Well, Thursday 30th January 2020 was looking like being the day before the supply/demand balance becomes very ‘interesting*’ tomorrow …

* though perhaps those sweating the the AEMO control rooms, and other control rooms across the NEM would rather call them as ‘challenging’ or ‘stressful’, or something less printable

However circumstances conspired otherwise – so, to follow on from my running commentary this evening on Twitter here and longer-form comments on LinkedIn here I will just note a few things here this evening, but note:

1) Tomorrow, time permitting, we hope our regular guest author Allan O’Neil might have some time to piece together more of a forensic (and less of my frenzied!) look at what happened during this evening; and

2) Because tomorrow’s still forecast to be even higher demand than today (current forecast for 35,073MW at 17:00 on a Scheduled Demand target basis), I’ll be having more of a look at tomorrow, tomorrow!

3) In more general terms, this evening’s activities just help to reinforce what we noted in last year’s publication of the Generator Report Card 2018 in that that ‘the level of risk in the NEM is increasing’.

This report was released on 31st May 2019, but is still worth your while reflecting on – particularly given we’ve just updated the stats side of this report with the Generator Statistical Digest 2019.

(A) Scheduled Demand peaked much higher than earlier forecasts

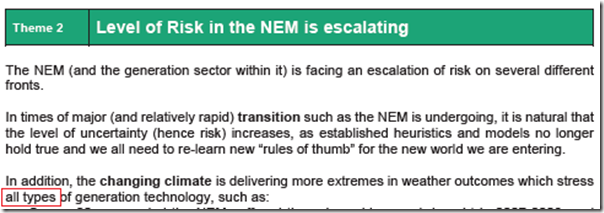

In the 18:10 dispatch interval the NEM-wide Scheduled Demand peaked for the evening at 34,257MW – as captured in this snapshot at snapshot from NEMwatch v10.

This was higher than what the AEMO had (on Wednesday evening when I noted this) been expecting for the higher demand period on Friday evening! Did the hotter temperatures hit the NEM sooner?

The colour coding of the regions are set on a sliding scale between blue (historical minimum levels of demand for the region) and red (historical maximum level of demand for the region). So we can see all of the mainland regions well out of their respective green zones and well on the way towards red.

Note that it is very, very rare to have coincident high temperatures across the broader NEM driving each region’s demands in the same sort of way.

Obviously we can also see the dispatch prices in VIC and SA up towards the Market Price Cap, and dispatch prices in the QLD and NSW regions also well above $1000/MWh.

(B) Wind production was quite low, right across the NEM

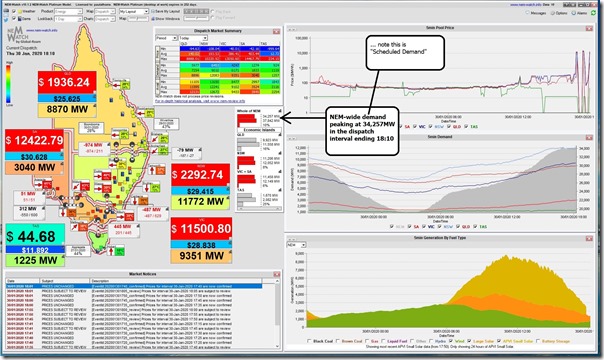

The lowest level of contribution from Wind, right across the NEM, was only 460MW metered at 16:55 – so 75 minutes before the highest level seen for demand (at 18:10) but coincident with the 2nd highest peak in Scheduled Demand seen as dispatch target for 17:00 (34,253MW, just 4MW below today’s peak) – as captured in this snapshot from NEMwatch at the time:

This was quite an unfortunate coincidence, but one that we need to understand is certain to occur in the future – so (as noted in the GRC2018) we need to ensure that the NEM is designed to ensure sufficient dispatchable capacity is installed (and the incentives are such that it will continue to be there when required) to meet that gap. Today was very, very close…

One thing that Allan might dig into further tomorrow is the extent to which this NEM-wide lull in wind was expected?

My quick review today seemed to indicate it tracked fairly well against forecasts – however tomorrow Allan will have more time (I hope) and also access to more data (published at 04:00 tomorrow for today) that I can’t see now…

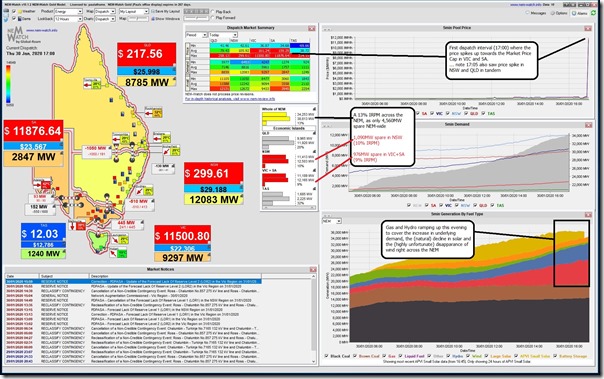

(C) Solar declined into the evening

Combining APVI’s updated estimates for rooftop PV and what AEMO meters from Large-Scale Solar systems through the afternoon, we see that (as expected) solar production declined through the day. The scale of the numbers are worth noting, however – peaking at 7,240MW NEM-wide at 12:40 (NEM time), but down to just over 3,000MW by 17:00 (first peak in demand above) and further to just over 1,200MW at 18:10 (time of today’s peak in demand).

By 18:55 when the following snapshot was taken, aggregate production from solar (large and small, all the way across the NEM) was under 400MW and fading further.

Thankfully, as noted on the image, aggregate production from wind had started a gradual increase off its evening low point.

(D) Loy Yang A3 trips

I’d noted earlier that there had been 44 of 48 coal units fully operational through the earlier part of the evening, with outages just at the following four units:

1) None in VIC (all 10 units online)

2) Three in NSW (Bayswater unit 4, Liddell unit 1, Mt Piper unit 2)

3) One in QLD (Gladstone unit 4).

Also worth noting that I had (only earlier this afternoon) discussed at the bottom of this post how the evidence does not suggest that high ambient temperature is in some way related to coal units tripping, or being fully unavailable.

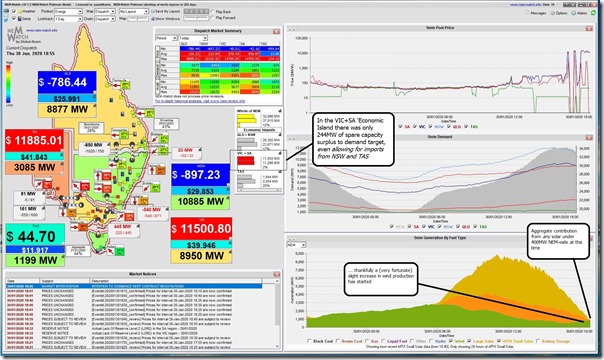

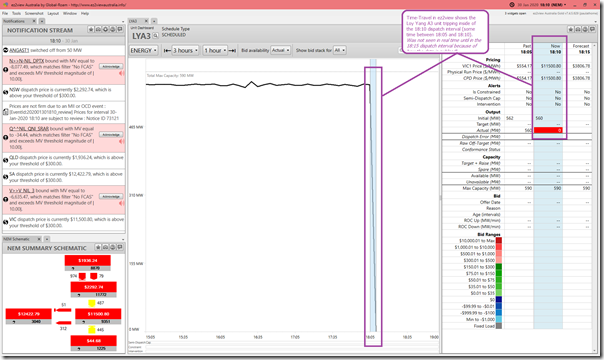

In that article I had again noted about the all-to-common point of confusion between Probability (no more likely on an afternoon like today) and Consequence (so much higher, because demand is higher – and also because wind is low, etc…). Well, today’s trip of Loy Yang A3 was a perfect case in point here – in this snapshot of a 3 Widgets in ez2view Time-Travelled to 18:10:

Sadly won’t stop those seeking to propagate the misleading “coal fails in the heat’” meme, however…

Only other point worth noting today (i.e. as at 20:25 now) is that it currently looks like the expectations at AGL Energy are that the unit will be back in operations by 14:00 tomorrow. Getting quite tight for the expected higher level of NEM-wide demand.

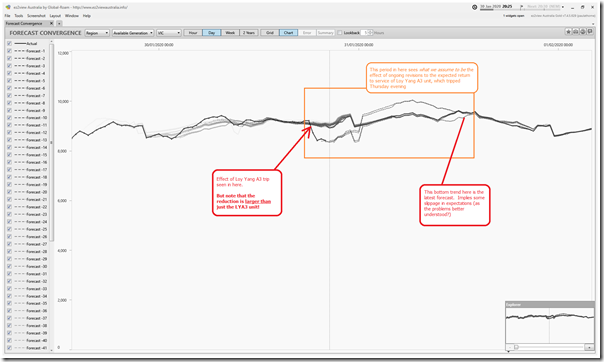

Also noted on the chart is that the reduction occurring over the 1-hour period around the trip is larger than just the capacity of Loy Yang A3 – so something else was happening around then as well?

Hold onto your hats again…

(E) Reserve Trader negotiations

Before I forget, AEMO also issued Market Notices (a bit later than I would have expected – but then the mechanics of RERT are not so familiar to me) indicating they would commence negotiations for Reserve Trader in both VIC and SA.

However I don’t think this was triggered…

———————————-

…. and over to Allan for a more considered review!

Leave a comment