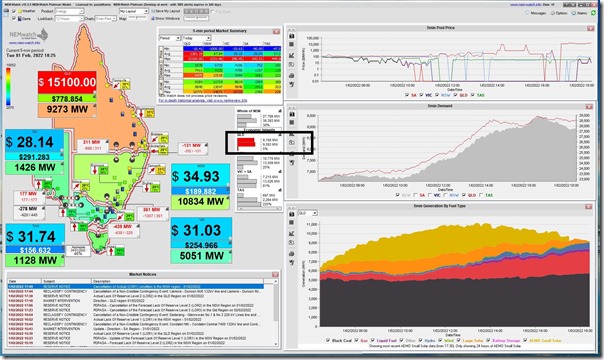

Hold onto your hats… as solar fades out completely this evening, the Instantaneous Reserve Plant Margin (IRPM) has dropped to a measly 5% for the QLD ‘Economic Island’, as shown in the snapshot here from NEMwatch at 18:30:

In the numbers highlighted in the grid, we have:

1) Aggregate Available Generation capacity in the QLD region (any fuel type at any price) of 9,593MW…

2) …. which is supplying net ‘Market Demand’ of 9,108MW ….

(a) … which is the 9,273MW shown for the QLD region ‘Market Demand’

(b) less the 180MW net contribution from NSW over the QNI interconnector (i.e. minus the export to NSW from QLD over DLINK).

3) That leaves 485MW of spare capacity in QLD at any price

4) Which equates to the measly 5.3% Instantaneous Reserve Plant Margin.

…. and remember that this might be after the effect of the Reserve Trader, which has already been triggered, has been taken into account.

We don’t know yet the specifics of what was triggered, but it seems likely that the effect of Reserve Trader will already have been taken account of in a lower demand number (if it’s a demand side curtailment, for instance).

Yikes!

Why is direct link sending energy into NSW? Sometimes these constraints create what appear to be very strange outcomes.

https://nemweb.com.au/Reports/Current/Market_Notice/NEMITWEB1_MKTNOTICE_20220201.R94395

An Actual LOR2 condition has been declared under clause 4.8.4(b) of the National Electricity Rules for the QLD region from 1700 hrs.

The forecast capacity reserve requirement is 443 MW.

The minimum capacity reserve available is 77 MW.