Two years ago I did warn about a ‘crunch coming – oversupply in northern Queensland?’ … but did not expect it to surface as dramatically as it did yesterday, with this price spike to $15,000/MWh in the 09:45 dispatch interval in conjunction with the sudden 600MW drop in output across 10 solar farms.

That article led to a bit of discussion later on Tuesday on LinkedIn (various places including here) and also some speculation on Twitter (such as here).

Thankfully, we have access to a broader data set with which to explore further and understand what happens, such as:

Additional Data #1) This includes data from the AEMO in the MMS which was ‘private’ in real time … so not visible yesterday to us, but now visible. I will get into this as the 3rd part of this case study.

Additional Data #2) In real time, we also did have access to a ‘Qdata’ set from Powerlink which we update for some of our clients and make visible in our ez2view software, in particular:

2a) Near real-time intra-regional transmission flows, such as those shown in the ez2view snapshot shown here in Part 1 of this Case Study.

2b) In addition, we also receive (and feed through to clients with a subscription) live zonal consumption data for 11 zones that Powerlink use to describe the structure of the QLD grid.

Because of time constraints and other commitments, I’ll need to do this in parts, so am calling this article ‘Part 2’ to follow on from yesterday’s ‘Part 1’. There will be other parts to follow…

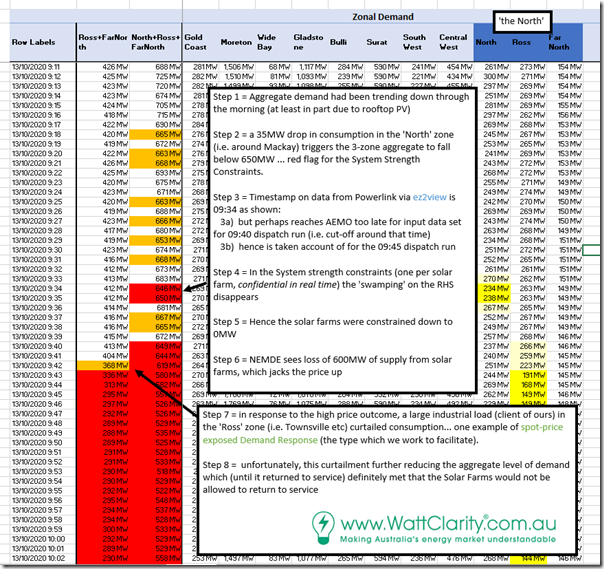

In this short article, I just wanted to flag this table of data from these 1-minute snapshots of zonal consumption for the 11 zones that Powerlink uses to define the Queensland region. Pay particular attention to the three highlighted zones that together constitute ‘the North’ (spoken in true Westerosi reflecting the ambivalence people in northern QLD feel for those in southern QLD).

In particular (with respect to the System Strength constraints) it is the aggregate consumption dropping below 650MW (for 3 zones) and/or 350MW (for the top 2 zones) that triggers the bite in the System Strength constraint (i.e. by the disappearance of the ‘swamping’ component):

As noted in the image, my hypothesis about the sequence of events yesterday is currently as follows:

———————-

Step 0 = The constraint set ‘Q-BCNE_821’ has been active from 6th October because of an outage of line 821 (i.e. the 275kV feeder from H10 Bouldercombe (i.e. near Rocky in Central-West) to H11 Nebo (i.e. near Mackay in North).

More on this later, but this particular outage means that different (i.e. stronger) constraint equations are being used to limit the output of the Solar Farms under certain conditions … which we saw unfold yesterday.

Note that this constraint set is scheduled to remain invoked (i.e. the AEMO fancy term for ‘in use’) until the end of the day Friday 16th October…. so what we saw Tuesday might re-occur!

Step 1 = Aggregate demand had been trending down through the morning (at least in part due to rooftop PV). As a result of this reduction, both aggregate columns were very close to alert levels.

Step 2 = a 35MW drop in consumption in the ‘North’ zone (i.e. around Mackay) triggers the 3-zone aggregate to fall below 650MW:

2a) This was a red flag for the System Strength Constraints.

2b) The reason for the drop in consumption in the ‘North’ zone is unknown. Perhaps some drop in consumption at one of the mine sites that are counted as part of the zone?

Step 3 = Timestamp on data from Powerlink via ez2view is 09:34 as shown:

3a) but perhaps reaches AEMO too late for input data set for 09:40 dispatch run (i.e. cut-off around that time)

3b) hence is taken account of for the 09:45 dispatch run

Step 4 = In the System strength constraints (one per solar farm, confidential in real time) the ‘swamping’ on the RHS disappears

Step 5 = Hence the solar farms were constrained down to 0MW

Step 6 = NEMDE sees loss of 600MW of available supply from solar farms as an input into the dispatch process for the 09:45 dispatch interval (calculated at 09:40), which jacks the price up to the Market Price Cap.

Step 7 = in response to the high price outcome, a large industrial load (client of ours) in the ‘Ross’ zone (i.e. Townsville etc) curtailed consumption… one example of spot-price exposed Demand Response (the type which we work to facilitate).

Step 8 = unfortunately, this curtailment further reducing the aggregate level of demand which (until it returned to service) definitely meant that the Solar Farms would not be allowed to return to service.

———————-

Happy to be corrected, if any of the above is incorrect?

If AEMO’s logic hasn’t yet linked their own constraints to their dispatch engine, it probably should. A bit like that time QLD islanded and AEMO were dispatching QLD generators against a NSW frequency…

The insight on flexible load reacting to high prices and exacerbating a system strength problem is a curly one. Some loads also contribute inertia and fault current.

It would be a shame to be trying to save money by reducing load, and being penalised more under user-pays than was saved.

Interesting choice of title for the post Paul – a backhander at the “PV saved the day” stuff sometimes seen on other sites?

In reality it seems that a less drastic formulation of the relevant system strength constraints could avoid this sort of disruptive dispatch outcome. I doubt that the underlying physics of the network is quantized.

Allan

It would seem that more graduated constraint would have been better. This would have resulted in a more gradual transfer of the generation. It would likely have resulted in a small increase in the price, without the massive spike.

This time the overly risk adverse constraints almost caused network instability.

So now that the full picture is available, can we agree that yesterday’s Wattclarity article headline referencing “many Large Solar Farms tripping” was entirely misleading, inaccurate, and unhelpful? Turns out no so solar farms ‘tripped’, rather they were doing exactly what they were supposed to: following their AEMO issued dispatch targets.

With all the commentary about energy transition “villans” on this website… it would seem Wattclarity fell into its own trap yesterday. I would think an apology or correction is in order.

Trial run for when a big storm comes over.

At least the solar farms weren’t off target, but this seems like a perverse market outcome where bidding high can lock your competitor out of the market (and would become worse with widespread price-sensitive demand response).