The Final Report of the Australian Competition and Consumer Commission (ACCC) Pricing Inquiry presents evidence that smaller retailers and new entrants are disadvantaged when it comes to managing wholesale price and volume volatility.

Two areas of disadvantage were highlighted:

1) market access and

2) market illiquidity.

In the first case, inevitably small trade sizes, credit risk, and the high transaction costs of negotiating complex hedges (e.g. a mix of caps and swaps) are a barrier. In the second case, the ACCC contends, vertical integration of large retailers decreases overall market activity for that business and reduces contracting options for smaller retailers.[1]

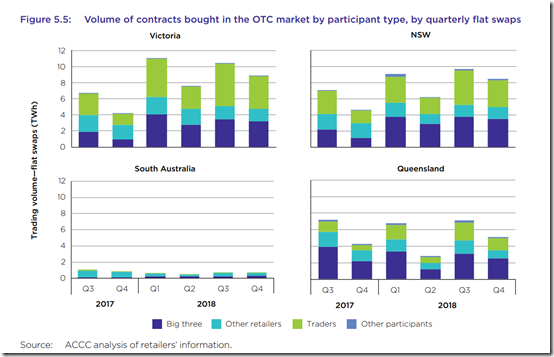

The below figure from the ACCC Report gives a snapshot of cap activity, note the extremely low trading volumes in South Australia (and the barrier this presents for new entrants).

The ACCC’s investigations looked at a range of wholesale risk management practices employed by retailers including minimal hedging, load-following hedges, portfolios of contracts and vertical integration.

Over the past year, Compliance Quarter has worked with the majority of new entrant retailers in National Electricity Market (NEM) jurisdictions. Drawing on our experience, I ask, what hedging practices are we seeing? And what implications do these practices have for the retailer, the end-customer and the broader market?

(1) Related entity hedging

One way of lowering the barrier to hedging contract markets is to leverage the expertise and capital of a related entity within a broader corporate group or commercial arrangement. I have seen several new entrants partner with specialist businesses that hold or manage a financial services licence and look after hedging arrangements.

While this is, perhaps, a solution for established businesses/business groups seeking to enter the retail space, this won’t work for new entrants starting ‘from the ground up’. Furthermore, it does nothing to alleviate contract market illiquidity/ the cost of hedge contracting in the first place. In the end, the premium paid for hedging products passes through to the customer.

(2) The rise of the ‘on-selling’ retailer

There is another option for new retailers; forgo wholesale market exposure altogether.

Let me explain. Private electricity (‘embedded’) networks are on the rise in Australia. While precise numbers are unknown, the Australian Energy Market Commission (AEMC) estimates there are currently 3-4000 in the NEM.[2] In many cases, the owner/operator of the embedded network ‘on-sells’ energy bought from a market retailer at the ‘gate meter’ through a retail exemption. However, as the size and number of embedded networks grow, a rising number of these on-sellers are becoming authorised retailers. Furthermore, with recent ‘power of choice’ reforms giving all embedded network customers the right to go ‘on market’, these on-selling retailers directly compete with market retailers.

With no direct wholesale market risk, do on-selling retailers have an unfair competitive advantage over market retailers? Not necessarily. The on-selling retailers end up taking on a ‘residual’ wholesale market risk. As market retailers pass on hedging costs to their customers, the on-selling retailer ends up paying through its retail contracts at gate meters. Larger on-selling retailers will often need to negotiate (and re-negotiate) multiple retail contracts at gate meters with multiple retailers, and pay the premium dictated. If dealing with non-vertically integrated market retailers, unfairness or inefficiency in the hedge contracting market is still being passed on to the on-selling retailer and the eventual customer.

(3) The rise of embedded generation

In the previous two strategies, any general inefficiencies or unfairness in the hedging contract markets may be passed on to the end-customer. One way I have seen new entrants, both market and on-selling, alleviate even residual wholesale market risk is through distributed or ‘embedded’ generation.[3]. This involves retailers installing generation, often solar photovoltaic, and then supplying/selling the energy to their customers. In some cases, the generation is ‘behind the meter’, supplied directly to customers through private infrastructure; in other cases, the energy is fed back into the NEM and sold through Power Purchase Agreements (PPAs). In either situation, the embedded generation constitutes a partial hedge for the retailer through the ‘fixed’ price they receive for that generation. In essence, it’s vertical integration for the small players.

While embedded generation can help effectively manage wholesale market risk, it has been argued that it presents broader risks to the NEM. One of the key motivations for the National Energy Guarantee (NEG) is the risk that newer renewable generation poses for system reliability. Solar and wind cannot easily be ‘dispatched’ to meet surges in demand. As most embedded generation is currently non-dispatchable its growth must be managed alongside other ‘balancing’ initiatives including battery technology and demand response.

Overall, it is clear that new entrants are employing a range of strategies to compete with the big players, many of which mitigate disadvantages in the hedging contract markets. It remains to be seen whether regulation of the hedge contracting market in the NEG (likely to happen), or the ACCC Review (may happen), will make an easier path for new competitors.

[1] See ACCC’s Retail Electricity Pricing Inquiry—Final Report (June 2018), pp104-134.

[2] See AEMC’s Final Report: Review of Regulatory Arrangements for Embedded Networks (November 2017), p15.

[3] Not that this is the only, or even primary, reason for embedding generation.

About our Guest Author

|

Dr Drew Donnelly is a Regulatory Specialist with Compliance Quarter.

Dr Drew Donnelly holds a PhD in Legal and Moral Philosophy from the University of Sydney. He has extensive government experience including as policy analyst. In Compliance Quarter, Dr Drew helps new entrant retailers with their regulatory compliance. Compliance Quarter provides world-class systems and expertise to energy retailers and other market participants You can find Drew on LinkedIn here. |

Be the first to comment on "How do New Entrant Retailers manage wholesale market risk?"