In a previous post we explored some aspects of the proposed new demand buy-back mechanism that might be implemented into the NEM in the coming months.

Further discussion and consideration ensued, online and offline, as a result of which I’ve set out this post to explore how the new buy-back mechanism might impact on the way in which prices are set for the NEM.

To make the calculations simple, I’ve set up an entirely fictitious (and very simplified) dispatch interval and re-run it three times to look at what the situation would be with and without Demand Response (and looking at two different methods of Demand Response).

I’m keen to hear if I have understood the new mechanism correctly?

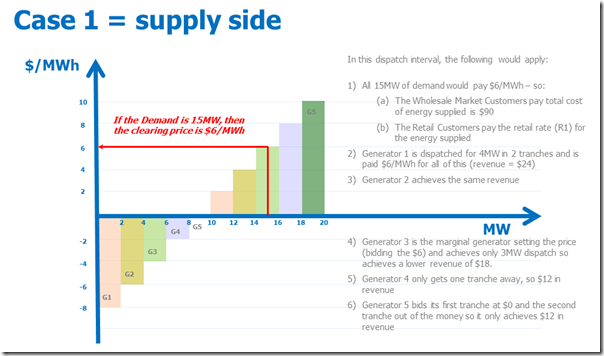

Case 1 – “normal” dispatch with the supply side meeting demand

In the first scenario, illustrated below, we assume there are 5 discrete generators bid to supply the market demand. Some are fully dispatched and some only partially so – but all are paid the common clearing price for the volume dispatched.

Here we assume that the entire load is paying the retail rate (R1, in this case).

Because the entire load sees only the retail rate in their electricity bill, they have no commercial incentive to moderate their consumption when the supply/demand balance is tight (in which case the $6/MWh clearing price might be $6,000/MWh or higher in the real world).

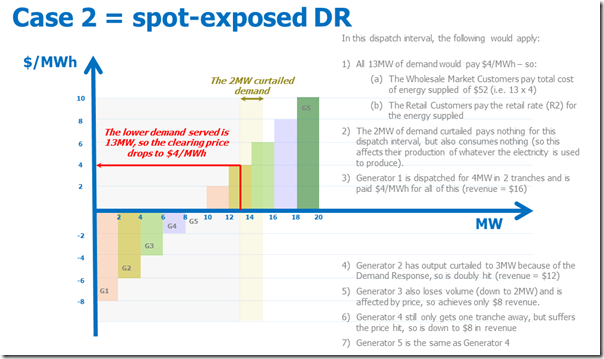

Case 2 – Demand Response, through spot price exposure

In this scenario we take the above case and modify it slightly, by:

(a) Assuming only 13MW of the 15MW demand pays the retail rate (R2, in this instance); whilst

(b) The remaining 2MW of demand is one large, price-sensitive energy user which has opted to pay the spot price for electricity, rather than pay the retail rate.Let’s say that the clearing price above ($6/MWh) is more than the spot-exposed energy user is willing to pay, so they choose to switch off their consumption for this dispatch interval.

* Note that we have been active for more than a decade in facilitating this form of Demand Response in the NEM.

A growing number of energy users are operating in this manner (some with our help, some independently). Some have become very sophisticated in their operations, fine-tuning their curtailment decisions with respect to such parameters as:

(a) The size of their order book; and

(b) Their production lead time.Under this scenario, the clearing price is lower than what it would be under case 1, assuming all other things stay the same:

Based on our experience, we see that this type of operation achieves two potential benefits:

Effect #1) For the spot-exposed energy user, their average cost of consumption over the year is lower:

In the single dispatch interval shown, this energy user pays nothing (but also consumes nothing – and so produces none of their own product in this interval).

Because of the disproportionate impact of the long-tail distribution of extreme prices, energy users that operate in this way can significantly reduce their average cost of electricity consumed over a year with only a small number of half-hours curtailed.

Effect #2) For other wholesale market customers in this dispatch interval, the reduced spot price that results also has a beneficial effect:

It’s a more complicated question to think through how these lower spot prices would feed through to the retail market. One might think there would be some effect- though perhaps separated in time.

Effect #3) As noted in the image, generators (particular those unhedged – and so reliant on spot prices and volumes) will be negatively impacted by the lower prices that results, whilst one in particular will suffer volume risk as well.

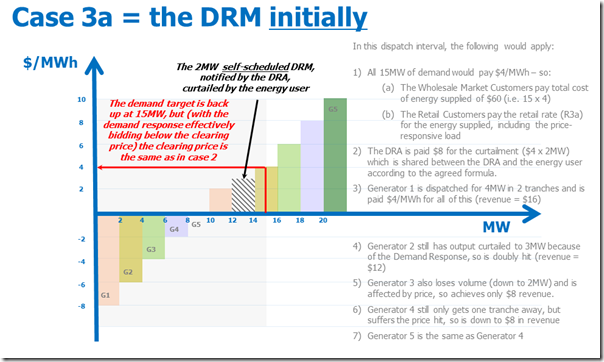

Case 3 – Demand Response, through the demand buy-back mechanism

In the final scenario, we assume that there’s the same volume of price-sensitive demand (i.e. 2MW), but we assume that it interacts with the market through the proposed new demand buy-back mechanism rather than through direct spot price exposure.

As others have noted, several aspects of market design which are (in combination) unique to Australia’s National Electricity Market mean that the new buy-back mechanism is not directly equivalent to other demand response mechanisms that have been operating in other electricity markets for some time.

As a result, the scenarios presented below are entirely speculative (and hence may well be wrong). We have worked through these not to be definitive about what will happen, but as worked examples to help us understand the key variables to look for as it unfolds:

Case 3a) DRA under the initial method

When it is first launched, the AEMO proposes that demand buy-back quantities will be self-scheduled* into the market.

* i.e. the energy user will commence curtailment, at a time that they decide, and then inform the AEMO that they are doing so (within that trading period).

In effect this will operate as if the “negawatts” were bid below the clearing price, such as shown here:

As noted here, the outcomes here are broadly the same for all stakeholders as would be the case in scenario 2 above – with the exception of the price-sensitive energy user.

In the case of the price-sensitive energy user:

(a) Under Case 2, that energy user does not consume, but also does not pay anything for that period – neither the clearing price that eventuates ($4/MWh) nor, more correctly, what it would have been had they consumed ($6/MWh).

(b) Under Case 3a, the energy user pays the retail rate (R3) but is then paid some share of the revenue delivered from curtailing in this way. In this case the total revenue is shown as $8, which might be split 50/50 (or by some other ratio) between the energy user and the aggregator that interfaces with the AEMO on their behalf (if any).

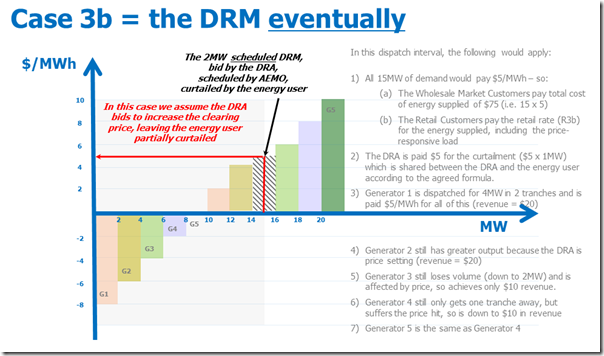

Case 3b) … and when it becomes dispatched

It’s our understanding that the AEMO’s intention is to move the DRM towards a scheduled mechanism once the initial teething problems have been ironed out (we’re unaware of a definite timeframe for this transition, however).

Once this move has been made, it would be possible for the DRM to be setting the price, on occasions – such as in this hypothetical example:

In the same way that a portfolio generator might spread its bids in order to try to lift the clearing price (i.e. acting as “price maker” not “price taker”) it would seem reasonable to expect that a portfolio DR aggregator could operate in the same sort of way:

One of the most significant drivers of this behaviour (as it is with generators) is the extent to which they are long or short generation, in relation to their hedge cover.

Hypothetically let’s say that Generator 1 is also (in a related entity) the Demand Response Aggregator – in this case it will have lifted its portfolio revenues compared with the Scenario 3a above:

Total Revenue in Case 3a = $16 + $8 = $24

Total Revenue in Case 3b = $20 + $5 = $25

If this were the case, the benefit shared with the energy user providing the demand response would be lower (because it is only partially dispatched):

Energy User benefit in Case 3a = share of $8, less 2MW purchased at retail rate R3a (none of which they actually use)

Energy User benefit in Case 3b = share of $5, less 2MW purchased at retail rate R3b (but 1MW of which is not curtailed, so they can actually use)

Obviously there are a number of permutations that could be described – even just using this simplified model.

If time permits, in future, we might return to this question with some real-world examples…

Some other thoughts…

In reviewing some more of the details of the proposed implementation, and working through these examples, we’ve started pondering a few other things, such as:

(a) Another ambiguous name

In my prior post, I noted how the proposed name of the new buy-back mechanism was ambiguous and likely to cause confusion – indeed, we have already witnessed the confusion inadvertently caused when people equate the “DRM” to the broader pool of methods that comprise Demand Response.

In reading through the details of the proposed implementation, I was struck by how the naming of the new type of market participant – the Demand Response Aggregator (DRA) – seems to imply that a 3rd party aggregator needs to be involved, whereas this is not the case.

To avoid confusion in future, I would have suggested a less ambiguous title such as “Wholesale Negawatt Supplier”?

Whatever the title, this will be a new classification to show on a subsequent update of our “Power Trading Schematic” Market Map.

(b) Questions about equity

The following are some place-holders for questions we’ve started pondering – which we might have time to return to later, and which some of our readers might be able to help us with?

i. How will retail rates (R1, R2, R3a and R3b) differ?

It is likely that the retail rates offered under each of the scenarios above would vary, because of the impact that each of the scenarios will have on spot prices, on the retailer’s contract positions and spot volumes.

Is it possible to make & test some hypothesis of how these would vary – or is this an unanswerable question?

ii. What effect will the 5/30 issue have?

The introduction of the new DRM leaves me wondering if there will be, as a result, one more perverse impact follow on – with respect to the 5 minute dispatch and 30 settlement mismatch inherent in the NEM design currently.

In case 2 and case 3 we see two different methods by which demand response might be working in the NEM in future.

Under Case 2, a spot-exposed energy user feels real pain (i.e. cash outlay) when the spot price spikes unexpectedly in the last 5 minutes of a trading period – whereas under Case 3, the energy user might view this only as a missed revenue opportunity (so, psychologically, not be as affected, even if the net result still might mean a higher average cost of energy).

If the price spike occurs at the start of a trading period, I wonder if the different psychological driver under case 3 means that more negawatt capacity is dumped into the market in the later dispatch intervals in the trading period (like some generators now do), possibly producing more negative prices than are currently the case?

iii. What about irregular loads?

Because of the inherently artificial nature of the “negawatt” construct on which the proposed new DRM is based, it is understandable that the AEMO needs a Accreditation and Classification processes that will allow them to “measure” the demand response.

For such processes to work, in the real world, they need to be prescribed in such a way to work with “predictable” loads – i.e. loads that have a relative root mean square error (RRMSE) of less than 20%.

Whilst this is understandable, it will – necessarily – have the effect of excluding a certain type of energy user (e.g. one with an irregular load) from participating in the DRM. For such an energy user, the avenue of spot price exposure for the provision of demand response would still be open – and may, depending on the controllability of the irregularity, offer them significant benefit.

iv. The incentive to increase consumption

In its proposed detailed design of the DRM, AEMO has proposed what appears to be a two-step process for establishing a demand baseline (i.e. what they would otherwise have consumed, except for the demand response):

Step 1 = to look back at similar days and develop a sense of a typical demand for that half-hour (within the RRMSE tolerance noted above); and

Step 2 = to then adjust this number with reference to what the consumption had been earlier on the day of the event.

Especially in the initial period (when this demand response will be self-scheduled), there appears to be an incentive for the energy user to increase their demand ahead of time to achieve a better outcome for them when they curtail later in the day – for a couple of reasons, including:

1) Given the energy user pays only the retail rate (R3a) for their consumption, there is an asymmetric benefit in doing this;

2) A hot day with tight supply/demand balance is likely to be the type of day where all market participants (including this energy user) are going to be aware of the potential for volatility – increasing demand on a day such as this increases the potential for the price to spike (and, in general terms, places greater stress on the system); and

3) By increasing discretionary demand earlier on these days, the energy user will be able to deliver a bigger “measured” reduction through demand response when (if?) the price did spike later in that day.

I would expect that the body charged with regulating behaviour under these new provisions (would this be the AER?) would view these types of decisions in the same way that the contentious “bidding in good faith” provisions for generators are currently viewed.

We’re keen to hear back from you, with respect to the above – have we understood the dispatch mechanism correctly?

Leave a comment