We are clearly in quite uncertain, and unsettled, times – and it seems certain that the situation is going to get worse before it gets better.

As a business we have done all that we can think to do to minimise the risk to our employees, and hence ensure we will be able to continue serving all of our diverse group of clients through the weeks and months ahead whilst we all grapple with finding out what the ‘new normal’ will be. I’ll be trying to contact each of our clients directly in the coming days to outline more of how we’ll be operating for the foreseeable future, in case they have questions.

Frequent readers here at WattClarity will understand my concern about how COVID-19 (the latest in a range of different influences) might affect the Australian National Electricity Market (NEM) – and I know I am not alone in thinking through the various different implications that might come about in this respect. So in this article I will introduce the general mental model I am using, and then follow up with further analysis as time permits, and as the situation unfolds.

Seems to me that it’s important to understand that the phrase ‘impact of COVID-19 on the NEM’ could have a number of different meanings – for those familiar with the NEM, I mean. So it probably is important to start with me acknowledging three different levels of impact, as follows:

Level 1 = risks to disruptions to operations in the core electricity supply chain

First and foremost I acknowledge that there are risks that need to be managed in the core supply chain.

This is like key person risk on steroids, and is most critical. It starts with the AEMO and the TNSPs but also extend to the DNSPs and the Generators. The larger generators will be particularly critical – but perhaps it’s the case that the smaller generators (e.g. especially new entrants*) are more exposed to more key person risk, if they are still grappling with traversing the risks discussed in prior articles).

1) For this reason it was particularly important to see that AEMO had escalated its pandemic response plan last week, on Thursday 19th March. This morning I also noted this tweet response from CEO Audrey Zibelman with respect to international reports of power industry staff preparing to sleep at work to reduce keep person risk.

2) That’s why we understand we won’t be meeting with clients across this supply chain in the months ahead, and nor will pretty much anyone else.

3) For those smaller new entrants noted at (*) above, it may be that this key person risk could be managed in part through the Overwatch Energy company I discussed previously here.

Level 2 = changing patterns to electricity demand

What will happen with electricity demand is obviously a question that will be occupying many different people’s minds – for a number of different reasons:

1) For generators it translates directly to size of market to be supplied, and indirectly into the revenue earned for whatever production they can manage;

2) For others servicing those generation companies, it also feeds in for demand for their product or service.

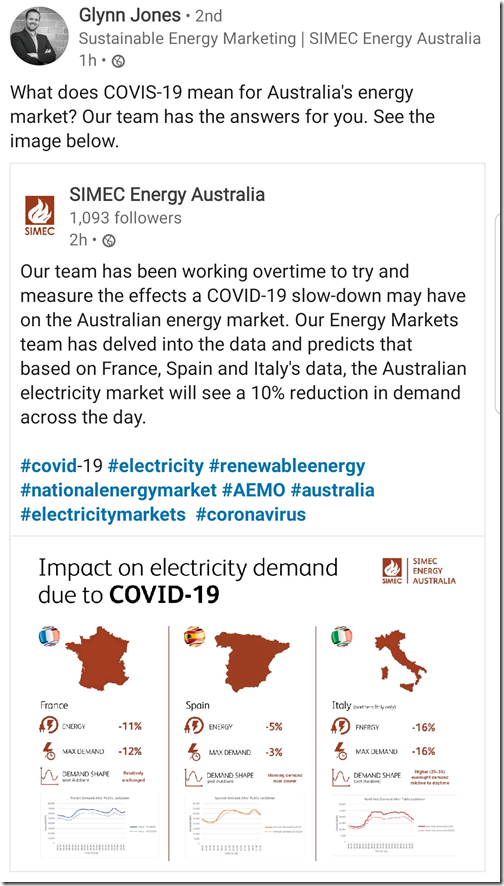

Hence it was no surprise to see that energy retailer SIMEC Energy had crunched the numbers. In this case they say it might translate into a 10% reduction in demand across the day:

Some other initial thoughts were posted by Bruce Mountain and Dr Steven Percy here on RenewEconomy about ‘will demand go up or down?’ on Monday 23rd March – and then bounced around on social media.

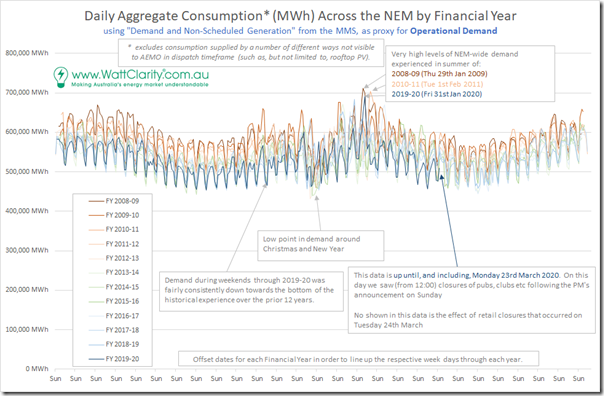

Using this query in NEMreview v7 to take a quick look at the AEMO’s ‘Demand and Non-Scheduled Generation’ data as a proxy for Operational Demand (as the AEMO’s published data of that name does not extend back far enough) we see there is significant natural variability in NEM-wide demand – which will make it tricky to accurately isolate our a ‘this outcome was due to COVID-19’ conclusion (though some will surely try):

A few general observations:

Observation 1) It’s too early to see much impact in demand at this NEM-wide level, as the pain (in terms of electricity consumption) has only emerged quite recently.

Observation 2) This has also coincided with change in season (with the seasonal effects quite obvious in looking at the 12 x traces over the year seen above).

Observation 3) Compared to the ‘peak year’ of 2008-09 we can see a consistent pattern of daily demand being lower by an average of 50,000MWh across all the days in 2019-20 to date – which equates to a reduction in demand of just over 2,000MW across all hours* in each day.

* however we know that the reduction is not uniform across all hours, because of Observation #4

Observation 4) This reduction in consumption has been occurring for the 11 years shown in the chart above, and it’s not just due to any single factor – but rather a combination of factors such as those discussed here as far back as 2011:

4a) Each factor will operate differently at different times of the day (and seasons), hence the 2,000MW average reduction is just that – an average of different measures across the

4b) For instance, reduction in Operational Demand due to substitution for rooftop PV will only occur during daylight hours, whereas consumption reduction through more efficient lighting will predominantly occur at night.

Observation 5) The demand destruction resulting from business failures and general economic slowdown stemming from COVID-19 will just add to the ever-growing list of why demand patterns continue to change. It seems fair to say that these effects will probably be more difficult to forecast as they have not been experienced before on the electricity grid, and are evolving rapidly as a result of Government initiatives trying to catch up with an accelerating virus trajectory.

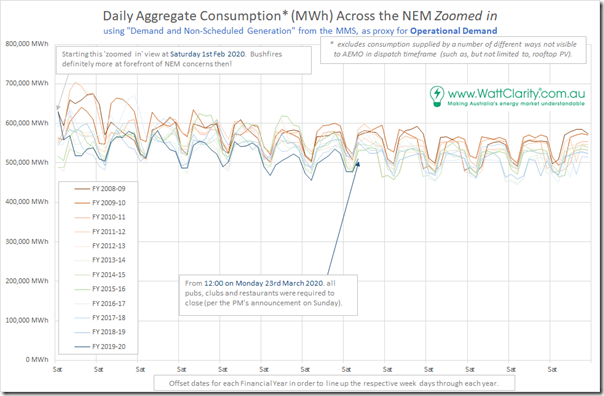

Here’s a zoomed-in view, to make this clear:

With this in mind, I’ll endeavour to revisit this analysis in a number of weeks in order to see if there has been a noticeable deviation from the pattern above.

Level 3 = possible impacts amongst the broader energy sector

However before we leave this topic for today, it’s also worth flagging that corona virus will have varying impacts across the broader group of stakeholders across the energy sector.

As a software company serving many companies directly involved in the supply chain, along with many others as well, we see ourselves squarely in this group. Thankfully we don’t see that our business should be badly affected – and may be able to help others (so long as our employees all stay well – and we are taking every step that seems reasonable to try to ensure this).

However, the effects look set to be significant for a number of other stakeholders, and this will have flow-on effects. Here are just some:

(A) Slowing the pace of generation development?

As if the developers of new generation projects were not grappling with enough given escalating challenges emanating from the ‘spreadsheet business model meets real world’ clash that many are facing.

Now they have the virus, and the broader restrictions placed on the economy to deal with. It’s difficult to see how the travel and other restrictions won’t end up delaying (or perhaps even fundamentally curtailing) the development of specific new generation projects that were on the cards a few short weeks ago. Just this week we see this example noted on RenewEconomy of a delayed council meeting delaying project approval.

If this is the case, it will obviously have flow-on effects – including:

1) Implications for the future supply/demand balance in the NEM, and

2) Our trajectory of reducing carbon emissions (depending on how long this lasts, and whether any developers who leave return when safer to do so); but

3) The impact will also be felt more personally by those organisations providing services to the developers of these new projects.

These circumstances would certainly be part of the reason why the CEC and other organisations are calling for COVID-19 stimulus measures to include a focus on greening the energy sector.

Perhaps others can help me understand how this is going to work?

(B) Resetting the pattern of endless industry events and coffee catch-ups

There’s ordinarily an endless list of industry conferences, briefings and other events that would be providing opportunities for meeting, learning and thrashing out challenges related to the energy sector. All of these have disappeared, replaced by virtual coffees through a smorgasbord of virtual meeting platforms.

With this shut-down likely to last for many months, there’s a fair chance we will come out of this with quite a different view of the best way forward to achieve the underlying objectives these events were set up to assist with.

I also note (as Sophie noted here) that the shut-down of the conference sector is having flow-on effects, such as with sites like RenewEconomy that are partially funded by those same conference organisers because of the value they have obtained in the past from these platforms as lead generators. Some of our readers might want to respond to the request for donations to RenewEconomy (at that link) to enable it to continue providing the service that it has over a number of years.

Challenges ahead in so many ways!

———–

That’s all I have time for today.

It’s early days in this space (and each week seems to last a lifetime currently) so we will return in the coming weeks to continue to unpick what’s unfolding.

There are many interesting developments yet to unfold.

1. It is likely that with Queensland gas prices falling below $3.50 with possibly further to fall that Queensland’s CC gas plants will undercut older coal plants and Pelican Point will export to NSW via Victoria. Combined with overall falling demand and increasing renewables, particularly rooftop solar, coal powered demand will fall faster than anticipated which may result in medium term withdrawal of one or more coal units in NSW.

2. Work continues on new wind and solar plants and methods will be devised to gradually reduce constraints on existing farms while demand stays depressed. Q3 may well see 30% renewables and coal share falling below 60% particularly if a wet winter tops up hydro resources

3. The economics of Snowy II, always dodgy at the best of times look like a disaster now.

4. There are conflicting reports of demand for rooftop solar but a sure way to put a lot of people to work quickly after the lock-down will be to broaden support for new rooftop solar and local storage.

5. Although the stink of the Pink Batts fiasco still lingers, a wide scale home efficiency upgrade program is another quick high employment scheme that might see the light of day, further suppressing overall demand.