A very quick post to look at one of the several reasons we are seeing LOR3 and LOR2 forecasts for NSW and Queensland respectively next Wednesday (27 November).

Previous posts from Paul (including this one) have looked at a range of factors, including weather / demand, network outages and generation availability. This post just focuses on the last of these in a time-series fashion, as in “how did we get here?” – with a significant amount of thermal generation unavailable across the NSW and Queensland fleets. Looking at thermal units of at least 150 MW capacity – all the coal-fired plus the larger gas-fired units – nearly one-third of this appears to be unavailable for the first few days of the week.

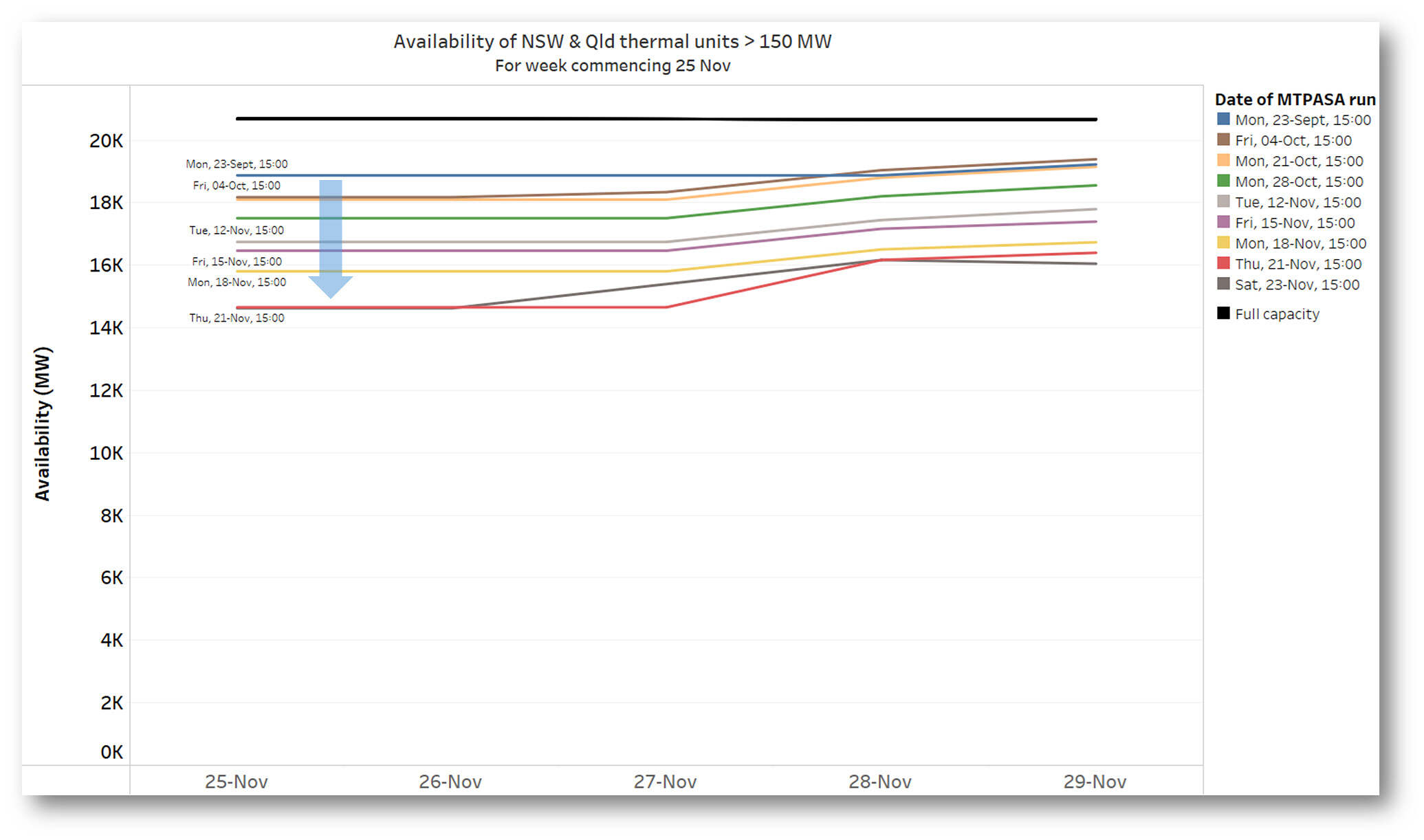

The first chart shows how the MTPASA forecast view of availability for these units has evolved over the last couple of months, and particularly the last couple of weeks, picking dates on which there have been material changes:

From looking fairly benign up to the end of October, there have been a series of downward steps in projected available capacity in AEMO’s MTPASA runs.

From looking fairly benign up to the end of October, there have been a series of downward steps in projected available capacity in AEMO’s MTPASA runs.

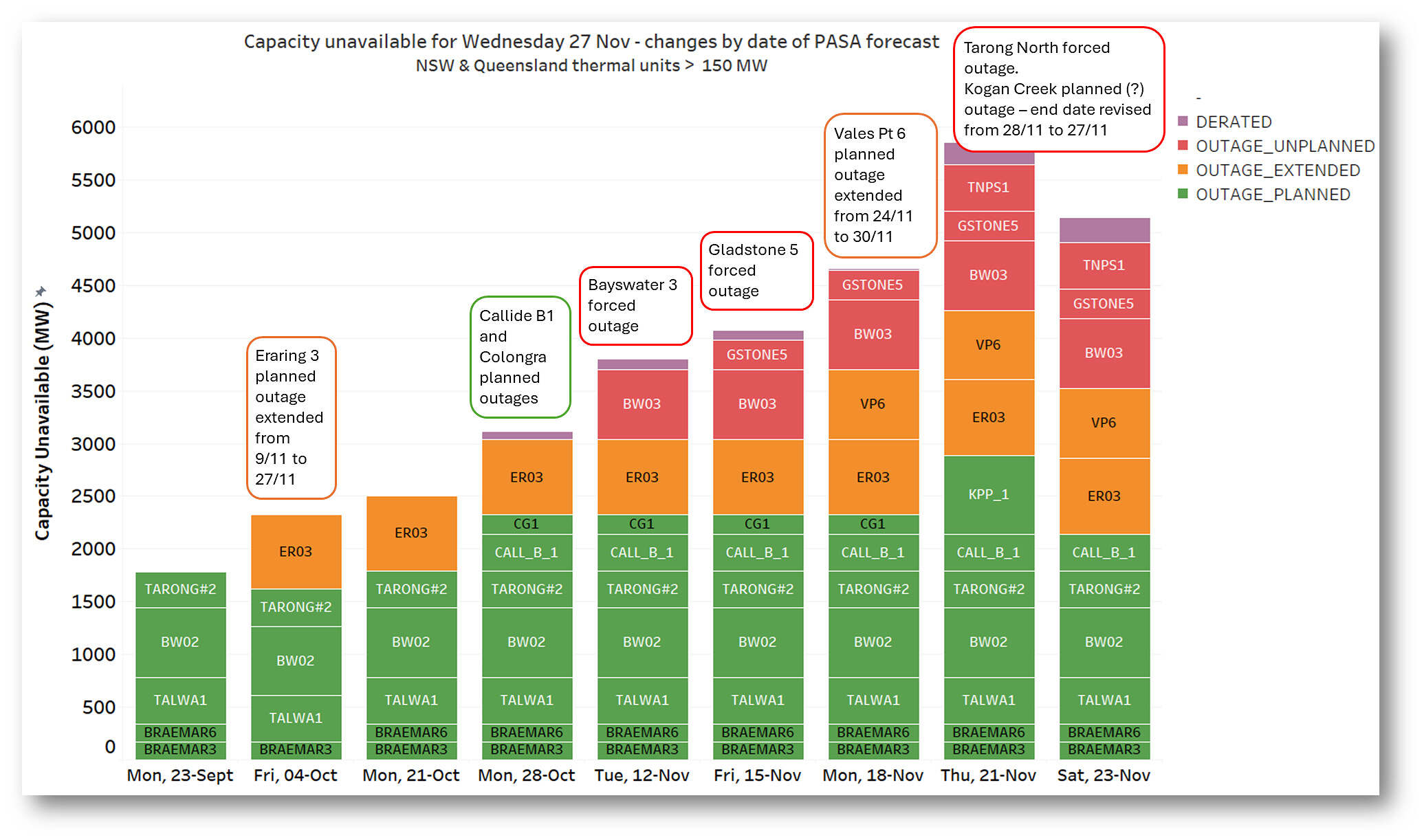

The next chart, concentrating on 27 November, shows the unit outages contributing to these downward steps at each selected forecast date:

- planned outages which have been “on the books” throughout the leadup period (Braemar units, Tallawarra, Bayswater 2 and Tarong 2)

- A more recent planned outage emerging for Callide B1 – and a fairly late-notice extension of an ongoing planned outage of Kogan Creek, which has now changed to being due back on 27 November in the lastest run charted (fingers crossed)

- Slippage in return dates for two NSW coal-fired units which are completing longer term outages (Eraring 3 and Vales Point 6), and

- Forced outages emerging over the last two weeks at Bayswater 3, Gladstone 5 and Tarong North

Lets hope one or more of these come back earlier than planned and that there are no further outages leading into next week.

As Paul says, that’s all for now.

=================================================================================================

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be occasionally reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Be the first to comment on "Northern NEM capacity outlook next week – a series of unfortunate events"