Editor’s Note – This is the text of a speech presented by Pan Galanais at All-Energy in Melbourne on Thursday 24th October 2024. Pan’s talk was the first of 4 presentations that Paul noted in his article ‘‘Operating in the NEM’ … from All Energy 2024’.

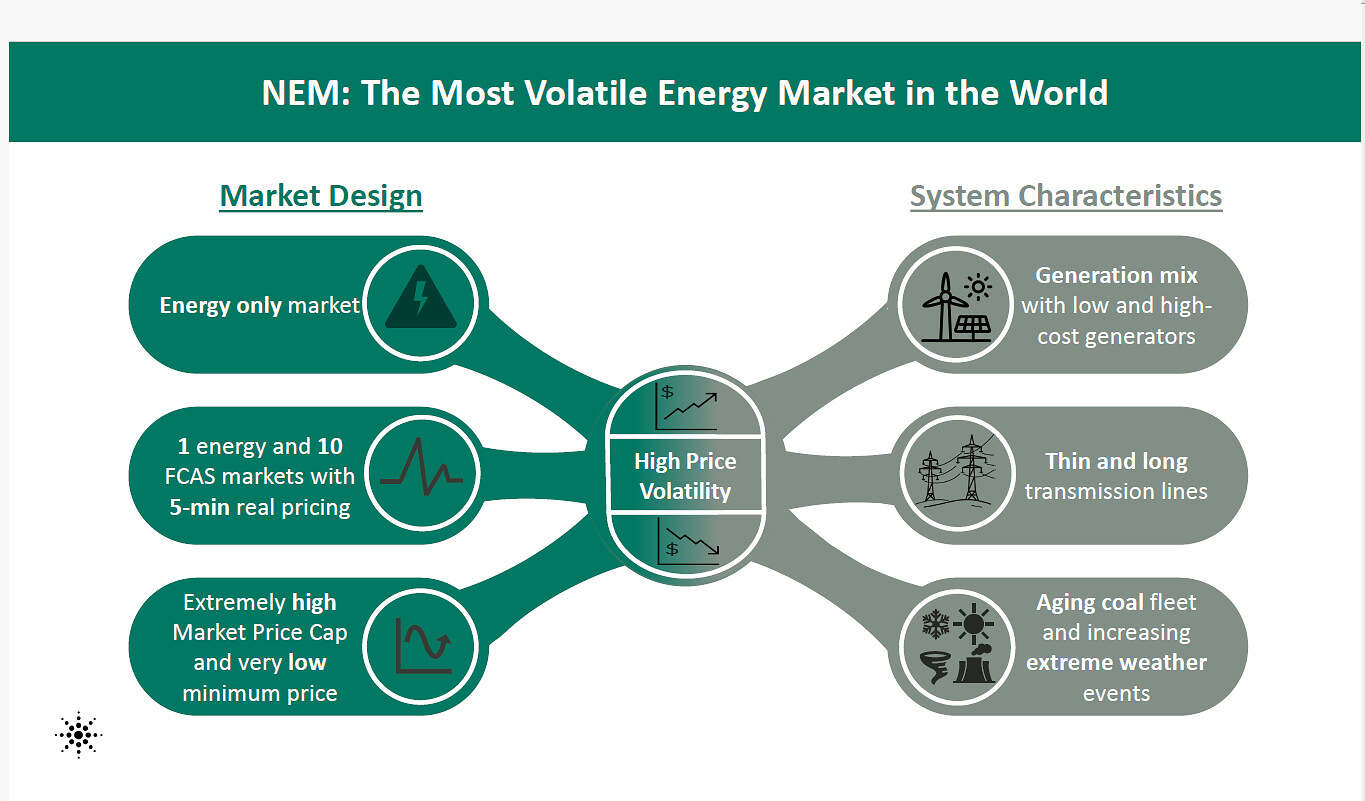

The NEM is often recognized as the world’s most volatile electricity market. According to an analysis by Rystad Energy of 39 global electricity markets, the NEM leads in daily price fluctuations. Two primary factors drive this extreme volatility: the NEM’s unique market design and the characteristics of its energy system.

First, let’s look at market design:

- The NEM operates as an energy-only market, which means participants are compensated only for the energy they dispatch—not for their capacity.

- Additionally, there are 10 Frequency Control Ancillary Service (FCAS) markets that operate in real-time, settling every five minutes. This rapid cadence demands a high level of responsiveness from market participants.

- The NEM’s price caps, ranging from -$1000/MWh to $17,500/MWh, add to the unpredictability. These swings occur every five minutes, creating a truly unique environment.

Second, the characteristics of the NEM system amplify this volatility:

- Low-cost solar floods the market during midday, pushing prices down, while high-cost thermal and hydro plants often set prices in the evening.

- The transmission network is long, thin, and built for a different era, making it vulnerable and often limiting power flow from remote renewable generators.

- With aging coal-fired plants and the effects of climate change, the NEM is as chaotic as it is dynamic. But this chaos isn’t a problem; it’s an opportunity for those willing to embrace the complexity.

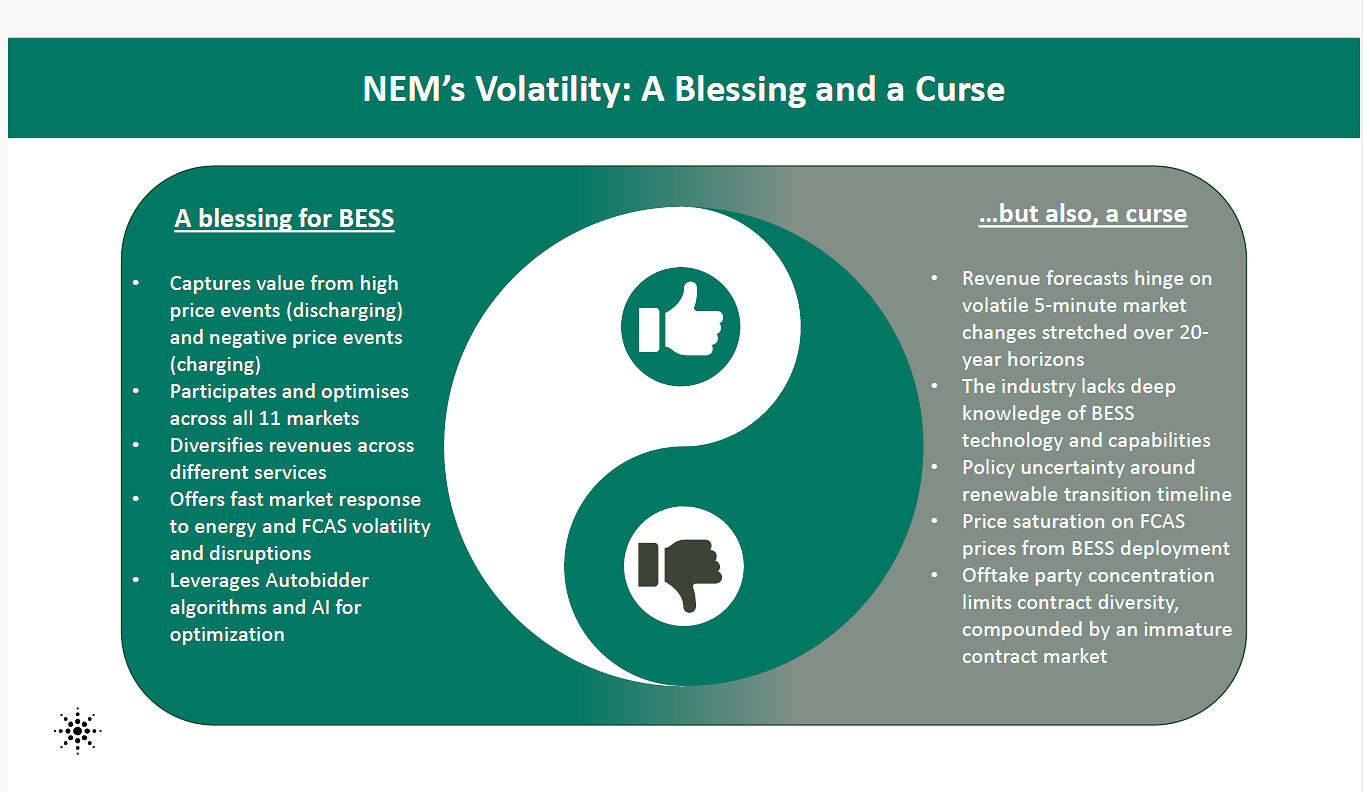

Is NEM Volatility a Blessing or a Curse?

The NEM’s volatility is a double-edged sword for battery storage developers and operators. On the positive side:

- BESS allows us to take advantage of both ends of the price spectrum. We can discharge during high-price events and charge when prices dip into negative territory.

- Operating in all 11 markets, BESS diversifies revenue streams and helps manage grid stability.

- BESS’s rapid response capability is well-suited to capture energy and FCAS volatility, especially during unexpected disruptions.

- AI-powered autobidding algorithms, like those we use, enable faster and smarter market participation, optimizing returns in real-time.

However, volatility also presents several challenges:

- Revenue forecasting becomes complex when prices fluctuate every five minutes, and this uncertainty compounds over a 20-year project lifecycle.

- The industry still lacks a full understanding of the capabilities of emerging technologies, and this knowledge gap can hinder informed decision-making.

- Policy instability around the renewable transition adds additional risks, as does the saturation of FCAS markets as more BESS assets enter.

- The immature contract market complicates securing long-term offtake agreements, impacting revenue stability.

Despite these challenges, volatility doesn’t deter us—it motivates us. It forces us to innovate, adapt, and turn market complexities into growth opportunities.

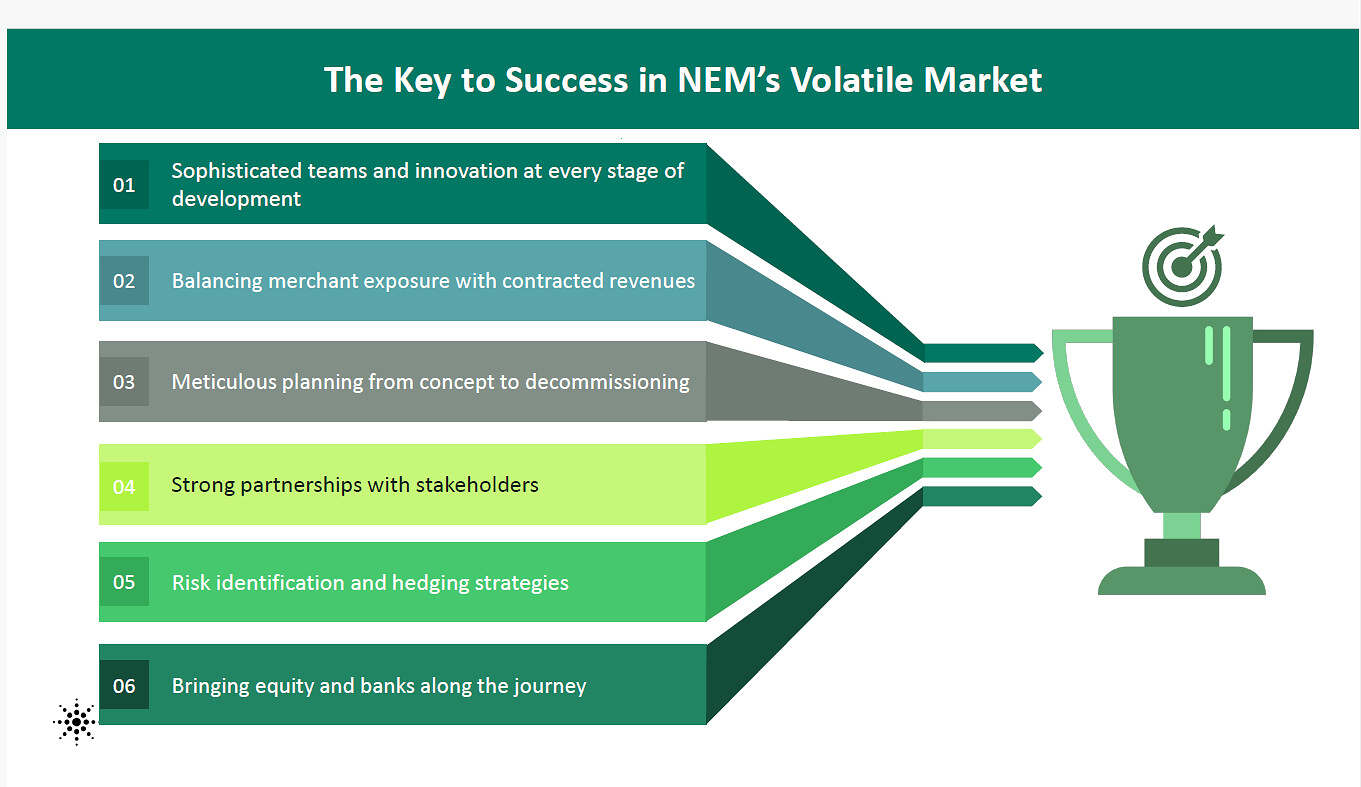

The Key to Thriving in NEM’s Volatile Landscape

Succeeding in a market as volatile as the NEM requires more than advanced technology; it demands vision, agility, and a commitment to innovation.

- Assembling Sophisticated Teams: Success in this space is driven by people as much as technology. Skilled teams are essential to navigate the intricacies of the NEM.

- Balancing Revenue Streams: Balancing merchant exposure with contracted revenues stabilizes cash flows in an unpredictable market, building confidence among investors and lenders.

- Planning Every Step: From project concept to decommissioning, planning is meticulous. Nothing is left to chance.

- Forming Strong Partnerships: Collaboration with key stakeholders is essential. Strong alliances make navigating market volatility smoother and ensure collective resilience.

- Risk Management: Identifying and hedging risks is essential. In a volatile market like the NEM, you have to anticipate change and have robust strategies to manage it.

- Aligning Interests with Equity and Banks and Local Communities: Securing the support of equity investors and banks and local communities by aligning goals fosters a stable foundation for long-term success.

By turning volatility into value, Akaysha Energy is leading the charge in the NEM, delivering gigawatts of storage capacity in the world’s most dynamic energy market. Through our commitment to innovation and resilience, we’re not just keeping pace with market shifts; we’re setting the standard for how BESS can transform energy markets globally.

Akaysha Energy

At Akaysha Energy, we’re working to reshape energy storage in the NEM and beyond by deploying mega-scale Battery Energy Storage Systems (BESS). Supported by BlackRock, we aim to accelerate the shift toward a cleaner, smarter, and more dynamic grid. With our approach, we’re transforming the way energy storage can provide value in volatile markets like the NEM.

About our Guest Author

|

Pan Galanis is the Director of Energy Markets at Akaysha Energy. Pan has over sixteen years of experience as a consultant and a project manager and has a broad practical and academic experience. This experience spans electricity, gas and energy markets, project management, project development and civil engineering construction.

Pan has conducted multiple modelling, statistical and qualitative studies of electricity markets in Australia and internationally for the exploration of market design changes, the evaluation of proposed reforms and the impact of different policies, the reliability of power systems, the forecast of large and small-scale renewable generation and storage systems, the cost-benefit analysis of regulated transmission assets, the projection of future energy prices, the forecasting of power generation and revenue for market due diligence projects and the assessment of PPA offers. You can find Pan on LinkedIn here. |

A good summary of battery opportunities in the NEM but I’m curious as to why you think there is an immature contract market. OTC trades have existed since before the NEM started in 1998 and the ASX started trading futures in 2001. I can appreciate that getting contracts of sufficient tenor is a challenge as most customers don’t contract past 3 years whilst project owners seek contracts as long as 20 years. Surely, this is a mismatch of the price and volume risk that a customer faces as compared to that of the project owner more than any fundamental problem with contract markets per se?