Readers might be aware that there’s a rule change process currently making its way through the AEMC relating to the the establishment of a “wholesale demand response mechanism” – which I would prefer to refer to as a “centralised Negawatt dispatch mechanism” to reduce confusion.

The draft ruling made on 18th July 2019 (operations to commence on 1st July 2022 – i.e. a year following the commencement of 5 Minute Settlement) following deliberations over 3 different rule change proposals published in November 2018.

Submissions on that draft ruling closed almost 6 weeks ago (on Thursday 12th September) with the submssions linked on the AEMC webpage here.

Two weeks later (on Thursday 26th September) the AEMC published this “Summary of stakeholder submissions to draft determination on wholesale demand response mechanism”. What I found of most interest, in reviewing the AEMC’s summary of stakeholder submissions, is that none of the comments really seem to capture the essence of our concern. In the AEMC’s summary of submissions, they note:

“However, a few stakeholders considered that the benefits of introducing the mechanism set out under the draft rule would be outweighed by the associated costs.”

… but my concerns are not about the cost/benefit, but more about whether we’re actually headed in the right direction in relation to the challenges we’re likely to face in future as this energy transition picks up speed.

Readers should not read into the above that I’m criticizing AEMC for omitting something in their summary of the submissions (clearly as we did not make a submission, our views could not be included in this summary). My comment is more one of puzzlement:

1) wondering if we’re the only ones wondering whether turning right into NegaWatt land will actually make it harder to achieve a genuine two-sided market and hence ensure the energy transition can succeed;

2) which is, after all, what our primary objective should be (isn’t it?).

So, given that submissions and closed and AEMC has written their summary – but also noting that the final rule change decision has not yet been made (deadline extended and currently due 5th December 2019 – 6 weeks away), and that there are a sizeable number of AEMC staff (along with a broad range of others across the energy sector) who read WattClarity with interest, bear with me whilst I make a number of comments…

(A) Background

(A1) About Demand Response

We need to start by re-stating that “demand response” is an umbrella term used to describe a broad range of arrangements under which energy users might temporarily reduce their consumption, in response to some incentive to do so. Who these energy users are, the manner in which they reduce their consumption, and the incentive provided to them, can take many different forms.

We note in the AEMC documentation that they have also added in an additional quality into their definition (on the first page of their Summary in their Draft Ruling):

”It also implies a degree of transparency where consumers can signal to the rest of the market what they are intending to do”

… and whilst we understand the value that such transparency delivers to the market, it’s important to understand that this is not something that has been established as an essential prerequisite in definitions of Demand Response used in the industry for decades.

Unfortunately much of the discussion about demand response has historically not seemed to get past the starting gate, given that some stakeholders have come with pre-conceived notions that Demand Response does not currently exist in the NEM. This reality (and the unfortunate by-product that it was actually one of the real barriers we’ve encountered in continuing to grow the utilisation of demand response in the NEM) was one of the reasons that prompted us to invest in the creation of the information resource at www.DemandResponse.com.au, complete with this resource explaining some of the different approaches to demand response.

These efforts (and those of others) have helped:

(i) We particularly acknowledge the efforts of the AEMC in this current iteration of a rule change proposal for not repeating misleading statements made by others based on a narrower view of all that “demand response” encompasses (though note the caveat above about the limitation added by AEMC for perhaps laudable reasons – but which could inadvertently lead to that barrier continuing).

(ii) However (as also noted back in 2015) it is clear to me that, whatever the outcome of this rule change request, it would promote clarity (and avoid unwanted confusion) if the AEMC chose to call this a “Negawatt Dispatch Mechanism” rather than using the current term “Demand Response Mechanism” – which is broader, and so potentially ambiguous (for example, see section C2 below).

(A2) Our involvement with Demand Response

Frequent readers will understand how we’ve played an active role of building the scale of Demand Response operating in the NEM since the start of the NEM:

1) We summarised some of our our own demand response journey here;

2) Including the real barriers we’ve encountered in helping large energy users be more responsive to spot prices.

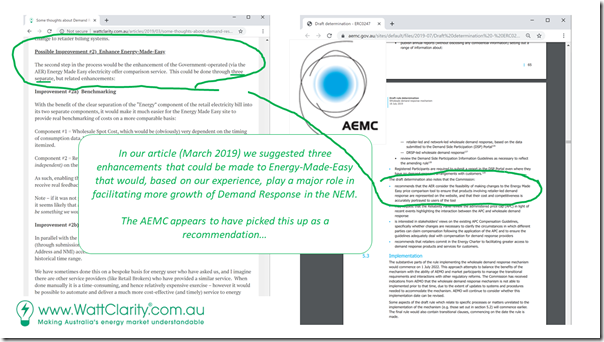

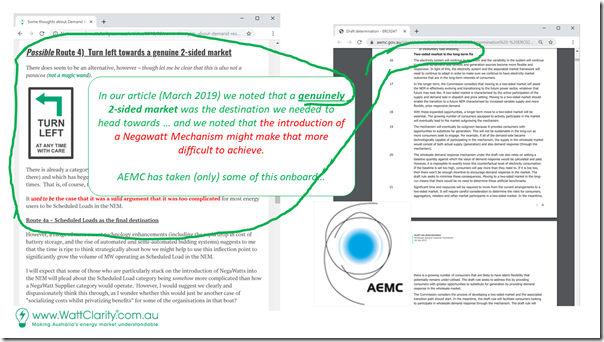

Back in March 2019 (i.e. before the AEMC published its draft ruling) we posted these initial thoughts here about what we see as the route forward that will actually help deliver on this energy transition.

Readers should note that there also was prior discussion accelerating changes underway in the NEM as part of this energy transition throughout our Generator Report Card 2018, released on 31st May 2019 (with Theme 12, Theme 13 and Theme 14 in Part 2 containing discussions of particular relevance to this deliberation about Demand Response).

(B) Glass half full, or half empty?

There are definitely two different ways in which one might read the work done by the AEMC in this respect:

(B1) It could have been worse… (much worse)

On the “glass half full” side, we’re definitely pleased (perhaps even pleasantly surprised?) to see that the AEMC appears to have taken onboard a number of the suggestions we made suggestions we made in March 2019 (and by others as well).

Pleasant surprise #1) AEMC has knocked off many rough edges of what could have been much, much worse

I understand that the political pressure to do something has been escalating in recent times (at least in part due to the evolving train wreck of a mismanaged energy transition). Hence when viewed in a certain sort of a way, the AEMC has done a commendable job (under such overwhelming pressure to act) in knocking off a number of the (very) rough edges of some of the ideas circulating prior to the draft ruling being published:

(a) In particular, the way the AEMC has proposed for retail volumes to continued to be settled on metered volumes is one step that would seem to (at least to the extent we understand) lower the information systems costs relating to this implementation.

(b) Unfortunately to do this the AEMC has needed to wave their magic wand to conjure up the concept of a “reimbursement rate” with which to ensure retailers are made whole in the wholesale market. Hence two artificial measures (i.e. the Negawatt, and the Reimbursement Rate) are combined in a necessary step to try to reduce the imbalances caused by the introduction of the first artificial measure (the Negawatt). What could go wrong there, we wonder? It’s no surprise that retailers are looking at that particular aspect of the draft ruling very closely…

For logical reasons, the AEMC has also proposed that the method be first available to larger energy users. This will enable a period of review to ensure that the program is actually delivering on the benefits that are assumed to flow as part of the rationale for the change (however we note – as below – that this review has not been facilitated in the rule that has been proposed).

Pleasant surprise #2) AEMC has also clearly picked up on a number of our other suggestions

Whilst “knocking off rough edges” was certainly part of the thrust of our comments back in March 2019, we also included a number of other suggestions that would (in our view – formed by 15+ years of actually making demand response work in the NEM) go a long way to broadening the scope of demand response activities.

For instance, we provided suggestions for the enhancement of Energy-Made-Easy, which the AEMC has copied through into its draft determination (see page 66 in the main body, with also further discussion in Appendix H – Other Changes (see H2.2 from p174)).

(B2) … but is is really the best we can do?

On the “glass half empty” side, however, we wonder whether “could have been worse” is really an appropriate performance standard for an area of reform that will need to deliver much more to deal with the challenges of the future?

A bit like the end-of-year-report for the wayward kid in school who we seem to accept is never going to amount for much – except that this is an essential service that is being called upon to fundamentally reshape to eliminate carbon in a very short space in time (relative to the challenge). We’re counting on little Johnny NEM to deliver us big things in future, so I know I would be more comfortable if the report card said more than “could have been worse”.

In our comments back in March 2019, we (hopefully) made it clear that achieving a genuinely 2-sided market was essential to making this energy transition succeed. In our Generator Report Card, through various themes in Part 2, we provided some of the background to why the NEM is evolving to the point whereby this will be essential – and in a relatively short space of time.

The AEMC acknowledges this in its draft determination in several places (in the Executive Summary, and then ) – but then seems to almost skirt around this fact and propose the implementation of a Negawatt Dispatch mechanism in a way that (in our view) will make it all the more difficult to actually progress to a 2-sided market! Here are some examples:

| Statements from the AEMC | Our comments |

In the Executive Summary, the AEMC writes (point 19):

That the mechanism that’s proposed is not scalable, or sustainable was a point that we made in our comments back in March 2019! |

…. however the AEMC does not appear to have understood what we see as the implications of implementing a mechanism that’s not scalable or sustainable, especially as there appears to be no pathway provided in the rule changes envisaged to get where we actually need to go.

It’s easy to foresee a future point in time (which is likely to be closer than many think) where the AEMC will need to ‘unmake’ this rule in the change-over. Imagine the shit-fight (that’s the technical term?) that will come from the Demand Response Service Providers whose very business viability could well be at stake with their revenue source (payment for negawatts) were to be removed in the move to a 2-sided market arrangement that is actually scalable and sustainable. Given that this is the case, we would expect that (if the AEMC wanted to implement a Negawatt mechanism as an interim arrangement) at the very least they should provide an explicit pathway in these same rule changes. This might include: In our comments back in March 2019 we likened this to turning right at an intersection (towards what we see as a very rocky road) whereas where we really need to head is leftwards, towards a genuine two-sided market! |

In the Executive Summary, the AEMC writes (point 20):

The inherent challenges in searching for that ‘Goldilocks baseline’ was another of the points we made in our comments back in March 2019 (as have many others) …. |

…. clearly the challenge of baselines is one of the unavoidable (and ultimately impossible – certainly not scalable!) challenges inherent in the encouragement of any kind of Negawatt-centred form of Demand Response, no matter whether: 1) Centrally determined and administered by the AEMO, as contemplated in this rule; or 2) Decentrally determined and administered (e.g. by retailers), as has been the case to date.Readers are reminded that these are not the only ways of delivering demand response, however!We take particular notice that the AEMC says “The draft rule seeks to minimise these consequences” and we provide additional suggestions below (see the table in section D)) that, we believe, should be implemented in conjunction with this rule change to provide additional capability for the energy sector to manage the risks inherent in the centralised support for the use of Negawatts (and hence baselines). |

In the Executive Summary, the AEMC writes (point 22):

and then (from p41):

We certainly welcome this perspective, and the discussion (p42-43) from the AEMC… |

…. however (unless we missed it), we cannot find a single initiative contained in this rule change that either:

1) provides for that process of developing a two-sided market to start; or 2) (as noted above in this table) provides a real pathway from what the Negawatt Mechanism the AEMC is proposing to implement now, and where we actually need to be. As noted above, in the absence of this pathway, what the AEMC is doing now will unfortunately & inevitably become a real barrier. As discussed below (anecdote C3) I have not seen a single advocate for the Negawatt Mechanism, in the weeks following the publication of the draft rule (noting that some have been very vocal in various mainstream media outlets) acknowledging that what the AEMC has proposed: The AEMC has a golden chance, in progressing from this draft rule to a more workable final rule, to prevent that looming bun-fight ahead, by making sure that everyone’s eyes are focused on where we really need to go… |

The AEMC notes that (in p39):

however …. |

…. the AEMC does not appear to acknowledge that any Negawatt Mechanism cannot (by their very nature) properly address the challenges inherent in the ‘duck curve’ for a number of reasons, including:

1) That negawatts are based on reductions from a pre-determined baseline, and so inherently cannot deal with increases from that baseline (such as in the case of negative prices); and 2) The fundamental nature of the ‘duck curve’ (i.e. occurring frequently, but with some variability) make it less likely a workable baseline can be established if the load is responding either to either:

|

The AEMC notes that (in p43):

Say what?! In short-hand, we’re on the path to create a mechanism that is, ostensibly, about helping energy users to be more responsive to supply/demand balance as revealed through spot prices – however if those same energy users are too responsive, then that same very mechanism we’re proposing to implement breaks down and does not work. Got that? The paragraph continues, by explaining:

|

Now, we understand very well what the AEMC is saying – in that the scope of demand response (as envisaged in this Negawatt Mechanism) is much more restricted than some energy users, and their advisors, might wish for it to be. After all, it was one of the reasons given back in March 2019 about why a mechanism like envisaged in the draft rule will not be scalable and sustainable.

However (see anecdote C1 below) it’s become quite apparent to us, following conversations with our existing energy user clients and others, that they do not understand. On top of the bun-fight looming when we reach the inevitable point where we need to unwind this interim arrangement and proceed to a proper 2-sided market, I also foresee we’re going to end up with a significant case of buyer’s remorse amongst another group of energy users who will react negatively to the revelation that they’ve been sold (in their case) a dud, in the case of a Negawatt Mechanism. This buyers remorse could well end up being one more barrier to achieving real flexibility on behalf of the demand side – which we are surely going to need in this energy transition.

|

To sum up our perspective, our view remains that the mechanism that is proposed is neither scalable or sustainable – nor does it address the underlying challenges that are fast approaching us with this energy transition.

Instead, it seems intent to implement something designed to solve yesterday’s perceived problems, but at the same time create significant barriers to where we really need to go.

(C) Confusion abounds about what’s actually proposed

Unless I am mistaken in reading the substance of what is proposed, it also seems to me that confusion abounds about what is actually proposed. Perhaps three anecdotes would be useful to illustrate this situation:

Anecdote C1) Double-dipping

As noted above, we have a number of large energy users as clients – where they take some form of spot exposure and use our software to help manage the risks (and secure the benefits) related to this.

One of those clients had a conversation with us a few weeks back about their understanding that this new mechanism would enable them to gain more value from the – not understanding the AEMC’s caveat that (ironically) these types of energy users, who are already quite active, would be excluded from participation.

How many others are out there believing mistakenly the general pronouncements by advocates that this will be a bonus for them?!

Anecdote C2) No solution to negative prices

As noted on WattClarity and elsewhere in recent times, we have seen a spate of negative prices in the NEM. It’s an entirely logical thing that energy users would be looking to move consumption to those times, to take advantage of those over supplies of cheaper generation.

I found it a little bizarre that a number of comments have been made by various stakeholders (including some working at prominent Negawatt advocates!) which implied that the new ruling would help to create a “solar sponge” to utilise these periods of surplus generation.

As noted above, this will not be the case – but what concerns me is that some quite prominent advocates for the ruling apparently do not realise this. Again, what does this mean for “buyers remorse” when energy users find out that what they believed to be true is not possible?

Anecdote C3) No mention of sustainability or scalability

In our comments posted in March 2019, we made the point that what was being proposed (in the form of ‘creating’ Negawatts as supply-side options in dispatch) was neither a scalable or sustainable solution. In the AEMC’s draft determination, it seems that they agreed with this, but have decided to:

1) Propose the creation of the mechanism anyway; but sadly

2) Not with any explicit provision in the rule for a pathway to a genuinely 2-sided market.

Instead, in the media talk-fest that has followed on from the release of the draft ruling, the consistent message coming out from the advocates has seemed to be that this will be “the” solution to our energy transition challenges.

No mention has been made (to my knowledge) of concerns we raised, as echoed by the AEMC, that it is neither scalable nor sustainable. Hence this seems to reinforce our other related concern – that unmaking this rule at a future point in time to enable us to go where we need to be headed in the first place is going to be all the more difficult as a result.

(D) AEMC assessment framework

In the AEMC’s draft rule determination (from section 4.2 on p45) the AEMC outlines the way in which it assesses rule changes proposed (and alternate ‘preferable rules’, such as what it has drafted here). Of particular interest to me were the 7 different principles it has adopted for evaluating rule changes (section 4.3 on page 48).

Given that the AEMC has stated these as the principles/criteria used to assess rule changes, I thought it would be helpful to add in the following thoughts on some of the 7 principles:

| Principles listed (page 48) | Thoughts with respect to each principle |

| Principle 1/7 = Promoting Competition and Consumer Choice | Noting to add here. |

| Principle 2/7 = Resilience of framework | In the AEMC’s document (p49), they write:

We wholeheartedly support “resilience” as a guiding principle, and appreciate the AEMC stating this explicitly. However that’s what makes us all the more surprised to see that: Step 1) The AEMC is proposing to implement a Rule Change that they themselves acknowledge is not scalable or sustainable, and will need to be replaced in future years; and yet Step 2) At least to my reading, the proposed Rule does not take the principle of resilience into consideration – which it would do if it included explicit consideration of a sunset date on the rule, or some some form of review process baked in from Day #1. Instead (as noted above) we would expect to see an almighty bunfight on that future day as AEMC recognises the need

|

| Principle 3/7 = Not distorting efficient market outcomes | Noting to add here. |

| Principle 4/7 = Reliability and transparency | In the AEMC’s document (p50), they write:

Once again, we wholeheartedly agree. In the AEMC’s document (p51-52), goes on to say:

Readers can think of it this way – to understand the nature of a triangle, one must understand the length of all three sides (or two sides and one angle). In other words, three data points. It’s the same with understanding the validity and value of Negawatts dispatched into the market, an analyst would need to understand the three different data points: Instead, my reading is that there seems to be some (perhaps unintentional?) sleight-of-hand proposed here with data for only one side of the triangle to be published in the market data (i.e. the Negawatt supply-side contribution). It seems inevitable that there will be two outcomes from this: 1) it will give any third party zero ability to understand anything actually meaningful about the contribution of demand response: 1a) earlier this year we collaboratively invested approximately 10,000 hours in the preparation of a very widely read (and much appreciated) Generator Report Card analysing a wide range of performance: 1b) In the rules, AEMO is required to wear all four hats: 2) Instead, it seems, we’ll unfortunately be left to see some statistics of how many negawatts have been dispatched – which will devolve to a ‘vanity metric’ in the absence of the other two sides. To me this is especially surprising given that the AEMC has explicitly named ‘reliability and transparency’ as one of its cornerstone principles, and also because it devotes much attention (Appendix E) to the inherent challenges with landing on that ‘goldilocks baseline’

|

| Principle 5/7 = Appropriate risk allocation | Noting to add here. |

| Principle 6/7 = Administrative and Implementation costs | The AEMC notes (p50) that:

As we have noted above, what the AEMC has proposed is much better than what might had been the case had some of the very rough edge been knocked off the initial proposal. Also as noted above, we wonder whether “could have been worse” is an acceptable performance standard we should be aspiring to, given the inherent challenges in the energy transition.

|

| Principle 7/7 = Appropriate customer protections | The AEMC notes (p50) that:

Unless we are misunderstanding the proposed rule, the consumer protection framework seems to be one still left with the legacy retailer (i.e. not applying to the Demand Response Service Provider) – and so, in effect, this change would just be another case of ‘socialising cost whilst privatising benefit’.

|

(E) Calling for Expressions of Interest in provision of “Negawatt Factories”

Finally, it’s worth noting that (should this rule change go ahead) we might be seeking expressions of interest in the creation of “Negawatt Factories” for the NEM using a particular methodology that we have developed – patent pending*

* only joking about the “patent pending” bit….. perhaps?

It’s interesting (or ironic?) that reducing demand is being discussed in the same era as some others discuss the benefits of 200% and even 700% installed capacity of intermittent generation.

It’s a tipsy topsy world these days:

– pay some users to reduce load, to reduce costs for others

– generators pay to generate, while consumers costs go up

I’m not convinced electricity should be this difficult.

If we had our time again, with what we know now, would we allow individual rooftop PV and unconstrained access to the grid by intermittent generators?