The past 7 days saw several events coincide which have driven SA prices to significant levels and driven volatility in the spot market. While the financial year to date is averaging just under $70/MWh, May closed with an average pool price of $108/MWh with the first 5 days of June reaching an even higher average of $221/MWh. This article looks at some of the fundamental drivers of the volatility and key points to determine the current price risk triggers.

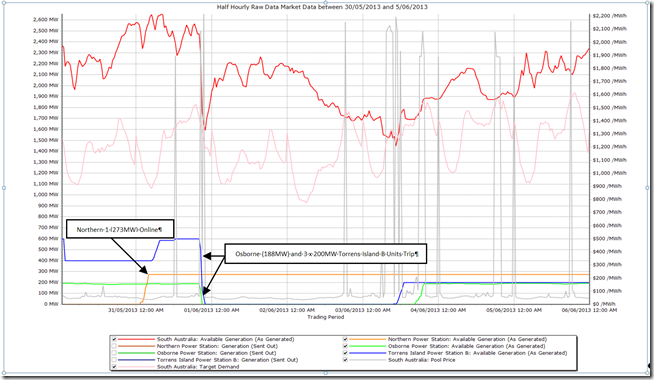

Demand, Availability and Surplus Generation

Adelaide temperatures this week have been reasonably comfortable with no extreme cold weather apparent. As a result demand has remained moderate reaching a maximum of just under 2000MW.

So with mild temperatures keeping peak demand down why has there been such volatility?

Demand is only relevant to high prices when measured against the region’s levels of available generation including generation imported from Victoria into SA. The difference between the total available generation and demand is referred to as Surplus Generation. It is surplus generation that is the key to identifying the current triggers for volatility in the South Australian electricity market at the present time.

Since mid April, Northern Power Station (2 x 270MW coal fired units) has been offline while Pelican Point, has been generating at half load at 240MW due to a planned outage. This is approximately a quarter of the state’s registered capacity missing.

Northern Unit 1 returned to service on Friday morning, adding 273MW of generation to the state’s available capacity, however this later coincided with the unplanned outages at 9:30pm on Friday night, where Osborne and Torrens Island B rapidly lost a combined total of 788MW from the grid.

In addition to reduced local availability of generation, further pressure was added to the system with one of the two interconnectors between Victoria and South Australia out of service since mid May. The Murraylink interconnector normally provides up to 220MW of exported electricity from Victoria into SA and is scheduled to be back by Saturday evening.

Prices spike on generator trips

While demand may not be at high levels, the difference between demand and the availability is tight and aligns closely with the price spikes.

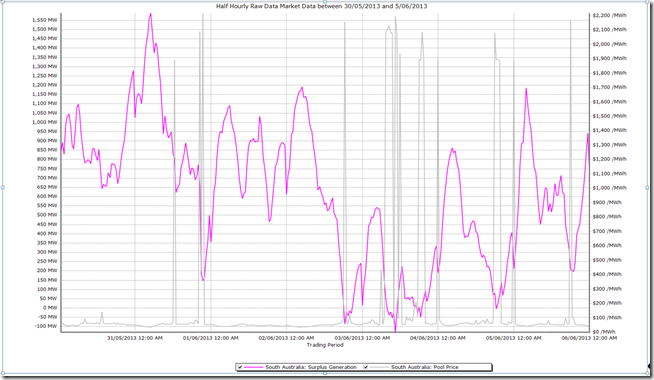

Prices spike on low surplus generation

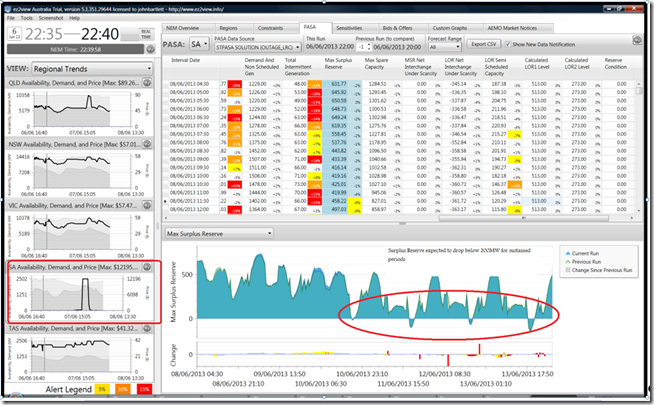

Surplus generation at a closer look, where the effect on pool price volatility can be seen under sudden changes or sustained shortfalls in generation availability against otherwise low demand

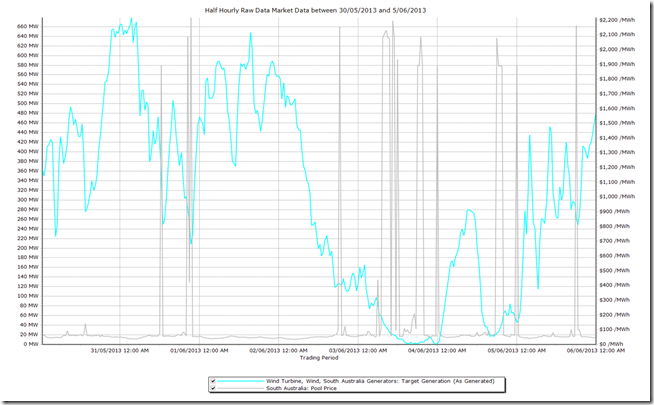

Prices spike on Low Wind Generation

This week has seen some extremely low levels of wind generation. This had been another factor that contributed to the pool price volatility particularly on Monday. The minimum level of wind generation dropped below 100MW for the entire day on Monday and sat close to 0MW for a sustained period. Adding to the effect on volatility is the how quickly the change in wind generation dropped and contributed to the price spike events over the week.

Market Dynamics

Scarcity of available generation provides participants a greater opportunity to sell energy into the market at a higher price within the guidelines of the National Electricity Rules. It is not uncommon to see bids and offers fluctuate for periods under times of system stress as generators compete to dispatch into the grid.

What does this Mean Going Forward?

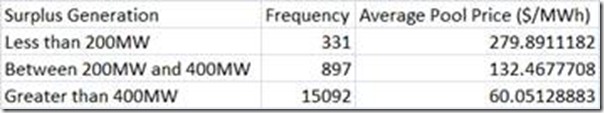

The scatter graph below displays where the volatility has occurred as reserve levels have dropped in the current financial year for each trading interval. This was compared to see the uplift in prices in relation to low surplus events. As can be seen in the table, average pool prices have increased by more than double when reserve levels drop below 400MW and increase by more than double again when the surplus drop below 200MW.

The last 7 days has seen an unusual number of coinciding events take place; Planned and unplanned unit outages, extremely low levels of wind generation and the Murraylink Interconnector outage.

While rarely two events are always the same, taking note of the regional generation surplus reserves against the 400MW and 200MW trigger marks should signal the potential for pool price volatility.

Looking at the week ahead surplus capacity is looking very tight and in particular on Friday volatility should be expected as reserve levels close in. The opening of the Murraylink interconnector will bring some relief from Saturday night but with availability at just over 2000MW and forecast net demand exceeding this figure later in the week there will likely be more activity to what has been seen lately.

About the Author.

Our latest guest author on WattClarity ®, John Bartlett is an analytical energy industry professional, who is experienced in financial and physical energy markets, contract pricing and forecasting.

John’s background is provided on LinkedIn here.

About the Software.

In performing this analysis, John has utilised the NEM-Review and ez2view software packages.

Good article – having the concept of surplus capacity helps provide greater context to high prices. A couple of questions:

1. Did wind generation reflect wind quality or were turbines disengaged?

2. Why is the Murraylink Interconnector down?

Michael Williams

Hi Michael,

1. The low levels of wind generation reflected wind speed. It is possible that some individual turbines (around 2MW) may be out of service but no entire wind farms were offline. It is more difficult to see this graphically as wind availabilty always matches the output unlike fully scheduled generation where it is clear to see reductions in availability due to maintenance, system constraints etc in comparison to registered capacity.

2. The outage on the Murraylink interconnector was a preplanned outage in Victoria preventing the flow into SA. At this point I dont have more detail on whether maintenance or upgrades were taking place, but it could be obtained by contacting Electranet SA or SPAusnet in Vic.

Does this help answer your question?

Regards,

John Bartlett