Early this morning we asked whether with … ‘With heat building, is NSW the one to watch today?’.

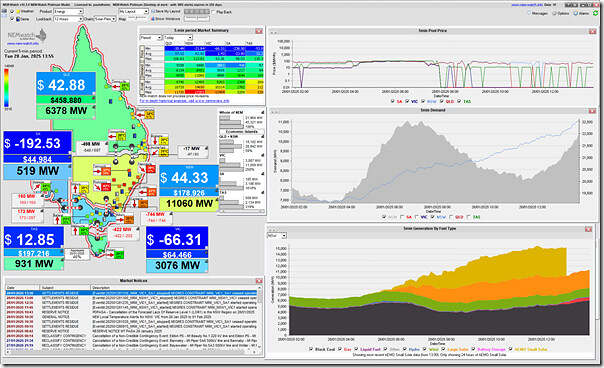

We have been watching, but as shown in this NEMwatch snapshot as at 13:55 (NEM time) today the ‘Market Demand’ has just passed 11,000MW and prices are remaining quite modest:

Note in the image we can see:

1) The VIC1-NSW1 interconnector constrained to flow south, in contrast to the price differential (so accruing negative settlements residues).

2) From a supply resource point of view:

(a) AEMO’s estimates for rooftop PV (noting the caveats about opacity) at about ~5,000MW shortly beforehand* that is keeping a lid on the ‘Market Demand’

… (*) noting that the AEMO’s estimates lag the other dispatch data

(b) From Large Solar, there is a contribution of ~3,000MW

(c) We can also see ~1,500MW of wind production in NSW

3) Taken together, these contributions are keeping prices modest.

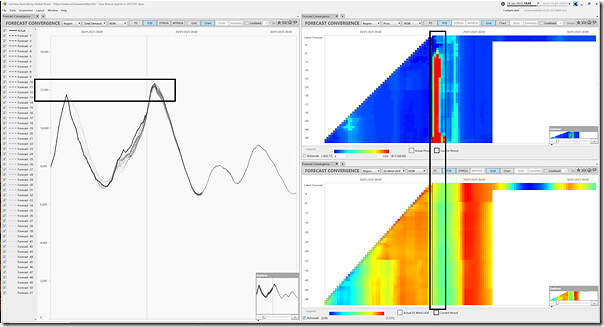

Taking an updated look at AEMO’s P30 predispatch forecasts in the ‘Forecast Convergence’ widget in ez2view at 13:55 we see that the current forecasts are that the next couple hours could be quite subdued:

On a day like today, that’s quite notable.

Be the first to comment on "NSW ‘market demand’ climbing (Tuesday afternoon 28th January 2025) but not to extremes"