We’ve known for a couple days that the weather forecast is for a late hot blast to close out summer 2018-19 in South Australia and Victoria later this week.

I’d checked some of our dashboard back then and did not see anything sufficient to distract us from the intensive data crunching, analysis and explanations that are underway for our Generator Report Card 2018 (delivery date rushing closer – current ETA is early April), so had been comfortable to leave the shorter-term analysis alone for a while.

——————

However this afternoon I noticed two Market Notices via NEMwatch v10, our entry level dashboard:

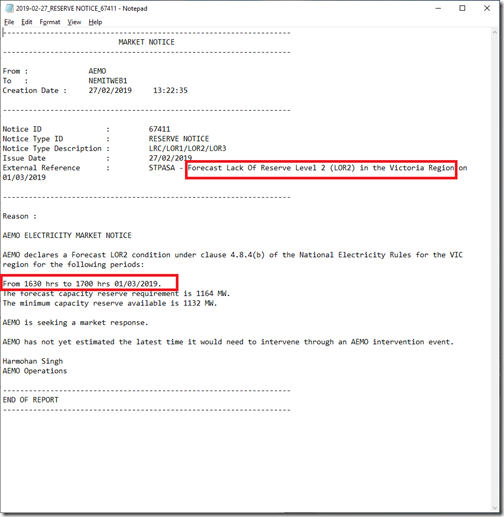

At 13:22 the AEMO published this Market Notice talking about a forecast LOR2 condition expected late on Friday 1st March:

… not an everyday occurrence, and also seen a bit more frequently (my sense – frequency not statistically verified) more recently following the change to the PASA processes, and also after the closure of Hazelwood.

Note the LOR2 warning was revoked at 14:58

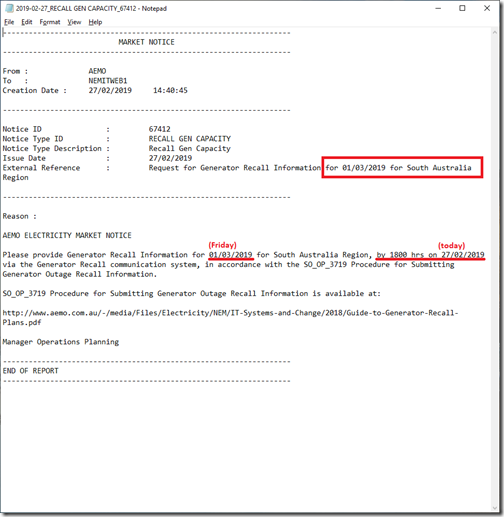

At 14:40 today we also saw this notice talking about “Generator Recall Information” in relation to this standing operating procedure:

… and I could not recall seeing something like that before.

Searching the entire history of Market Notices through that widget in ez2view found only one other instance when such a notice about “Generator Recall” was issued – on Monday 31st December 2018 where Notice #66231 was issued pertaining to forecasts for 3rd January 2019. In the earlier years, perhaps they did a similar thing but not using the specific term “Generator Recall”?

Given I had looked a couple days ago and had not seen anything too remarkable, I wondered what had changed. Thankfully we’re making that easier and easier to see (so much so that writing up these posts is taking a much longer percentage of the time!)

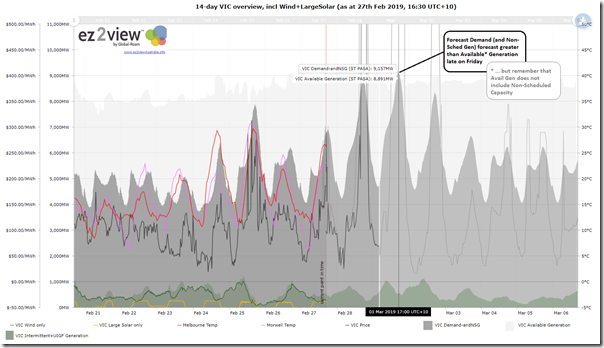

Using some pre-prepared web-based trends created with ez2view online, I took a quick look at forecasts for Victoria and South Australia as they currently stand in the late afternoon of Wednesday 27th February, looking forward into Friday. Here’s the view for Victoria (using the trend which clients can access here):

Note that the forecast demand for Victoria (Demand and Non-Scheduled Generation) is just above 9,000MW – so still 1,400MW below the record, though that was experienced in the days prior to Hazelwood closure, which reset the supply/demand balance equation to some extent.

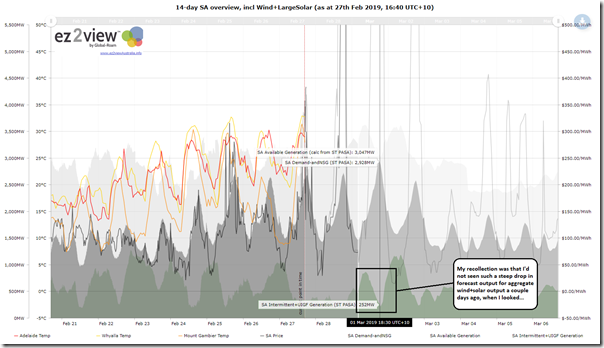

Here’s the analogous trend for South Australia (using the pre-configured trend that clients can access here for live updates):

Again demand forecast (at less than 3,000MW) is high, but not startling (not as high as on 24th January, for instance). What jumped out at me was the pretty steep drop in forecast output for intermittent generation in the region – as noted, it jumped out at me as it did not match with my memory of what I had seen a couple days ago when I checked. If AEMO are seeing revised forecasts for poorer wind conditions in conjunction with a hot evening, this would be some reason why they are looking to recall scheduled plant to cover a range of possible supply/demand scenarios.

——————

Thankfully with Forecast Convergence in installed ez2view, we’re progressively making it easier to look at real numbers to see if these hunches are correct – this is a never-ending ongoing improvement process.

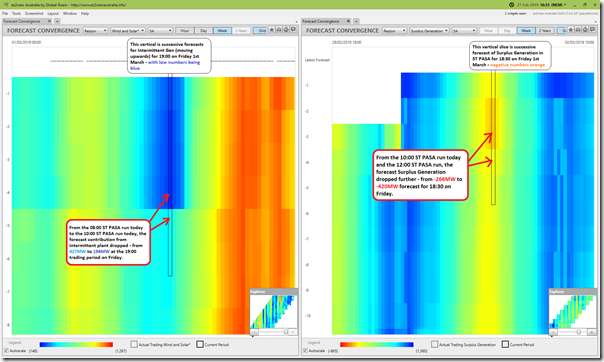

Here’s a quick look juxtaposing a view of aggregate UIGF and Intermittent Generation on the left and Surplus Generation on the right, with both focused on the verticals for Friday evening in South Australia. We can see that both have changed:

I’ve added a couple comments to clarify the flat image, which misses the mouse-over functionality in the real application. We see that the forecast for Friday evening’s contribution from intermittent supplies did drop significantly between different ST PASA forecast runs today – and that there also is a drop in the forecast surplus generation in the South Australian region (in negative territory up towards the import capacity from Victoria, which will also be hot at the same time).

However there seems a time gap between the changes in the updated ST PASA runs (per the notes on the image). If I had more time, I would investigate further…

——————

However that’s all for now – back into the Generator Report Card 2018 …

Interesting that the LOR was cancelled yesterday but is back up again today with a 5 hour peak price period forecast in Vic and SA, similar to the 24 and 25 January 2019 event.