Does the deployment of increasingly high shares variable renewable energy generation characterised by zero short-run marginal costs of production require electricity markets to be rethought and redesigned? If so, to what extent, and how?

In September, I chaired a webinar as part of the ‘ESIG Down Under’ conference on Designing the Energy Markets of the Future with an expert panel from Australia and the U.S. During the session (the recording is available here), I asked the audience a question to gauge perceptions about our National Electricity Market (NEM) design, as follows.

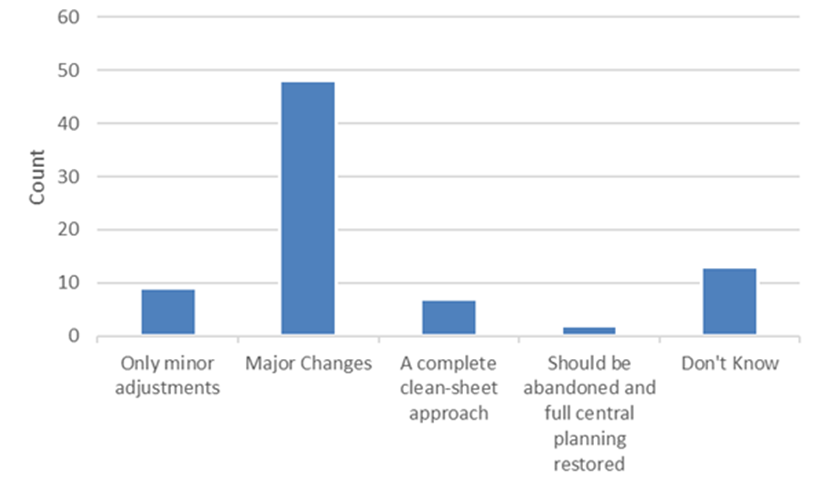

Which statement would you most closely agree with?

Australia’s current market design of the NEM needs…

Although not a scientific survey, the instant poll results are interesting. Of those who answered, a majority indicated that they think major changes are needed to the design of the NEM. Most favour building on or modifying the design we currently have. Only a small minority were of the view that “a complete clean-sheet approach” is needed. Another small minority were of the view that “only minor adjustments” are needed.

Only one or two people in the audience were of the view that Australia’s electricity market should be abandoned, and full central planning restored. I found this interesting because in November 2016, I asked an audience in the energy stream of the Engineers Australia conference to “raise your hand if you believe Australia would be better off returning to centrally-planning our electricity systems, as we did before the 1990s?” I was astonished when a clear majority of those in the room raised their hand.

The Energy Systems Integration Group (ESIG), which began in North America and now has members in Europe and other regions, was founded by and for technical experts interested in exchanging knowledge on the challenges of integrating renewable energy (originally wind power) within electricity grids. ESIG has a growing membership in Australia, and the level and rate of renewable energy deployment in Australia is of international interest.

Some supporters of renewable energy have argued that electricity market designs will need to be changed to accommodate renewable energy. Others are of the view that an electricity market should be technology neutral, designed neither to encourage nor to discourage any type of energy source or technology, whether practically or as a matter of principle.

Yet, different types of generation have very different technical and economic characteristics. In a grid they may interact with each other in ways that are complementary, coordinated, cohesive, and constructively competitive; or they may conflict and create challenges for each other, or for consumers and the system as a whole.

In a policy paper in 2017, I made the case for offering consumers price-differentiated retail electricity service products with various combinations of reliability and sustainability “…that would require minimal design changes to create the next generation electricity market.”

In 1983, at the dawn of the era of the liberalisation, reform, restructuring and deregulation of the electricity industry, and long before wind and solar power generation were deployed in electricity systems, Professors Paul Joskow and Dick Schmalensee at MIT wrote that ‘…we find it hard to imagine that base-load power plants anything like those we see today would be constructed in the face of the extraordinary additional opportunism risks inherent in a regime permitting only spot market sales.’ In a June 2019 interview with the authors about that book, Prof Schmalensee said: ‘If you look at that book, it says we need intelligent decisions about the capacity mix and long-term contracts to enable financing. Here we are.’

In an ‘in my view’ piece in the Jan/Feb 2019 issue of the IEEE power and energy magazine Professor Bill Hogan from Harvard University made more or less the opposite case. He described the ‘…argument … that zero-variable-cost supply will produce low spot prices that could never support efficient investment.’ Then, duly acknowledging that ‘[t]he defects in practical short term markets are not minor issues that can be ignored’, Hogan argued from the economics of scarcity pricing to conclude: ‘But a comprehensive rethinking of the market design is not required.’

‘The Market’ means different timescales

In introducing the panel discussion, I asked panelists and the audience two questions:

What do we mean by “market design”? and

What do we mean by “electricity markets”? —emphasising the plural.

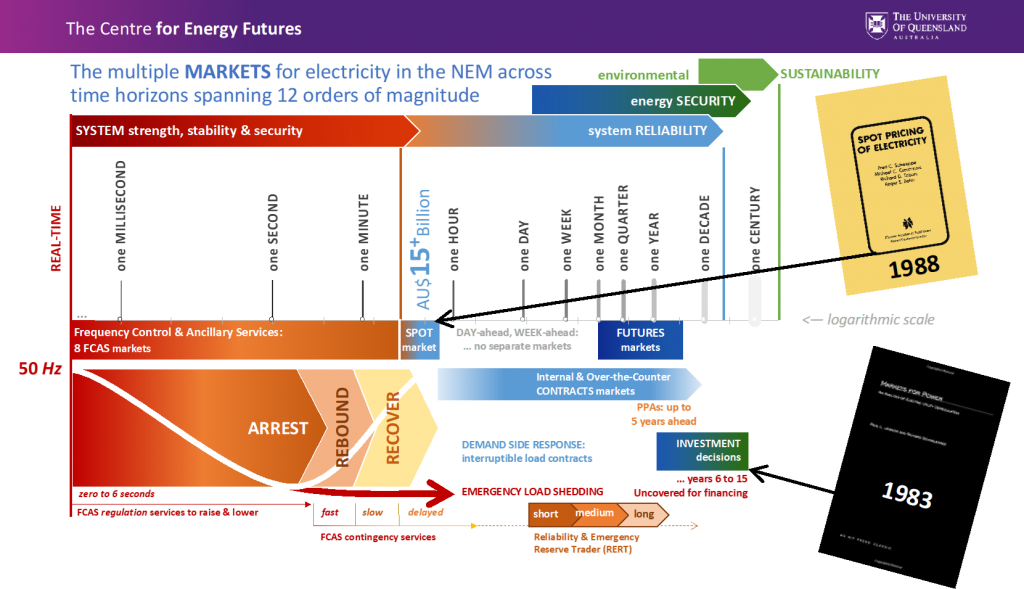

To provide some structure for the discussion, I shared a schematic diagram that I have found helpful both as a framework for my own thinking, and to refer to in conversations.

The diagram uses a log scale that spans from a century in the future back to real time, representing continuously scrolling time horizons that span twelve orders of magnitude: a trillion-fold difference. When people talk about electricity markets, they are usually thinking about only part of this scale, a few orders of magnitude, not the entire time frame. Journal papers on generator unit commitment for example, talk about two weeks as ‘long-term.’ For papers on emissions and environmental sustainability, a year is the very short term. The full business development cycle for new power generation can easily take five to ten years.

Many different types of computer models are used to understand what is happening and what would happen in a power system under various conditions. Even in 2020, we still do not have the computing power and capability to build one model that can look across the entire time horizon from real time to many decades.

At least three different models are required to gain a reasonable picture, and it is not yet practical or possible to ‘soft-link’ those models. That is before considering things like the coupling between electricity and gas (or hydrogen) and the complex feedbacks between energy, the economy, and the environment. I have heard of utility companies in the U.S. using as many as six or seven separate models to support decision-making. Bethany Frew from the National Renewable Energy Laboratory (NREL) in Colorado presented on work underway to develop a new suite of models that link electricity market outcomes with investment.

The time horizon diagram above is presented from an operational point of view: looking forward in time. System operators, market operators, power plant operators, plant owners, and investors are forward-looking. If we were to arrange those parties on our time scale, they would appear in the order just mentioned, from left-to-right.

From a planner’s point of view, the time scale appears as a mirror image. If you lift your finger and flick a switch on now, there is a 99.998% probability that your light—or your large industrial motor—will be energised. That is because of a long chain of historical decisions and actions, in a mirror image of the chart above that stretches back a century and more to Faraday, Maxwell and Einstein; Tesla, Edison and Westinghouse; Monash, Hudson and Schweppe, and countless others in a chain of technology, resource and project development, investments, industry standards, legislation, regulation and market design.

Close to real time, we are concerned about the strength, stability and security of the AC power system. Looking further ahead we are concerned about power system reliability and energy security more generally. Environmental sustainability is a longer-term issue.

An energy spot market is in the middle of our log scale and at the core of many market designs, including Eastern Australia’s National Electricity Market of five interconnected regions, which we call the NEM. The spot market design problem was solved by Professor Schweppe and colleagues at MIT in the 1980s. The link below to Professor Hogan’s viewpoint article extends that thinking from marginal cost pricing to scarcity and abundance pricing.

Our spot market exists in a daily cycle of bids managed by AEMO for the 5-minute to half-hour time windows. More than AU$15 Billion churns through that market each year for about 200 million MWh of energy.

In the WattClarity Glossary, there are a collection of articles that help explain how dispatch works, and prices are set in the NEM which have been useful for many.

.

Futures markets—on financial exchanges separate from AEMO—exist in the monthly, quarterly and yearly windows. In Australia’s NEM we don’t have separate day-ahead or week-ahead markets. Internal contracts between the generation and retail arms of companies and Over-the-Counter (OTC) contracts markets perhaps bridge that interval.

Investment decisions need to look ahead a decade or three. Investors are increasingly—but not exclusively—interested in environmental sustainability. A very important topic for market design is price signals for investment, as Joskow and Schmalensee discussed in an MIT podcast interview in 2019 about their 1983 book.

For client research in 2017, we interviewed bankers from almost every major Australian, Asian, American and European bank with a presence in Australia for financing the energy and infrastructure sectors. Every banker we spoke with, under the Chatham House Rule, described in their own words, a recent reality that one succinctly summarised as follows: “No-one can produce a bankable price forecast of the Australian electricity market today.” In many cases the point was made before we had a chance to ask the corresponding question.

Financing requires full coverage with Power Purchase Agreements (PPAs) with creditworthy off-takers. Years 6 to 15 are uncovered at the time of the initial financing. These are non-trivial issues for market design.

The thing that makes electricity markets very different from any other market is that “…electrical current…must be produced, to the millisecond, at the moment of consumption, giving an exact balance between power supply and demand. Stable power grids are based on this principle” as Ziegler and his co-authors put it.

When the system frequency diverges from 50 Hertz, it needs to be arrested, then rebound and recover. AEMO achieves this with eight Frequency Control and Ancillary Services or FCAS markets, known as:

1) Regulation services,

2) plus fast, slow and delayed Contingency services.

These FCAS services were described by another guest author (and ESIG Down Under Moderator), Jonathon Dyson, on 23rd March 2017 in ‘Let’s talk about FCAS’ – an article that continues to be widely read amongst the WattClarity readership.

.

As AEMO has explained, system strength is important to be able to maintain “…normal power system operation, for the power systems dynamic response during a disturbance, as well as for returning the power system to stable operating conditions.” While AEMO operates eight FCAS markets in parallel with the main energy spot market, and generation owners can arbitrage their bids and offers between all of those markets, there are not markets at present for system strength, or inertia. During the webinar, Julian Eggleston from AEMC indicated that it is not yet clear at this time whether it is possible to define system strength in a way that would enable a market in system strength to be designed.

On longer horizons, AEMO can use the Reliability and Emergency Reserve Trader (RERT) function “…to take all reasonable actions to ensure reliability of supply by negotiating and entering into contracts to secure the availability of reserves under reserve contracts” as the AEMC’s 2019 Guidelines explain.

Those contracts are deployed when the supply side of the market and demand-side response including interruptible load contracts are insufficient to ensure system reliability.

The last ditch is emergency load shedding or ‘blackouts’ when the system cannot rebound or recover—dropping part of the load on a system to try to avoid losing all load in a ‘system black event.’ Such events may suggest a market design that is not functioning well.

Transmission and distribution networks must not be forgotten in discussions about balancing electricity generation and demand from milliseconds to decades. Networks are regulated, not assets exposed to competition, but they enable energy and FCAS markets, as designed. Networks account for a significant proportion of the value chain as expressed in retail prices. In the webinar, Ezra Beeman from Energeia made the case for unbundling network tariff design reflect costs and be indifferent between centralised and distributed energy resources.

The electricity market design debate is re-energised, has serious heavyweights on various sides, and seems far from resolved. Solutions are needed that work across all time horizons.

This article follows on from the Designing the Energy Markets of the Future expert panel session that Stephen facilitated in September as part of the ESIG Down Under webinar series, organised by the Energy Systems Integration Group and supported by AEMO. A recording of that session, information on the panelists and other events from the series are available at www.esig.energy/event/esig-down-under/

References and suggested further reading

AEMC (2019) Reliability Panel, Reliability and Emergency Reserve Trader Guidelines, Final guidelines, 25 July

AEMO (2020) System strength in the NEM explained, March

William W. Hogan, ‘Market design practices: which ones are best?’ IEEE Power and Energy Magazine, Jan/Feb 2019 https://ieeexplore.ieee.org/document/8606530

Paul L Joskow and Richard Schmalensee (1983) Markets for Power—An Analysis of Electric Utility Deregulation, MIT Press

Francis O ‘Sullivan, ‘Electricity Markets,’ MIT Energy Initiative podcast episode #14, June 2019, http://energy.mit.edu/podcast/electricity-markets/

Fred C. Schweppe, Micahel C. Caramanis, Richard D. Tabors, Roger E. Bohn (1988) Spot Pricing of Electricity, Kluwer

Stephen Wilson (2017) How to reform the electricity market before we reach the top of a cliff, EPIA Public Policy Paper 1/2017, Sydney

Ziegler, et al (2017) A Compendium for a sensible energy policy, Bundesinitiative Vernunftkraft, November, Berlin

www.esig.energy/about/history/

About our Guest Author

|

Stephen Wilson is a Professor at the University Queensland where he leads the Centre for Energy Futures in the School of Mechanical and Mining Engineering, and teaches Energy Markets, Law and Policy and Professional Practice in the Business Environment. |

Hedging for purchasers has historically meant protection against high prices.

Now the hedged purchaser is in the unfortunate position of being exposed to very low prices, which costs them more, under a CfD.

Is it possible to hedge against both high and low prices at the same time, or has the combination of rampant growth in rooftop PV, uncontrolled semi-scheduled generation, and manipulated CfD purchasers broken the market for good?

And yet bankable forecasts are made all the time and banks accept some forecast when lending money. Noone can produce bankable forecasts of the oil price, or of share prices. And yet there is a market for such forecasts because the paradigm for valuation requires a forecast of future cash flows. This is not news.

Its also always helpful when looking at surveys to know the sample size.

And finally like management people don’t know what they want or what is need until they see it. . No-one knew they needed a smart phone until they saw one.

Equally there is quite the challenge in designing rules when the technology is changing very quickly. My own view is that the distinction between market facing and regulated business may be more harmful than helpful going forward and that least cost is not always the same as best. Many of us drive cars that are not least cost. How do you incentivise technology lead investment when volumes are declining and still give consumers least cost? It can’t be done. Anyhow enough rabbiting on on Friday afternoon.

It can be done:

– by having market rules that do not favour any particular technology

– by having market rules that ensure all participants provide the same product

– getting market distorting subsidies out of the picture

– getting non-market government investment out of the picture eg offtakes forcing RE into a saturated market

– by removing the spectre of a carbon price

– by allowing all possible technology to enter the market

– by limiting hedging to a portion of the generator’s capacity

– by enforcing the intent of the National Electricity Obligation at all levels of bureaucracy

– by eliminating central planning for transmission ie remove AEMO from its central planning role

– removing the ESB