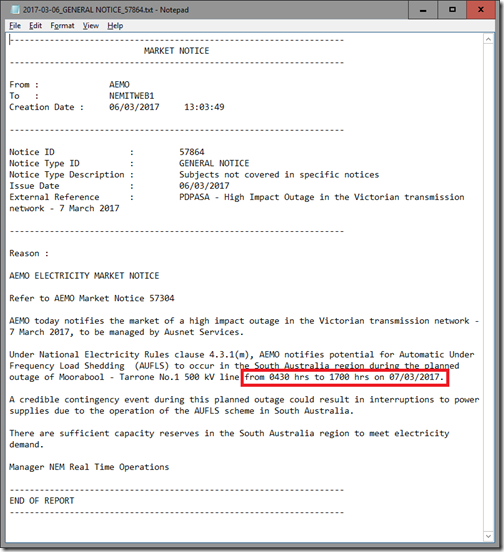

With the collective skittishness about South Australia in the broader energy sector at present (not helped by the transformer explosion and subsequent unit trips at Torrens and Pelican Point last Friday), the following Market Notice from today (Monday 6th) in NEM-Watch about tomorrow (Tuesday 7th) will be of interest to a number of our WattClarity readers:

Several points:

(A) The possibility of Automatic Underfrequency Load Shedding

From 04:30 to 17:00 tomorrow (NEM time, so add 30 minutes to read in Adelaide time) there’s a heightened risk of automated load shedding if the largest single contingency would occur:

1) The contingency they speak of would be for the other Heywood line to trip, thereby forcing South Australia into an “islanded” state.

2) Under such circumstances, no matter what plant (whether gas or wind – or coal, if it was still in operation) was running in SA, the rate-of-change-of-frequency (ROCOF) would be so large that AUFLS would need to occur to keep the system stable.

I believe, but have not checked with anyone else, that this was the reason behind what happened on 1st December.

3) Now AEMO could prevent this from happening, by procuring more FCAS services up-front, however a decision was made by back in 2001 (I think following pressure from the SA Government) that had the effect of:

(a) Lowering the amount of FCAS purchased on an ongoing basis; in return for

(b) Instances like these occurring periodically when interconnector maintenance reduced the redundancy for the SA grid.

It may be (I have not checked) that this is the outage that was going to be performed last week, but which was postponed with the dramas at Torrens.

(B) Price outlook for tomorrow

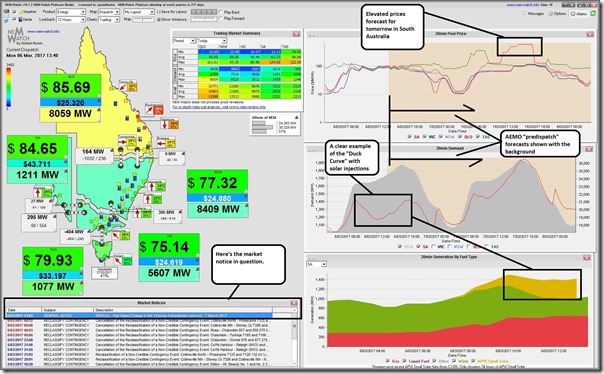

Looking forward into the AEMO’s current base-case predispatch forecast for South Australia in NEM-Watch in this 13:40 snapshot shows that demand tomorrow is forecast to be higher than today (but notably the peak in demand will be after the outage is scheduled to be completed, and after solar PV injections have waned for the day):

In new software (not shown here) being developed following a specific client request, we see the spike in prices forecast for tomorrow afternoon coinciding with a forecast lull in wind farm production (down to about 170MW at 13:00 compared with a forecast peak aggregate wind production of 1,126MW at 22:00 tonight).

(C) About the “High Impact Outage” terminology

Interestingly, in a quick scan of the total 55,568 Market Notices back to December 1998 we have accessible through our copy of ez2view for the “High Impact Outage” key phrase, the only other times I can find that this particular phrase has been used are 14 other times between July 2011 to November 2012. No wonder it appeared a strange title!

I have been told that this term is more frequently used in the NOS. No time to check on this one, today.

Leave a comment