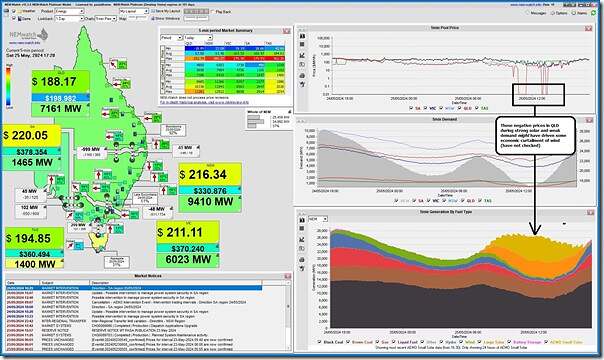

The evolving run of low wind yield in evenings after sunset what was documented on Thursday 23rd May and Friday 24th May has continued into Saturday 25th May (i.e. at least 3rd day in a row), as seen in this NEMwatch snapshot at 17:20 (NEM time):

At this time, the solar yield is pretty much gone and prices are healthy … but yet the aggregate wind yield right across the NEM (though it has ramped up slightly) is just at 500MW.

In other recent articles we’ve cautioned that this low wind might be a result of a combination of factors:

1) Including, of course, low underlying resource for wind;

2) But also including curtailment (for network or economic reasons), as Dan illustrated here with respect to 8th May 2024 in NSW.

How much impact might curtailment be having?

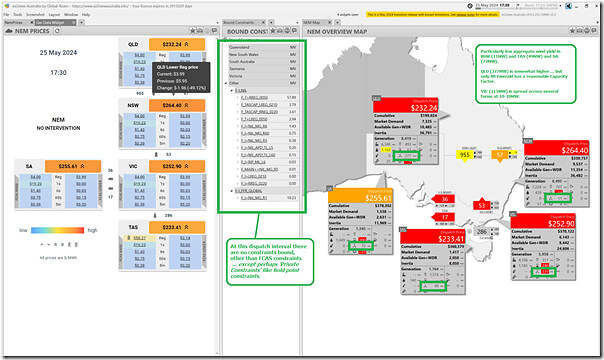

Curiosity got the better of me with particular respect of this evening, so I quickly flipped to this snapshot of ez2view for the 17:30 dispatch interval that provides more context:

With this snapshot we can see that:

1) Unless there’s some ‘Private Constraint’ we can’t see in real time, there is zero ‘network curtailment’ affecting the output of the wind farms

2) Price are healthy in all regions, which suggests also zero ‘economic curtailment’ … though noting that there might have been some in QLD during the middle of the day

3) Which means that the low wind yield this evening is wholly due to low wind conditions (i.e. becalmed across almost the whole of the NEM).

(a) The only bright light across all the wind farms I saw in a brief scan of each region schematic was that of Mt Emerald Wind Farm in far north Queensland, which is running at ~50% capacity factor

(b) But note that (on quick glance) the same does not seem the same for Kaban Wind Farm (is it still in commissioning?) or Kennedy Wind Farm, so would need to look in more detail at local conditions in northern Queensland to understand more…

Ideality meets Reality?

This week’s already been one where it seems, to some extent, that ideality has come crashing into a bit of reality – both with:

Reminder #1) The AEMO’s update to the 2023 ESOO has both:

(a) painted a less rosy picture of the forecast supply-demand balance in the coming couple of years

i. In part because of delays on delivery on a number of different projects

ii. Speaking of which, Colin Packham’s article Friday evening ‘Nearly 20pc of Australia’s most advanced renewable projects have suffered delays in last year‘ in the Australian explores these challenges.

(b) but also included, for the first time (at least in my recollection), included coverage of certain aspects of ‘Keeping the Lights on Services’ such as System Strength services:

i. The inclusion of which should be highly commended (I look forward to seeing more of this in the 2024 ESOO)

ii. But which reminds of other challenges for the accelerated closure of coal.

Reminder #2) This wake-up call from the AEMO then fed into (along with other inputs) the decision to contract for the extension to operations to Eraring Power Station.

Reminder #3) So perhaps we could add this succession of ‘low wind during sunset peak demand times’ as one more reminder that reality’s more complicated than more simplistic models …

How low might the long-range stats be for April and May 2024?!

There’s just under one week left until the end of the month … after which time I’ll be keen to update these long-range stats for wind production to see how low the aggregate levels of production have been through April 2024 and May 2024…

Be the first to comment on "Low wind yield (again!) during sunset … this time Saturday evening 25th May 2024"