In a sign of the times, the cumulative price in South Australia has turned negative. Whilst negative spot prices have been becoming increasingly common, cumulative prices have very rarely strayed negative, up until now.

If you need a refresher, cumulative price is explained in the WattClarity glossary – but in short, it is the rolling total of the previous 7 days of trading prices (i.e. the previous 2,016 five-minute dispatch intervals). The measure is important because there is a timing mis-match between the wholesale market and the retail market, as such this measure exists largely to track the cumulative price against the Cumulative Price Threshold. As we’ve seen in practice (most memorably in June 2022), if this price threshold is reached, Administrated Pricing comes into effect to cap the regional dispatch price in order to limit liquidity risk. The cumulative price threshold is currently set at $1,490,200 for the 2023-24 financial year.

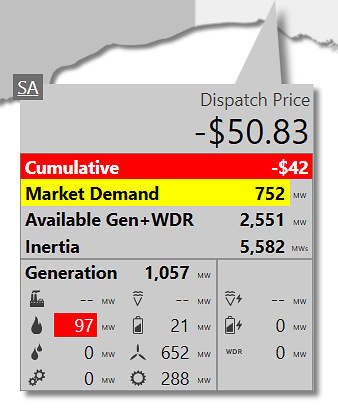

Whilst there is no floor to the cumulative price (i.e. in contrast to its threshold), a negative cumulative price for a region is a sure sign of prolonged low and negative pricing. From a quick glance at ez2view, the cumulative price in SA first went negative during the 16:25 dispatch interval yesterday, the 26th of October 2023 when it hit -$42.

The cumulative price for South Australia turned negative from the 16:25 dispatch interval yesterday.

Source: ez2view‘s NEM Map

The cumulative price has continued to drop in SA, and is currently at -$13,114 at the time of writing (10:40AM NEM time on Friday). Whilst the cumulative price in VIC has also been falling and is currently at $12,700. There have been relatively few occurrences of negative cumulative prices in the history of the NEM, with the longest and deepest period to date occurring in SA and VIC in mid-December 2022.

Leave a comment