Earlier today we wrote the seeming oxymoron: ‘Highest-ever wind yield … *and* worst wind yield since June 2017!’ when looking at wind production statistics firstly zoomed in (to three days at the end of May) and then zoomed out (to the 61 days over the 2-month period).

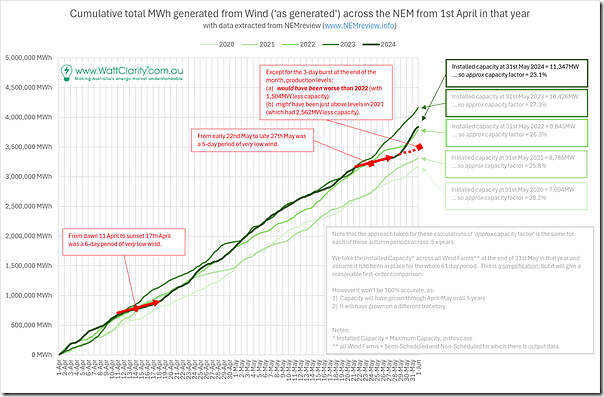

To illustrate the disappointing yield (and also the significance of ‘three days of plenty’) we’ve utilised our NEMreview software to extract aggregate wind production statics (i.e. aggregate FinalMW for every dispatch interval) over this 61 day period for each of 5 similar time ranges:

1) April to May (61 days in total);

2) For five consecutive years (2020, 2021, 2022, 2023 and 2024)

With this data we’ve drawn these cumulative worm trends that start at 0MWh produced in the time range at the start of 1st April and trend upwards to the right as the 61 day period progresses:

Firstly, let’s get some (‘no sh*t sherlock’) truisms out of the way firstly:

1) Obviously we’d expect each trend to continue upwards to the right, as it’s a cumulative trend;

2) Also obvious, we’d expect the worm lines won’t be perfect straight lines, as the underlying wind resource (and market/system conditions leading to economic curtailment and network curtailment) are all variable;

3) Because the installed capacity* base for Wind Farms across the NEM is growing, we’d expect each year to see each year producing more wind energy.

* notwithstanding these complexities about measuring any power generation facilities ‘Installed Capacity’ to use as the denominator in this calculation.

But obviously that’s not the case, because weather conditions (and possibly other factors) have intervened!

From a headline perspective we see the following…

Comparing 2024 to 2023

Apart from the first few days in April (where early April 2023 was evidently low wind conditions) the worm for 2024 never exceeds the worm for 2023 … and indeed ends up substantially down on output:

1) Indeed, it’s 326,848MWh lower at the end of the 61 day period

2) That’s 7.8% lower across 61 days

3) Despite installed capacity being 921MW (or 8.8%) higher on 31st May 2024 compared to 12 months beforehand

Comparing 2024 to 2022

Now, part of the reason is that (it’s been noted elsewhere) that same period in 2023 was particularly windy, so let’s compare to 2022:

1) Which was, at the end of the day:

(a) 44,137MWh higher at the end of 31st May 2024 compared to 31st May 2022

(b) Which is 1.16% higher

(c) But that’s with capacity being 1,504MW (or 15.3%) higher on 31st May 2024 compared to 24 months beforehand!

2) And the kicker is that we can clearly see with my (sketched in) approximation, if it was not for the 3-day run of wind gales at the end of May 2024 (that was only predictable 3-4 days in advance), the aggregate worm line for 2024 would have been considerably lower:

(a) Certainly well below the results for 2022

(b) And down much closer to the results for 2021.

Comparing 2024 to 2021

Speaking of 2021, if we compare to actual results for 2024, we see:

1) Production was 522,118MWh (or 15.74%) higher in 2024 compared to three years earlier

2) But that’s after a growth in installed capacity of 2,562MW (or 29%) on levels as at 31st May 2021.

Comparing 2024 to 2020

Going all the way back to 2020 and comparing with 4 years later, we see:

1) Production was 658,291MWh (or 20.7%) higher in 2024 compared to four years earlier

2) But that’s after a growth in installed capacity of 3,653MW (or 47%) on levels as at 31st May 2020.

So all of this points to how we invested a significant increase in installed capacity across 4 years for a much smaller benefit in energy production (and presumably also emissions reduction, though I have not checked directly), in the 61 day period.

1) Let’s hope, for all of our sakes, that the wind conditions turn around

2) But surely we need to bring the ‘A Team’ into planning for the required amount of firming capacity as coal units leave the grid!

… reminds me that we flagged this specific challenge when covering ‘What’s next for market modelling’ as Key Observation #6 within GenInsights21 a few years ago now!

Halleluiah! We are now starting to get on the same page. The bottom line is you simply cannot expect to get base load energy generation out of inherently intermittent, essentially unpredictable, sources of energy without simply gross overbuilds of capacity and storage that will have to be paid for by someone. I suggest people go and read carefully the work done by Gamma Energy Technology that displays the results as exponential cost of decarbonisation for the NEM. (the reason any of this is being undertaken, remember people!). This is why simply comparing LCOE between technologies is simply silly. You need to look at the total system cost of energy supply to get the correct (least cost) mix of primary energy sources. Near zero carbon emissions simply becomes a constraint on that list of suitable technologies. Wind and solar certainly have their place and contribution, but the blind ideological belief that we can achieve (let alone afford) a 100% renewable power system is going to take us to a dark place.

Renewables are still cheaper when factoring in storage. The CSIRO report made this clear. In a 100% RE NEM, wind and solar are not the only energy sources. You are ignoring the not insignificant hydro component. There will be additional energy sources such as off shore wind (higher capacity factor than onshore), solar thermal (built in storage), possibly wave, geothermal and more.

Australia is not alone in experiencing lower wind output despite higher installed wind capacity.

From Reuters article 15 Feb 2024:

“Power generated by Texas wind farms dropped by 22% in January 2024 from the same month in 2023 as low wind speeds continue to stifle output across the main power system in Texas, the largest power market in the United States……

As wind power is the second largest source of electricity behind natural gas in Texas, the drop in wind output so far this year has forced utilities to sharply increase generation from fossil fuels to balance system needs.

Combined output from natural gas and coal was close to 50% greater in January 2024 than in January 2023, underscoring the enduring importance of fossil fuels within the ERCOT system despite the ongoing build-out of renewable generation capacity.”

Data from the Electric Reliability Council of Texas (ERCOT)

ERCOT –

What comes first:

1./ The removal of the legislated ban on a nuclear industry, or

2./ A Royal Commission where all the financial aspects of nuclear fuelled electricity generation can be put and thoroughly tested against those of a renewables based system.

Australia is becoming bogged down in a highly politicised faux discussion wherein truth is the first casualty while elsewhere in the world,evidence that supports the nuclear option is becoming undeniable.

Each passing day sees huge torrents of taxpayer dollars flowing fourth.

Is it really flowing in the best direction?

I would suggest your sketched trendline overstates the case, since it is assuming the 5-day period of very low wind extends out to 9 days. A more reasonable comparison to see “what would have been” if the large burst of wind generation at the end of month hadn’t occurred would be to extend it at the rate of the overall May average?