Firstly, please let me express my apologies for the factual error I made early on Tuesday 15th, in posting these comments about the recent changes that have occurred at Tamar Valley power station in Tasmania, following its mandated acquisition by Hydro Tasmania.

1) Tamar Valley is not mothballed

On Wednesday 16th, Hydro Tasmania released this note here clarifying that the station is not mothballed.

My post was prompted by an article in the Tasmanian news media, which I was alerted to through Twitter. As noted in my previous post, I did check (through NEM-Review) that the station had stopped production. However I made the mistaken inference that the drop in production seen since early July till now would be permanent.

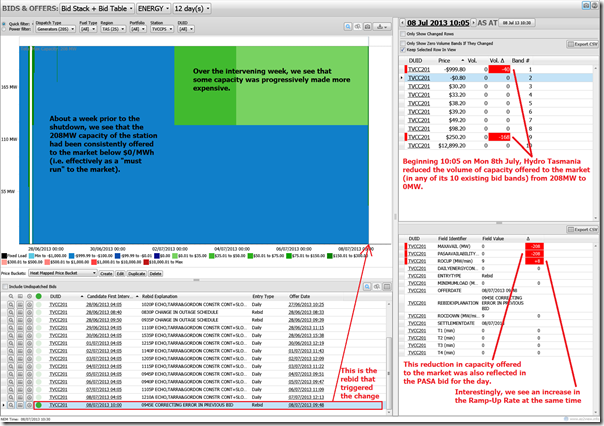

Interestingly, when we retrace how these changes unfolded, using ez2viewAustralia, we see that the change at the combined cycle plant was effected on the morning of 8th July 2013 with a rebid that incorporated the reduction of available generation capacity from 208MW, where it had been for some time, down to 0MW. This change has persisted to the current time (i.e. Tamar Valley combined cycle is not offered to the market, at any price):

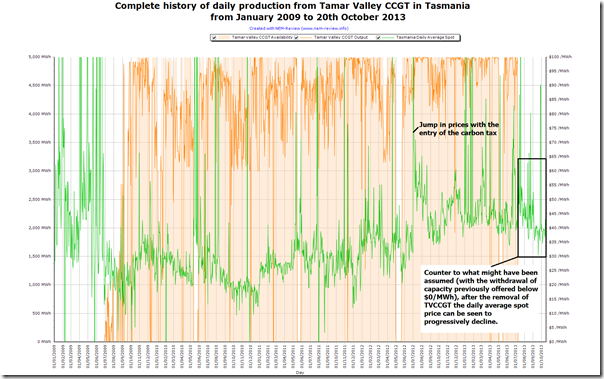

Returning to NEM-Review, we see that the utilisation of Tamar Valley (under its prior owner – the retailer Aurora Energy) was consistently high in the years following its commissioning, which does make the change in operations (under new owners Hydro Tasmania) very clear:

Interestingly, we see that prices have trended downwards in Tasmania following the seasonal reduction in demand following winter, and coincident with the withdrawal of Tamar Valley.

2) Where to from here, for Tamar Valley?

On Wednesday 16th, Hydro Tasmania released this note here clarifying that the Tamar Valley combined-cycle station is not mothballed. The note explains that “The longer-term operation of the power station will continue to be optimised within the hydro portfolio”.

As would be expected in a larger portfolio – particularly one in which the majority of capacity is hydro (with marginal cost close to $0/MWh) – the need to run Tamar Valley is greatly reduced from the case under the previous owners.

Of particular interest to us, over the coming 9 months, will be to observe how bid patterns at Tamar Valley change over time, especially in the light of the following considerations:

2a) Rainfall patterns

The release from Hydro Tasmania mentions “higher than average inflows” as one of the reasons why the return of Tamar Valley has been delayed this spring.

With aggregate storage volumes at around 50% across Tasmania (as seen in NEM-Watch), there is plenty of water available to meet Tasmania’s energy requirements, and to provide for flows across Basslink as required.

How the rainfall patterns develop over the coming 9 months will impact heavily on the strategies derived under the following considerations:

2b) “Bonus” revenue, till 30 June 2014, with the carbon tax

As we previously noted on WattClarity, hydro generators across the NEM took the opportunity prior to the introduction of the carbon tax to reduce production and “bank” available water, and utilise this stored energy to generate higher revenue from July 2012 with the introduction of the carbon tax.

With the politicking about the repeal process underway, it’s probable that the same sort of pattern will occur (where circumstances allow) up to 30 June 2014 – whereby hydro generators will run hard in the period to 30 June in order to secure the benefit of the carbon-inclusive spot price before it disappears.

2c) Potential double-bonus, with additional LGCs (RECs)

One interesting permutation on top of the above, should it prove to be wetter-than-average over Tasmania in the coming 9 months, is that the incentive to run harder prior to 30 June might be compounded by the possibility of producing production volumes in calendar 2013 and/or calendar 2014 above the baseline established for the generators, and so generate additional Large-scale Generation Certificates (LGCs).

This possibility is not as compelling as it would be if LGCs were awarded on a financial year basis, but is worth watching in any case.

2d) Gas pricing in VIC and TAS

A fourth consideration is the extent to which Hydro Tasmania (now the counterparty to a significant gas supply contract for Tamar Valley – and also for the plant it operates in Victoria) will be watching Victorian gas prices – as more data points relevant to the above considerations.

For those who are interested, keep an eye on what’s happening in the two east-coast gas markets through our GasWatch application.

With a portfolio optimisation challenge that is already complex (given the different hydro catchments and dam capabilities), it looks like this will be even more complex in future at Hydro Tasmania.

Stay tuned for further updates on WattClarity.

Thanks for another excellent example of the real costs of political interference (i.e. with carbon taxes, etc) in energy markets. What a blunder (net cost of ETS would be $1,345 billion to 2050 according to Treasury figures)! Will we ever learn?