Schools are back today (at least in Queensland), which gave me pause to reflect that my SMS (spot price) alerts have been strangely subdued through summer 2022-23, at least to this point.

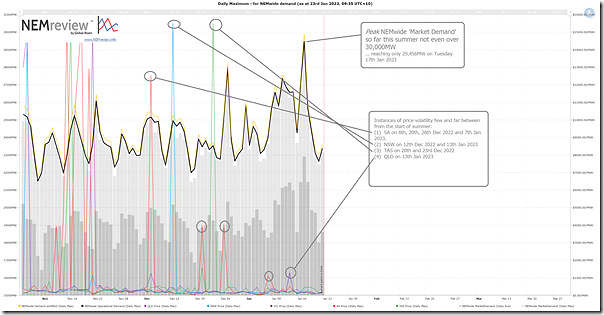

A quick look at this trend of daily extremes for price and NEM-wide demand from NEMreview v7 illustrates this clearly:

We see that:

1) There’s not been a single day where the NEMwide ‘Market Demand’ as peaked above 30,000MW (at least thus far) …

… it’s been many years since we’ve given away a BBQ for the ‘Best Demand Forecaster in the NEM’, but (when we compare to the demand profiles of yesteryear) this is remarkable in its own right.

2) This would be one of the reasons why prices have been subdued (only 3 days when any spot price has spiked above $10,000/MWh, and even on those days not for long).

Let’s see what unfolds for the rest of summer

Imagine a summer where green hydrogen vessels are lined up at east coast ports and electrolysers need to operate all day every day to supply the export green hydrogen. Politicians are speaking as though this will be Australia’s reality pre-2030. Add to this demand from EVs and desalination plants and what will be the NEM peak demand? How much pumped hydro and batteries will be operating pre-2030? The alerts may be coming in thick and fast and not just in summer months.

Much of the green hydrogen and related products are likely to be off grid. That is even if they are partly connected to the NEM, the bulk of the energy will generated and consumed outside of the NEM. I notice that the QLD owned transmission companies have been trying to at least obtain a small cut of this potentially large pie. I expect that we may see private transmission lines in a few locations to avoid some of the costs and regulation related to the NEM.