Ooops – I goofed.

As Reinhard has pointed out, I inadvertently omitted the forecast bids made on Sunday 1st January and Monday 2nd January.

In the updated (re-sorted) table below, I have include the 8 additional estimates made over this period (by Reinhard, Brian, Aden and Chris – who are all surely keen for the BBQ). I have also adjusted Philippa’s entry, which was indeed a typo.

Hence, the following is the table by which we’ll adjudge the winner (or you can, too, if you keep an eye on NEM-wide Dispatch Target demand through NEM-Watch)

Forecaster # entries Date Organisation Forecast Bid (MW) Aden Fanning 8 30/12/2011 InterGen 31,003 Aden Fanning 8 29/12/2011 InterGen 32,003 Alan Lao 1 23/12/2011 Delta Electricity 32,326 David Sweeney 1 23/12/2011 Aurora Energy 32,400 Connell Burke 1 31/12/2011 Westpac 32,750 Chris Muffett 1 28/12/2011 AEMO 32,911 Aden Fanning 8 28/12/2011 InterGen 33,003 Bandu Gamage 1 23/12/2011 AEMO – Melbourne 33,025 Aden Fanning 8 2/01/2012 InterGen 33,175 Reinhard Struve 11 1/01/2012 in Adelaide 33,332 Chris Scott 6 1/01/2012 Powerlink Queensland 33,333 Mark Roberts 1 23/12/2011 Attunga Captial 33,333 GaryWyatt 1 23/12/2011 ANZ 33,351 Aden Fanning 8 1/01/2012 InterGen 33,425 Alistair 1 23/12/2011 ANZ 33,500 Ben Blake 2 30/12/2011 AEMO 33,501 Philippa Kirk 1 23/12/2011 Transend 33,513 Jorge Heijo 1 23/12/2011 ANZ 33,617 Reinhard Struve 11 29/12/2011 in Adelaide 33,619 Brian Massey 10 1/01/2012 in Adelaide 33,896 Ian Phillips 3 29/12/2011 InterGen 33,897 Brian Massey 10 29/12/2011 in Adelaide 33,999 Aden Fanning 8 26/12/2011 InterGen 34,003 Mottel Gestetner 1 27/12/2011 EnerNOC 34,008 Ian Philips 3 28/12/2011 InterGen 34,183 Reinhard Struve 11 30/12/2011 in Adelaide 34,184 Reinhard Struve 11 28/12/2011 in Adelaide 34,435 Paul Daniel 1 23/12/2011 ANZ 34,441 Steven Grotte 1 23/12/2011 ANZ 34,450 Ben Blake 2 29/12/2011 AEMO 34,501 Kathy Staggs 2 29/12/2011 NSW Trade and Investment 34,555 Elijah Pack 2 29/12/2011 AEMO 34,566 Tim Astley 1 23/12/2011 Office of Energy Planning and Conservation – Tasmania State Government 34,567 Elijah Pack 2 23/12/2011 AEMO 34,568 Brian Massey 10 28/12/2011 in Adelaide 34,579 Richard Hickling 1 30/12/2011 AEMO 34,636 Simon Taylor 1 28/12/2011 Powerlink 34,672 Brian Massey 10 30/12/2011 in Adelaide 34,673 Brian Massey 10 27/12/2011 in Adelaide 34,895 Aden Fanning 8 23/12/2011 InterGen 35,003 Brian Massey 10 23/12/2011 in Adelaide 35,017 Ben Johnson 1 30/12/2011 ERM Power 35,105 Ian Philips 3 23/12/2011 InterGen Australia 35,200 Reinhard Struve 11 31/12/2011 in Adelaide 35,327 Ben Hayden 1 23/12/2011 NRG Gladstone Operating Services 35,328 Brian Massey 10 24/12/2011 in Adelaide 35,335 Chris Scott 6 30/12/2011 Powerlink Queensland 35,351 Kathy Staggs 2 23/12/2011 NSW Trade and Investment 35,444 Reinhard Struve 11 2/01/2012 in Adelaide 35,446 Brian Massey 10 25/12/2011 in Adelaide 35,645 Brian Massey 10 26/12/2011 in Adelaide 35,895 Reinhard Struve 11 27/12/2011 in Adelaide 36,145 Chris Scott 6 2/01/2012 Powerlink Queensland 36,223 Chris Scott 6 29/12/2011 PowerLink Queensland 36,251 Brian Massey 10 2/01/2012 in Adelaide 36,253 Chris Scott 6 28/12/2011 Powerlink 37,250 Reinhard Struve 11 26/12/2011 in Adelaide 37,895 Chris Scott 6 31/12/2011 Powerlink Queensland 38,001 Reinhard Struve 11 25/12/2011 in Adelaide 38,145 Reinhard Struve 11 23/12/2011 in Adelaide 38,515 Reinhard Struve 11 24/12/2011 in Adelaide 38,645 Aden Fanning 8 31/12/2011 InterGen 38,700

For completeness, I have also updated the analysis completed yesterday:

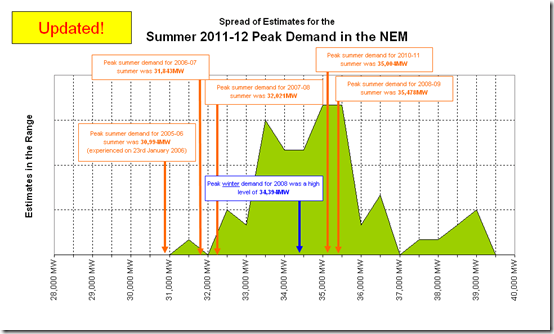

Spread of estimates:

The main perceptible change in the chart below compared to yesterday’s chart is that there is now also a spike in entries around 33,500MW – perhaps some last-minute insight that the demand might not shape up as aggressively as initially thought (or perhaps just hedging bets)?

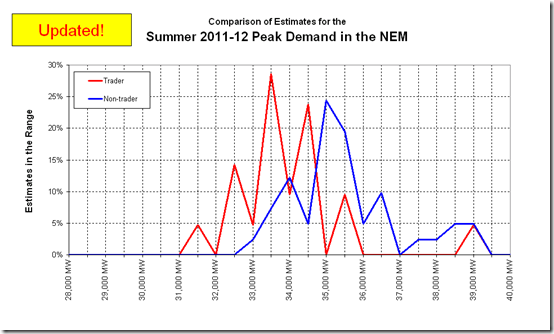

Traders –vs- Non-traders

There does not appear to have been any significant change in this chart:

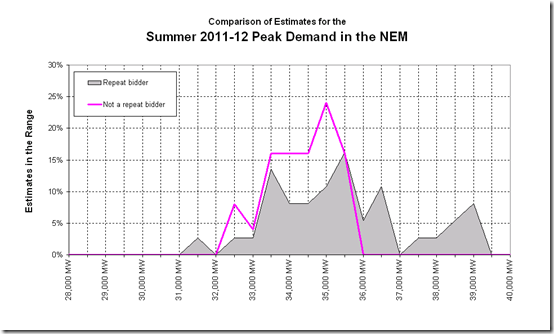

The wisdom of the crowds

In his comment this morning, Tim made the point about whether mechanisms like this could be used to assess the “Wisdom of the Crowd”.

In operating the competition in this way for a number of years, we have been curious to see (and share) just what might be seen in terms of where a consensus view falls (albeit that the results above are coloured by a relatively small sample size, and also the presence of the hyper-keen repeat bidders).

We can remove the 2nd issue (as we have done in the chart below) and we see that those who only entered once or twice largely cast their entries in the range between 33,000MW and 35,500MW. In contrast, the keen repeat bidders spread their bets much more broadly, as could be understood by the different motivation, perhaps.

On the one hand, we could look at this and say that this is a “reasonable” outcome, given all the available information, in terms of how demand growth has been trending in recent years, recent economic factors, and weather forecasts for this summer.

However on the other hand it also highlights the problem that the infrastructure companies have in forecasting where the peak demand will land, and hence what the requirement is for sufficient generation, transmission and distribution equipment. In those situations, there is much more than a BBQ at stake.

Simply put, there is a spread of almost 2,500MW on views of where the peak demand will lie – and this is for the current summer period. This highlights the challenge in forecasting peak demand years in advance.

Leave a comment