“Extraordinary” is a word that seems to be quickly becoming ambiguous in relation to Australia’s National Electricity Market – given that these “extraordinary” events are occurring almost every week during what is normally the fairly boring (low demand, not-much-happens) period of summers in the NEM. What happened today in the NSW region of the NEM is just one more example of this.

As it was unfolding (and questions started to arrive via Twitter, LinkedIn and also more directly) I published this short initial article prior to 16:00 (NEM time) during the afternoon. What follows is a bit more context that I can find in the couple hours that followed as I watched what was unfolding – thoroughly distracted by what I had hoped to be finishing off on our Generator Statistical Digest 2019 and other projects…

(A) Warnings leading into the event

What happened on Saturday was not entirely unexpected – I did have things I wanted to finish off in the office, but had gone in today with full knowledge that something like this might end up distracting me for a number of hours, as it surely did…

(A1) Warnings from the AEMO

Bushfires are not a new risk in the National Electricity Market.

Back on 16th January 2007, for instance, there was a large loss of load in the Victorian region as a result of a network trip with (that event ended up with a NOUS report “16 January 2007 – electricity supply interruptions in Victoria – What happened and why, Opportunities and recommendations” being commissioned by the Victorian Government). As a result of reviews like this, AEMO’s operating procedures have been improved for situations such as these (and I would expect a similar learnings process to come out of this summer, once the immediate dangers have receded).

However, I certainly don’t remember a summer in which all regions have suffered impacts from bushfires in a summer that might (scarily) be only just warming up…

At 13:46 on Tuesday 31st December, the AEMO issued this Market Notice 72236 which could be paraphrased as reading “anything could happen in NSW on Saturday”:

________________________________________________________________________________________________

Notice ID 72236

Notice Type ID Subjects not covered in specific notices

Notice Type Description MARKET

Issue Date Tuesday, 31 December 2019

External Reference Non-credible contingency event more likely to occur due to existence of abnormal conditions NSW region. Tuesday 31 December 2019.

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

AEMO has identified that a non-credible contingency event is more likely to occur in the NSW region because of the existence of abnormal conditions, namely severe and extreme bushfire conditions for Tuesday 31 December 2019.

Extreme Fire Danger

Australian Capital Territory

Illawarra/Shoalhaven and Southern Ranges

Severe Fire Danger

Greater Hunter, Greater Sydney Region, Far South Coast, Monaro Alpine,

Central Ranges and Southern Slopes

As at the time of this notice there is a possibility of bushfires impacting multiple transmission elements in NSW on Tuesday 31 December 2019.

Conditions can change rapidly and potentially impacted plant may change. Further notices will only be published to advise of any reclassification, or when the abnormal conditions have ceased to impact the likelihood of a non-credible event occurring.

Manager NEM Real Time Operations

… this warning was re-emphasised with Market Notice 72261 published at 09:00 yesterday (Friday 3rd January).

At 10:23 on Wednesday 1st January, the AEMO had issued this Market Notice 72247 speaking to the risks apparent in the NSW region for today:

________________________________________________________________________________________________

Notice ID 72247

Notice Type ID Subjects not covered in specific notices

Notice Type Description MARKET

Issue Date Wednesday, 1 January 2020

External Reference Market reporting for forecast extreme temperature in the New South Wales region on 04/01/2020

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE

AEMO’s weather service provider has issued forecast temperatures for New South Wales region that are equal to or greater than the Generation Capacity Reference Temperatures.

On 04/01/2020: Maximum forecast temperature 42 degrees C at Bankstown for the Sydney area.

AEMO requests Market Participants to:

1. review the weather forecast in the local area where their generating plants are located and,

2. if required, update the generation levels in their dispatch offers consistent with the forecast temperatures.

Details on Generation Capacity Reference Temperatures can be accessed using the following link to AEMO website:

http://www.aemo.com.au/Electricity/Planning/Related-Information/Generation-Information

Generation Capacity Reference Temperatures:

QUEENSLAND – BRISBANE AREA 37 degrees C.

NEW SOUTH WALES – SYDNEY AREA 42 degrees C.

VICTORIA – MELBOURNE AREA 41 degrees C.

SOUTH AUSTRALIA – ADELAIDE AREA 43 degrees C.

TASMANIA – GEORGE TOWN 30 degrees C.

BASSLINK- (Latrobe Valley Airport 43 degrees C AND GEORGE TOWN 33 degrees C)

Ryan Burge

AEMO Operations

With these temperatures being forecast, the AEMO is expecting that generators invest the time to provide the AEMO with true indications of plant limitations in the heat (remember that, with the prior bout of heat a week ago, AEMO had on 23rd December felt the supplementary need to directly ask Semi-Scheduled generators to respond in this astonishing Market Notice).

Very early (at 00:36) this morning the AEMO issued this Market Notice 72269 emphasising the risk to the transmission grid:

________________________________________________________________________________________________

Notice ID 72269

Notice Type ID Subjects not covered in specific notices

Notice Type Description MARKET

Issue Date Saturday, 4 January 2020

External Reference Non-credible contingency event more likely to occur due to existence of abnormal conditions – NSW region.- Saturday 4 January 2020

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

AEMO has identified that a non-credible contingency event is more likely to occur in the NSW region because of the existence of abnormal conditions, namely severe and extreme bushfire conditions for Saturday 4 January 2020.

Extreme Fire Danger

Illawarra/Shoalhaven, Far South Coast, Monaro Alpine, Australian Capital Territory and Southern Ranges

Severe Fire Danger

Greater Hunter, Greater Sydney Region, and Central Ranges

As at the time of this notice there is a possibility of bushfires impacting multiple transmission elements in NSW on Saturday 4 January 2020.

Conditions can change rapidly and potentially impacted plant may change. Further notices will only be published to advise of any reclassification, or when the abnormal conditions have ceased to impact the likelihood of a non-credible event occurring.

Manager NEM Real Time Operations

So we can’t say we were not warned!

(A2) Warnings in the Mainstream Media on Friday 3rd January

A number of journalists had picked up on the threat, and covered it in these articles:

At 15:52 (AEDST?) on Friday 3rd January in the AFR, Angela Macdonald-Smith had written about “Snowy power line under threat during horror Saturday”.

Focus of this article was on the possible impacts on transmission capacity because of bushfires and heat.

At 16:47 (AEDST?) on Friday 3rd January in the SMH, Nick Toscano and Mike Foley had written about “Energy grid under threat as bushfires bear down on power lines”. In this article, Nick and Mike note:

Power giant AGL’s damaged generation unit at Victoria’s Loy Yang A coal-fired power station will not be back in service for another three weeks at least. AGL also said it would have to bring another unit offline at its Liddell power in NSW for five days beginning on Saturday for repairs.

At 17:50 (AEDST?) on Friday 3rd January in the Australian, Nick Evans had written about “AEMO warns of bushfire threat to power grid in NSW, elsewhere”.

In this article, Nick had flagged risk factors including the risks to transmission, but also two outages at AGL Energy stations. One outage would be the recurrent outage at Loy Yang A2, but I am not sure which outage he had been thinking of as the 2nd (Loy Yang A3 did trip at 20:20 last night, but was fully back online by 03:00 this morning – or it might have been about the talk of an outage to be taken at one of the Liddell units, but all four were operational all day).

There were probably other reports, but these were the only ones I noticed at the time.

(A3) but the “base case” forecast was that all would be well

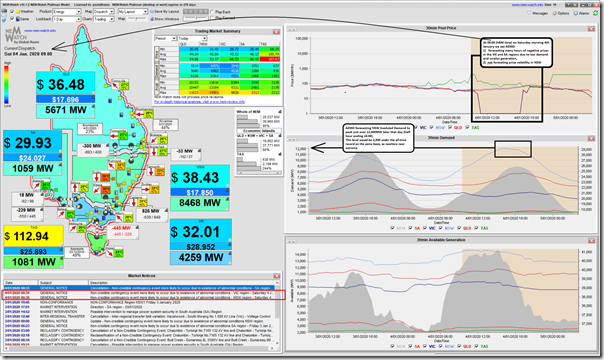

This morning I did think to take this snapshot from our NEMwatch v10 entry-level dashboard to show that the AEMO was not forecasting price volatility in the NSW region for the afternoon period:

(B) Bushfires trip interconnection capacity

I noticed this tweet here from NSW Energy Minister Matt Kean that illustrated the degree of the concern about this central electricity infrastructure:

Incidentally one Government Minister (state or Federal) who actually seems to get how serious the situation is this summer…

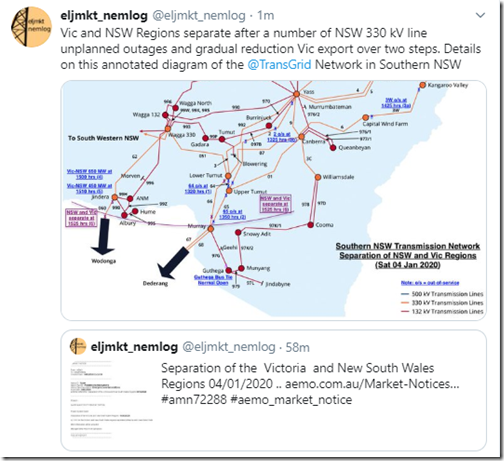

My earlier article “Bushfires under interconnectors through Snowy Mountains cause separation of NSW from VIC region” summed up – broadly – the sequence of events leading to the separation event, so no need to repeat it here…

I did see that Geoff Eldridge had posted this handy image here on Twitter to explain the network configuration (using a diagram that TransGrid had published and very usefully indicating the timing of each of the transmission elements that tripped):

Thanks Geoff!

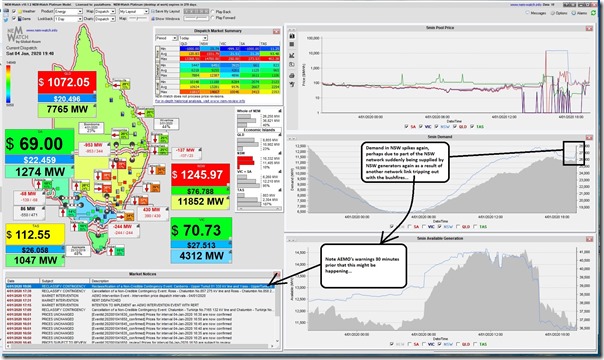

(C) Prices gyrate as a result

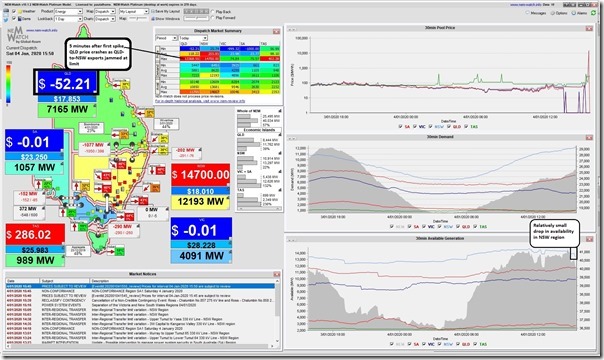

My earlier article ended at the 15:45 dispatch interval, with the dispatch price up to the Market Price Cap (currently $14,700/MWh) in the NSW region, and almost as high in QLD region as a result of the sudden loss of the supply coming in from VIC – so, as a result, everyone scrambled to supply whatever they could in order to keep supply and demand balanced in the QLD+NSW Islanded Network. Here’s the next dispatch interval (15:50) where we see the NSW price remain high but the QLD price drop below $0/MWh as a result of the

The NSW Region price for energy remained at $14,700/MWh from 15:45 until 17:40 (i.e. for 24 dispatch intervals), which drove the Cumulative Price to the region up above $76,000 (well on the way towards the Cumulative Price Threshold).

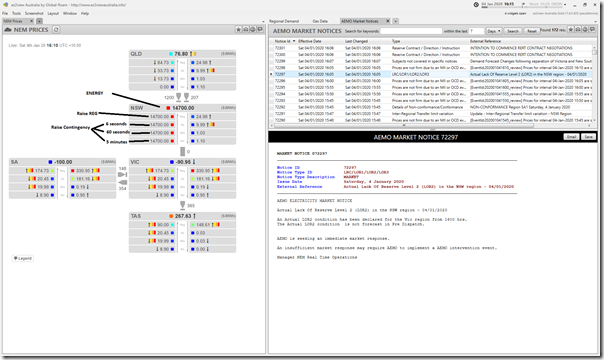

What was perhaps more interesting, in a way, was how the prices for all 4 x Raise FCAS commodities in the NSW region also spiked to the Market Price Cap, as captured here at 16:15 in this combination of various Widgets in the installed ez2view:

That’s a sign of how tight the supply/demand balance was in the region.

Notes for ez2view users about this ‘NEM Prices’ Widget:

(a) you can also access the ‘NEM Prices’ Widget here in ez2view online (handy on a phone); and

(b) one of the jobs I was hoping to finish today, before more of our team return for Monday, was to further flesh out the enhancements requested for this widget by one of our clients. If other clients also have requests for this widget, please let us know!

(D) Low Reserve Condition warnings, Demand Response, Reserve Trader etc…

Here’s a quick summary of a few key events:

(D1) Loss of Generation Supply

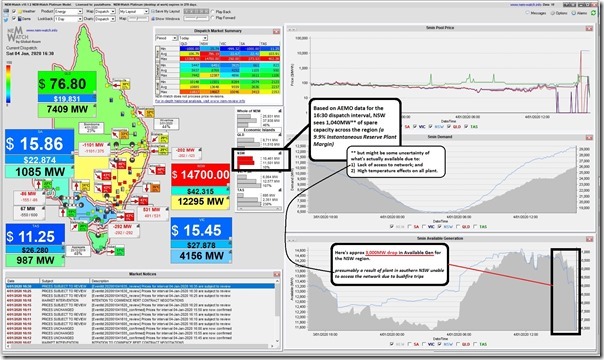

Not only did the transmission outages mean that imports from Victoria were not possible – we need to understand that there was also a loss of approximately 3,000MW of supply capability in the NSW region as a result. This was annotated in this snapshot from NEMwatch v10 for the 16:30 dispatch interval:

As a result of this reduction in available capacity, the IRPM (Instantaneous Reserve Plant Margin) for the NSW Economic Island dropped down to only 9.9% (i.e. just over 1,000MW of spare capacity of any type, at any price)!

(D2) Low Reserve Condition Notice

As a result of the sudden loss of import capability from Victoria, the NSW region was instantaneously plunged into a situation of a very tight supply/demand balance. Along with prices spiking, it was also no surprise to see AEMO issue Market Notice 72297 at 16:05 announcing NSW was experiencing an Actual LOR2 Low Reserve Condition:

________________________________________________________________________________________________

Notice ID 72297

Notice Type ID LRC/LOR1/LOR2/LOR3

Notice Type Description MARKET

Issue Date Saturday, 4 January 2020

External Reference Actual Lack Of Reserve Level 2 (LOR2) in the NSW region – 04/01/2020

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE

Actual Lack Of Reserve Level 2 (LOR2) in the NSW region – 04/01/2020

An Actual LOR2 condition has been declared for the Vic region from 1600 hrs.

The Actual LOR2 condition is not forecast in Pre Dispatch.

AEMO is seeking an immediate market response.

An insufficient market response may require AEMO to implement a AEMO intervention event.

Manager NEM Real Time Operations

This was updated at 16:35 with Market Notice 72315 which did not provide new information.

As a result of this LOR2 level, the AEMO scrambled to commence negotiations with their Shortlisted candidates for urgent dispatch of RERT (Market Notices and 72300, 72301 and 72310).

The Actual LOR2 period continued until 21:00 (notice of cancellation in Market Notice 72339).

(D3) Spot Price triggered Demand Response?

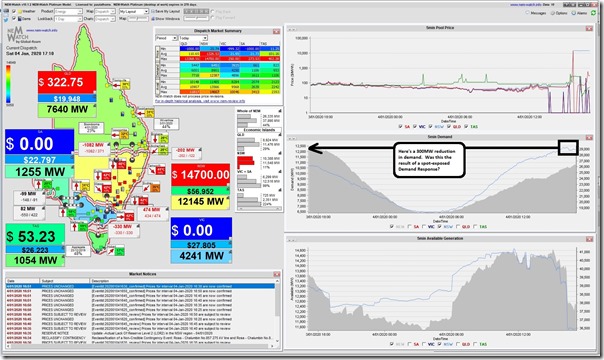

Coincident with the spot price jumping to the Market Price Cap, we do see a drop in the Scheduled Demand of approximately 300MW between 16:25 and 16:35 – which we presume was probably as a result of spot-exposed Demand Response (energy users make their own call on when to turn off – in some cases we would have thought it might have been earlier, at first sign of spike).

We also note Market Notice 72299 issued at 16:07 which notes that the load in the Wagga area (of NSW, geographically) was now being supplied from the VIC region as a result of the network outages. This would also have contributed to the drop in NSW Scheduled Demand.

Here’s a view in NEMwatch v10 we took at 17:10 that asked the question:

This is the type of Demand Response we have been active in facilitating for over a decade (including with one sizeable NSW-based client noted here just yesterday).

(D4) Reserve Trader dispatched

In Market Notice 72334 published at 17:31, the AEMO noted that it had dispatched Reserve Trader (RERT):

________________________________________________________________________________________________

Notice ID 72334

Notice Type ID Reserve Contract / Direction / Instruction

Notice Type Description MARKET

Issue Date Saturday, 4 January 2020

External Reference RERT DISPATCHED

________________________________________________________________________________________________

AEMO ELECTRICITY MARKET NOTICE.

AEMO Intervention Event, Reliability and Emergency Reserve Trader (RERT) – NSW1 Region- 04/01/2020

Refer AEMO Electricity Market Notice no. 72333

AEMO has dispatched/activated reserve contract(s) to maintain the power system in a Secure and Reliable operating state.

The reserve contract(s) was dispatched/activated at 18:20 hrs 04/01/2020 and is forecast to apply until 22:00 hrs 04/01/2020

AEMO has implemented an AEMO intervention event for the duration the reserve contract(s) is dispatched/activated/

To facilitate the RERT process, constraints commencing with the following identifiers may be evident at various times in dispatch,

#RT_NSW1

Manager NEM Real Time Operations

It’s always difficult to guess what the scale was of the response (AEMO generally does not tell us in real time, and it’s intrinsically difficult to guess ‘what would have otherwise been’) but there does appear to be a reduction in demand of about 500MW between 17:40 and 18:10. Some of this would have been a reduction that was happening anyway (due to underlying demand shape), but I am guessing some of it was at least contributed by Tomago Aluminium taking a potline out of service (and cycling through this reduction across the pot lines in service until 22:00 in order to avoid ‘freezing’ of the pots).

Dispatch of Reserve Trader ceased at 21:45 (noted in Market Notice 72340).

(E) (Some) things I don’t know…

There are many things that I don’t know, or don’t have time (or the data) to work out at this point. Perhaps some of our readers can help?

(E1) What happened to frequency in QLD+NSW with the islanding?

No time to delve into this today, but presume we would have seen frequency drop in QLD+NSW as a result of the islanding (and rise in VIC+SA as a result of the loss of the NSW export market).

(E2) Is it true that “Lines from Snowy to NSW have been destroyed by fire”?

Over on LinkedIn here I noted that David Waterworth asked the question:

“Ch9 are saying the lines from snowy to NSW have been destroyed by fire – any idea if that is true or they’ve just tripped or been taken out of service.”

No time to find, or link to, the actual coverage at Channel 9 (perhaps a reader can help in the comments below?), but my first thoughts are:

(a) Whilst it certainly would be possible that transmission lines have been destroyed in the fire;

(b) It’s more likely that this was a result of a misunderstanding somewhere (i.e. a “trip” somehow becomes misinterpreted as “destroyed”).

Worth noting, however, that (were that to be true) it would have longer-lasting implications for the supply-demand balance across the NEM for the rest of summer, and then into the future…

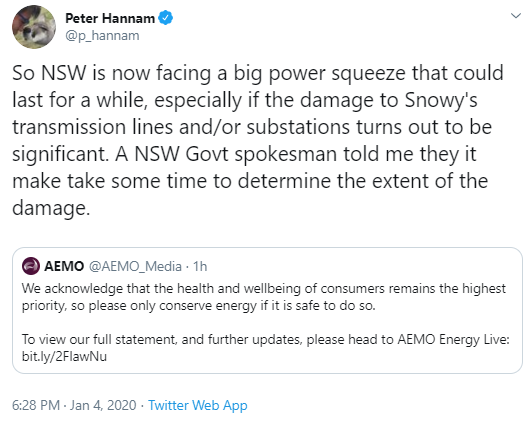

PS1 approx 20:30

I did (later) note this tweet from Peter Hannam at the SMH:

PS2 approx 21:11

Over on LinkedIn here, Canberra resident and leader within the Smart Energy Council, Steve Blume comments that “Two sub-stations in the Snowy region have been destroyed. Not sure what the impact will be. ACT residents have been asked to conserve”. Not sure of the source for Steve’s information?

PS3 approx 21:33

In Angela’s article late today, which I have just had time to read more thoroughly, she notes:

Mr Italiano said TransGrid said that while backburning had helped protect the Upper Tumut substation from fire risk, damage to some mechanical equipment at the site meant the company could no longer operate it remotely so it had to be powered down.

Meanwhile the Lower Tumut substation was completely surrounded by fire, meaning it had also be be taken offline.

The two substations form the point where the NSW and Victorian power grids connect.

… which seems to indicate not much damage at the time the advice was supplied by TransGrid

(E3) No supply from any generator in southern NSW

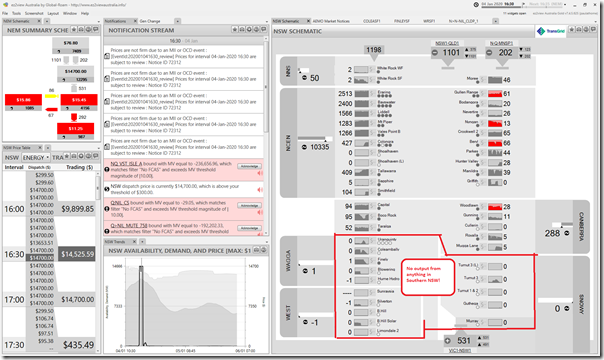

At 16:30 today I took this snapshot of a combination of several different widgets inside of the installed ez2view dashboard:

I’ve highlighted the area of southern NSW (covering several zones, as defined by TransGrid) that shows no production from any of the generators shown in this area.

I’m guessing that these generators were probably individually constrained down by the AEMO as a result of the lack of access to a transmission flow path to any customer, but note that I could not see constraints occurring today (this would be the case if constraint equations were Private as a result of having just one DUID on the LHS, so we will have to wait until tomorrow to know for sure).

(E4) Confusion over the flows shown on the VIC-NSW interconnector subsequently

I did note questions like these on social media about some confusion caused by the data published by AEMO, which some confused as meaning that the interconnector was “back up” after only a couple hours:

Thankfully our frequent guest author, Allan O’Neil already jumped in and answered this one:

… though I would like to dig further (another time!) in order to understand more specifically what went on.

(F) Early coverage elsewhere

I’m about done for tonight, but wanted to tag in these articles I could find on a quick scan:

At 18:55 (AEDST?) today the AEMO published this note “Power System Event in NSW” via AEMO Live.

At 19:41 (AEDST?) today Angela MacDonald-Smith wrote in the AFR about “NSW at risk of blackouts as fires cut power link with Vic”

At 19:51 (AEDST?) today Peter Hannam wrote in the SMH about “NSW residents urged to cut power use as fire threatens Snowy Hydro”, in which I see that Peter has written:

If the Snowy’s ability to transmit power was impacted beyond a temporary hitch, both NSW and Victoria could face regular outages, possibly for weeks.

(G) … but not out of the woods yet….

Just as I am about to hit publish, NEMwatch v10 shows the price in NSW and QLD spiking back up over $1,000/MWh at 19:40 (NEM time):

… but I really have to head home now… (stay safe, everyone)

Re: (E2) Is it true that “Lines from Snowy to NSW have been destroyed by fire”?

Minister Matthew Kean was on ABC Sydney radio just before 6pm saying that at this stage he was being told that the ability to control the output of snowy was lost but that no expensive equipment had been destroyed so there should not be a prolonged outage.

Transgrid (via Twitter) reports upper and lower Tumut substations were subject to fire damage. Lower tumut restored, but upper awaiting road or air access to site.