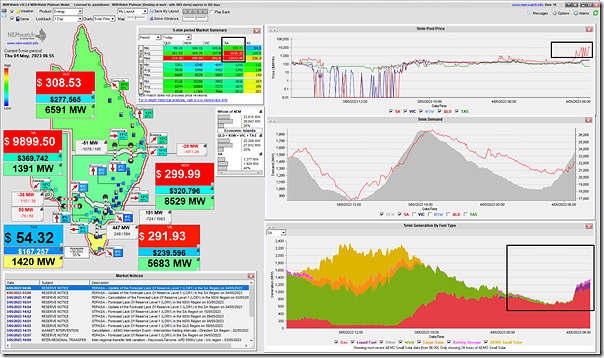

A quick note this morning with a snapshot of NEMwatch at 06:55 with the spot price in SA up towards $10,000/MWh:

My phone has been buzzing intermittently for a number of hours due to the volatility highlighted in the chart at the top.

Nothing further, at this point.

Yesterday afternoon at 3pm wind output across the NEM was 6300MW at 60% capacity factor.

This morning it is 420MW at 4-5% capacity factor.

The situation is even worse in SA with output below 20MW (between 4am and 8:30am) at a capacity factor of less than 1%

This reflects on the lack of wind based generation in NE NSW and more particularly QLD. If QLD had the 6GW+ of wind based generation capacity that it should have by now, then there would be far more consistency in wind based generation output across the NEM as the cold fronts sweep across the country.

Wind generation isn’t a good option for QLD due to it’s higher latitudes.

Maybe SA should build a new coal plant.

Pithy, but unhelpful in my humble opinion.

In progress – another interconnector from SA to NSW

In progress – NSW REZ

Build more wind in QLD, build additional interconnection to NSW possibly – good for the whole NEM as it diversifies away from localised geography.

Why take a state-by-state approach to the NEM which is, ultimately, larger than a single state?

Great reporting: market design flaws AND lack of dispatchable power will lead to an expensive rush for batteries which will fail…dire consequences!

What batteries have failed? Batteries are more reliable than coal or fossil gas generators.

Once the 100GWh pa MegaPack factory comes online in Shanghai we are going to see a significant increase in the storage deployed in Australia, along with lower pricing.

Is this related to recent unavailability of Torrens Island B2 and B4?

A major contributing factor was the lack of transmission capacity between Victoria and SA. Transmission capacity was down by at least 600W, which would have had a major impact on the price.

Price is hardly surprising seeing you got into liquids to keep the lights on. look forward to it as reliance on intermittent generation increases. Unless called up well in advance cold thermal machines won’t get there in time and they won’t be there eventually because their business model is broken and they are all bleeding money because of daytime solar. Little business case for GTs without a capacity market. Then their is the small matter of how do you contract for fuel (gas) when you have no idea when and how much you need. Can be fixed with storage (both electricity for short term and gas for long term) but the punters are going to have to pay at the end of the day. But the experts tell us that renewables are cheaper …..really? This is going to end in tears. Looking at the spot market right now, dare I say the missing 1000MW from Liddell might already be showing up in pricing.