It was almost exactly a year ago when I spoke at Clean Energy Summit 2017 and provided a forecast of sorts (for train wreck underway). This means that Clean Energy Summit 2018 is just around the corner, and I am looking forward to using this opportunity to resume some conversations, and learn from other perspectives about this multi-faceted energy transition.

During my talk last year, I undertook to post more about the “villains” I saw who/which have been acting to create and propagate the train wreck which is still very much a real risk. Over the 12 months since the conference I have only managed to post about the first three villains:

Villain #1) First and foremost are our emperors, who are repeatedly revealing that they have no clothes –

Villain #2) However we, the voting public are complicit in this tragedy.

Villain #3) This happening, at least in part, because of a very vocal rump at either extreme of the Emotion-o-meter who are each presenting the transition as a black-or-white issue.

… and so this bring me to Villain #4, which is what I see as a growing deficit in sector-wide aggregate “Energy Literacy” required to deal with the manifold & complex challenges in this energy transition.

(A) Evidence of this gap

We are well aware that a “sector-wide aggregate level of Energy Literacy” is not a metric that can be accurately measured, or trended over time (rather, it’s a term that I’ve conjured up to explain this concern). Whilst it can’t be measured, we certainly can see instances where the gap has been evident.

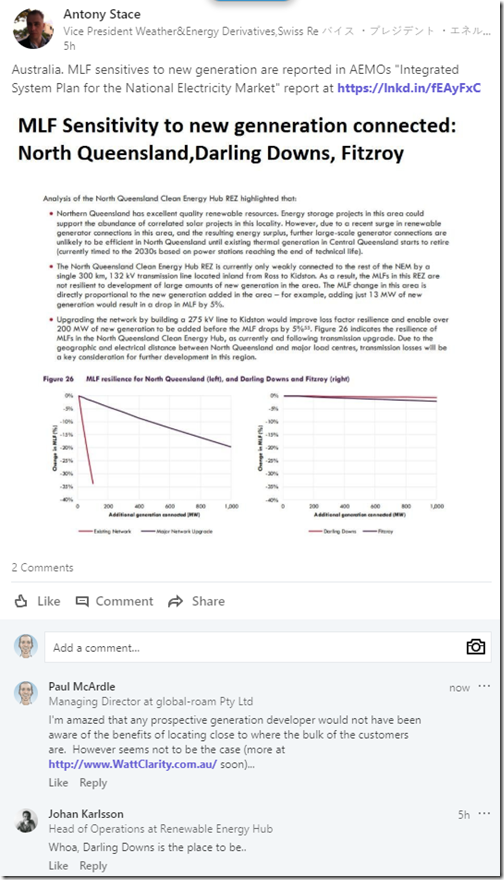

As just one example of this, earlier this week I noted the start of a conversation on LinkedIn about some useful content developed by the AEMO in their Integrated System Plan 2018 to help prospective developers understand that Marginal Loss Factors (MLFs) are a material determinant of the long-term returns they might earn on potential generation developments in different parts of the NEM:

In my comment I noted I was “amazed” – however “gobsmacked” would be a more literal interpretation of my response when I’ve read elsewhere of the responses of some new entrants to the generation game express complete surprise at being slapped with large changes in MLFs after competition had loaded into the same locations as them (i.e. remote/weak parts of the network, a long way from the bulk of the customers).

- As if it were some form of grand conspiracy, rather than just a reflection of physics at work.

- See some of the comments/quotes expressing surprise in this article on 1st May in RenewEconomy (there was plenty of the same that flowed onto LinkedIn and Twitter at the time).

I feel a similar response to hearing of surprise when new entrants experience their output being constrained down, and not knowing why:

- More surprised comments quoted in RenewEconomy on 7th May,

- With some more background to the types of constraints in prior WattClarity articles here.

Also some surprise expressed by some at being hit by a “solar correlation penalty” or its cousin, the “wind correlation penalty”, like it was not inevitable (though I did note here that I was surprised at how quickly its arrived in Queensland during low demand seasons).

It seems clear to me that there will be some people take a big haircut on their investments – fundamentally (and sadly) because there was too great a gap in required “Energy Literacy”. Given so much of our future will depend on a number of these new entrants, with the new projects and innovations they bring, it’s worth thinking through how this particular part of the gap has evolved and what can the energy sector can do to rapidly close that gap (involving the developers themselves, but also the consultants that serve them and the financiers that invest in their projects).

.

(B) Several factors contributing to growing the gap

We wonder if there are not several reasons why this gap is growing, including these three:

Factor #1) The space has become another step-change more complex

Back (a couple decades ago) when my involvement started in the energy sector, it was a more stable place – where heuristics developed over prior decades of industry experience could provide good “rules of thumb” that would get you through most challenges.

Through the 1990’s we started developing the competitive market structure and disaggregated the QEC, SECV and ECNSW into many smaller organisations and we had our first step change in complexity. From a small room of people in each state (the Dilbert types) who guarded the precious secrets of how dispatch worked in a grid using cost-based dispatch, we moved to an environment with 40 or so organisations with trading desks, each staffed with their own people who needed to know the same thing – but overlaid with considerations of competitor behaviour in a market environment as well (i.e. moving from cost-based dispatch to price-based dispatch).

This was a significant step change in complexity, and also coincided with when our organisation came into being. As noted in Sept 2017, the wholesale** market served us pretty well over almost 2 decades since NEM start – providing some illustration of how we collectively navigated the increased complexity that came out of the commencement of the NEM.

That same article also highlighted the recent sharp price escalation that is symptomatic of the train-wreck we’ve brought on ourselves, at least in part because we’ve missed the need to skill up for the next step change in complexity that’s already upon us:

| Used to be | In the past, we operated in an environment whereby there was essentially just one non-controllable variable (i.e. electricity demand) with controllable/dispatchable supply sources dispatched to meet expected demand levels. Fairly simple, compared to how it now is … |

| Now is | We’re already in an environment where we have thrown in at least 5 other independent variables: 1) We have sunshine and cloud cover, and how this affects solar PV (somewhat inversely aligned with demand during summer, but not so during winter); 2) We have wind patterns of a very different cycle, and with higher degrees of correlation than I’d been led to believe by some of the motivational pitches by wind advocates; 3) We have drought/flood patterns that will affect hydro catchment areas (already 2 significant events in NEM history), and will do more in future. 4) We’ve now tightly linked our electricity market to the international market for LNG and oil; and 5) Perhaps most complex of all, our energy sector has become inextricably intertwined in both global science and global political sentiment (both of which are important) relating to concerns about climate change. |

| Could well be in future | In the future, it looks pretty certain that we will need to almost come full circle and end up controlling large swathes of demand (either directly via demand response, or through storage) in order to deal with a majority of uncontrollable supply sources. |

The AEMO sums up this step change in complexity in their Integrated System Plan 2018 as follows:

“In the current period, the changes are far more comprehensive and fundamental. The industry is now experiencing the simultaneous effects and benefits of digitalisation, ageing infrastructure, a markedly and rapidly changing cost structure in both supply and storage, flattened and even negative demand growth, the impacts of climate change, cyber security concerns, and a profound change in consumer preferences and expectations for the industry. ”

We, as an industry, knew such challenges were coming down the pipe and yet (like a deer in the headlights) have not done enough to prepare ourselves for it.

However the challenges don’t end there…

Factor #2) There’s an increasing number of people clamouring to have their say

Layered on top of the step change in challenges facing the energy sector, there has also been a rapid escalation in the number of voices trying to be heard with respect to this energy transition. Both the volume, and the splintering, of the conversation has come about in part because of the advent of social media (of which WattClarity is one example, of course).

Whilst social media has been an enabler, the fundamental driver has been the sharp uptake in business and community interest in the energy sector. Interest has risen for several reasons – including 3 big ones:

1) Primarily because of the sharp escalation in energy costs for most; whilst also

2) Accentuated by concerns about climate change by many; and

3) Not to mention naked political motivation for a smaller number (especially the vocal operators at either extreme of the Emotion-o-meter).

All this has led to a much greater volume of “discussion” occurring (though in some quarters labelling it “discussion” is a perhaps too kind).

Hence with increased interest in the energy transition, and escalation of volume and spread of the discussion, how would a genuinely interested and objective bystander see the woods for the trees?

I recall that the QEC (decades ago) had some “lucky” engineers periodically assigned to review, and sometimes reply to, letters from earnest contributors who’d write in with some proposal or other about production of energy through their version of a perpetual motion machine. That element of society has not gone away – just shifted online (where everyone can be a dog).

Just because some statement about the energy transition attracts a number of “likes”, this does not make it factual, or worthwhile. It just means that it’s popular in a particular crowd:

1) but might be an example of the blind leading the blind

2) with the unfortunate addition being that most of our political class fall into that “blind” category.

Factor #3) The passage of time, and pace of change, is presenting a risk of loss of industry memory

It’s almost exactly twenty years since the NEM commenced – with the NEM following on the prior state-based market (VicPool started 1994 from memory). The passage of time is naturally meaning that some of the people who assisted with that step change increase in complexity are no longer around to assist us with this next step change.

This natural attrition is being compounded by the rapid pace of change in the sector, as a result of which the employee churn rate is higher than would otherwise be the case.

Organisations, particularly the large ones, also have their own flavours of this churn challenge (e.g. because of internal cultural dynamics in an uncertain/challenged external environment) that is requiring attention to manage – too low and capacity grows scale, too high and organisational capacity walks out the door. This is the case for wholesale participants (e.g. on trading desks), and for our key institutions, along with the large services sector supporting those operational organisations as well.

.

(C) Some steps we’re taking to help

As a company, we’ve been operating since 2000 – and have been consistently focused on making complexity understandable. As such, striving to offset Villain #4 is a core part of what we do.

We do this through a variety of licensed software applications for our clients – and we’re also pleased to be able to provide a range of services that are free to access more broadly:

| WattClarity ® | Hard for us to believe that WattClarity has been running for more than 10 years! We appreciate the feedback we receive from readers who appreciate the service (and also from those who admonish us to do better in future). As a result of identifying Villain #4, more recently we have been including a number of educational articles under an “Energy Literacy” banner. This is something we’ll be seeking to extend in future. |

| Widgets that are free to access | We also appreciate the opportunity to work with a range of different sponsors to help increase the level of awareness and understanding in several different areas of this energy transition with a range of widgets available, particularly these four: 1) Since it was first launched in 2015, we have been pleased to work with RenewEconomy to help broaden understanding of the current mix of fuel types coming together to meet electricity demand through the NEMwatch Widget. This was upgraded late 2017 in response to the introduction of the Hornsdale Power Reserve 2) We also worked with Energy Consumers Australia to launch a different NEMwatch Widget that helps users to understand the link between electricity demand and the underlying weather patterns across Australia. 3) We’ve also worked with the Smart Energy Council to provide our Battery Finder Widget, to help people access data on makes and models of battery storage systems available for use in Australia. 4) Currently we’re working with our ez2view clients to help them create, publish and embed their own live updating widgets focused on parts of the energy market particularly of interest to them (the trend widget here showing the live output of the Hornsdale battery is one example of this).Others are in process… |

We’re very aware that we’re making this journey up the learning curve along with everyone else – i.e. we are part of the problem (as well as, we hope, part of the solution as well). We are reminded almost every week that there is a large volume of knowledge we should possess, but don’t.

- Behind the curtain we’re pedalling like crazy in order to bridge our own capability gap as fast as we can, though the complexity in the energy sector continues to grow.

- In our own internal efforts, we’re pleased to be able to work closely with a number of external service providers who can work with us to stretch our own capability (which sometimes amounts to us all sitting down to puzzle through something we all don’t understand – like, for instance, certain outcomes in particular dispatch intervals).

- If you know of others who could also work with us to build our own capability, we would ask you to point them in our direction, please. We really want (need!) their help.

I’m not speaking at Clean Energy Summit this year , however will look forward to attending and might see you there.

To those clients who are our first “Quarterly Highlights” session on Monday 30th July in Sydney, we’ll look forward to discussing more of what we’re doing.

Thanks for the article Paul.

I will add a couple of points increasing the complexity further:

1. Climate change and potential for an increased number (and duration) of extreme weather events e.g. heat waves.

2. Increased temperature responsive load, driven by renewed housing stock which, by being generally well insulated and installed with airconditioning, is space heating/cooling load efficient in mild temperatures, but significantly increase demand when temperatures are outside the mild range.

I’m constantly amazed at the blurring of Energy (MWh) and Peak Demand (MW) in the discussion.

50% renewables (ie MWh) does not mean 50% installed capacity (MW).

There is very little understanding about diversity, and capacity factors, especially for wind generation.

Queensland’s 50% renewables target is a 50% energy (MWh) target. In essence it’s also a 50% non-renewables target, and the policy relies on the contribution of coal generation to stabilise the network and provide reliability, but no-one talks about that

Your widgets are amazing. keep up the good work.

You’re not wrong when you have a play around with wind outputs for Australia and compare say July13 with July17 overall. That’s bad enough to cope with but then knock off all the State’s outputs except South Australia for July13-

http://anero.id/energy/wind-energy/2018/july/13

How on earth is a national grid (ie a rational system) supposed to cope with that because MLFs and gobsmacked doesn’t begin to do the problems justice and where is the omniscient benevolent dictator to solve it all or wind back the clock?

Is villan no. 5 the sheer rapidity of change, to the extent that there are very few people that really understand some key aspects of the power system? The best example of this is in “grid security”, which is often used in South Australia to curtail wind output, but also limits most inter connectors to well below their thermal capacity. How many wind farm developers in South Australia included this as part of their financial assessment? Even the NEM rules were until recently were for an energy-only market. As an example of this, on 13 November 2016, just a few weeks after the system black in South Australia, the SA market operated with only a single gas generator, and all other energy from wind. This would now be considered “not in a secure state”. Even AEMO don’t seem to have many people skilled in this area.

WattClarity does a great job of helping to reduce the evilness of Villlan #4 (including me). I would be wary of the strength of the emotion-o-meter villain #3. I have witnessed how it has ruined the gas extraction and GM foods industries and no calm reasoning of fact based website has found a way to bring them back from the margins to the sensible centre. It’s a little like a story about a horse, a gate, and a bolt left unlocked.

I like the premise of this article.

Do you have any thoughts on the QLD government proposed “CleanCo” – a new government owned clean energy generation company?