Firstly, it’s useful to reference three prior articles about low wind conditions, which we surely have been experiencing:

1) On 1st June 2024 we published ‘More detail on the poor wind yield through (most of!) April and May 2024’ containing 5 ‘worm line’ trends for cumulative production from wind farms across the NEM through April and May of 5 most recent years.

2) That followed from the earlier article in the same day noting the seeming oxymoron: ‘Highest-ever wind yield … *and* worst wind yield since June 2017!’

3) Finally, with reference to question in the title of this article, this harks back to the article published on 30th June 2017 ‘Where’s the wind gone? NEM-wide wind farm operation lowest in 5 years (maybe ever, on like-for-like basis?)’ … referencing a prolonged period of low wind through June 2017 (seven years ago).

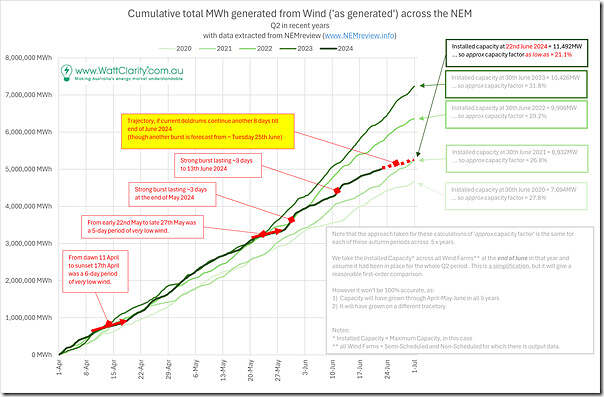

A view through (almost) the whole of 2024 Q2, compared to the 4 most recent years

Given what might turn out to be the early stages of a an emerging 2024 Energy Crisis, we’ve been interested to learn more about how Q2 has been evolving. Hence (starting with wind) we have taken the ‘worm line’ trend from the first article noted above, and have extended each of the 5 trends through until the end of June of that year (or for the current year to earlier today, 22nd June 2024).

Now note that the AEMO forecasts from this afternoon were suggesting a moderate burst of wind that would last ~24 hours from around midday on Tuesday 25th June 2024 … which will mean:

1) What eventuates may not be quite so dramatic as what’s drawn in the dotted red line;

2) But it should be plain to see for all readers here that the aggregate yield from Wind Farms across the NEM in 2024 is easily the worst of the 5 years sampled:

(a) Even in absolute terms, it will be miles below the aggregate yield in 2023 Q2 and 2022 Q2 (i.e. that same quarter of the 2022 Energy Crisis!) .

i. In both 2022 and 2023 we see that the gradient of the worm line increased in June of those years (i.e. wind yield increased)

ii. In 2024 this definitely has not happened (save for 2 x 3-day spurts thus far) … and indeed I wonder if the gradient has not slightly dropped, compared to April and May?

(b) Given the growth in capacity from the earlier two years, it should be clear the performance is much poorer in 2024 Q2 compared to those earlier years:

i. Approximately 2,500MW more capacity in 2024 than 2021 (3 years earlier) and a yield that might be about the same level!

ii. Almost 4,000MW more capacity in 2024 than in 2020 (i.e. ~50% more) and yet a yield that might only be 15% higher than 2020 Q2.

3) In aggregate terms, eyeballing the chart it should be relatively easy to see that 2024 might be as much as 3,000,000MWh ‘short’ of wind production through 2024 Q2 compared to what some might have expected

All in all, what’s above is (at the same time) both a frightening picture … but also completely expected (at least by some of us).

Remember, this is Output (which can be suppressed for several reasons)!

Remember that these trends above are of output of wind farms collectively. In reviewing these results, readers should be aware that this output could have been affected by any (or all) of the following factors:

Factor #1 – lulls in the wind resource

There’s definitely been some of this at work in 2024 (e.g. persistent blocking high pressure systems) … but is it the only factor?

Factor #2 – plant unavailability

It’s possible that some wind farms might be experiencing poor plant availability, which would impact … but how would we actually know that?

(a) Since 7th August 2023 the Semi-Scheduled operators have been able to use MaxAvail in the bid to quickly reflect situations such as plant unavailability. Through the remainder of 2023 we saw that many DUIDs did utilise this capability.

i. At this point we have not checked to see how much of this was active through 2024 Q2

ii. But we’re also conscious that, even if we did, the same visibility is not there for prior Q2 periods (so comparing to some historical precedent would not be possible).

(b) However there’s still not complete clarity about physical issues onsite at the Semi-Scheduled units, as the AEMC neglected to extend the responsibilities stemming from ‘the ERM Rule Change‘ to Semi-Scheduled units (as we’ve written concerns about several times before, such as here).

Factor #3 – spillage

It’s possible that some wind farms might also been spilling available energy through one or more of the Q2 periods … if so, that would not be visible in the above.

There are numerous articles written here about curtailment of VRE, with some particularly useful ones collated under the ‘Curtailment of VRE’ category. Remember that ‘spillage’ or ‘curtailment’ might due to several reasons, including two big ones:

Factor 3a = spillage for Economic Reasons

In simple terms, ‘Economic Curtailment’ occurs when the unit does not like the spot price (e.g. it’s below their ‘negative LGC’ break even price) and so they switch off

i. since the AER Rule Change, this was clarified that it needs to happen only through their bids.

ii. However (particularly in recent weeks) my sense has been more middle-of-the-day prices at very healthy levels, so I would not expect that there would have been much Economic Curtailment in recent weeks. We’ll see a more methodical review of 2024 Q4 prices when we publish the next edition in this ‘Review of Q2 Price Outcomes’ series of articles.

Factor 3b = spillage due to Network Constraints

… in other words, they are being ‘constrained down’ because of localised situations in the network (or sometimes broader reasons, like System Strength constraints).

Seven years since the ‘Wind Drought’ in 2007

Note the significance is of the 7 year time-span since the ‘wind drought’ of 2017 Q2!

It reminds me of the analysis we compiled in Appendix 27 of GenInsights21 a few years ago now … in which we identified (based on 16 years of weather data history at the time) that significant & sustained bad wind periods:

1) Occurred three times in that same period … hence averaging to once every 5 years; and also

2) Actually occurring, on the calendar, roughly 5 years apart.

Earlier this year we thought it would be useful to share this ‘precis of the ‘Exploring Wind Diversity’ analysis completed in Appendix 27 of GenInsights21’. It will be with keen interest that we (when time permits, in July) publish an update on these long-term wind production statistics to include the full-month capacity factor for June 2024.

We need decades of weather history, not just a year or two, for robust modelling (and credible conclusions)!

In Appendix 27 of GenInsights21 we utilised 16 years of weather history, because that was all we had … but we were clear in the report at noting that it would be better to have used 50 or 60 years.

The 5 years presented above are a very visible (and topical) reminder that some years can be much more challenging than others.

Makes me shake my head when seeing others model a year or two of weather history and then offering the results of the (very, very limited) modelling to purportedly ‘prove’ some hypothesis about the amount of firming capacity required!

“Makes me shake my head” It makes me shout at the computer!!

It is easy to get 30 or 50 years of wind data at 100m from ERA5 from open-meteo say at Sheparton:

https://archive-api.open-meteo.com/v1/archive?latitude=-36.38&longitude=145.39&start_date=1980-04-01&end_date=2024-06-21&hourly=wind_speed_100m&wind_speed_unit=kn&models=era5

They even supply a few climate model data as well for future forecasts!

Of course what further complicates the use of historic wind data is climate change. Meaning that the probability of low wind periods could be changing over time. Of course 30 plus years of data is still going to be much more meaningful than two or three years.

A further complicating factor is that as more wind farms are installed, more wind energy is removed from the system meaning an overall reduction in generating capacity.

The law of conservation of energy makes it pretty clear we can’t just use the wind to spin blades and not have any negative impact on wind patterns.

Going out in time we can also look forward to the combination of low wind and old wind farms that need. 1. replacing and or 2. lots of maintaining coupled to a financial depression. But I am sure Hydro will not be in a once in a 10,000 year drought at the same time.

Heading needs an update: “Seven years since the ‘Wind Drought’ in 2007”