A short article today which might be of interest to some readers.

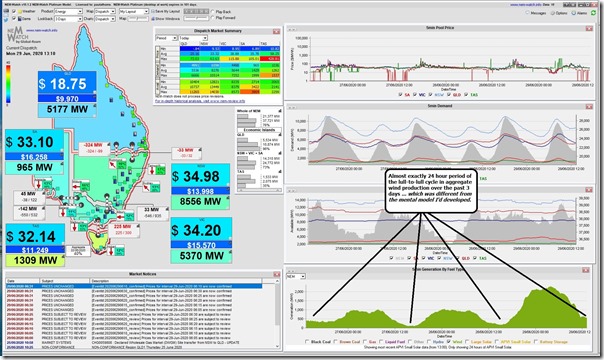

I’d been noticing what seemed to be a cycle in aggregate wind production in recent days which (at almost exactly 24 hours between peaks, or lulls) did not match with the mental model I’d developed subconsciously (i.e. which was that the period of the cycle was typically longer – roughly 3 days or so).

Here’s a view of what’s been happening over the past 3 days courtesy of our NEMwatch v10 entry-level dashboard:

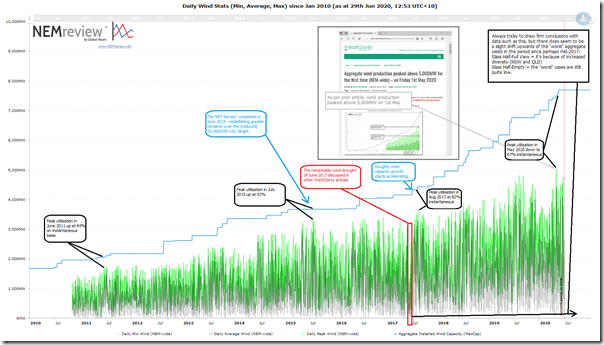

Taking a short break from other things, I quickly produced the following chart of daily extremes of aggregate wind output across the NEM since data first began to be published in 2010 – using this trend query in NEMreview v7:

I’ve annotated with a few points I found of interest:

Observation #1) There’s been a noticeable acceleration in growth of capacity being registered with AEMO (the blue line showing aggregate Maximum Capacity). This seems to start roughly 2 years after the ‘RET Review’ (i.e. the Warburton version) was completed.

Observation #2) In parallel with this accelerated growth in installed capacity, the growth in output did not lift as markedly. Hence there is a widening gap between peak output and installed capacity:

2a) To pinpoint some examples, we see peak utilisations for very windy dispatch intervals drop from 80-90% in earlier years down to only 67% instantaneous on this day in May 2020 where aggregate wind output peaked over 5,000MW.

2b) This is presumably due to a number of different factors including:

Factor 1) There’s been problems with commissioning that has delayed operations at many wind farms – leading to a lag between MW being seen in Maximum Capacity and MW being seen in output.

Factor 2) There’s also been an increasing incidence where simplistic spreadsheet models used to approve wind farm projects bump up against increasingly complex real-world realities of operating in the NEM, leading to lower than anticipated utilisation. These have been occurring in scenarios including:

Scenario 2a) Negative prices due to the ‘wind correlation penalty’, and hence wind farms curtailing at times of negative prices (thankfully most often not in in the way that’s concerning the AER);

Scenario 2b) Constraints, and particularly the ‘System Strength’ constraints affecting South Australian generators – and Mt Emerald Wind Farm in northern QLD – and soon to be the Tassie wind farms as well, etc…

Scenario 2c) The realities of operating through tricky periods like the two weeks in February 2020 where the wind farms lost money in generation due to high FCAS costs.

Factor 3) There’s also a likely effect of increased diversity of wind farm operations with the introduction of Mt Emerald & Coopers Gap in QLD and wind farms in northern NSW.

… would need a lot more detailed analysis to understand the relative contribution of these 3 (and other) factors.

Observation #3) Presumably because of the introduction of more diversity of sources, we see the ‘worst’ dispatch intervals, in aggregate terms, are less likely to be at ‘rock bottom’ levels

3a) As noted in the article, the ‘glass half-full’ view might be that this means fewer times where the aggregate output is very low;

3b) Whereas the ‘glass half-empty’ view is that there are still occasions where aggregate output is still quite low – hence the low statistical System Reliability benefit that ensues:

(i) e.g. a low of only 76MW on 19th April and 87MW on 11th June 2020

(ii) This is not a surprise to us, given the investigations in diversity of wind output completed in some detail for the Generator Report Card 2018.

Observation #4) In terms of what prompted me to have a look in the first place, some of these lulls have been 24 hours apart in the past.

———————–

That’s all I have time for today

This has been a weird month for wind power. There have been some extended periods of low wind on each side of some great wind days on the 13-16th and 19th. There were also some periods of very rapidly rising and falling wind power. This must be causing some problems for grid management. Do you think it will get worse as the installed capacity increases or do you think it will settle down?

Paul, if you are looking for another mental model of wind farm output may I suggest you review a recent article I posted on this subject https://www.linkedin.com/pulse/feature-spectrums-bruce-miller/.

The back end acceleration is hardly surprising. Given the RET scheme had a drop dead date this year, and that the obligation was on retailers “to procure” and generally the big retailers are vertically integrated, bringing on new generation at (say) $60-70 / MWhr LRMC that simply canibalises their existing fleet (able to trade at SRMC) why wouldn’t you kick the can down the road as long as you can? And over the years of the RET scheme the technology got better and cheaper.

Many of the really good sites (best wind resource and easiest network access) were probably snapped up first in the process (read South Australia) so lower capacity factors in latter projects may well be expected. Allowing for some seasonal (and maybe annual) variability in wind and it may explain much of it. Might be worth looking again with a couple of years of clean data given many of the projects need to be delivered by years end for RET purposes.