Last October, the Wholesale Demand Response Mechanism (WDRM) was introduced into the NEM to allow large industrial energy users (or aggregations of energy users) to bid a reduction of their demand directly into the market, a term coined as ‘Negawatts’.

I was interested to examine how far WDR has come since that time, and whether the units registered under the mechanism are helping to alleviate supply-demand tightness during extreme events like last night.

Demand Response

Demand Response (DR) is a broad term used to refer to temporary changes in electricity consumption by energy users, particularly large industrial energy users, in response to a commercial incentive e.g. lower electricity costs.

There are a few different broad types of demand response that we see in the NEM, some of which are listed below

- Wholesale: directly into the market through the WDRM

- Non-wholesale: through a retailer or by other private arrangements

- Emergency: eg. the RERT – an acronym that you might hear pop-up during events like last night

- Ancillary Services: directly or indirectly into the FCAS markets to help manage frequency

What role did WDR play last night?

Based on data from NEMreview, four WDR units were dispatched at some point last night, hitting an aggregate peak of 17MW at around 7:00PM. From my quick maths, I estimate that they contributed a total of ~44 MWh of energy reduction throughout the evening.

All of the WDR was dispatched in NSW and VIC. There are currently no units registered for wholesale demand response in QLD, which also hit tight supply levels.

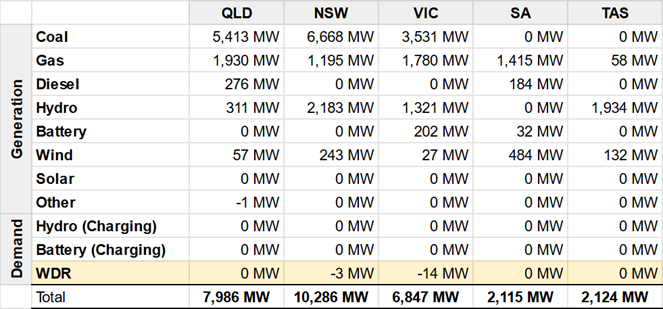

A snapshot of the generation and demand-side output in the NEM by type at the 19:00 dispatch interval last night. Source: NEMreview

How much WDR capacity is there in the market?

There are currently 12 units registered for WDR with the AEMO as of today. That’s up from 3 that were registered in my last update in December. Collectively, these 12 units have a total maximum capacity of 59MW.

Enel X – a subsidiary of the Italian energy giant Enel – is the participant registered for all of these units. Formerly known as EnerNOC, they were one of the main advocates for the introduction of the WDRM.

It would seem that we are still some way from the AEMC’s goal of allowing “meaningful volumes of demand-side participation in dispatch and associated system operation benefits at minimal cost and in the near term” which was stated in their final determination of the rule change in June 2020.

Considering that earlier in the day the AEMO forecasted a 623MW capacity reserve shortfall in NSW – and while we can’t expect WDR to shoulder all of this lack of reserve – perhaps this provides a perspective from which we can view 17MW and think about what we should define as a ‘meaningful’ contribution.

As consumer advocate we are keen to see network tariff reform include more emphasis on load controlled tariffs. Around 900 MW in Queensland but it could be more.