Around this time of year there’s no shortage of end-of-year summaries: Spotify Wrapped, LinkedIn Year in Review, Strava Year in Sport, and other assorted attempts to distill twelve months of activity into a neat summary. Here on WattClarity, we have a similar annual tradition where we look back at what happened in the NEM, drawing together the events and issues that most shaped our coverage here on WattClarity over the year just gone.

In 2025, that coverage amounted to over 600 published articles and more than 1.5 million visits to our site, continuing our run of continuous reporting and analysis on the market that began in 2007.

This article follows our usual end-of-year tradition, pulling together a snapshot of the moments and developments that stood out over the year, along with some of the best of our coverage on WattClarity.

Year in Review

The year got off to a hot start. In January, Frontier Economics published two highly publicised and contentious economic reports supporting the Coalition’s nuclear energy policy. On January 15th, the NSW region experienced weather-driven market volatility, with the same weather system also causing distribution outages affecting more than 140,000 customers. A week later, on January 22nd, QLD demand reached a new all-time record, surpassing the previous record that had been set exactly one year earlier. In similar circumstances to last year’s event, reserve levels in QLD at one point fell to around 4% IRPM. Toward the end of the month, Stage 1 of Project EnergyConnect commenced operation, prompting regular WattClarity contributor Allan O’Neil to caution that the market should “be careful what you wish for”.

At the beginning of February, heavy rainfall across North Queensland led to significant flooding, including inundation of the Ingham substation north of Townsville. Rainfall totals exceeded 400 mm in some locations over a 24-hour period. On February 3rd, we saw some ‘remarkable’ demand outcomes NEM-wide, with demand particularly elevated in VIC and SA compared to historical norms. Later in the month we published our annual review of network and economic curtailment across the NEM, highlighting ongoing seasonal and locational challenges that stand in the way of VRE utilisation. SA saw some supply-demand tightness on February 12th, with spare capacity in the region dropping below 100 MW at one point. Later that month, it was announced that the oldest commercial wind farm in Australia, Codrington Wind Farm, will be decommissioned in 2027, after 26 years of operation.

The Ingham substation in North Queensland was submerged by flood waters in early February following heavy rainfall in the region.

Source: Ergon Energy

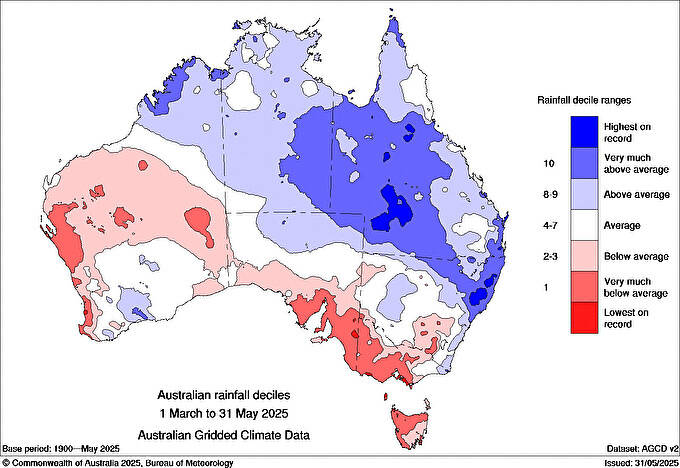

In early March, ex-Tropical Cyclone Alfred made landfall near Brisbane, triggering widespread distribution-level outages across the Energex network. On March 15th, there were multiple faults across the transmission system in South Australia, affecting electricity supply to the Yorke Peninsula, with ElectraNet stating this was caused by an ‘accumulation of dust and salt combined with fog conditions’. From March through to May, we also observed a notable “north–south switcheroo” in solar conditions, with above-average irradiance across the south-west part of the NEM and below-average conditions affecting much of the north-west half.

A persistent high-pressure system brought below-average rainfall and cloud cover across the south-western half of Australia, while the north-eastern half experienced the opposite. These conditions had a material impact on solar irradiance outcomes for solar generation within the NEM.

Source: BOM

In April, the newly elected Queensland state government outlined elements of its revised energy policy, including the unwinding of parts of the previous government’s Energy and Jobs Plan. It later emerged that the state-owned Callide C3 unit had suffered a clinker incident several days earlier, resulting in an outage lasting close to three months. In international electricity market news, a widespread system blackout across the Iberian Peninsula on April 28th left millions of customers without supply in Spain and Portugal — with forensic investigations into the incident later highlighting two periods of power, voltage and frequency fluctuations preceding the outage.

May started with the federal election, with the Coalition’s nuclear policy featuring prominently in the campaign, alongside persistent cost-of-living pressures. During the month, the four-member Nelson Review panel travelled across the five capital cities in the NEM for public forums as part of its consultation process, following the release of public submissions from the initial phase of the review. On May 26th, several developments coincided: the NEM recorded a new high for wind generation, a dust storm swept across South Australia, and a large dispatch error was observed across the semi-scheduled wind and solar fleet. On May 28th, a fire broke out within the nacelle of a turbine at the Bulgana Wind Farm — impacting availability at the facility for the next several months.

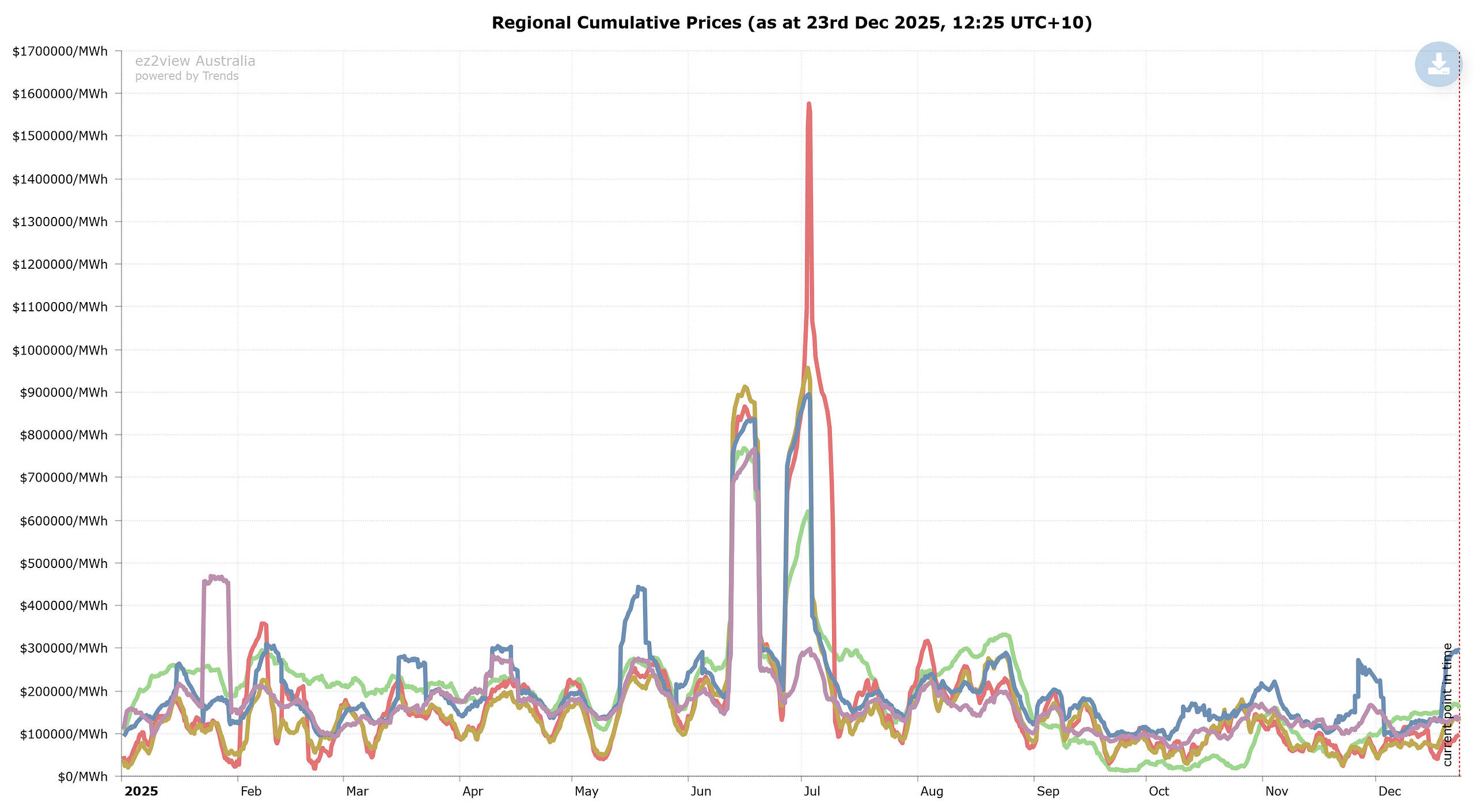

June proved to be another busy month. On June 8th, the new Frequency Performance Payments (FPP) scheme commenced. On June 12th, renewable energy conditions deteriorated across much of Australia, with David Osmond — who runs an ongoing NEM modelling exercise — later noting that this two-day period ranked among the most challenging in his simulations. At one point during this window, spot prices briefly exceeded $15,000/MWh across multiple regions, while IRPM fell as low as 10.34%. Toward the end of the month, on June 26th, a prolonged period of cold, still, and cloudy weather drove an extended run of market volatility.

Across the year, all five regions saw their cumulative price peak in June or early July.

Source: ez2view’s Trend Editor

The new financial year began in July, with the Market Price Cap (MPC) increasing to $20,300/MWh — the largest annual increase since the start of the NEM. The same day also marked the commencement of the federal government’s home battery scheme. July 1st turned out to be an even more eventful day, with a “bomb cyclone” hitting parts of NSW, leading to distribution-level outages affecting more than 40,000 customers. Separately, the region recorded its highest demand in fifteen years that evening. On July 24th, the market saw its first taste of the new MPC, with the SA Lower 1-Second FCAS price spiking coincident with scheduled outages along the Heywood interconnector. When the annual Clean Energy Summit was held in Sydney in late July, significant change was underway at the Clean Energy Council, with much of the senior leadership team — including long-serving CEO Kane Thornton — moving on.

With a new leadership team at the CEC, the July Clean Energy Summit in Sydney saw system stability, data centres, price forecasting, and minimum system load, feature prominently in discussions.

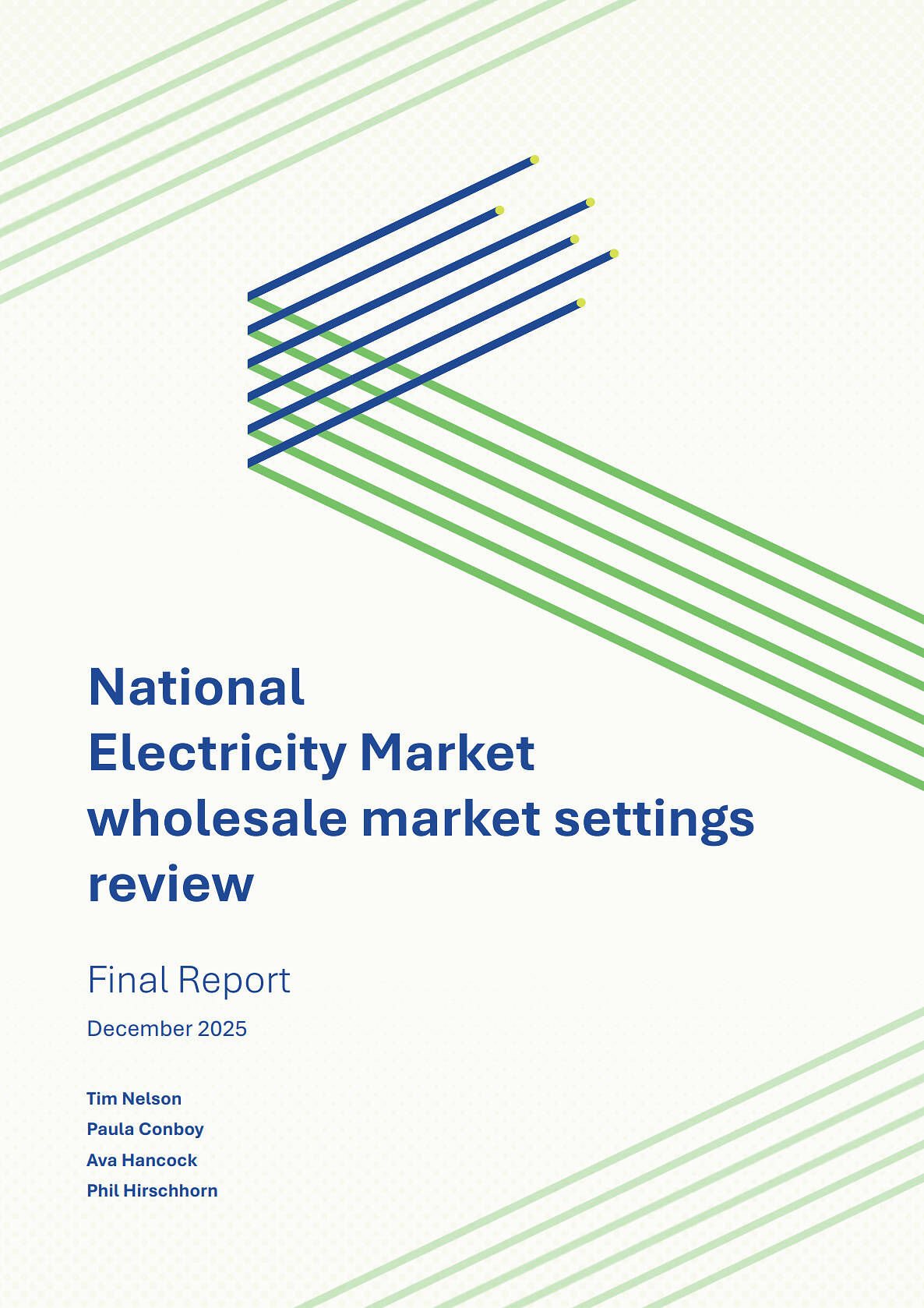

August saw the release of the long-anticipated draft ‘Nelson Review’, which for the first time set out the proposed Electricity Services Entry Mechanism. On August 19th, a serious operating incident in the physical market unfolded over a period of around 25 minutes after a data glitch at a self-forecast provider, during which mainland frequency drifted outside normal operating bounds. On August 21st, AEMO published the 2025 Electricity Statement of Opportunities (ESOO) — with Paul later writing about his ‘six lenses’ in which one could view the report.

In September, media speculation grew around a possible further extension to the operating life of the Eraring coal-fired power station beyond 2027. Ahead of COP30 in Brazil, the federal government announced a proposed 2035 emissions-reduction target of between 62% and 70%. Later in the month, the winners from the third tender round of the Capacity Investment Scheme (CIS) were announced, with 4.1 GW of dispatchable projects awarded contracts. Also of note in September, was the CEC’s Queensland Clean Energy Summit in Brisbane, where we observed that the tone of presentations at the conference was far more sombre than we’ve heard in previous years — with more focus on some of the ongoing challenges of the transition.

October began with the ABC suggesting Gladstone Power Station could be retired earlier than previously expected, a discussion later picked up on WattClarity by Greg Elkins. On October 10th, the Queensland Government released the Queensland Energy Roadmap — formally replacing the former state government’s Energy and Jobs Plan. Later in the month, the results of the fourth CIS tender were announced — the scheme’s largest round to date — with 6.6 GW of VRE capacity awarded contracts. Towards the end of October, the annual All-Energy conference was held in Melbourne, where we noted that home battery systems seemed to outnumber nearly everything else on the exhibition floor — a telling reflection of how much attention and commercial momentum is now centred on behind-the-meter storage.

In November, the federal government announced that a ‘Solar Sharer Offer (SSO)’ will be introduced next financial year — under which many consumers across the NEM will be able to access several hours of ‘free’ electricity. On November 7th, we observed a prolonged unplanned outage at the Waratah BESS; it later emerged that a ‘catastrophic’ transformer failure had occurred on-site the previous month. From late November, South East Queensland experienced an unusually high frequency of hailstorms, with one event, and accompanying thunderstorm, leaving up to 161,000 customers without power. Toward the end of the month, New South Wales recorded two days of elevated middle-of-the-day prices, driven by a combination of cloud cover, high temperatures, ramping limitations of units, and binding network constraints.

The draft report of the ‘Nelson Review’ was released in August, followed by the final report just last week.

Source: DCCEEW

December has been dense with reports, announcements, and headlines. On December 1st, AEMO released its ‘2025 Transition Plan for System Security’, with parts of the media seizing on the report to run blackout-focused headlines. Similar coverage resurfaced a week later following speculation about the timing of Yallourn’s closure. Several major reports followed in quick succession. On December 10th, the AEMO published the draft 2026 Integrated System Plan, and on December 16th, the final report of the Nelson Review was released, with federal and state energy ministers agreeing in principle to its recommendations — with the exception of Queensland. Operationally, on December 6th a grass fire broke out at Wellington North Solar Farm, then mid-December saw a handful of tight supply–demand days in NSW, with actual LOR2 conditions emerging. Just yesterday we saw the release of the federal government’s gas market review, which included a policy announcement requiring gas exporters to reserve between 15% and 25% of production for the domestic market.

Most Read Articles in 2025

With a little over a week left in the year, we have so far published 647 articles in 2025, covering day-to-day developments and deeper analysis across the NEM. Our editorial priorities are driven by what market events we think warrant further notice, examination or explanation at the time, rather than what we think will get the most amount of views.

That said, as we do each year, it’s still useful to step back and look at which pieces attracted the most readership, as it offers a rough guide to which issues and topics generated the most interest over the year. The list below sets out the twenty articles that drew the highest number of readers during 2025:

- Power Outages in Northern NSW and South-East Queensland at Saturday morning 8th March 2025

by Paul McArdle - Ausgrid report that 140,000 customers in NSW were impacted or lost power last night Jan 15th 2025 .. Part 7

by Dan Lee - PEC Stage 1 in operation – be careful what you wish for

by Allan O’Neil - The growing NEM BESS fleet: Who is controlling all this capacity, anyway?

by Matt Grover - The state-of-charge for 2024: The highs and lows of the big battery boom

by Dan Lee - Wellington North Solar Farm offline in ST PASA data from Saturday 6th December 2025, following grassfire

by Paul McArdle - Keeping up with the curtailment 2024: A little? too much? or much ado about nothing

by Dan Lee - The challenge of imperfect foresight: Storage operation in a highly renewable NEM

by Josh Boegheim - Frequency Performance Payments 44 days in

by Linton Corbet - An initial look at Winners and Losers from Frequency Performance Payments (FPP)

by Jack Fox - How the NEM BESS fleet is operating on peak days, and how to be a savvy operator

by Matt Grover - Not all renewable projects are created equal: Why approval times vary dramatically across Australia

by Alice Matthews - Lower 1-second FCAS volatility continues in SA on Sunday 27th July 2025

by Linton Corbet - Interconnector intricacies: double and triple auto-clamping of pesky negative residues

by Dan Lee - The trend continues: a review of Q2 2025 spot prices

by Dan Lee - NEMDE nightmares – parallel pathways and clashing constraints

by Allan O’Neil - Spare capacity in South Australia drops below 100MW on Wednesday evening 12th February 2025

by Paul McArdle - Unpacking some of the drivers of volatility in NSW today, on Wednesday 26th Nov 2025

by Dan Lee - What is the real size of Australian corporate demand for Renewable Energy?

by Tristan Edis - The forgotten market and its critical role in Australia’s transition to clean energy

by Anita Stadler, Gilles Walgenwitz and Lachlan Goodland-Smith

Charts of the Year

In the next section, I highlight my top five charts published on WattClarity this year that, in my view, did a particularly good job of illustrating different trends or explaining different concepts in the NEM.

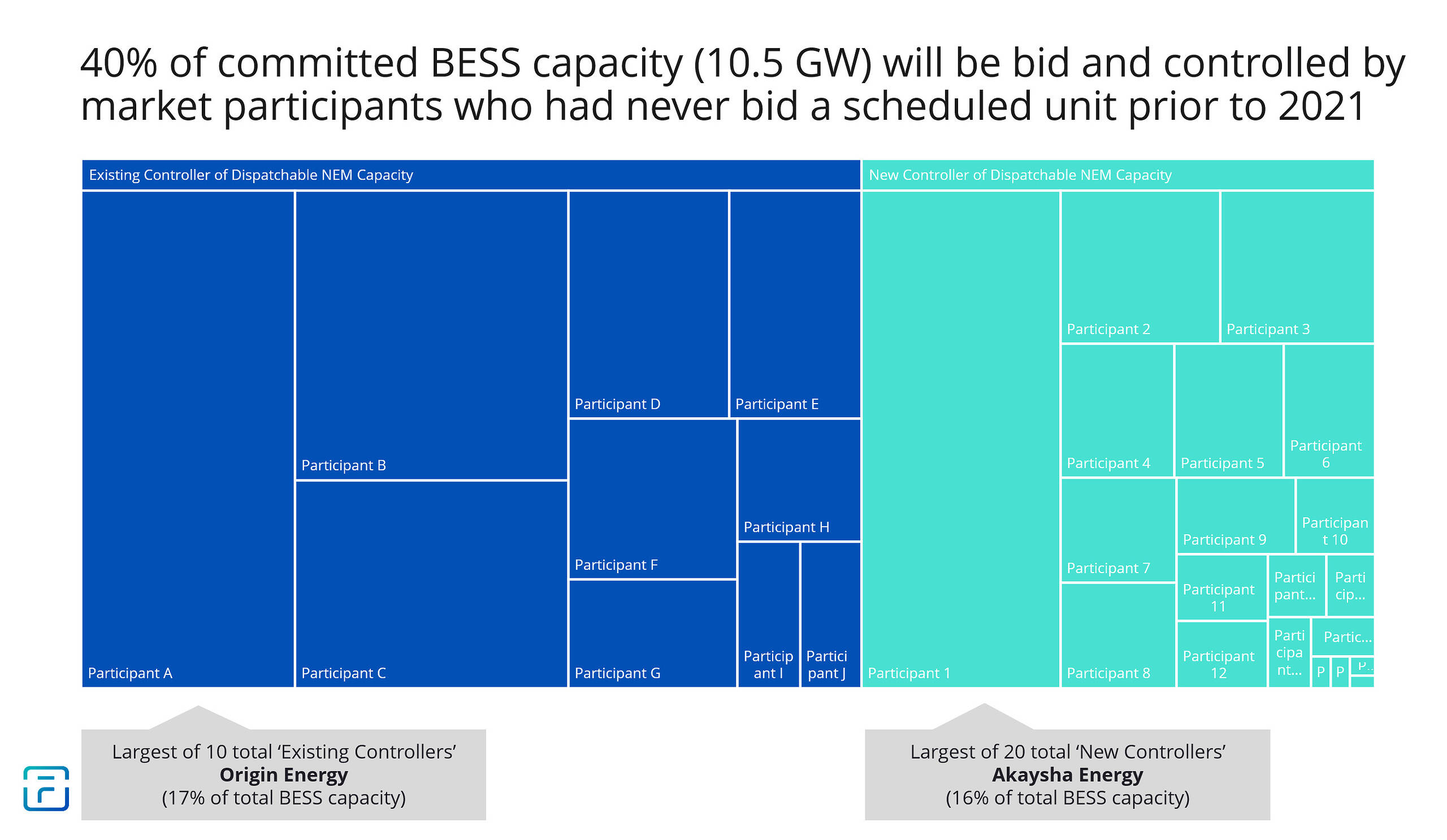

We’ll start with this treemap diagram from Matt Grover’s article “The growing NEM BESS fleet: Who is controlling all this capacity, anyway?”. It does a great job to illustrate how, by 2027, a substantial share of committed utility-scale battery capacity is expected to be bid and operated by market participants with no prior experience running scheduled units in the NEM — a material shift in who is actively controlling dispatchable capacity now.

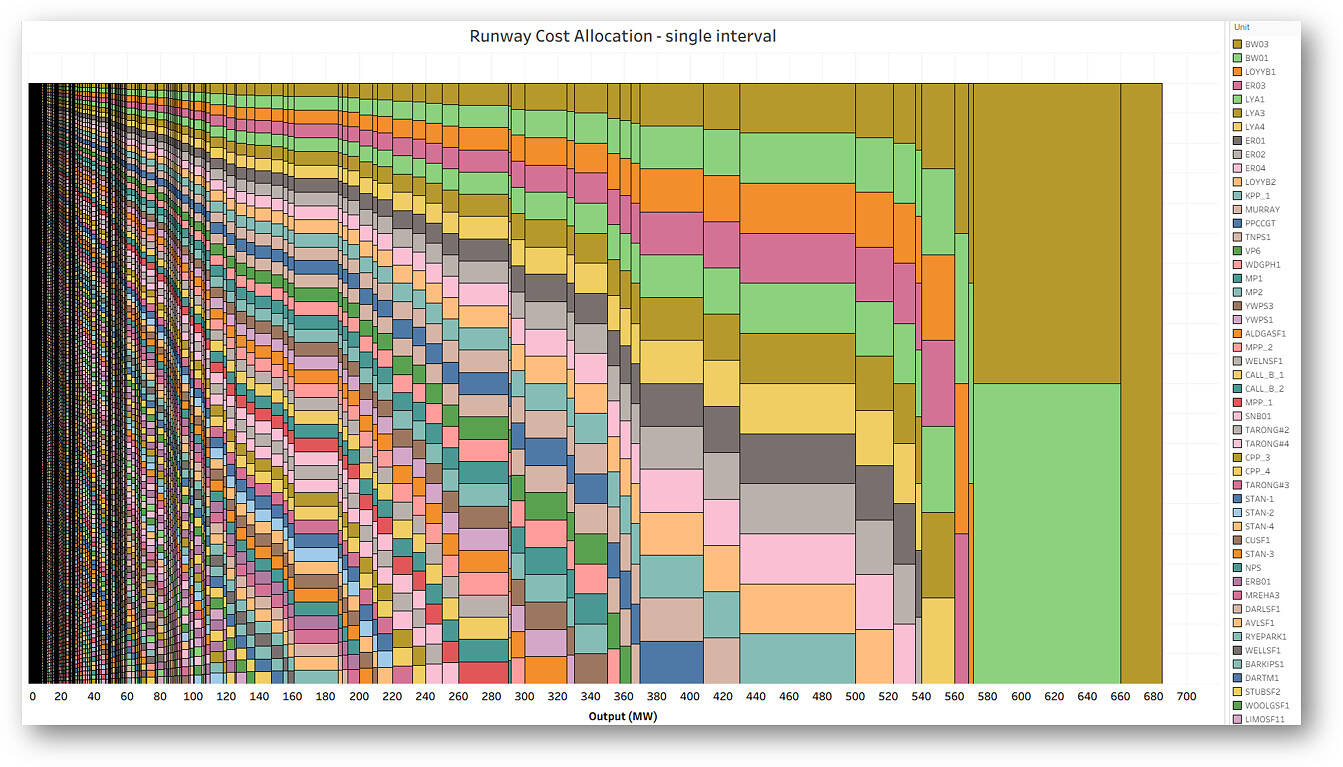

This next chart was published just last week by Allan O’Neil, in his article “Runway cost allocation – ready for liftoff?“ to explain how a ‘runway pricing’ scheme would work in the NEM if introduced for the contingency FCAS markets — it demonstrates the distribution of costs across units for a single dispatch interval as an example of this cost allocation approach.

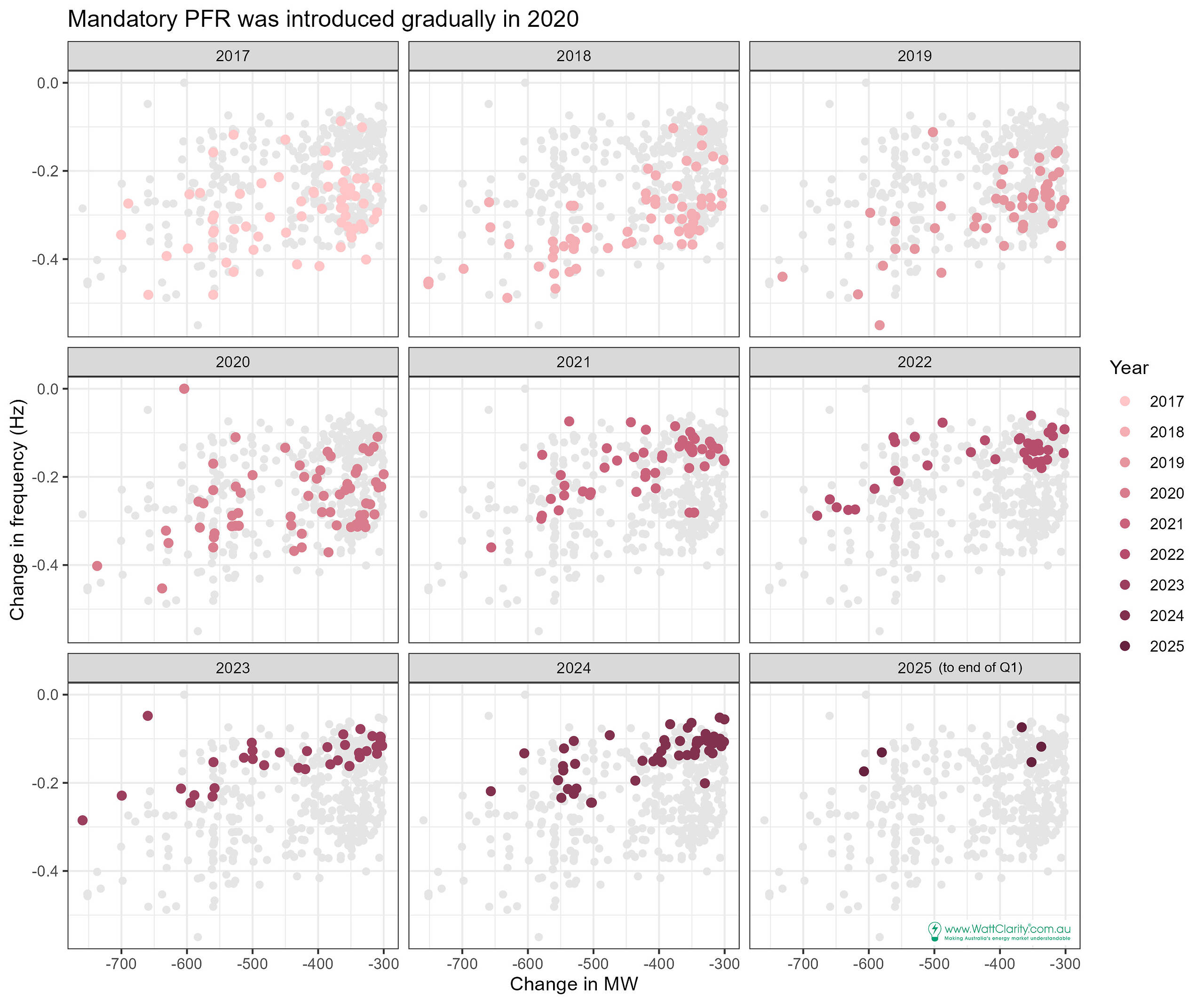

This next chart comes from Linton Corbet’s article “Frequency change associated with coal generation events”, which examines system frequency changes during coal unit trips/large output reductions since 2017. While it’s often assumed that coal outages are making frequency outcomes worse, the analysis and this graphic suggests a more nuanced picture: events involving drops of 300 MW or more by coal units have become less strongly correlated with negative frequency deviations, particularly since the introduction of mandatory Primary Frequency Response in 2020.

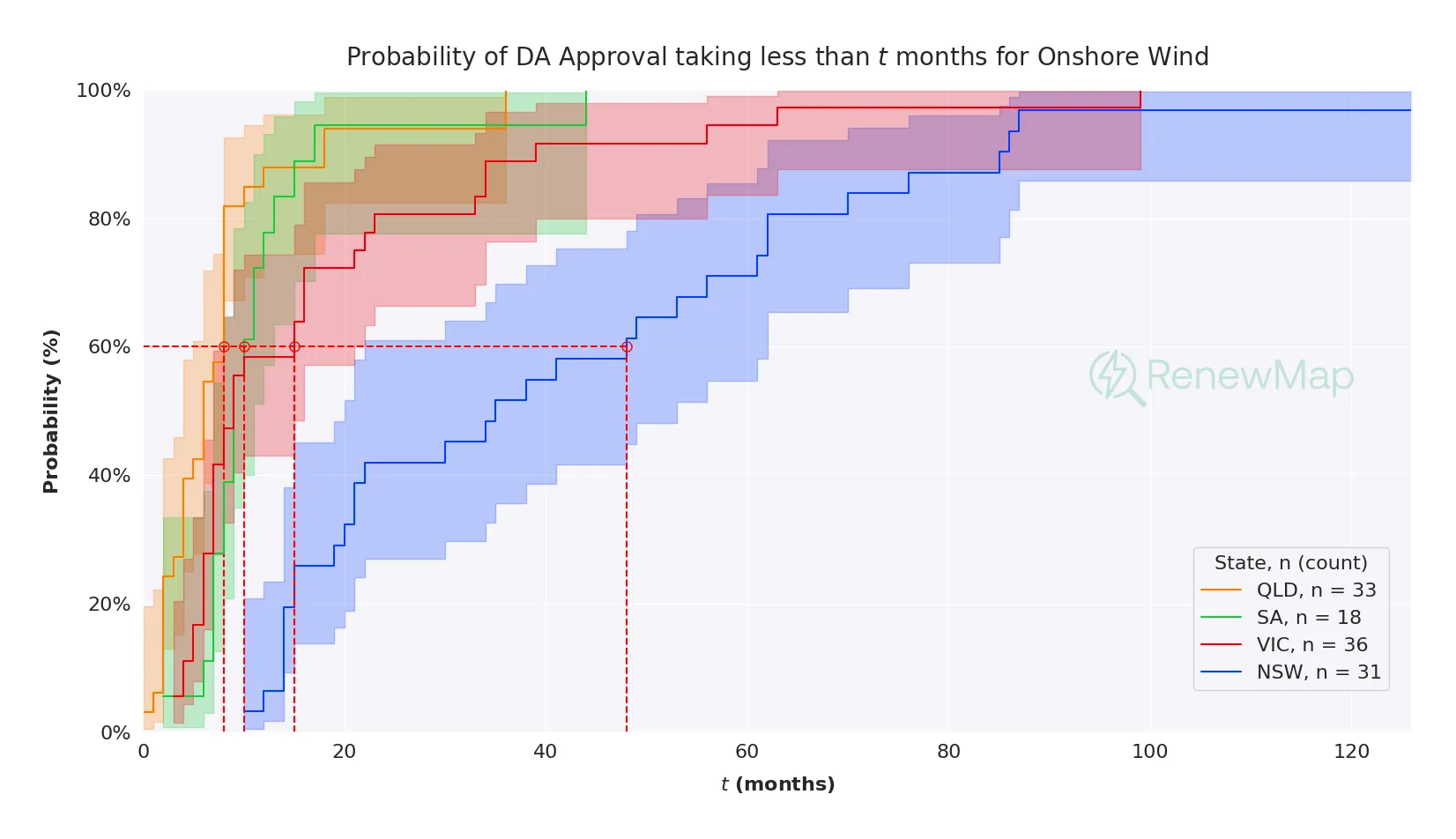

Next is a Kaplan-Meier survival curve published in Alice Matthews’ article “Not all renewable projects are created equal: Why approval times vary dramatically across Australia”. It shows that onshore wind development projects in NSW lag well behind other NEM states in terms of DA approval time, with a much flatter curve indicating a higher probability of approvals taking several years rather than months.

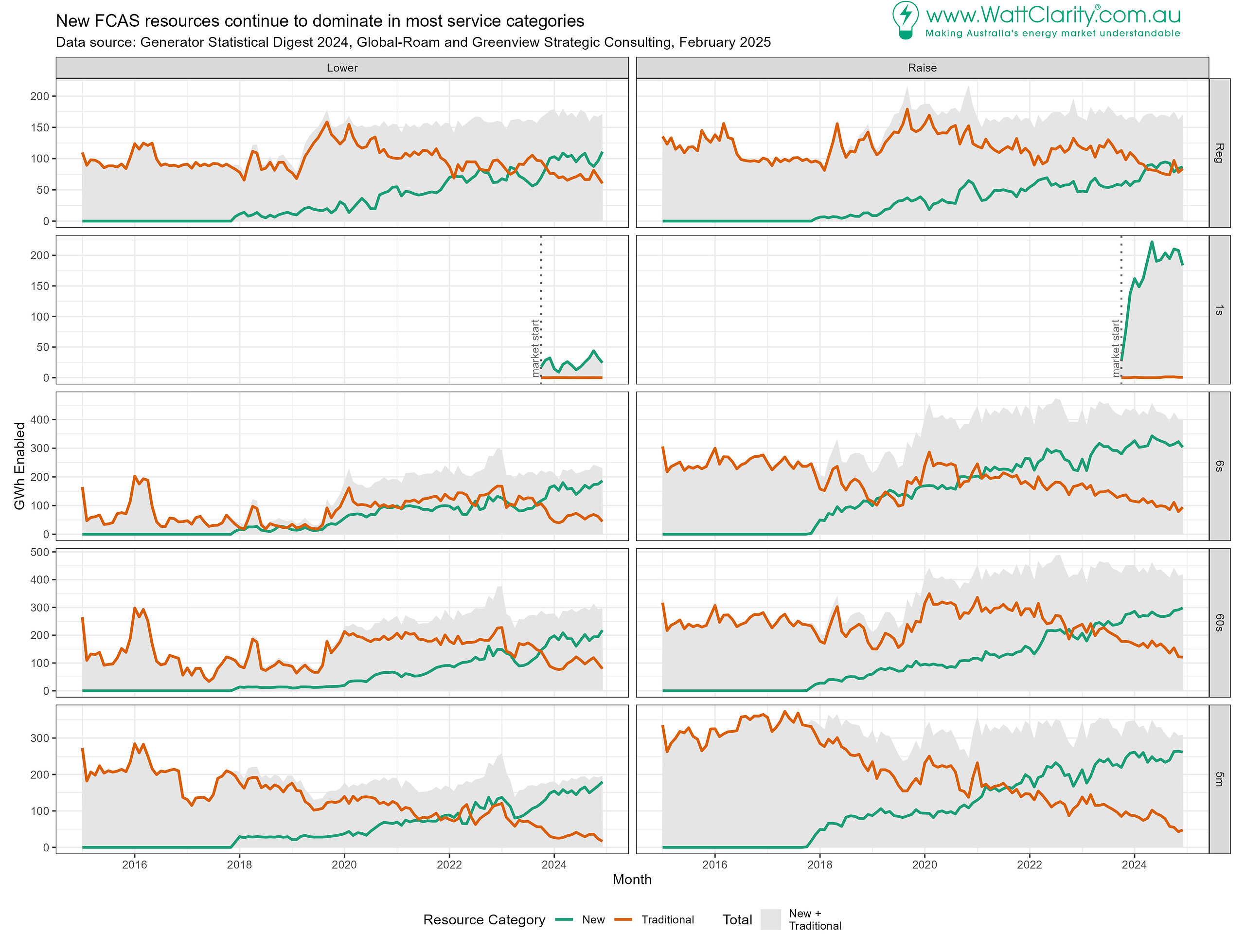

The final chart comes from earlier in the year, in Linton Corbet’s article “New FCAS resources dominate enabled levels in 2024”. It showed that newer providers of FCAS — most notably batteries — have overtaken traditional providers such as thermal and hydro units, becoming the dominant source of enablement across all ten FCAS commodities.

WattClarity references by other media, reports, and academic research

From time to time, analysis published on WattClarity is referenced or republished by other sources (and occasionally we are contacted directly by journalists seeking comments on events in the energy markets).

One of the more interesting references that we came across this year was the work from a group of students and researchers from the University of Sydney, who attempted to train several large language models using WattClarity content, to test whether our market commentary could meaningfully improve electricity price forecasting. Unfortunately, the results were mixed at best — which perhaps suggests that forecasting is a mug’s game after all…

As we’ve done in previous years, Paul and I have kept a running list of all of the external mentions and citations of our work. It’s not intended to be exhaustive, but it hopefully it helps point out which pieces of our analysis resonated beyond WattClarity and found their way into more mainstream coverage.

Australian Financial Review

- On June 10th, Paul’s article “Unplanned outage at YWPS3 (tube leak) extended (due to air duct collapse)” was referenced by Ryan Cropp and Angela Macdonald-Smith from The Financial Review.

- On June 13th, Paul’s article “Loy Yang A1 back online, Thursday evening 12th June 2025” was referenced by James Hall, Angela Macdonald-Smith and Sumeyya Ilanbey from The Financial Review.

- On November 26th, my article “Unpacking some of the drivers of volatility in NSW today, on Wednesday 26th Nov 2025” was referenced by Angela Macdonald-Smith from The Financial Review.

ABC

- On September 1st, Paul’s article “Unplanned outage on Yallourn Unit 2 extended another month” was referenced by Stephen Letts from the ABC.

RenewEconomy

- On February 3rd, Paul’s article “New lowest-ever* point for NSrW ‘Market Demand’ on Sunday 16th Feb 2025 was lower than AEMO’s earlier forecasts“ was referenced by Giles Parkinson on RenewEconomy.

- On February 4th,Paul’s article “~13 months later, a GSD2024-inspired review of operations at Cohuna Solar Farm through 2024“ was referenced by Giles Parkinson on RenewEconomy.

- On February 19th, my article “The state-of-charge for 2024: The highs and lows of the big battery boom“ was republished on RenewEconomy.

- On February 21st, my article “The state-of-charge for 2024: The highs and lows of the big battery boom“ was referenced on the RenewEconomy Energy Insiders Podcast.

- On April 15th, Matt Grover’s article “The growing NEM BESS fleet: Who is controlling all this capacity, anyway?” was referenced by David Leitch on RenewEconomy.

- On May 14th, Matt Grover’s article “The growing NEM BESS fleet: Who is controlling all this capacity, anyway?” was referenced by Fred Hopley on RenewEconomy.

- On June 10th, Paul’s article “Unplanned outage at YWPS3 (tube leak) extended (due to air duct collapse)” was referenced by Sophie Vorrath on RenewEconomy.

- On June 13th, my article “North-south switcheroo as solar conditions swing opposite directions over Autumn 2025” was republished by RenewEconomy.

- On June 13th, Paul’s article “The commencement of Frequency Performance Payments (FPP)” was referenced by Rachel Williamson on RenewEconomy.

- On July 10th, Linton’s article “Wholesale Demand Response Capacity in June 2025” was referenced by Rachel Williamson on RenewEconomy.

- On November 17th, my article “Reflections from our presentation to the CEC this week: A stocktake on the CIS“ was referenced by Chris Briggs on RenewEconomy.

- On December 23rd, Allan O’Neil’s article “With the benefit of hindsight – or who’d be an auto-bidder?“ was referenced by Paul Bandarian and David Leitch on RenewEconomy.

PV Magazine

- On February 4th, Paul’s article “~13 months later, a GSD2024-inspired review of operations at Cohuna Solar Farm through 2024“ was referenced by David Carroll from PV Magazine.

- On February 7th, my article “Keeping up with the curtailment 2024” was republished by PV Magazine.

- On February 19th, Linton’s article “Indicators of solar farm performance with GSD2024“ was republished by PV Magazine.

- On February 27th, my article “Highs and lows of Australia’s big battery boom” was republished by PV Magazine.

- On June 26th, my article “North-south switcheroo as solar conditions swing opposite directions over Autumn 2025” was republished by PV Magazine.

- On November 10th, Paul’s article “What’s up with Waratah BESS (unplanned outage till 3rd May 2026)?“ was referenced by Tristan Rayner on PV Magazine’s ESS News website.

- On November 25th, Paul’s article “Further thoughts (and questions) about Waratah BESS, two weeks after the snowball started to roll…“ was referenced by Tristan Rayner on PV Magazine’s ESS News website.

- On December 8th, Paul’s article “Wellington North Solar Farm offline in ST PASA data from Saturday 6th December 2025, following grassfire” was referenced by David Carroll from PV Magazine.

The Energy

- On May 8th, my article “Is the price right? A historical exploration into the NEM’s price cap“ was referenced in The Energy’s Newsletter.

- On May 26th, Paul’s article “Might be a new all-time record for NEMwide wind production on Monday night 26th May 2025” was referenced in The Energy’s Newsletter.

Other

- In February, several of our articles were referenced in the academic paper “The Scheduling role of future pricing information in electricity markets with rising deployments of energy storage“ by Abhijith Prakash, Anna Bruce and Iain MacGill of the University of New South Wales.

- In February, Paul’s article “Origin Energy drops Minimum Generation levels at Eraring Power Station to 180MW“ was referenced in the report “The Case for Closing Eraring in 2027” by Nexa Advisory.

- On March 1st, Anita Stadler, Gilles Walgenwitz and Lachlan Goodland-Smith’s article “The forgotten market and its critical role in Australia’s transition to clean energy” was referenced in Keith Orchison’s Coolibah Consulting Monthly Newsletter.

- On March 14th, Jack Fox’s article “An initial look at Winners and Losers from Frequency Performance Payments (FPP)” was referenced in Endgame Economic’s Weekly Dispatch.

- On April 15th, Matt Grover’s article “The growing NEM BESS fleet: Who is controlling all this capacity, anyway?” was referenced by David Leitch on the ITK Research blog.

- In April, Allan O’Neil’s article “A closer look at coal-fired generation availability“ was referenced in the report “Delaying coal power exits: A risk we can’t afford” by IEEFA.

- On April 17th, Allan O’Neil’s article “Don’t Forget About FCAS!“ was referenced in a post on the Hachiko Energy blog.

- On April 30th, Linton’s article “About System Frequency” was referenced in a post by Alex Chalmer on the Work in Progress blog.

- On May 3rd, Tristan Edis’ article “Do we have enough gas to wait until nuclear comes along?” was referenced in Allan Kohler’s Intelligent Investor Weekend Briefing.

- In June, my article “Need for speed: How long has each battery project in the NEM taken to deliver?” was referenced in the report “Lessons Learnt and Future Directions from ARENA’s Grid-Forming Battery Portfolio‘ by Ekistica.

- In August, Paul’s article “Operational snags at Bayswater unit 2“ was referenced in the report “Coal Performance in the National Electricity Market” by Nexa Advisory.

- In August, my article “The trend continues: a review of Q2 2025 spot prices“ was referenced in the CEC’s Submission on the ‘Draft Guideline on Community Benefits for Renewable Energy Projects’.

- On October 1st, Paul’s article “Notable forced outage at Yallourn Unit 2 … due to ‘LP turbine issue“ was referenced by Lynton Hoey in Open Electricity’s Monthly Wrap-Up.

- In November, my article “The state-of-charge for 2024: The highs and lows of the big battery boom“ was referenced in the report “South Australia: The Denmark Down Under” by the CEIG.

- On November 27th, my article “Are CIS-ters doin’ it for themselves? Part 4: Policy lessons highlighted by the Nelson Review” was referenced on page 45 of the AEMC’s “2026 Reliability Standard and Setting Review Draft Report“.

- In December, a number of our articles were referenced in the report “The Great Solar Opportunity” by Solstice AI.

Conferences and Presentations

Occasionally, Paul, Linton or myself are invited to present and explain the analysis we publish on WattClarity at various conferences or for organised events. Below is a list of our presentations in 2025, with links to the related analysis we presented:

- In March, Linton and I presented to the Clean Energy Council’s Market, Operations and Grid Directorate about the new FPP scheme and market trends we noticed throughout the previous calendar year.

- In August, I presented at the CSIRO’s South-East Asian System Planning Workshop about the history of utility-scale battery deployment and FCAS participation in the NEM.

- In May, Paul was a panel member at the EUAA National Conference in Melbourne, where, amongst other topics, he discussed demand response in the NEM.

- In September, I presented at the IEEE Australian Universities Power Engineering Conference (AUPEC) about demand forecasting performance in the NEM.

- In October, Paul presented at the NEM Development Conference (NEMDEV) in Brisbane about an eclectic mix of topics, including suggested recommendations for the Nelson Review to consider.

- In November, Linton and I delivered another presentation to the Clean Energy Council’s Market, Operations and Grid Directorate about the success of the Capacity Investment Scheme to date.

Guest Authored Posts

A special shoutout to the following individuals for their guest-authored contributions to WattClarity throughout 2025:

- Warwick Forster

- Oliver Nunn

- Ashleigh Madden

- Allan O’Neil

- Anita Stadler

- Declan Kelly

- David Leitch

- Jack Fox

- Tristan Edis

- Matt Grover

- Josh Boegheim

- Jonathon Dyson

- Ben Nethersole

- Cameron Sheild

- Paul Moore

- Greg Williams

- Carl Daley

- Alice Matthews

- Greg Elkins

- Ellise Janetzki

- Connor James

- David Dixon

- Nadali Mahmoudi

- Anthony Cornelius

Merry Christmas, Happy New Year and all the best for 2026

As 2025 draws to a close, Paul, Linton, the rest of the Global-Roam team and I would like to thank our readers for their ongoing support, and to wish everyone a Merry Christmas and a Happy New Year!

Be the first to comment on "NEM Wrapped 2025: What you might have missed on WattClarity this year"