Numerous SMS alerts today from NEM-Watch Platinum reminded me that the hot weather in southern Queensland was driving demand high on a weekend, and hence still impacting on prices.

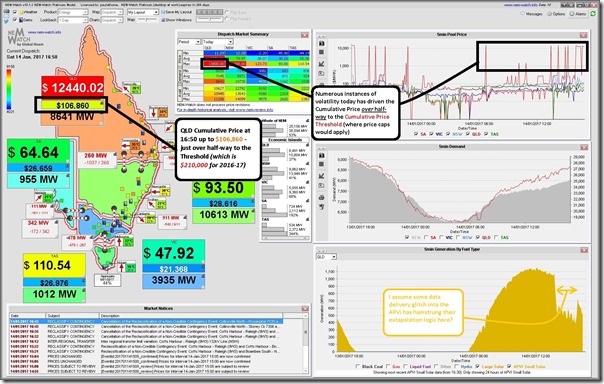

Here’s the single snapshot from NEM-Watch today at 16:50, coincident with me sitting down to write this short post. It shows the Queensland Cumulative Price over half-way to the Cumulative Price Threshold:

For the 2016-17 financial year, the CPT is set at $210,000 (i.e. 15 x the Market Price Cap). Should the Cumulative Price reach the CPT, then AEMO is required under the rules and step in to cap prices in the Queensland region for a period of time.

Off the top of my head, I don’t think it has ever happened in the Queensland region, despite periods of great volatility (it did reach about the same level in March 2015, for instance) – however it has happened elsewhere, at least as follows:

(A) Victoria has hit the Cumulative Price Threshold once before

Few in the market, or the energy sector, will forget the events of late January 2009 when extreme temperatures led to bushfires (including “black Saturday”) and extreme outcomes in the electricity market as well. I posted this article on Thursday 29th January 2009 to describe some of what happened on that day – including both Victoria and South Australia hitting the CPT.

(B) South Australia has hit the Cumulative Price Threshold several times before

This happened a number of times, including at least these instances documented on WattClarity before:

B1) In March 2007, after an extraordinary late heatwave, the

B2) As noted above, Thursday 29th January 2009 saw the CPT reached in South Australia – however also noteworthy that it almost reached that level about a week earlier (on Tuesday 20th January) as well.

B3) On Friday 13th November 2009 the South Australian region hit the CPT after some late spring volatility.

(C) Tasmania has hit the Cumulative Price Threshold once before

On Tuesday 16th June 2009, the CPT was reached in Tasmania later in the evening.

(D) NSW has not reached the CPT before, I think

It has come close, though – like this point in February 2011 where the Cumulative Price rose above $150,000 (at this time the CPT had risen from $150,000 because of the rise of the Market Price Cap above $10,000/MWh).

Note that the Cumulative Price is up at $124,373 in the 17:30 dispatch interval as I release this note – and current dispatch volatility means it will trend higher still…

Buckle up for a challenging summer, in a number of different ways…

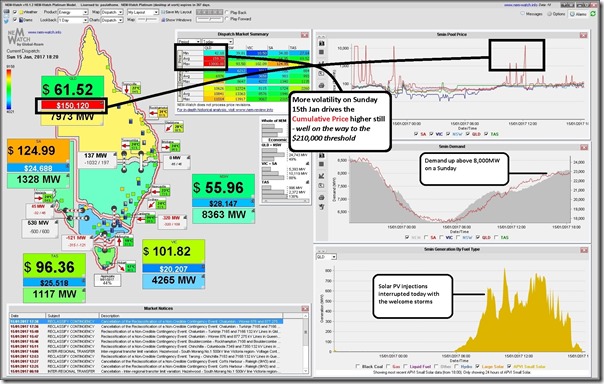

PS late on Sunday

I’ve been out for the day, though the NEM-Watch SMS and Email alarms continued in response to ongoing volatility. Checking in now sees the Sunday 18:20 snapshot from NEM-Watch showing the Cumulative Price now up over $150,000:

These crazy prices must surely help the business case for additional large-scale solar farms in Queensland, and the GenEx pumped storage station. The spot gas prices were crazy too, at $13.73/GJ at the gas supply hub.

The high demand in Qld is presumably due to the LNG activity and the high temperatures, however, I’m curious to know how big of an impact the high temps are having. In other words, due to the LNG trains the demand in Qld increased, and due to this increase will even small-to-medium increases in temperatures (and thus load) lead to significant price jumps?

seems the 50% QRET is quiet timely, for daytime loads anyway (PV).