Paul’s on-the-day post gave a wide-ranging overview of the multiple factors involved in Monday’s 5-digit dispatch prices in South Australia. To summarise very briefly, these were:

- low wind, with very little output from SA’s 1,500 MW-plus of installed windfarm capacity

- restrictions on the primary interconnection with Victoria (Heywood) which actually forced flows out of SA despite the high prices

- reduced small-scale solar output (showing up as increased scheduled demand), due to cloud cover

- gas prices (although in the context of recent winters these were not remarkably high)

- reduced availability at Pelican Point

- relatively low output levels from SA’s largest gas-fired station, Torrens Island, despite having six out of eight units online and generating throughout the day

In this followup I’ll focus on some things Paul didn’t have data or time available to investigate further, including:

- the physical supply-demand balance

- the detailed reasons for and impact of the constraints on the Heywood interconnection

- bidding behaviour of the key thermal generators

- the patterning of prices within half hourly settlement intervals, highlighting the “5/30” effect we’ve previously commented on here

- what ended the period of volatility?

I’ll be making extensive use of market data views available from ez2view and in particular its time-travel capability, enabling drilldown into data and conditions as they appeared at various times throughout the day. All times referenced are NEM time, unless otherwise noted.

Physical Supply-Demand Balance

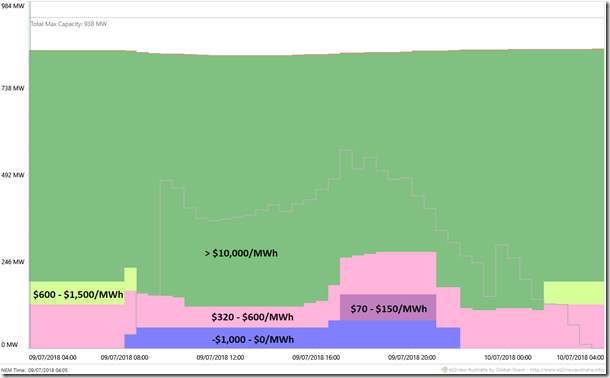

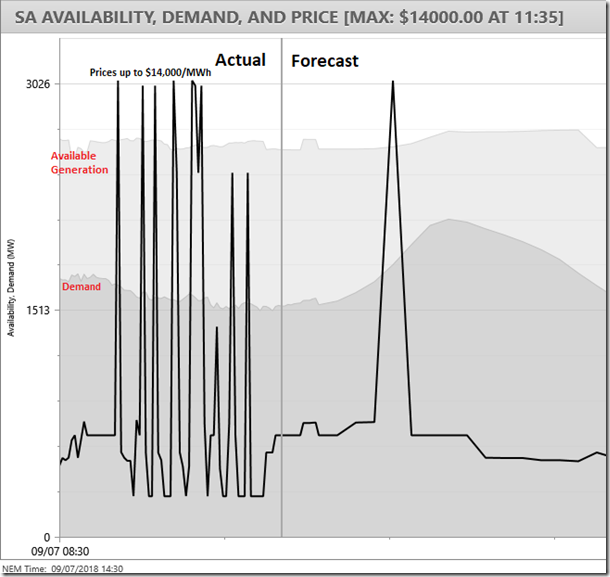

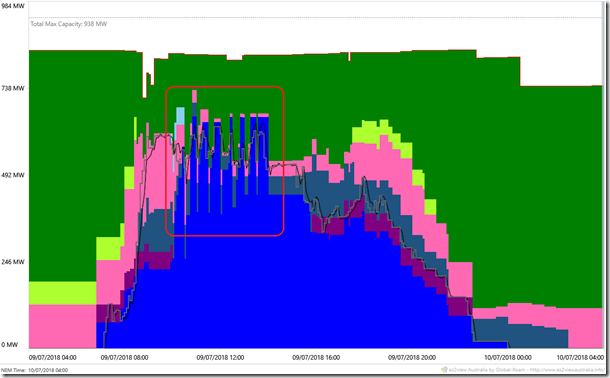

The first thing to point out is that despite the low wind, reduced capacity at Pelican Point, and absence of imports, the supply-demand balance in South Australia was never an issue. Throughout the period of price volatility, at least 1,000 MW of undispatched capacity remained available against a demand level of only 1,500 – 1,700 MW. The chart below shows actual and forecast outcomes as at 14:30, after the main period of price volatility had ended:

SA Price, Available Generation & Demand Outcomes 9 July 2018 (as at 2:30PM)

While some of the available generation shown represented “fast start” generating units not actually running, much of it was available at online generating units which were dispatched to well below their maximum output levels purely because of the way they had been bid into the market – more on this below.

Heywood Restrictions

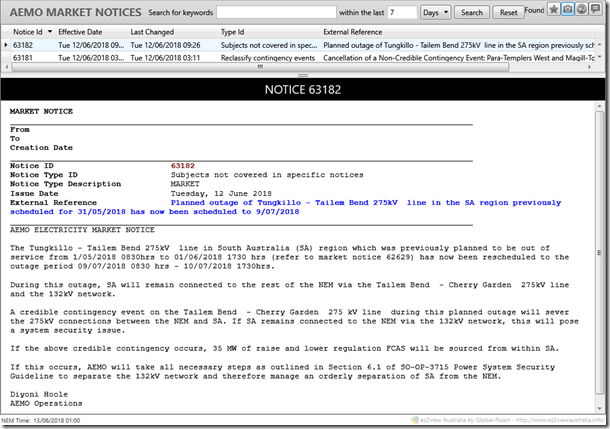

The underlying cause of restricted import capability was an outage of a 275kV transmission line forming part of the connection between Victoria and South Australia via Heywood, outlined in an AEMO market notice from nearly four weeks earlier:

AEMO Market Notice – SA Transmission Outage

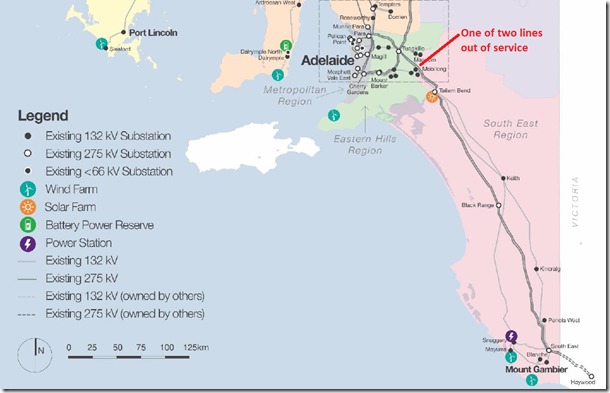

Interestingly, the transmission line in question is nowhere near the border between South Australia and Victoria, highlighting that “an interconnector” is not a single transmission line connecting two states, but an elongated flow path which may comprise many different lines and pieces of equipment, all of which contribute to the ability to carry power between regions:

South Australian Transmission Network Diagram

(Source: ElectraNet 2018 Annual Planning Report)

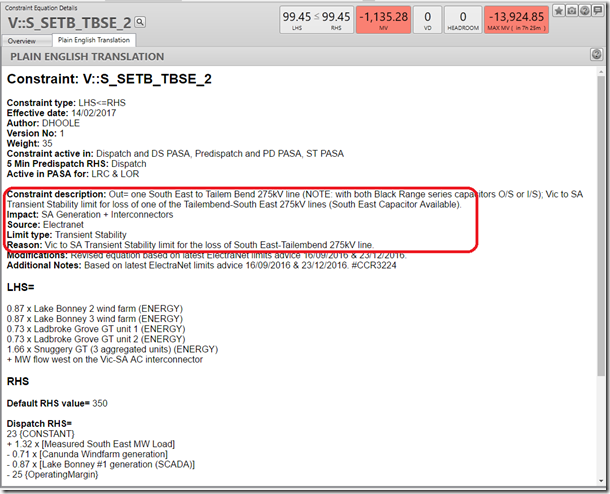

Now, one might expect that with one of two lines on this flow path out of action, ability to import power might be reduced – perhaps by 50% – rather than completely lost; however a key constraint applied by AEMO during the outage actually implies that system security would be at risk, in the event of the parallel 275kV line suddenly tripping, unless total northward power flows from the south-east of South Australia (including flows from Victoria) are held at less than about 30-40 MW. The details of this constraint (like most constraints) are eye-wateringly complex:

Constraint Restricting Vic to SA Flows

– but a key detail is that it is a transient stability constraint, which means it protects the system and its components against sudden instability in the event of the second 275kV line tripping. In other words, the risk addressed by this constraint is not necessarily inability of generation in South Australia, or under-frequency load shedding, to arrest the supply-demand imbalance within a few seconds if flows on the tripped line had been significant, but much shorter-term electrical phenomena arising from a trip, which could put system stability at risk.

In effect, this constraint reflects an internal transmission limitation within South Australia requiring generation & load in the south-east corner, as well as flows from or to Victoria, to be essentially separated from the rest of the state. So if generation in the south-east corner – the Snuggery and Ladbroke gas turbines, and Lake Bonney and Canunda windfarms – exceeds local load plus a small net transfer northward, the balance of that generation has to flow eastwards to Victoria.

When SA prices exceeded those in Victoria, any such eastward flows were in the opposite direction to what would prima-facie be expected given the price differential – transfers would normally be from the NEM region with lower prices to the higher price region. The effect of internal transmission constraints like this one can be to force output from generation on the “wrong” side of the constraint (but still receiving the high regional spot price) to flow into a lower price neighbouring region. This reflects a compromise adopted in the design of the NEM between a more economically pure “nodal pricing” market, and one with fixed regional boundaries within which uniform regional spot prices apply.

Also in operation throughout the transmission outage was a similar constraint effectively limiting southward flows across the single 275kV line to Tailem Bend and maximum exports to Victoria. In the event, this constraint did not bind because AEMO “clamped” flows to Victoria at even lower levels to limit the buildup of negative “settlement residues” arising from expensive SA power being exported to lower-priced Victoria.

Bidding Behaviour & Price Outcomes

With imports from Victoria not available and minimal wind generation, the bidding behaviour of South Australian thermal generation became crucial in setting spot prices. I noted above that there remained around 1,000 MW of undispatched spare capacity throughout the period of price volatility, meaning that the high prices reflected the way generation had been offered into the market rather than tight physical supply-demand balance.

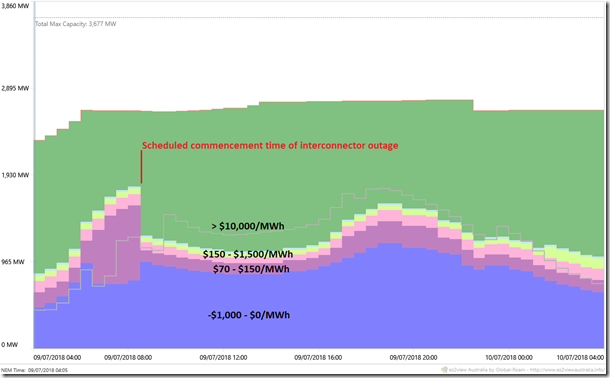

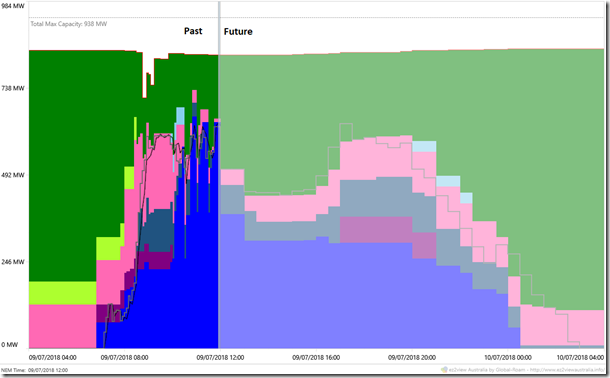

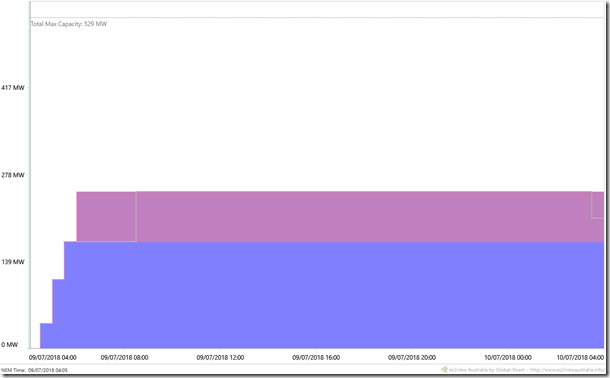

We can start by looking at how the thermal generators in SA had set up their bids at the start of the day (bid days run from 4am to 4am):

SA Thermal Generators’ Aggregate Bids as at 4:05am 9 July 2018

Immediately obvious is the reduction in capacity offered below $150/MWh from the half hour trading interval 8:30-9:00am, due to coincide with the start time of the interconnector outage (note: while the physical outage was due to start at 9:30 am, AEMO commences applying special “ramping” constraints to interconnector flows one hour beforehand to progressively reflect the constraint ultimately applying).

Nearly all of this reduction in “cheap” spare capacity reflected the start of day bid setup at AGL’s Torrens Island power station, shown in the next chart:

AGL Torrens Island Power Station Bids into the future, as at 4:05am 9 July

The key thing about this bid setup is the clear expectation of changed market conditions, and very likely a willingness to see or even promote spot price volatility, associated with commencement of the transmission outage at 8:30 AM.

The overall impact of these bids, low wind, and import restrictions was clearly signalled in the outlook for prices in on the day predispatch runs, for example the 4am run:

Predispatch Price Forecast for SA as at 4:05am 9 July 2018

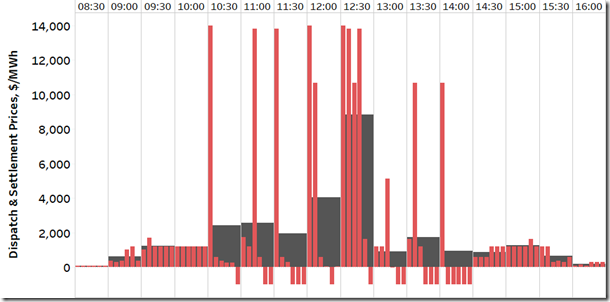

Spot prices outcomes, while very volatile, were obviously less extreme than the fifteen hours near the Market Price Cap shown in the predispatch forecast above – the chart below shows 5 minute dispatch prices (red) and 30 minute averaged settlement prices (black) between 8am and 4pm, highlighting the half hour trading interval boundaries (the labels refer to the end time of each trading interval):

SA Dispatch and Trading Interval Prices 9 July 2018 8:00AM – 4:00PM

(Source: AEMO Market Data)

What shows up clearly here is the concentration of extreme dispatch prices in the first few 5 minute intervals of the half hours from 10:00-10:30 to 14:00-14:30, with dispatch prices then typically falling across the remainder of each half hour to as low as –$1,000/MWh in the last few 5 minute dispatch periods.

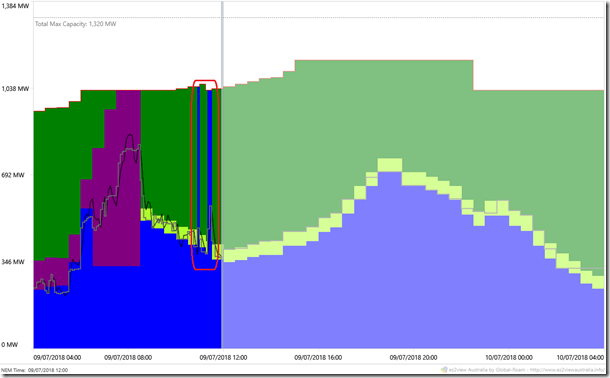

This price patterning was driven predominantly by dynamic rebidding from the many fast start peaking generators in South Australia (a mix of open cycle gas turbines and liquid fuelled plants, owned by a variety of market participants). At the start of the day, a substantial portion of capacity on these units was offered at very high prices:

SA Peaking Generators’ Aggregate Bids as at 4:05am 9 July 2018

(‘Peaking Generators’ here comprise Hallett, Dry Creek, Mintaro, Quarantine, Port Lincoln, Angaston, Lonsdale & Port Stanvac)

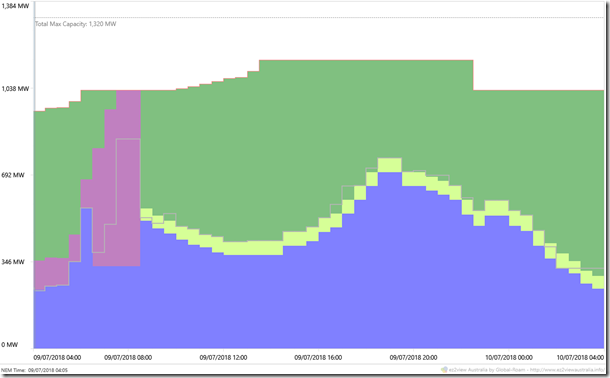

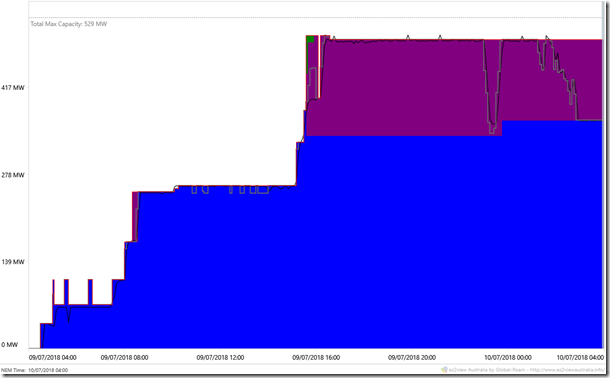

Having a large majority of their capacity offered at very high prices like this is not an unusual bid setup for fast-start generators in the NEM. With high short run marginal costs (typically several hundred $/MWh) and substantial costs of startup, such plants often “park” their capacity in very high price bid bands so that they will not be called on to start by AEMO for single dispatch intervals at moderate spot prices which would not be economic. If high spot prices do eventuate, plant owners may then choose to rebid capacity into lower price bands in order to run. Across a day like Monday, several hundred rebids across dozens of fast start units were made in response to the high dispatch prices, so that by the end of the bid day, the final bids made by these generators looked very different:

SA Peaking Generators’ Aggregate Bids for 9 July as at 4:00am 10 July 2018

As the day progressed, the peaking generators offered far more capacity into “must-run” price bands (as low as –$1,000/MWh), and highlighted in the red area above we can see a pattern of volumes in this price range being pushed up even further when a 5 minute dispatch price spike occurred early in a half hour trading interval. This “crowding in” of offers is what led to 5-minute South Australian dispatch prices falling to as low as –$1,000/MWh at the end of many of these half hours.

To get a further sense of how dynamic this rebidding was, we can look at the bids as they appeared at midday, halfway through the period of price volatility:

SA Peaking Generators’ Aggregate Bids for 9 July as at 12:00pm

As many commentators have pointed out, this form of rebidding is a predictable artefact of the disparity between 5 minute dispatch pricing and 30 minute settlement pricing in the NEM. A single dispatch price close to the Market Cap at the start of a 30 minute trading interval can essentially guarantee a very high (> ~$2,000/MWh) 30 minute settlement price for any energy generated within the half hour, so fast start generators with short enough startup times can rebid immediately they see a price spike, and once started run for the balance of the half hour to capitalise on the high settlement price.

Obviously slow-start generators already online with capacity offered at high prices can also rebid some or all of this capacity down to low prices to seek higher dispatch volumes – for example AGL’s Torrens Island:

AGL Torrens Island Power Station Bids for 9 July as at 12:00pm

The change from 30 minute settlement to 5 minute settlement recently ruled by the Australian Energy Market Commission and scheduled for commencement in 2021/22 will require a quite different approach to bidding and operation of fast start peaking generation and may well challenge the economics of some existing peakers.

A couple of other impacts of these “5/30”-driven price outcomes are worth a quick comment:

- increases in SA generation offered at low prices towards the end of relevant half hours would tend to force increased energy flows from SA to Victoria, but on a half hourly settlement basis, SA prices were much higher than those in Victoria, so net eastward flows are financially negative. These counter-price flows caused AEMO to “clamp” export levels on the Heywood interconnector to levels no higher than required by the transient stability constraint discussed earlier;

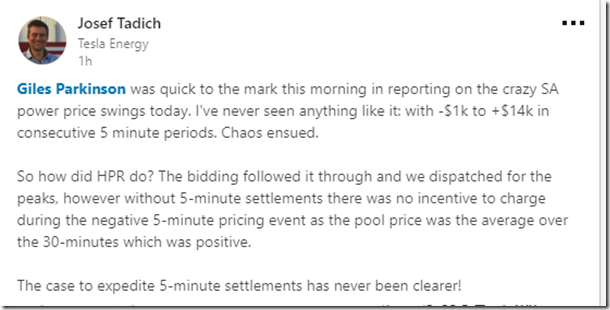

- despite the gyrations in 5 minute dispatch prices between $14,000/MWh and –$1,000/MWh, it was not possible for the Hornsdale Power Reserve (Neoen-Tesla battery) to arbitrage these price differences, since like any other market participant it pays and receives the half hourly settlement price for energy stored or discharged, not the 5 minute dispatch price.

Comment from Tesla Energy on 5-minute Settlement (from LinkedIn)

Pelican Point Availability Increase

So what caused the price volatility to subside earlier than predicted in the start of day predispatch outlook? The answer was Pelican Point being able to increase its availability on the day, as shown by the difference between its start of day and final bids:

Engie Pelican Point Power Station Bids looking forward for the day 9 July 2018 as at 4:05AM

Engie Pelican Point Power Station Bids for 9 July 2018 as at 4:00AM 10 July

The key rebid increasing available capacity from 260 MW to nearly 500 MW (startup of the station’s second gas turbine unit) was made just after 2:00 PM. Runup of the turbine began just after 3:00 PM, following which price volatility subsided relatively quickly.

Final Thoughts

Like many aspects of the NEM, the details underlying Monday’s price behaviour in South Australia are highly complex. But the major underlying driver of this event is a simple one – limited competition.

With over 2,000 MW of potential competition for dispatch from Victorian imports and wind generation absent, South Australia’s largest generator, the AGL Torrens Island Power Station, held much higher than normal market influence for the moderate demand conditions on 9 July. By structuring its market offers with substantial volumes offered at 5-digit prices, well ahead of events (note that no significant upward price rebidding occurred on the day), AGL was able to establish conditions conducive to significant price volatility unless peaking generators chose to offer far more than their normal bid volumes at low prices. The effects of the 5/30 dispatch vs settlement disparity mean that peaking generators are not likely to set up their initial bids to quash volatility, being more likely to rebid down when and if volatility actually occurs.

None of this is surprising given previous similar events in the NEM, nor is it inconsistent with the market rules, and arguably not even with the basic intentions of the market design where high prices signal “scarcity” – in this case of competition, or perhaps of greater redundancy on major interconnectors.

What is surprising, perhaps, is that a major gentailer decided to carry on with “business as usual” in a week where some politicians – from both ends of the spectrum – called for a Royal Commission into the electricity industry, and the ACCC was due to release a major report into drivers of retail electricity prices. We’ll see how that decision works out.

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be sporadically reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Great read Allan, very informative.

At least the battery was there to keep the gird stable.

Great analysis Allan.

Allan

Thanks for the very good analysis and I agree that the primary issue is lack of competition. There is a view that 5 minute settlement will also depress competition so perhaps that is not the answer.

The work you did also highlights

that gate closure (say 1 or 0.5 hours before dispatch) would also address the problem

Another solution could be having the lower SE a separate region,or even part of Vic region

Regards

David

Hi David

Thanks for your comments.

1) Re Gate Closure

You’re not the only one talking about some kind of gate closure mechanism (e.g. the recent Grattan review) – and these calls tend to do the rounds periodically (e.g. when the SA Govt sponsored review at the AEMC into bidding a few years ago). However each time the call is made, no-one seems to be able to help me understand how no change would avoid the fact that there’d always be a “last bid” (hence the motivation to try to maximise profitability by changing bid). Doesn’t moving gate closure further out from “now” only end up making AEMO procure more Regulation FCAS services, given increased uncertainty about what demand will actually be?

2) Re Zonal and Nodal

My sense is that you’re onto a solution that would have a chance at being more effective, in terms of creating a separate Region for South-East of South Australia (and will need same solution for North Queensland in 18-24 months as well). However the politics of this would prove very tricky – which is why (despite the fact that it was allowed for in the rules) States have never been disaggregated into Regions.

Paul

To the layman, this post is incomprehensible, which is not in the least the fault of the author, but was almost certainly intended by the crafty folk who created this thicket of legislation, pseudo-market prestidigitation and regulatory gobbledygook. A mere two or three decades ago, the average voter could understand how the electricity system operated – a handful of large, often state-owned generators produced reliable electricity at low cost, which was distributed to everyone via an equally simple distribution network and sold directly to consumers as a regulated, essential monopoly product. State governments each operated their networks separately, and were thus responsible for the outcome. After two decades of massive subsidy, interference, distortion through hundreds of pieces of legislation and the creation of a dozen or so unaccountable regulatory bodies, all this simplicity has been swept away. By whom, and for what purpose? Can sanity in this essential industry ever by regained?

great post. I didn’t realise how the 5/30 split was leading to that incredible volatility. Looks like AGL is doing an ‘Enron’, and they’re being allowed to get away with it.