A recent AFR article on December 2 2024 brought the initiative to our attention.

The AFR article, linked via the image below, reported that the SA Government is urgently seeking to have the mothballed Snuggery and Port Lincoln diesel power stations reactivated.

The proposal of the SA Government comes in the form of a rule change: South Australian jurisdictional derogation – Interim reliability reserve eligibility.

The change requests that AEMO be allowed to consider two additional plant for IRR in summer. The two additional plant are the Snuggery and Port Lincoln power stations.

IRR means interim reliability reserves. AEMO’s Reliability and Emergency Reserve Trader (RERT) report for Q1 2024 clarifies: “Interim Reliability Reserves are a category of RERT which AEMO may procure for up to three years to address interim reliability exceedances identified in the AEMO Electricity Statement of Opportunities (ESOO) or updates to the ESOO.”

RERT eligibility includes being ‘out of market’

If the derogation is accepted, AEMO will be able to consider these generators eligible for RERT. Owner Engie will then be able to negotiate procurement of these resources with AEMO under the RERT mechanism.

Currently the rules require AEMO to only consider out of market resources for RERT. This is to prevent so called ‘double dipping’ between the wholesale market and this emergency mechanism.

The change is requested because both Snuggery and Port Lincoln were available and last dispatched in the market on 1 July 2024 , so they aren’t eligible, currently. That timing of being mothballed meant the generators don’t meet the criteria for having been out for at least 12 months.

They were mothballed at that time by owner Engie who announced the move earlier in the year.

Motivation

The SA Government, in its request, cites delays to Project Energy Connect are compounding the already identified shortfall identified in AEMO’s 2024 ESOO. In addition to noting fluctuations in ESOO reliability gaps over the years, it also notes the limited pool of out of market reserves it can draw upon for RERT within SA.

It asks for the generators to be considered eligible for the next two years.

Project Energy Connect (PEC)

Taking the motivation of the SA Government, that PEC is critical to SA’s reliability outlook let’s revisit the project’s details.

A deep dive into the background and progress of the project, PEC, was published earlier in 2024 in A tale of two mega-projects: Project Energy Connect and Snowy 2.0 timelines (Part 1).

In short it is a new transmission link from SA to NSW.

Stage 1 of PEC (PEC1) will increase transfer capacity from VIC to SA (and vice versa) by 150 MW. This increase is to be managed in dispatch as a combined flow on the V-SA (Heywood) interconnector. It is linked to VIC rather than NSW because Stage 1 stops at Buronga which then flows to VIC (via Red Cliffs). It is modelled as an increase on the Heywood interconnector as flows at the two points will be managed in tandem.

PEC1 has been undergoing commissioning testing in recent months.

PEC Stage 2 (PEC2) is anticipated to have completed commissioning a while later, in Q4 2027. This extends the transmission into NSW to Wagga Wagga.

The combined flow capability into SA, once PEC2 is complete, across V-SA and PEC interconnectors, is anticipated to be 1300 MW.

A collection of articles relating to PEC, including many observations on commissioning milestones, is available here:

An updated look at firming capacity in SA

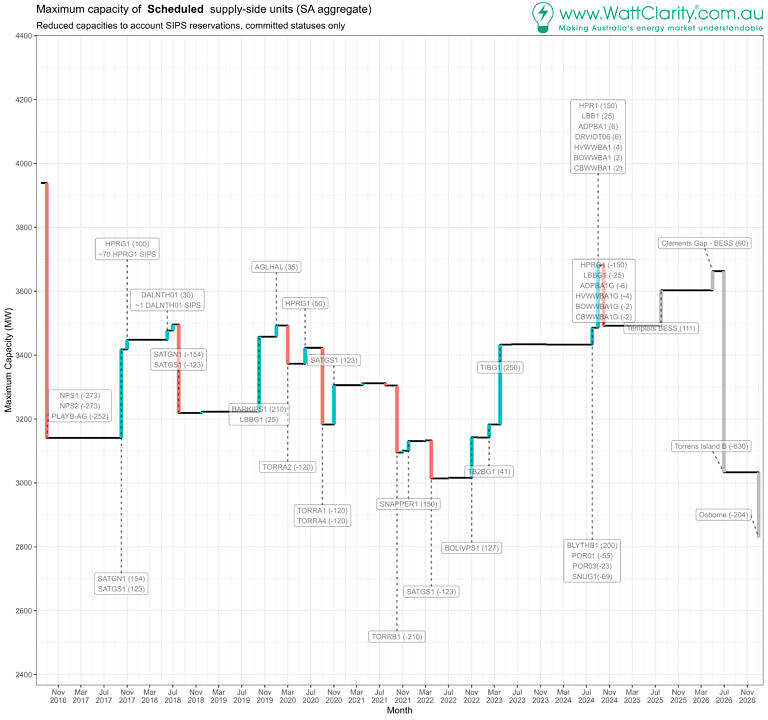

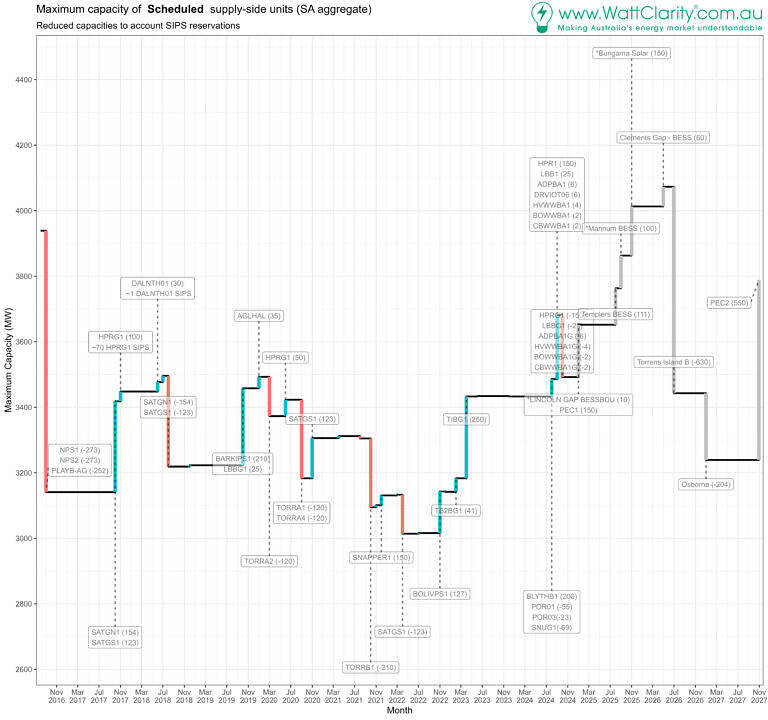

In-market dispatchable (scheduled) capacity is what’s needed to firm renewables in the long-term. To monitor this, we present the changes in max capacity (note the pros and cons of using this parameter) of scheduled supply resources in SA over the past and into the future.

We chart two variations:

- A conservative view of firming capacity to 2027 using only committed scheduled generation projects in SA.

- Optimistic view, including anticipated projects, and including the additional import capability afforded by PEC stages 1 and 2.

Both variants make adjustments (using estimates) to account for capacity reserved for SIPS or SIPS-like programs.

Conservative view: Current SA outlook with ESOO committed generation only

This first chart captures the bare-bones, conservative, view of firming capacity to 2027 using only committed scheduled generation projects in SA (October 2024 Generation Information).

It’s clear that the retirement of Osborne and Torrens Island B put a considerable dent in scheduled supply capacity.

Keen-eyed readers will observe the up-down in September/October 2024 which was the cutover of batteries (as load/gen) to bidirectional units.

Optimistic view: Current SA outlook with ESOO committed and anticipated generation, and PEC

This view suggests that PEC is critical in providing an option for additional power to enter SA. Large BESS units are also visible in contributing to increases capacity in 2025 and 2026.

Risks to PEC flows: There is an acknowledged risk (likelihood) that the loop flows created by PEC2 will contribute to greater potential for accumulation of interregional negative settlements residues, and that would lead to restricting flows on PEC under current management approaches. However, there is a rule change in progress to reform how negative residues around loop flows may be managed. The rule change, when implemented, is anticipated reduce the amount of dispatch clamping that will be required on the interconnectors as part of the normal occurrence of negative settlement residues from the commencement of PEC. Read more about this here. Negative residues may be a topic for a separate article. Yet it seems prudent to anticipate that the full capacity of PEC may not always be available to flow into SA, for this reason but likely others too.

On the above chart, we’ve included the increases to SA import from PEC1&2.

For the chart we set PEC1 to add 150 MW in January 2025, being additional schedulable capacity for supply into SA.

We added an additional 550 MW in 2027 to account for additional capacity with PEC2, representing the difference between the typical Heywood limit of 600MW, plus 150 for PEC1, and the 1300MW combined potential when PEC2 is operational.

Heywood interconnector limits and target flows hit a max of 600MW (V-SA, into SA), so we have used that rather than the notional 650 MW transfer capacity.

“Anticipated” projects are also considered in ESOO modelling for reliability analysis. There is less certainty about the timing of these projects and they are more likely to see delays. But there is still likelihood that they will proceed in some form eventually.

Coverage of the proposal in other media

The move to permit the diesel gensets to be eligible for RERT has been reported elsewhere too. We’ve observed the following:

RenewEconomy: https://reneweconomy.com.au/south-australia-wants-to-bring-back-mothballed-diesel-plants-due-to-lack-of-demand-side-options/

7 News Adelaide: https://x.com/7NewsAdelaide/status/1863477669469540469?t=hbwwX3z2nnFm9ur8uIGkxw&s=09

And as we mentioned earlier, the AFR: https://www.afr.com/companies/energy/south-australia-wants-to-restart-diesel-plants-as-cable-dream-frays-20241129-p5kun1

Leave a comment