Seven days ago (on Thursday morning 23rd May 2024) we wrote ‘Eraring Power Station closure delayed by 2 years (or maybe 4?)’ about the agreement reached to extend the service life at the station.

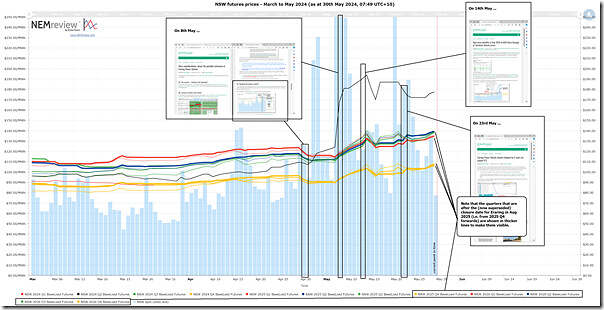

In the days since, I’ve been wondering what impact this decision (whilst strongly rumoured in advance) might have had on the futures market. So I opened up the same NEMreview v7 query that we’ve already used through this quarter in order to take an updated look at recent days:

For those with their own licensed access to the software, they can open their own copy of this trend here.

With respect to the complexity in this trend…

Earlier references

I’ve annotated the chart with a couple references to earlier articles that also looked at the same data to that point, including…

On Wednesday morning 8th May we’d written ‘More considerations, about the possible extension of Eraring Power Station’

… and noted:

‘There certainly does seem to be a drop in all of the 8 x Base Load contracts I have selected that is coincident with the rumours being published at the Guardian, and hence circulated on WattClarity and elsewhere.

However I wonder if this was the only trigger … as we see that Base Load contracts for 2025 Q1 and 2025 Q2 also dropped at the same time?

Given Eraring was always assumed to be available on those quarters, I don’t immediately understand why news of an extension to operation through 2025 Q3 and beyond that would have fed into the futures market (though never say never, as it does trade on sentiment, amongst other things!).’

On Tuesday 14th May we’d written ‘Spot price volatility in May 2024 in NSW flows through to ‘baseload’ futures prices’.

… at this point ‘we clearly see the price jumping up with each burst of spot price volatility …’

On Friday 17th May 2024 we’d written ‘Some yo-yo action in NSW baseload electricity futures’.

… noting ‘This clearly shows the drop in traded price for 2024 Q2 baseload contracts in NSW (and also the future quarters … traders trading on sentiment, as noted before) on Wednesday 15th and Thursday 16th May 2024.’

As noted above, on Thursday morning 23rd May 2024 we wrote ‘Eraring Power Station closure delayed by 2 years (or maybe 4?)’

… but have not had a chance to look further at the futures market until today (7 days later).

So is it any clearer?

In the articles above we’ve written about two factors that (we hypothesize) have flowed through to traded contract prices for quarters beyond 2024 Q2:

Factor 1 = the underlying volatility in the spot price during this period; but also

Factor 2 = the ongoing machinations about what’s going to happen at Eraring

Other Factors = but don’t forget that it’s likely there are other factors as well, playing on the minds of the various traders that drive these outcomes.

Clearly there are other factors at play, because (since the Eraring extension announcement) the contracts for earlier quarters (i.e. when Eraring was going to be operating anyway) have traded much in line with the later quarters (i.e. which now get a boost of having Eraring still available – albeit with possible flow-on effects on delays on other new supply sources).

It is worth noting that the futures price dropped noticeably coincident with rumours in the Guardian that the station would be extended … and yet has mostly risen since the actual announcement of the extension decision.

What is it they say … ‘sell on a rumour, buy on a fact’?

Be the first to comment on "What impact did the extension to Eraring have on traded prices for NSW Futures?"