At 16:30 today the AEMO published this ‘Update: AEMO outlines pathway for ending market suspension’.

Given the keen level of interest, I thought it would be worth copying in here directly:

‘AEMO can confirm the current outlook indicates sufficient electricity reserves for this evening, but conditions remain dynamic, requiring AEMO to manually direct generators to be available to meet consumers’ energy needs.

AEMO held a briefing with industry today outlining the assessment criteria and staged process needed to resume normal spot market operation in the National Electricity Market (NEM).

These criteria will provide indicators of the operability of the market under normal dispatch and pricing rules, to give AEMO sufficient confidence that it can end the market suspension with minimal risk of the same conditions re-emerging in the very short term.

After a series of checks and validations have been completed, AEMO’s next step will be to move to a period of monitoring normal dispatch pricing within the suspension period, after advance notice to has been issued to the market.

AEMO anticipates monitoring will continue for at least 24 hours from then and, if AEMO is confident the criteria are being met, the next step is to formally remove the market suspension and resume normal operation under the market rules. Again, notice will be provided to the market.

Irrespective of market operations, underlying factors mean there may continue to be challenges managing supply and demand, and AEMO continues to monitor reserve conditions across all NEM regions.’

Unfortunately I was not on the industry briefing today, so can’t speak directly about either the ‘assessment criteria’ or ‘staged process’ that the AEMO spoke about … but will look forward to hearing more.

From what’s written above, the last line is probably the most important one:

1) indicating ongoing tight supply-demand balance

2) i.e. we’re not out of the woods yet … especially in terms of the broader ‘2022 Energy Crisis’

3) in which case these measures we’re taking to provide greater visibility of LOR conditions will be quite useful to ez2view licensees … and a wide range of other WattClarity® readers as well!

We’ll post more when we know more.

—

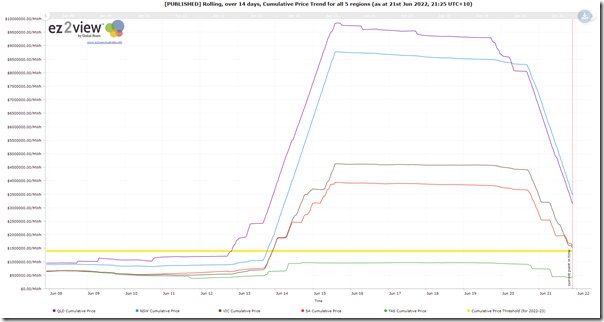

Taking another look at our dashboard of the last 4 days with the Cumulative Price for each region, we see that levels have been dropping sharply as the rapid roll-up in spot prices from beyond 7 days ago are starting to roll off… we see SA and VIC are now almost back to the CPT, with NSW and QLD also ramping down.

It will take another day-or-so for all regions to fall below the Cumulative Price Threshold (which steps up somewhat for the 2022-23 financial year).

Here’s a view of the current situation this evening (Tuesday 21st June):

However that would clearly only be the first milestone to reach before ending the suspension … it would seem logical to me that AEMO would need to be confident beyond this point to lift the Market Suspension …. and again assuming that this was discussed further in the briefing I missed earlier today

In terms of having confidence, it seems that there’d be basically two choices:

| Option 1 Raising the Administered Price Cap (at least temporarily) |

Option 2 Having confidence that the Cumulative Price Threshold won’t be reached |

|---|---|

|

One root cause (nothing that there were probably others, including some potentially more significant) of the mess we’re in that led to suspension was that the Administered Price Cap has not change for many years … indeed perhaps not since the start of the NEM 23 years ago. In recent times with the escalation of spot prices for export-exposed coal and gas, this would seem to be a major hurdle … given the SRMC of plant using this fuel may well be in excess of the currently set price for the APC ($300/MWh). It might* be possible that the Reliability Panel pass some interim ruling that the Administered Price Cap be temporarily moved higher in reflection of the upwards pressure on SRMC for a significant number of plant. * noting that I have no specific knowledge of the National Electricity Rules in this respect. If this were done, there would probably be flow on requirements … such as the need to look at those who had hedged on the basis of a $300/MWh Administered Price Cap … so it may well turn out to be a big can-of-worms. However I have heard next-to-no discussion on this front, so it would seem this option is a moot point at this stage anyway. |

Assuming the APC does not move, then it would seem necessary that the AEMO would need to have confidence that the Cumulative Price would not just bounce back up again past the Cumulative Price Threshold in the days/weeks immediately following the cessation of Suspension. Were this to happen, we’d just be back in the same mess (only worse, given the broader additional energy sector (and especially energy user) goodwill that would have been burnt). So I assume that this would be what the AEMO would have been speaking about in terms of its ‘assessment criteria’ and ‘staged process’ … but have no specific knowledge of the AEMO’s view: 1) Clearly having some plant on outage return to service would be a necessary prerequisite; 2) But would not seem to be enough, in its own right … given the current immediate issues seem more related to Energy rather than Capacity: (a) Something to reflect on in relation to the call for submissions (due Mon 25th July) on the high-level design for a Capacity Mechanism. (b) In terms of the here-and-now, how would the AEMO ascertain that key participants had enough Energy Stored? Are we all going to be counting coal trains and GJ in coal stockpiles? (c) More food for thought, in terms of ‘The Rise of Just-in-Time’ as we advance towards the energy sector of the future. This has a while to play out… |

More about this later…

PS … might be worth keeping an eye on whatever comments emerge on this related update on LinkedIn here.

Leave a comment