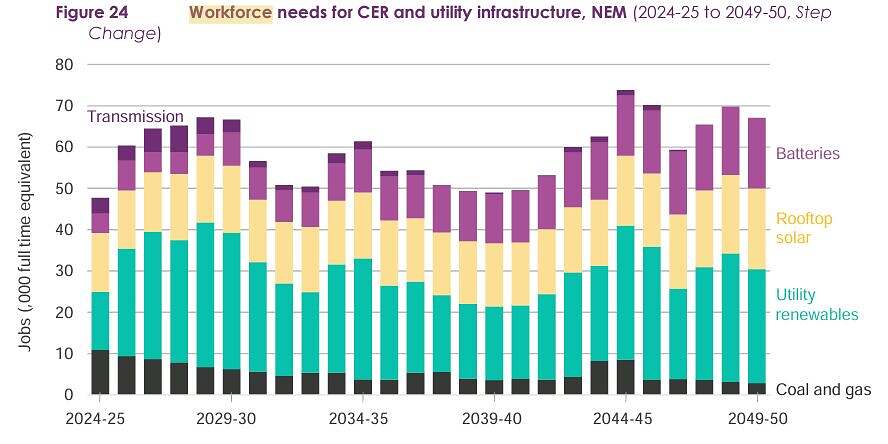

- The need for people is a major constraint – no surprises there

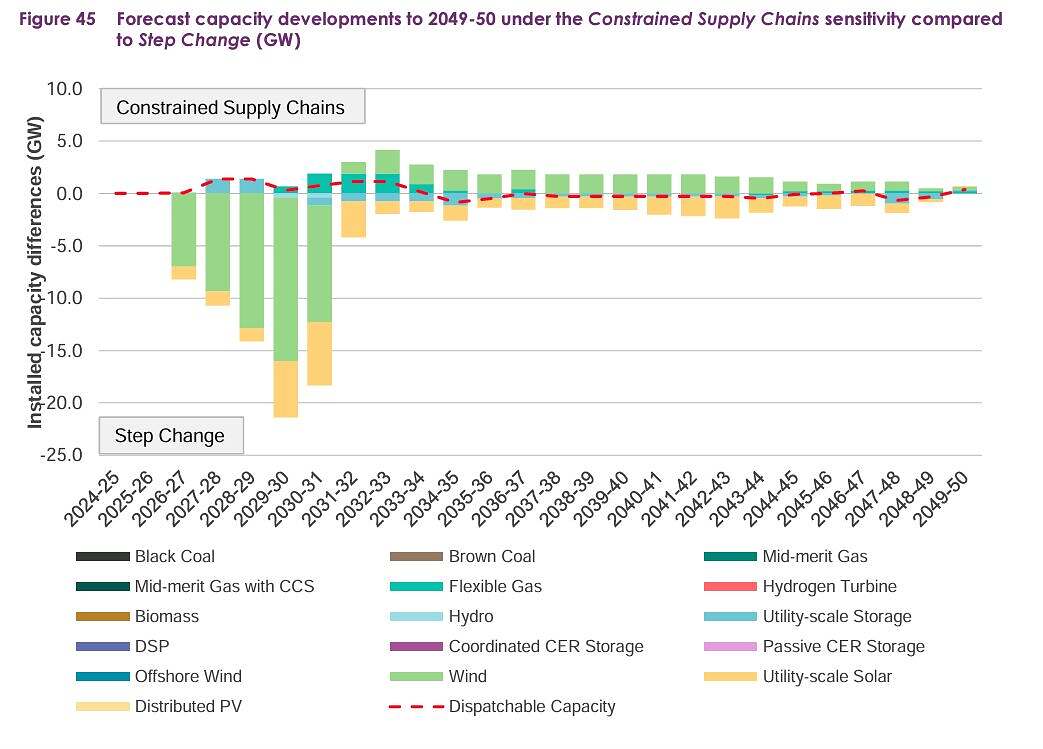

- The supply chain constraint sensitivity in Appendix 2 is interesting, and to me should not be modelled as a sensitivity but an actual, although the recovery in the chart seems incredible!

There are also some big questions marks mostly around the deliverability of the plan. In particular, I’m struggling to understand how the Delphi Panel voted Step Change as the most likely scenario for the following reasons:

- Offshore wind enters the market as early as 2030 – this seems highly unlikely, given global supply constraints of offshore wind installation vessels and other constraints like transmission connection infrastructure and suitable locations

- Capacity build of onshore wind in the Step Change scenario is heroic out to 2030, in the year 2026-27 alone nearly 7,858 MW of wind is assumed to be built, and a further 17,041 MW in the following 3 years. The record year for added utility scale capacity in the NEM was 2019-20 at 3,505 MW. Do we actually think we can build nearly 8GW of wind in 2026?

- A significant portion of the total additional utility-scale generation is built in the next 6 years, 38% of utility-scale build-out across the 26yr window occurs in the first 6 years.

- The plan assumes 47,888 MW of utility-scale capacity will be built by 2030, this is an average of 7,981 MW a year, well over double the annual record to date.

- The additional rooftop solar added by 2050 is astronomical, and perhaps actually achievable too given the incentive for consumers to reduce their bills, however, the plan also assumes very ambitious hydrogen demand which peaks during the day. There’s very little evidence that this will play out, it’s my view that commercials will push hydrogen plants to run 24/7 which will do nothing to solve the duck curve issue and only exacerbate the capacity issue. Removing hydrogen would result in far more battery storage required than is forecast in the plan, or massive curtailment of rooftop solar. (election risk anyone?)

- Major transmission project timelines, particularly in NSW are optimistic at best

- Workforce needs are massive, we are heavily under-resourced and the addition of workforce to the NEM seems ambitious without a shift policy ASAP.

Clutch covers the report in our monthly NEMScan service. I look forward to what changes in the final version. Submissions close 16th Feb.

This post was originally published on LinkedIn. Reproduced here with permission.

=================================================================================================

About our Guest Author

|

Mitch Baker is a Grid Connection Specialist at Clutch with several years of experience in the electricity, resource and energy industries. Mitch joined the Clutch team previously working with a Transmission Network Service Provider (TNSP), managing connections for renewable and thermal projects to the National Electricity Market as well as working with existing transmission customers to assist with expansions, modifications to their plant and compliance related matters.

You can view Mitch’s LinkedIn profile here. |

Be the first to comment on "Comments and questions about the 2024 draft ISP"