Saturday 1st October 2022 has been and gone – marking one year since the commencement of Five Minute Settlement on 1st October 2021.

When we released GenInsights21 on 15th December 2021 (i.e. a few short weeks after the commencement of 5MS) we included (as Appendix 28) some ‘Early Insights from Five Minute Settlement’ as a 49-page review

Prior to the release of GenInsights21, on 2nd December 2021 I spike at an Australian Institute of Energy event organised in Brisbane with the title ‘Early Insights from Five Minute Settlement’, which perhaps would have been more appropriately titled ‘Early insights on the Early Insights from Five Minute Settlement’, given that we were still finalising Appendix 28 in GenInsights21 at the time!

One of our subscribers to the more recent GenInsights Quarterly Updates in 2022 requested that we take an updated look (now that more time has elapsed) at some of what we could see in the 12 months that had elapsed since the start of 5MS, and included this as Appendix 7 within the GenInsights Q3 2022 … which we released on Monday 31st October 2022.

Here’s a look at the contents of this 19-page Appendix:

With respect to Outcomes from 5MS (at least to 1st October 2022), we thought it was worth sharing two particular observations:

(A) Price Outcomes

We thought it would be worth sharing a small excerpt from the report (the part highlighted in the image above).

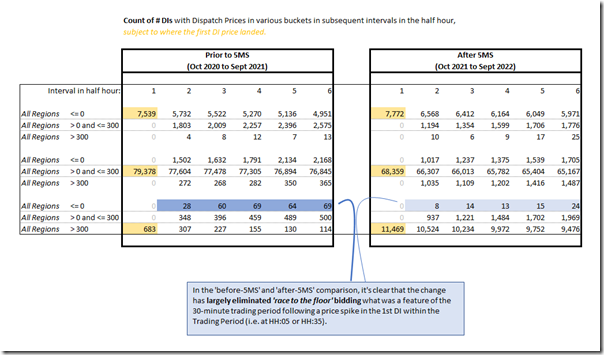

With respect to the image below, we noted:

‘An obvious data point to look at is in relation to price outcomes in the NEM … and particularly looking at the structure of 6 x 5-minute dispatch prices within each half hour block:

· In the 12 months prior to 5MS (i.e. Oct 2020 to Sept 2021) where the 30-minute blocks represent the Trading Period; and

· In the 12 months since 5MS, where the 30-minute blocks no longer represent any formal structure defined in the Rules.

In this table we categorise price outcomes for all regions together, and compare the 2 x 12-month ranges on the basis of where the Dispatch Price (for each region) landed, in terms of 3 x Price Range Buckets:

· Below $0/MWh (i.e. coloured blue in terms of bid ranges in GenInsights21 and ez2view)

· Between $0/MWh and $300/MWh (i.e. coloured green)

· Above $300/MWh (i.e. coloured red).’

… and concluded:

‘As noted in this image, there is clearly a shift away from the ‘race to the floor’ bidding patterns after a spike in the first Dispatch Interval of the Trading Period:

· Which had become such a focal point for the critics of Thirty Minute Settlement;

· But which (in aggregate terms) represented such a small number of dispatch intervals in total through the 12 month period.’

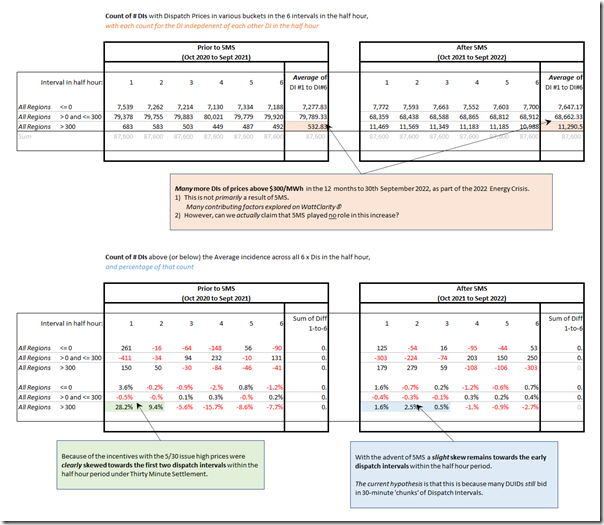

We then continued…

‘Obviously, there are many more high-priced dispatch intervals in the most recent 12-month period than there was the case prior to this point.

· Whilst the primary cause(s) of this increase in volatility are rooted in the physical and commercial factors driving the ‘2022 Energy Crisis ’;

· We should be cautious before pronouncing that the shift to 5MS had zero impact on this drive to more volatility.’

… after which we concluded

‘Prior to 5MS we can see a clear skew for high-priced events to be triggered in the first two dispatch intervals of the contiguous half-hour Trading Period.

After 5MS this skew has not entirely disappeared.’

Through other parts of this Appendix, we explain more of why this skew of high prices to the first DIs in the half-hour period has not entirely abated.

(B) So, how much did it all cost?

Those who have picked up their copy of GenInsights21 will know that we deduced two things about ‘what it all cost’:

1) First and foremost:

(a) That no-one actually knows even after the fact; but

(b) That estimates from a range of stakeholders before and during the process were two orders of magnitude difference (i.e. some were way off!)

… even when I asked the same question to an audience at CEC’s Large Solar Forum in May 2022 it was clear that the audience there had no idea (and was very bad at guessing). That’s no indictment on the people in the audience at the time but it is a worrying sign given that its these form of Wild-Arse-Guesses that (we saw in our review) played some role in the decision making process surrounding the cost-benefit of the implementation of 5MS in the first place.

2) Secondly, we established in our review that (as best as we could tell from the information we found published) that the implementation cost was between $500M and $1,000M:

(a) that’s as much as a billion dollars!

(b) yet some people at the start of the process were throwing around estimates an order of magnitude (or two orders of magnitude!) lower

3) Thirdly, we found in the process of compiling the review that there was no formal process (nor even much awareness of the value of doing so) to actually collate the true cost of its implementation soon after the fact.

(a) This seemed to us to be a little myopic, as a proper tally of the costs of the implementation of Five Minute Settlement would be a very useful point of reference for other big ticket reviews we’re still considering down the track in the transition to NEM 2.0

(b) So we included this commentary in GenInsights21.

—

With this as background, one of our subscribers to GenInsights Q3 2022 asked us, during the one-on-one Executive Briefing for them, whether we’d managed to firm up on the estimated range of cost that we published in GenInsights21.

Unfortunately we’d had to report that we had not done so – indeed, we’d seen no interest within (what we thought would be) the relevant bodies to actually complete this process.

To us, that’s a shame.

Leave a comment